Table of Contents

Table of Contents

- The Growing Importance of Employee Benefits

- Why Great Employee Benefits Programs Are a Strategic Advantage for Agencies

- How to Design an Employee Benefits Program That Works

- 3 Lessons Learned From Revamping Benefits at AgencyAnalytics

- Start With Core Benefits, Perfect the Foundation, and Then Build on It

7,000+ agencies have ditched manual reports. You can too.

Free 14-Day TrialQUICK SUMMARY:

As an agency grows, so do the complexities of managing an expanding team. An outdated benefits program leads to dissatisfaction, higher turnover, and difficulty attracting top talent. By modernizing benefits, agencies strengthen their employer brand, foster loyalty, and remain competitive in a talent-driven market. In this article, AgencyAnalytics’ Chief People Officer Lyse Cornelius-Biggs shares the importance of employee benefits, a systematic approach to designing an effective program, and lessons learned from a recent revamp exercise.

Take care of your people, and they’ll take care of your agency.

It really is that simple. After all, the employer-employee relationship is built on mutual value. Employees show up, bring their skills, and drive your agency’s success. In return, they expect their contributions to be recognized and their well-being prioritized.

That’s where benefits come in. They’re not just nice extras; they’re a tangible way to show employees that your agency cares about more than deliverables. A thoughtful benefits program supports their physical health, mental well-being, and financial security—essentially saying, “We see you, and we’ve got your back.”

Early on, many agencies start small with their benefits, maybe offering basic health coverage or a handful of perks to keep things manageable. But as the agency grows, so does the team. What may have worked for 10 or 20 employees often falls short when you’re talking about a significantly increased headcount. Scaling benefits is no longer optional in these scenarios–it’s necessary to retain talent, boost productivity, and stay competitive.

If you’re at the stage where your benefits program feels outdated or misaligned with your team’s needs, it’s time to make a change. In this article, I’ll walk you through why competitive offerings are non-negotiable, how to modernize your existing benefits plan, and what we learned from our recent benefits revamp at AgencyAnalytics.

The Growing Importance of Employee Benefits

Benefits play a key role in staff retention, employee engagement, and overall job satisfaction. More specifically, here’s what the stats are saying:

According to a recent study by Metlife:

63% of employees say their current benefits package helps reduce overall stress.

61% of employees report that their benefits help ease financial burden.

Nearly 66% of employees believe their employer is responsible for supporting their financial security, as reported by EBRI.

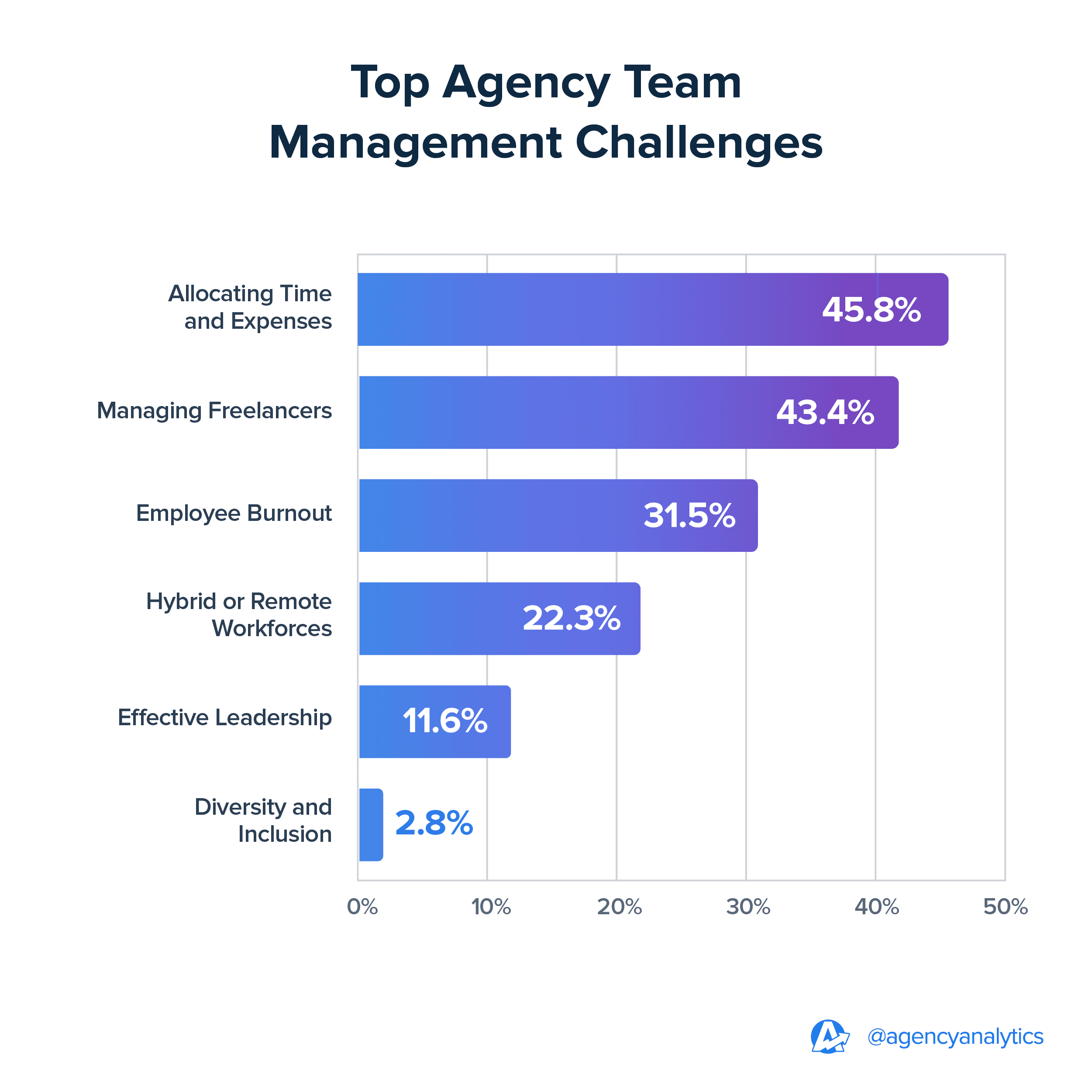

In our latest Benchmarks Report, 31% of agency leaders identified employee burnout as a significant challenge. Beyond its impact on mental health, burnout may result in higher absenteeism, reduced productivity, and less revenue.

Benefits address these needs and create a more engaged, loyal, and productive workforce. In turn, this directly impacts your agency's performance and bottom line.

That said, meeting these needs isn’t static. It requires adapting to the changing expectations of today’s workforce. Take Gen Z and Millenials, for example–they prioritize benefits in a way that previous generations didn’t. Mental health support was often stigmatized and talked about in hushed, cautious whispers. Now, these employees recognize their humanity beyond work tasks, placing greater emphasis on psychological safety.

From a value proposition standpoint, younger employees bring fresh perspectives, adaptability, and a strong sense of purpose. By understanding their needs, agencies will gain a competitive edge and attract the best talent.

My takeaway from working with Gen Z? The stereotypes are all wrong. They aren’t staring at their phones all day, afraid to work, or spending all their money on avocado toast or whatever. They’re hard workers, good employees, and effective teammates. They work well together and in groups, and they’ve made our company better from top to bottom. I’m glad I have plenty in my agency.

Danny Star, CEO and Founder, Website Depot

Why Great Employee Benefits Programs Are a Strategic Advantage for Agencies

Offering great benefits isn’t just the right thing to do; it’s smart business. When designed thoughtfully, a comprehensive package will strengthen your agency in the following key areas.

Increased Staff Retention

Many employers think of benefits as a tool for attracting talent—and they are. But here’s the kicker: Benefits are just as powerful for retaining employees.

Take health insurance. According to Benefits Pro, 72% of employees reported it as the top benefit influencing their decision to stay or leave a job. It makes sense, too. When you offer support that considers the whole person, it creates what I like to call “organizational stickiness.” People are far less likely to leave when they feel genuinely supported.

A well-rounded employee benefits package doesn’t replace fair compensation. However, it does ease some financial burdens, which is huge in today’s economic climate. With 65% of Americans deeply worried about inflation, benefits that offset major costs will make a meaningful impact.

When employees feel cared for, they’re more inclined to stick around. And for agencies, that’s a win. It means lower turnover, fewer resources spent finding replacements, and more time to focus on growth.

Invest in a tool that makes life easier for your employees and clients. Consolidate data across 80+ platforms, cut down on manual work, and streamline reporting–try AgencyAnalytics today, free for 14 days.

Elevated Employer Branding

Job candidates are doing their research. They’re not just glancing at descriptions; they’re digging into reviews of your agency culture, salary ranges, and, yes–your benefits packages.

Satisfied employees are your best brand ambassadors. When people feel valued, they naturally share their positive experiences, whether online or through their networks. That kind of word-of-mouth credibility? It’s worth more than any polished LinkedIn post or a well-curated Careers page.

Now imagine a highly skilled professional weighing two job offers. Both come with competitive salaries, but one also includes a comprehensive health insurance plan, retirement matching, flexible work options, and generous PTO. Which offer do you think they’ll choose? Probably the one with the better benefits package.

In other words, benefits are often the tipping point that helps job seekers decide where to invest their talent. It’s what contributes to your employer reputation and perceived credibility.

Increased Productivity and Staff Morale

Why are employee benefits important? Well, it impacts everything: Work performance, interpersonal relationships, client management, and even physical health. Consider that:

Motivated Employees Go the Extra Mile: Perks like performance bonuses, career development funds, and recognition programs inspire employees to exceed expectations.

Work-Life Balance Drives Innovation: Benefits that promote work-life balance (such as remote work flexibility or paid time off) allow employees to recharge. This results in fresh, innovative ideas and long-term productivity gains.

Reduced Absenteeism: Benefits like medical insurance and wellness programs help employees stay healthy. It leads to fewer sick days and more consistent team performance.

By investing in a solid employee benefit plan, you’ll create a ripple effect that keeps the agency moving forward.

How to Design an Employee Benefits Program That Works

Designing a benefits program doesn’t have to feel overwhelming–the key is to be intentional and focus on what truly matters to your team.

Here’s a step-by-step approach to employee benefits planning.

1. Understand Your Team’s Demographics, Life Stages and Needs

Start by truly understanding the people who make up your agency. Gathering demographic data is a great starting point—it helps uncover priorities based on life stages.

Are most employees early-career professionals focused on saving for their first home? Perhaps they’re mid-career and juggling family responsibilities? Hone into these key insights since each life stage comes with unique needs. While it’s tempting to emulate popular benefits from other organizations, they might not align with what your team values. Instead, take this strategic approach:

Ask Your Benefits Provider To Identify What’s Already Working. Which insurance benefits are employees gravitating toward? Is there any benefit offering that’s being overlooked? This insight will uncover what’s resonating and where there’s room to optimize.

Go Beyond Numbers–Have Conversations With Your Team. Instead of asking directly about what they currently use, focus on broader, solution-oriented questions like, “What’s missing?” or “What would make your life easier?” This route respects privacy while still gathering valuable feedback.

I lead from a place of honesty, directness, and respect. While I have a lot of experience, I don't have all the answers, and I don't want to. Hearing other people's opinions, thoughts, and differing opinions is critical to growth–both for myself and the business. It allows people to feel comfortable bringing all of who they are to the work, and it shows them that they are valued.

Yanira M. Castro, CEO, Humanity Communications Collective

By combining these perspectives, you’ll have a clear roadmap for investing in benefits that truly align with your team’s priorities.

2. Conduct Research to Gauge External Trends

Next, see what’s happening outside of your agency. It helps uncover opportunities to enhance benefits plans and ensure they align with industry standards. Here’s exactly how to do it.

Strategy | Details |

|---|---|

Do a Market Scan | Take a close look at what other agencies are offering. What’s considered standard in your industry? What unique perks might be setting others apart? Use these insights to design competitive employee benefits that fit within your projected costs. |

Consider Hiring a Broker | If you have the resources, partnering with a broker will save time and provide invaluable insights. They’ll have access to larger data pools and benchmark your benefits offerings against the broader market. |

Leverage Candidate Insights | Your hiring process is a goldmine of information. Don’t hesitate to ask candidates about the types of benefits packages they’ve seen in the market. This will give a sense of where your agency stands and what might be missing. |

Tap Into Peer Networks | If a broker isn’t an option, lean on your network. Reach out to other marketing professionals in your ecosystem to compare notes. Sometimes, a quick conversation uncovers valuable insights about what’s working for others. |

This exercise provides a comprehensive view of the benefits landscape beyond mere comparison. Instead, it focuses on ways to set your agency apart, identify opportunities, and develop a solid package.

3. Get the Basics Right Before Offering Specialized Benefits

Baseline fringe benefits–like health insurance, disability insurance, and retirement contributions–are non-negotiable. Skimping on these essentials will often leave your team feeling undervalued, no matter how exciting the extras are.

Simply put, nailing the basics sends a clear message: Your agency is committed to supporting employees in meaningful ways. This creates trust and stability, which are essential for sustaining employee morale.

Core benefits often tie directly to local laws, too. Take the Affordable Care Act in the United States: Employers with 50 or more full-time employees must offer minimum affordable health insurance or make a dedicated payment to the IRS. Ensuring these are in place protects your agency and employees, avoiding potential liabilities. It’s also a good idea to include this information in employee contracts and related insights (like how unemployment insurance works in the event of job loss).

Once the essentials are locked in, it’s much easier to layer on specialized perks. This may include things like a professional development credit, tuition reimbursement, or extended health coverage for dependents. If you’re at this stage, use the same systematic approach we previously outlined. This ensures any new benefits complement the existing foundation, not distract from it.

Remember, it’s also essential to balance these costs with value. Look into tax-efficient options–such as health savings accounts, commuter benefits, and 401(k) matching–to deliver value without stretching your benefits budget thin.

4. Prioritize Flexibility, But Be Intentional

Not every employee needs the same level of benefits.

Tiered packages—where employees opt into levels of coverage based on their needs— allow your agency to provide value without overspending.

A flexible spending account (FSA) is also worth considering. This benefits account empowers employees to allocate funds toward what matters most to them (like a fitness class or alternative health treatments). This way, your program becomes more inclusive, personalized, and meaningful.

Of course, there are also meaningful benefits that provide maximum value at minimal costs, such as flexible work schedules. The key here is defining clear expectations, like setting specific work hours or core availability windows. Here’s another thing: Certain benefits sound great on paper but don’t materialize as expected (both for your agency and employees).

Unlimited PTO is a prime example. While it sounds ideal, employees often take fewer vacation days under such policies due to feelings of uncertainty or guilt. A more effective method is establishing well-defined vacation limits. It eases cognitive burden, provides clear expectations, and encourages employees to take the time they need.

5. Have a Structured Approach to Communication and Assessing Employee Feedback

A benefits program is only effective if employees know how to access and use it.

Communication should be an ongoing process, not just a one-time rollout. Regularly share updates through multiple channels—emails, team meetings, or your internal portal—and train managers to answer common questions.

Reminders about specific benefits (like wellness stipends during Mental Health Awareness Month) ensure employees maximize what’s available.

It’s also equally as important to evaluate your program. Employee needs change, and your benefits should adapt accordingly. Use dedicated employee surveys (separate from monthly or performance check-ins) to gather this feedback. Include questions such as:

How satisfied are you with the agency’s wellness-related benefits (e.g., mental health resources)?

Are there any benefits you wish were included in the program?

Do you feel you receive enough information on how to use your benefits?

On a scale of 1 to 10, how satisfied are you with the current benefits package?

Are there any barriers preventing you from fully utilizing your benefits?

Once you’ve analyzed the data, make targeted adjustments to close any gaps. This could mean introducing a new benefit employees consistently request, clarifying unclear policies, or promoting underutilized perks.

3 Lessons Learned From Revamping Benefits at AgencyAnalytics

Our recent benefits overhaul at AgencyAnalytics provided invaluable lessons–here are a few things that stood out.

Lesson #1: Anticipate Utilization Surges

One of the most surprising outcomes of our benefits overhaul was the dramatic spike in utilization—double what we initially projected.

This was a critical learning moment for us. Fortunately, we had financial reserves to absorb the impact, otherwise, it may have been a different story.

Over time, utilization normalized as our employees became accustomed to the new benefits and had their needs met.

Lesson #2: Stagger Implementation To Manage Costs

Rolling out all changes at once could strain budgets. To prevent this, we opted for a phased implementation of new benefits, allowing us to spread the financial impact.

This approach also provided the flexibility to adjust based on early feedback and usage patterns. It also ensured employees received access to enhanced resources in a manageable way.

Lesson #3: Have a Refined Communication Strategy

Communication was a critical factor in the success of our program.

Initially, we provided a lot of information about the new benefits. Over time, though, employees tended to forget what was available, particularly with a broad menu of options.

In the second half of the rollout, we focused on regular reminders, targeted campaigns, and leadership training to answer key questions. This ensured employees remained aware of their benefits and could fully utilize them.

Start With Core Benefits, Perfect the Foundation, and Then Build on It

If there’s one thing I’d leave you with, it’s this: You don’t have to do it all, but you do have to make it count.

Designing a benefits package isn’t about trying to offer everything under the sun—it’s about offering what matters most. This starts with asking, “What’s important to our team?” Then, align the answers with your agency’s overarching strategy and compensation philosophy.

In summary, people stay where they feel valued, supported, and cared for. By investing in a thoughtful, meaningful benefits program, you’re enhancing your employees’ lives and making your workplace a better place to be.

The result? A loyal, motivated team that thrives and drives your agency’s success.

Impress clients and save hours with custom, automated reporting.

Join 7,000+ agencies that create reports in under 30 minutes per client using AgencyAnalytics. Get started for free. No credit card required.

Already have an account?

Log in

Written by

Lyse is a high-impact People and Culture Leader with over 20+ years spanning the Financial Services, Retail and Tech sectors. She is a Certified Coach and Change Management Practitioner with a proven track record of building ground-up people strategies for high-growth companies. Lyse leads the People Team at AgencyAnalytics to deliver a seamless employee and candidate experience enabling our ambitious growth.

See how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.