Table of Contents

QUICK SUMMARY:

Buying a marketing agency accelerates growth, providing instant revenue and new market opportunities. This guide details the key steps and tips for a successful acquisition, plus the common pitfalls to avoid. Gain insights from real-world experiences to explore acquisitions and confidently enhance your agency's growth strategy.

One of the most efficient ways to grow a marketing agency is to buy and absorb another successful business.

It’s fast—the growth is nearly instantaneous. And it’s affordable compared to the cost of building from scratch.

But there’s a lot to know for the best chance of success. Understandably, that can be intimidating if you’ve never done it before.

This article outlines all the steps, along with some tips to keep in mind, so you can feel more confident exploring the possibility of buying a marketing agency to add to your existing operations.

From Selling My Agency To Buying Marketing Agencies

I started an agency called London Road Marketing in 2016 after being a contractor for several years. We grew rapidly in the first few years through organic client growth, and we caught the attention of a private equity firm. They approached me with an offer, ultimately bought the agency in 2020, and my role shifted from owner to CEO.

London Road Marketing Headquarters

That was my first time going through the acquisition process as a seller. A year later, I started talking to an agency owner in a nearby city. In 2022, her marketing company was acquired by mine, and we merged operations to have one brand with two locations.

Also, in 2022, the private equity firm changed its portfolio strategy and was looking to sell most of the businesses it had acquired. Two partners and I went through the process of buying the company back, and that deal closed late in the year.

In all three cases so far—once as the seller and twice as the buyer—these have been very successful moves. The first gave us access to capital and mentorship, and other resources. The second gave us instant revenue, a new market, and new talent to add to the team. And the third gave us back our autonomy and increased financial incentive. We continue to work on more acquisition opportunities for our continued growth.

We learned a little more each time we go through this process, and we continue to refine the steps to ensure the acquisition goes as smoothly as possible.

This article will help you avoid some of the most common mistakes based on our experience, and ensure no steps are missed, so you can successfully grow your agency through acquisitions.

Step #1: Determine Your Objective

There are many reasons to go down the path of buying and merging a marketing company. They all relate to growth in some way but through different avenues. It’s important to have a clear understanding of the goal to help with the next step of finding the best candidates.

Here are seven things to consider when searching for an agency to buy.

1. Assets

In other industries, many company mergers are about acquiring assets like equipment, buildings, patents, etc. There are very few assets in most marketing companies, so it’s unlikely to be the reason for the purchase.

But there are instances where a marketing company could own assets like advertising media (i.e., billboards, a magazine, a popular blog, engaged social media profiles, or a podcast) that you could be seeking to acquire.

2. Brand/Reputation

You may be looking to increase market awareness and trust by buying a brand that has already captured it. Or, even if you don’t intend to keep the branding in place, the team’s reputation can persist even after a merger and rebrand transition, transferring that trust and credibility to your company.

3. Clients/Revenue

Earning clients through your sales team can only grow a company so fast. It’s resource intensive to earn leads and deals. But an acquisition can give you an immediate client list. You bolt that revenue on instantaneously. Just consider how much of it you can confidently say you will retain after the merge.

4. Location Expansion

You might be considering the acquisition to expand into a new geographic area. You can save a lot of time and get a shortcut into some local presence and knowledge by acquiring a business that’s already in that area.

5. Staff/Talent/Expertise

If you’ve had difficulty finding proven, talented, reliable team members, gaining them through an acquisition is a great way to grow. Or, perhaps, you’re looking to tap into a specific marketing channel and the other agency has proven success running client campaigns within that space.

However, you’ll want to get a good sense of how many of the staff are eager to hang on through the merger.

6. Infrastructure

Developing efficient systems and processes is a huge job. If you haven’t done that internal work in your own company yet, it can be easier to find a company that has.

You can use their infrastructure in the existing business after the acquisition. Infrastructure can include anything from backend processes, SOP documentation, to client reporting systems.

7. Absorbing Your Competitor

One surefire way to earn more market share is to buy a company that already owns some of it. You could buy an agency in the same market and merge operations to pool your market share into one organization.

Step #2: Find Good Candidates

Now that you’re clear on why you’re doing this, you will have a better idea of what criteria you’re looking for in an agency. If you are buying the reputation, the agency would need to have a strong and reputable brand.

If you are buying the team, make sure they have a great team and that they are willing to stay on after the transition.

But in addition to their suitability for your objective, there are a few other questions you should consider.

1. Would You Add Value to Their Operation?

Usually, you’re not just buying a company and then having it continue operating exactly as it was. The idea is to find a scenario where the whole is greater than the sum of its parts.

Would you provide better structure, systems and procedures? Access to more talented team members? New service opportunities for their existing clients?

2. Would They Add Value to Your Operation?

Flip the question above, and for the same reason: the whole should be greater than the sum of its parts. Do they have some expertise you could benefit from? Do they have staff that fill some of your gaps?

Either they need to add value to your company, or you need to add value to theirs (or, ideally, both) for this to make sense. There should also be some efficiencies in merging companies that allow for increased profit margins.

3. Would Their Clients Be a Good Fit (And Stay On)?

If part of your goal is client acquisition and revenue growth, will their clients be a good fit? Are they the kinds of clients that will work well with your business? Are they likely to stay on? Can you continue to serve their needs? Can you add new levels of service and increase the value provided to the clients?

You’re likely hoping to retain clients and revenue, so you want to find an agency with a client base that is a good fit with your company.

4. Would Their Team Be a Good Fit (And Stay On)?

Even if your purpose of buying an agency isn’t to gain a new management team and employees, you’re likely going to retain some in the process. Do they fit your culture? Are they interested in making the transition, or will they take this as a good time to leave? Do they fill gaps in your current roster, or create redundant roles?

5. What Is the Owner’s Potential Level of Interest?

This is hard to gauge from a distance, but it’s an essential component. Is the owner a marketer first who became an accidental entrepreneur? They may be happy to let someone else do the ownership part so they focus on the part they love: marketing. Are they too busy to work on the business and create strong systems and processes for scaling?

They might be excited to join a company that has done it. Find the people who are likely to be eager to consider selling for a new and bigger opportunity.

Step #3: Develop Relationships

With some suitable candidates identified, it’s time to get to know them. This shouldn’t just be a transaction—these are deals that can have a huge impact on people’s lives and will draw on their emotions. Develop a good relationship, and the rest of the process will work much better.

Lane Anderson speaking at the SocialWest Digital Marketing Conference in 2022.

A Passive vs. Direct Sales Approach–Which Is Better?

Different people will approach this in different ways. I am pretty passive in my sales approach. I like to introduce myself to other agency owners and swap stories.

In the process, they’ll learn what our goals are, and a more direct conversation may come of it. And if we can connect on LinkedIn, I post about what our business is up to, potentially sparking interest in any followers.

But you may be more direct and might reach out, letting them know that you want to find a partnership opportunity. Like in marketing, one is more palatable but takes longer, and the other may get some doors slammed in your face but can get more immediate results.

Develop Trust and Mutual Respect

I don’t advise coming in bullish. This process goes much smoother when you take the time to create trust and mutual respect. They are your equals. Find those commonalities and bond over your shared experiences. Meet over coffee and lunches and put some authenticity into it. This is more than business.

Learn Their Ambitions and Struggles

As you swap stories, you’ll want to learn a bit about what challenges they are struggling with. What parts of agency ownership do they dislike? What are their favorite parts, and what are their goals for the coming years? What do they hope to achieve?

With trust and respect in place, these are much easier conversations to have. They’re likely glad to have an audience who can relate to their experience.

Have the Real Talk

Eventually (or very quickly!), you hope to get to the fun conversation: Would they want to sell? You can ask them when you feel like they’re open to considering it. Or it may take some time for conversations to spin around in their mind, and they’ll come to you asking to take the discussion further. But, at some point, you need to find out if there’s interest in going to the next step.

Step #4: Pull Back the Curtain

Once there’s been an expression of interest to take the next steps, you’ll want to gather some information to get a better picture of what the business looks like. Time to dive below the surface.

Sign an NDA

Before anything confidential is exchanged, have a non-disclosure agreement drafted and get signatures. This is a legally binding promise to keep information private. A lawyer can help with this, and is generally your responsibility to provide.

Gather Client, Employee, and Financial Information

Request information about their clients. You’ll want to know how many there are, the billing amounts, what services they are provided, and how long they’ve been a client. Also, request employee info, including salaries, how long they’ve been employed, their roles and skills, and the company’s benefit and vacation agreements.

Then get the high-level financial information. You’ll do further due diligence later if the deal progresses, so for now, you just want to see a few years of year-end financial statements and a current balance sheet. Review all of this for an understanding of their situation, bringing in a trusted accountant if needed for the financials.

Provide Any Info They Request

If the potential seller wants any info from you, provide all of that. Be forthcoming. This isn’t relevant if the deal wouldn’t include equity in the purchase and if the seller wouldn’t be retained as an employee after the acquisition.

But it’s likely that there would be an equity portion to the deal and that the current owner would stay on, at least for a term, after the sale. So they may want to look under the hood of your business too.

Value the Business

With the information in hand, it’ll be possible to come up with an estimate of the company's value and selling price. It’s not a perfect picture yet, and the number isn’t set in stone at this point. It can be adjusted if anything big comes up later in the due diligence process.

But the intent should be to come up with a value that is accurate enough that it won’t change by the end of the acquisition process. You may need some help with this step from a good accountant or analyst or business broker. There is no right answer to the question of value. Because the value is whatever potential buyers are willing to pay and the seller is willing to accept.

Step #5: Come to an Agreement

This is where some negotiation may take place. Though not always! My experience has been that these things can be decided very quickly and with little disagreement. But there are several things to talk through before the first formal agreement is created.

Assets vs. Shares

First, get clear on what is for sale. Is it just some business assets, like the brand and clients, and infrastructure? More likely, it’s a share purchase for 100% of the company’s shares, making for a complete takeover.

This means you get all of the assets and liabilities. It’s much simpler and, therefore, more common. Just keep in mind that the company would need to be incorporated for a share purchase to be possible.

Sale Value and Structure

Having come up with your valuation of the company, have a conversation where both parties share their number. In two out of three of my times through this process so far, it was no more than a five-minute conversation.

Come up with a number you both agree on. Then talk about the makeup of how that value will be transferred to the seller. Will it all be in cash? All in equity? A note? A combination?

I did one deal that was 75% equity and 25% cash, one that was all in a note, and one that was all equity. If the plan is to have the owner stay on for a time (or indefinitely), having equity part of the deal helps create some security that they are invested in your business and its success.

Owner/Staff Retention

Speaking of the owner staying on, you’ll need to agree to who will stay with the company after the acquisition. Is the owner being offered a job? Are all the team members transferring across? These will all need to be determined at this point.

Brand

This topic is where people can be emotionally connected to the result. They’ve built a brand over the years that they rightfully have a lot of pride in. How will they feel if that is going to be dissolved to take on the name of your brand? Is that the right move? Do you keep the branding in place? Do you do a gradual shift over a period to help the market make the transition?

This will need to align with your objective in this acquisition, but ensure there’s an understanding of how this will be handled.

Any Special Terms

There is no template for business acquisitions. There could be all sorts of additional terms that can come up, and this is the time to note them. For instance, there may be a required term the owner will serve in the new company or a non-compete agreement.

Timeline

If there’s one thing you can count on with acquisitions, it’s that you can’t count on things happening on the timeline you set out. There are lots of people involved: both businesses, two sets of lawyers, two sets of accountants, government.

There are so many places where things can get pushed off track. But it’s still important to agree on a general timeline. Is there a desire to rush this and get it done in a couple of months? Will you plan for a final closing date well down the road? Maybe you’ll want to time it with your fiscal year-end. Align your expectations on the timeline.

Sign an LOI

Finally, the first formal agreement can be created. An LOI (Letter of Intent) is an expression of interest and very broadly details the deal. It will include who the parties are, what is being bought, how much it will be purchased for and how, and other important terms and conditions. This is not a legally binding document!

Things can still change or fall through after this point. But put down the things you’ve agreed to in this letter without all the backing legalese—just an overview. It should be your responsibility to have your lawyers draft this. Then you both sign.

Step #6: Arrange Financing

With the deal generally defined, it’s time to work out how to finance the transaction. This can be done a few ways, and you may already have a good idea of the method before reaching this point, but this is where it needs to be solidified.

Use Cash, Debt, And/or Equity

If you have cash in the bank, you can use it to buy the company. That’s the most obvious and straightforward way of completing the deal, but not always the best, strategically, even if you have the money. You can also use debt to get the cash, and that can be obtained through traditional lenders or private lenders.

Because a marketing company is mostly purchased on the value of its goodwill, places like banks will have a harder time giving money for something that doesn’t have hard asset value, so private lending or other small-business-friendly lenders might have to be considered, though their interest rates are likely to be higher.

You can also consider an equity transfer, either directly with the seller, as mentioned above in “Sale value and structure,” but it also could be a private investment (rather than private debt) to gain some cash to use for the acquisition. To make this decision, you’ll have to carefully weigh how much equity you want to give up, how much debt you’re willing to carry, and how much cash on hand you’re willing to utilize.

Would the Seller Finance?

Another form of debt is with the seller. Will they finance it for you? This can be a great deal and may be easier to obtain than other methods of financing or investment. Vendor financing or vendor take-back (VTB) means the seller will accept payments over a term, rather than cash up front (or a combination of both).

You would need lawyers to draft a legally-binding loan agreement, but the seller and buyer can work out their own terms, avoiding the need for banks or other third parties. Determine the payment term, schedule, and interest rate. This can make acquisitions very attainable by turning them into a monthly payment over a set number of years.

Step #7: Do Your Due Diligence

This portion of the deal can take longer than you might anticipate. There is a lot of information to gather and carefully examine. You don’t want any skeletons in the closet emerging after the acquisition. Due diligence means ensuring you have a very clear understanding of the true state of the business from every angle. Avoid nasty surprises after it’s too late to renegotiate!

This step requires trusted lawyers and accountants who have experience in acquisitions. They have the skill set to find red flags and put the data into terms you can better understand. I have a good understanding of these things, but I still wouldn’t do this without professional assistance in identifying what information to request and carefully poring through it.

Let them walk you through this step, but as a starting point, you’re likely going to want to look at the selling company’s year-end financial statements for the past three-five years, year-to-date statements, bank statements, employee contracts, an asset list, any possible litigation threats, lease agreements, client agreements, any licenses, and all corporate documents.

Don’t skimp on this step. Get answers to all the question marks. Some of this information is tough to track down, but you want to tick every box before moving forward. I wouldn’t advise just trusting that things are as they seem. It’s tedious work, but it’s essential.

Step #8: Do the Legal to Close

If everything looks good to proceed after due diligence, make any required adjustments to the deal based on the findings, and then your lawyers can draft all the required agreements. The job of your lawyers is to represent your best interests, and the seller’s lawyers will represent their best interests.

So there will likely be some back and forth as both parties negotiate some particulars to ensure nobody is being put in an unfavorable position or opening themselves up to vulnerabilities. This is how lawyers prove their value, but you also want to try to keep the drafts to a minimum.

Each round will raise the legal cost. The lawyers will arrange to have both the buyer and seller sign all the required documents on the closing date, and then the company is yours!

Congratulations, this is a huge milestone for both parties! Both buying an agency and selling your marketing agency are very big accomplishments.

Step #9: Integrate

Now that the acquisition is complete, there is lots of operational work to do. And this can take just as long as all the prior steps.

Start Before Closing

It is possible to start some of this work before the ink has hit the agreements if there’s good alignment and the risk of the deal going sideways is very minimal. A few of the low-risk things you could get started on are introducing new team members to your systems and processes, making introductions, and developing team relationships.

In every case, we started on some of these months before the legal was done.

Be Flexible

I wish that acquisitions were like flipping a switch and two companies instantly became one, but it takes some time to merge teams and systems, and processes. Be flexible with how quickly things align. You might have some duplication of roles, systems, and processes initially.

Get everyone in sync over time, as quickly as you can without overwhelming people and without turning everything into chaos.

Onboard and Train

You will want to set aside a lot of time for training and onboarding. It’s like hiring a new staff member, except there may be several employees, and they’re already used to working together in different ways. So this can demand more time than it would if they were new staff.

Keep Client Experience Top of Mind

Since this company you’ve acquired is likely coming with clients who need continued services, you want to minimize disruption to them. Otherwise, some of that goodwill you bought goes out the door as clients leave for other marketing solutions.

You will want to be delicate to avoid giving your new clients the feeling that they’re being forced into a new relationship or dynamic. And you don’t want your existing clients to suffer because of any internal chaos or distraction.

You’ll want to get the integration done as quickly as you can, but be careful about it coming at the cost of client experience.

Wrap up All Loose Ends

You’ll want to have a checklist of all the things that need migration, canceling, or updating. This includes things like the old bookkeeping system and data, any unnecessary bank accounts and credit cards, and addressing what you’ll do about social media channels, domains, websites, subscriptions, emails, etc.

Especially important are any government registries, like updating directors and getting access to tax filing and payments, and closing out old accounts that aren’t needed.

Try to be as exhaustive as you can be in making a list of all these items, or you’ll find random things months or years down the road that were missed.

The Takeaway

Buying a marketing agency can be a complex and daunting process, but with careful planning and execution, it can also be a highly rewarding and beneficial step for your business.

Remember to take the time to thoroughly research and analyze potential acquisition targets, as well as enlist the help of trusted professionals when necessary. It's important to remain realistic and understand that even with the best of intentions, there may still be hiccups and challenges along the way.

However, by keeping an open mind and learning from each experience, you can continue to improve and grow your marketing company through strategic acquisitions. Best of luck on your journey!

Written by

Lane Anderson is a marketer, entrepreneur, writer, and speaker. In addition to being a professional dad to three kids, he is also the Founder and CEO of London Road Marketing, a full-service marketing firm for local, small businesses with offices in small Canadian cities, powered by a central fulfillment hub in Lethbridge, Alberta.

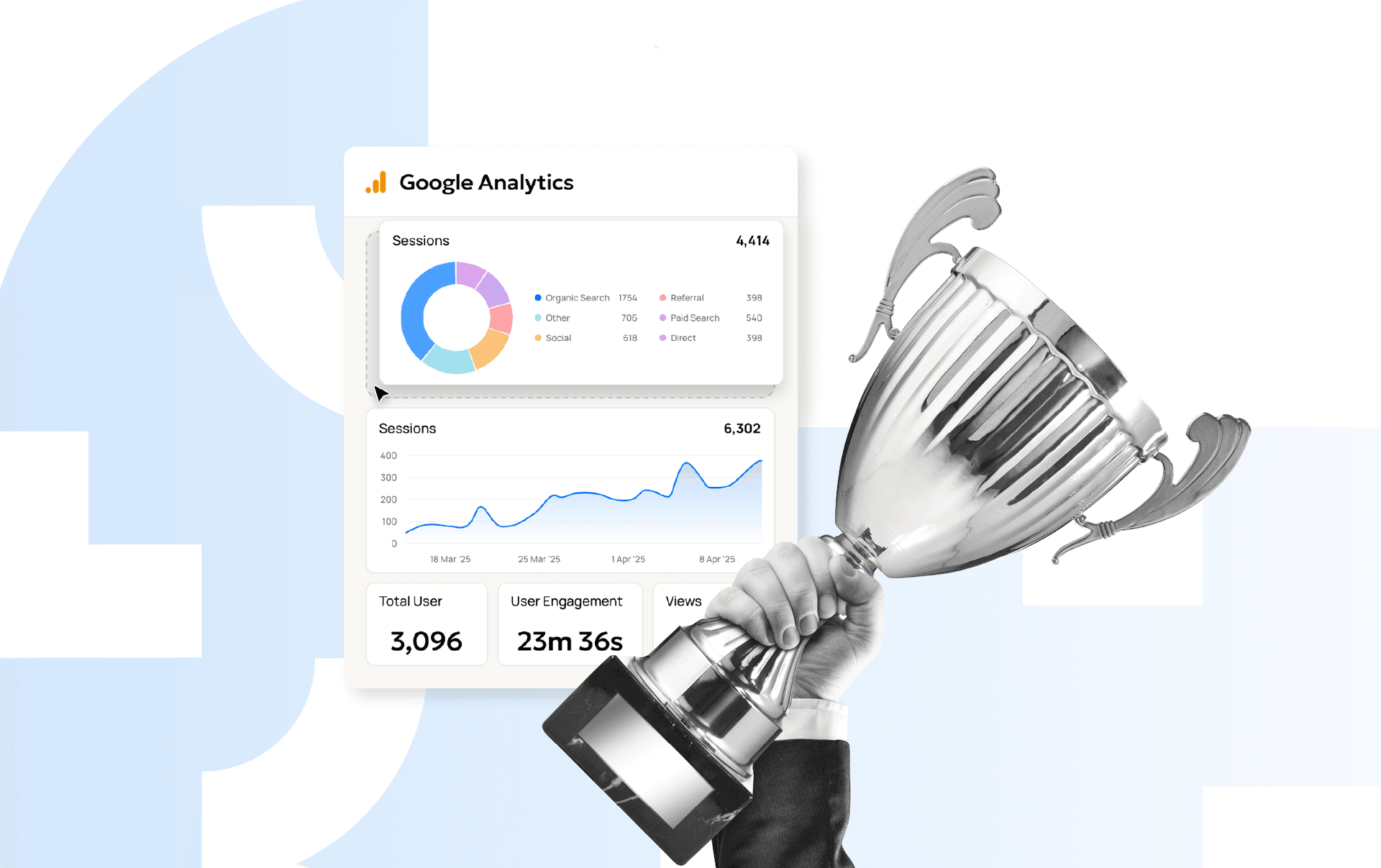

See how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.