Table of Contents

QUICK SUMMARY:

Net 30 is draining your agency’s cash flow and slowing your growth. Discover why modern agencies are ditching outdated payment terms in favor of upfront billing, retainers, and weekly payments—and how to take back control with smarter, more predictable revenue strategies.

If you run an agency, you've likely dealt with Net 30 payment terms—or are still stuck in them.

On the surface, Net 30 sounds reasonable: Deliver the work, invoice the client, and get paid within 30 days. But, in reality, Net 30 often turns into Net 45, Net 60, or worse. Meanwhile, your team still needs paychecks, your overhead costs don't pause, and the late nights managing accounting headaches keep adding up.

If you’re an agency balancing multiple client accounts and monthly service work, delayed payments create revenue gaps, throw off forecasting, and slow your agency's growth.

When Cody Jensen launched his agency, Searchbloom, he didn’t have the luxury of waiting 30, 60, or even 90 days to get paid.

“Early on, when starting an agency, if you’re not funded or don’t have a solid capital reserve, offering net terms for digital marketing services can be extremely challenging—if not impossible,” Cody tells AgencyAnalytics. “We needed cash flow to keep the business running, cover payroll, and invest in delivering results for our clients.”

For agencies like Searchbloom, extending Net 30 terms isn’t just inconvenient—it’s a serious threat to staying afloat. Even as agencies grow, those delayed payments still create gaps in revenue, throw off forecasting, and chip away at the ability to scale sustainably.

We asked 575 agencies to tell us exactly why Net 30 doesn’t work. Today, we’re sharing their top insights, alongside proven alternatives to smooth out your revenue streams from agency leaders who’ve successfully left Net 30 behind—and aren’t looking back.

What Does Net 30 Mean?

Net 30 is a payment term that gives clients 30 days from the invoice date to submit payment. It's been around forever and was largely designed for business transactions involving physical goods. It gives buyers time to receive inventory, check quality, and process payments. In essence, Net 30 functions like trade credit, granting clients time to pay after services are delivered.

However, in service-based businesses like digital marketing agencies, Net 30 works a bit differently. You're delivering expertise, not products. And once the work is complete, there's no “returning” it if payment doesn’t come through. That makes delayed payments more than an inconvenience—they directly hit your operational stability.

Our work is time and materials—it’s not a physical product we can reclaim if a client decides not to pay. Unlike goods-based businesses that can repossess inventory, our service deliverables are intangible and sometimes irreversible.

Cody Jensen, CEO & Founder, Searchbloom

For agencies juggling multiple retainers, campaigns, and ongoing optimizations, Net 30 turns your team into an unofficial lender—essentially offering clients a month-long, interest-free loan.

As we'll see in the next sections, that financial gap grows fast.

How Do Net 30 Payments Work in an Agency?

For most agencies, Net 30 means completing a month of work, sending the invoice on the first of the next month, and then waiting… and waiting. You’re essentially fronting the cost of labor, tools, and overhead while hoping the client processes the payment on time. (Spoiler: They often don’t.)

With Net 30, most agencies fall into a common trap:

Work through the service month.

Invoice on the first of the next month.

Wait 30 days (or longer) for payment.

Chase down late invoices.

Meanwhile, the team moves forward on next month’s deliverables, while revenue from the last project still hasn’t arrived.

That’s why many agencies eventually realize Net 30 isn't built for service businesses running on recurring work and slim margins. It forces your agency to cover the gap and absorb the financial risk while your clients enjoy flexible payment terms at your expense.

Frank Cowell, Founder of Revenue Ranch, explains why this setup creates a cash flow crunch and what he recommends agencies do instead:

The earlier you can get paid, the better. So the more you can be ahead of the work with money, the better. That means training your client that the invoice is going to come 30 days before the service month starts. You're getting an invoice on February 1 for March services.

Frank Cowell, Founder, Revenue Ranch

This approach shifts the typical Net 30 cycle by getting payment in hand before the work begins.

Common Arguments for Using Net 30 Payments

Despite the headaches, some agencies still stick with Net 30. Why? Usually, it comes down to legacy habits, client expectations, or the appeal of landing bigger contracts.

Here's what agencies often cite as reasons for sticking with Net 30—and why those arguments tend to fall apart.

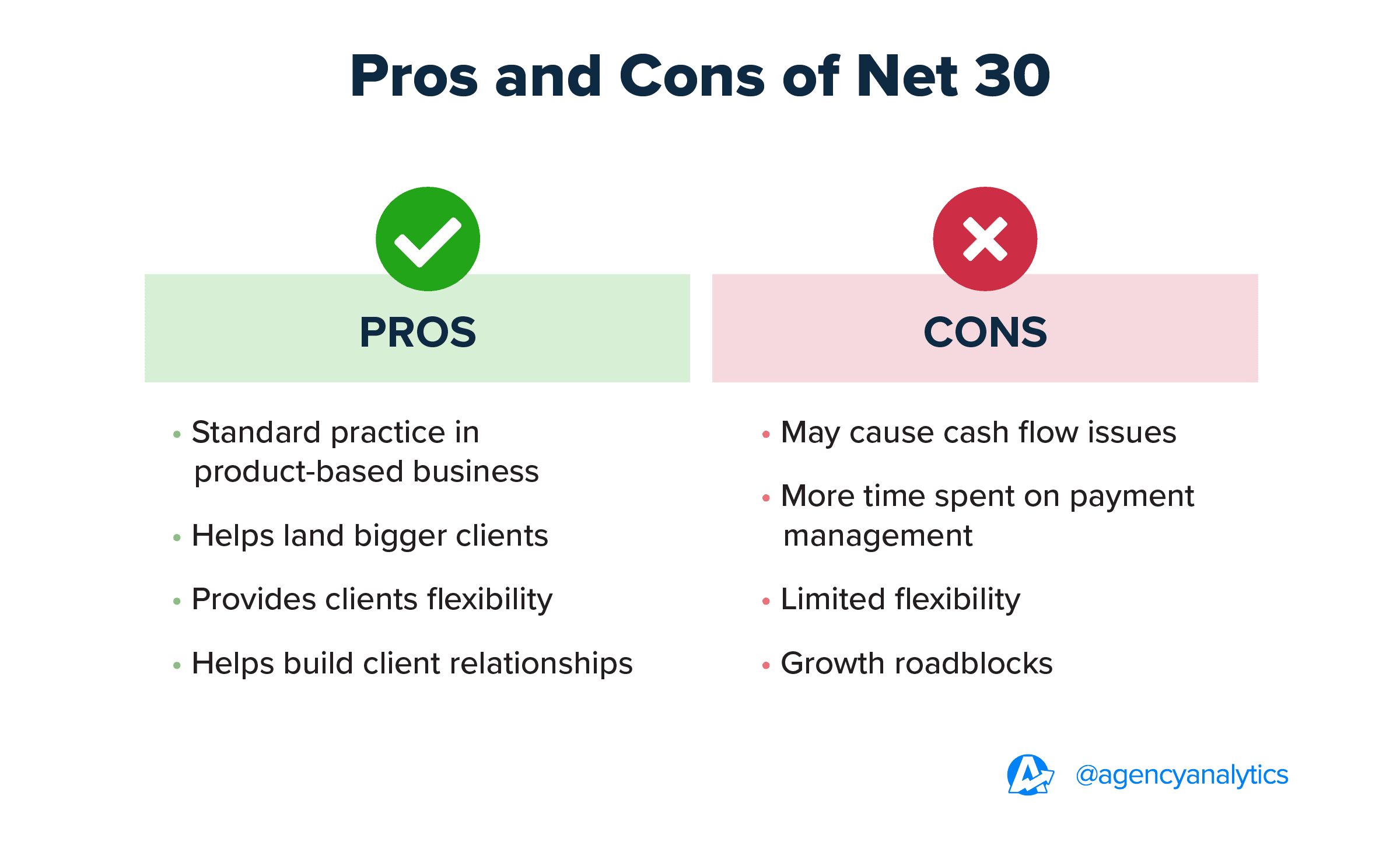

Advantages of Net 30 (at Least on Paper)

1. “It’s standard practice.”

Many agencies default to Net 30 because it's the norm, especially when working with larger brands or corporate clients whose finance teams require it. But just because it's common doesn't mean it's good for your business.

Even if a customer pays on time, you're still waiting weeks after delivering the work to receive funds. The extended payment period leaves agencies covering costs while waiting for funds.

2. “It helps land bigger clients.”

Some agencies believe offering Net 30 makes them more appealing to enterprise clients. But the downside of delayed payments tends to hit hard, as Jonathan Bannister of TopServ Digital found:

The large upfront chunks are definitely nice to have, so that’s why we started out using this method. But we’ve since switched to weekly billings because the downside of Net 30 is getting cash flow under control.

Jonathan Bannister, CEO, TopServ Digital

3. “Clients like the flexibility.”

Sure, clients love flexible payment terms—especially when they're on your dime. However, giving clients too much breathing room on payments will create long-term cash flow issues for your agency, making it harder to cover your own obligations.

4. “It smooths out client relationships.”

On the surface, offering Net 30 seems like a goodwill gesture. But as Preston Palmer of Bellwether Creative Co. explains, success with Net 30 only works if you build strong communication and trust:

We do a much better job of laying out our process and payment expectations on the front end so our clients are aware and prepared to fulfill the Net 30 terms.

Preston Palmer, President & CEO, Bellwether Creative Co.

For agencies with the reserves, processes, and ideal client fit, Net 30 will function—barely. But for many, the disadvantages pile up quickly.

Disadvantages of Net 30

Agencies rarely realize just how much Net 30 is holding them back until the cash flow issues become impossible to ignore. Beyond the administrative hassle, Net 30 introduces serious financial strain that directly impacts your ability to operate and grow.

Here’s what agencies experience when Net 30 is part of their billing model:

1. Cash Flow Chaos

Net 30 terms create cash flow problems and revenue gaps, forcing agencies to float expenses while waiting on payments. Payroll, software subscriptions, and contractor invoices don’t pause because clients are dragging their feet.

Jonathan Bannister explains how the unpredictability of Net 30 disrupted their operations:

For us, the problem was inconsistent billing dates. We had these pockets throughout the month where cash flow would get out of control. That’s why we switched to weekly billing.

Jonathan Bannister, CEO, TopServ Digital

2. More Time Chasing Payments, Less Time Serving Clients

Instead of focusing on delivering results, Net 30 forces your team to spend time managing invoices, sending follow-ups, and escalating overdue payments.

This puts extra pressure on account managers and leadership to keep things moving while chasing payments.

3. Limited Flexibility for Smaller Agencies

For small business owners, Net 30 terms may cause cash shortages that impact payroll and scale.

David Pagotto, Founder and Managing Director of SIXGUN, stresses that Net 30 is often unsustainable for agencies without strong cash reserves:

Most agencies should avoid Net 30 payment terms altogether and opt for direct debit pay in advance terms. This in itself can substantially improve agency cash flow, which is the biggest challenge created by Net 30.

David Pagotto, Founder and Managing Director, SIXGUN

4. Growth Roadblocks

Without reliable, predictable cash flow, securing financing, hiring top talent, or expanding your service offerings becomes difficult—and sometimes impossible.

These are the hidden costs of Net 30—constant cash flow management, financial risk, and the distraction of chasing dollars instead of driving results.

Impress clients and save hours with custom, automated reporting.

Join 7,000+ agencies that create reports in minutes instead of hours using AgencyAnalytics. Get started for free. No credit card required.

Why Net 30 Is Bad for Most Agencies

For service-based businesses like marketing agencies, Net 30 doesn’t just slow down payments—it actively works against long-term growth and operational stability.

The problem is compounded when agencies don’t have deep cash reserves to bridge the gap. Early-stage agencies, in particular, are most vulnerable. Delayed payments may mean missed payroll, stalled projects, and putting off key investments that help the business grow.

Agency owners should always be seeking to improve cash flow.

David Pagotto, Founder and Managing Director, SIXGUN

By extending credit through Net 30, agencies assume financial risk without any of the benefits typically associated with lending. And even when an agency is large enough to “float” the risk, the administrative burden of chasing down payments and managing overdue invoices drags down productivity.

The takeaway? Net 30 terms aren’t designed for modern agencies running high-volume, recurring service models. They expose your business to unnecessary risk and force you to operate like a bank—offering interest-free loans to your clients while covering your own costs out of pocket.

What Net 30 Alternatives Should You Consider?

If Net 30 is slowing you down, the good news is there are better ways to bill. Agencies are moving toward models that prioritize predictable cash flow, reduce financial risk, and eliminate the month-long wait for payments.

Here’s what’s working for real agencies and why these alternatives outperform Net 30.

Upfront Payments

As an agency owner, you’re already covering expenses before the work starts—payroll, software, ad spend, and more. Waiting until the end of the month to invoice—and then another 30 days to get paid—ties up your cash flow and limits your ability to invest in growth.

Upfront payments flip that dynamic. They ensure immediate payment before work begins. Collecting full payment before the service month begins gives you the financial runway to focus on delivering results without worrying about covering costs out of pocket.

We operate on a pre-pay model, where clients pay for the upcoming month’s services before work begins. This ensures alignment, reduces financial risk, and allows our team to focus on delivering value rather than chasing invoices.

Cody Jensen, CEO & Founder, Searchbloom

For agencies with tight margins or fast-growing teams, upfront payments create breathing room and put you back in control of your cash flow.

Retainer-Based Billing

If your agency provides ongoing services—like SEO, content, or paid media—retainers offer predictable, recurring revenue that smooths out cash flow and stabilizes your operations.

Retainers allow you to accurately forecast revenue and staff projects and avoid the peaks and valleys of project-based work.

We primarily utilize retainers because of the volume of clients with similar accounts (and needs) we have. As long as we are communicating well and providing value, the retainer model works great.

Preston Palmer, President & CEO, Bellwether Creative Co.

Retainers work best when paired with strong client communication and clear performance tracking. They build customer loyalty by ensuring clients feel the value month after month.

Weekly Billing

For agencies handling high-volume work or large spend accounts, weekly billing provides a steady cash flow cadence and limits your financial exposure. Instead of floating costs for 30+ days, you’re collecting payments four times a month—making it much easier to stay on top of expenses and avoid cash flow dips.

Switching to weekly billing allowed our cash flow to get much more consistent and allowed us a few extra billing cycles throughout the year.

Jonathan Bannister, CEO, TopServ Digital

Weekly billing keeps your agency's financial pulse healthy and provides early signals if a client’s payment behavior starts to slip.

Direct Debit Pay-in-Advance

Chasing down invoices and processing manual payments adds friction and uncertainty. With direct debit pay-in-advance, your clients agree to automated withdrawals before the service period begins. Payments hit your account on schedule, and your team can focus on the work instead of playing collections.

Direct debit is the closest thing to set-it-and-forget-it revenue for agencies looking to streamline billing and eliminate late payments entirely.

How To Manage Net 30 Payments (If Your Agency Still Uses Them)

For some agencies, eliminating Net 30 just isn’t realistic. Whether it's required by enterprise clients or baked into long-term contracts, you might still need to offer Net 30 terms in certain situations.

However, that doesn’t mean you have to accept the late payments, cash flow gaps, and stress that usually come with it.

Here’s how agency leaders keep Net 30 from becoming a financial drain:

Bill Ahead Of The Service Month

If you're still offering Net 30, don't wait until after the work is done to invoice. Shift your billing schedule so clients receive their invoice before the service month begins, giving them their full 30-day processing window and ensuring you get paid on time.

Frank Cowell uses this model to train clients while staying financially ahead:

For recurring service models, the way I did it and the way I train all my clients to do it is, payment is due at the start of the service month, not at the end of the service month. That means we have to train our client that the invoice is going to come 30 days before that.

Frank Cowell, Founder, Revenue Ranch

Offer Early Payment Incentives

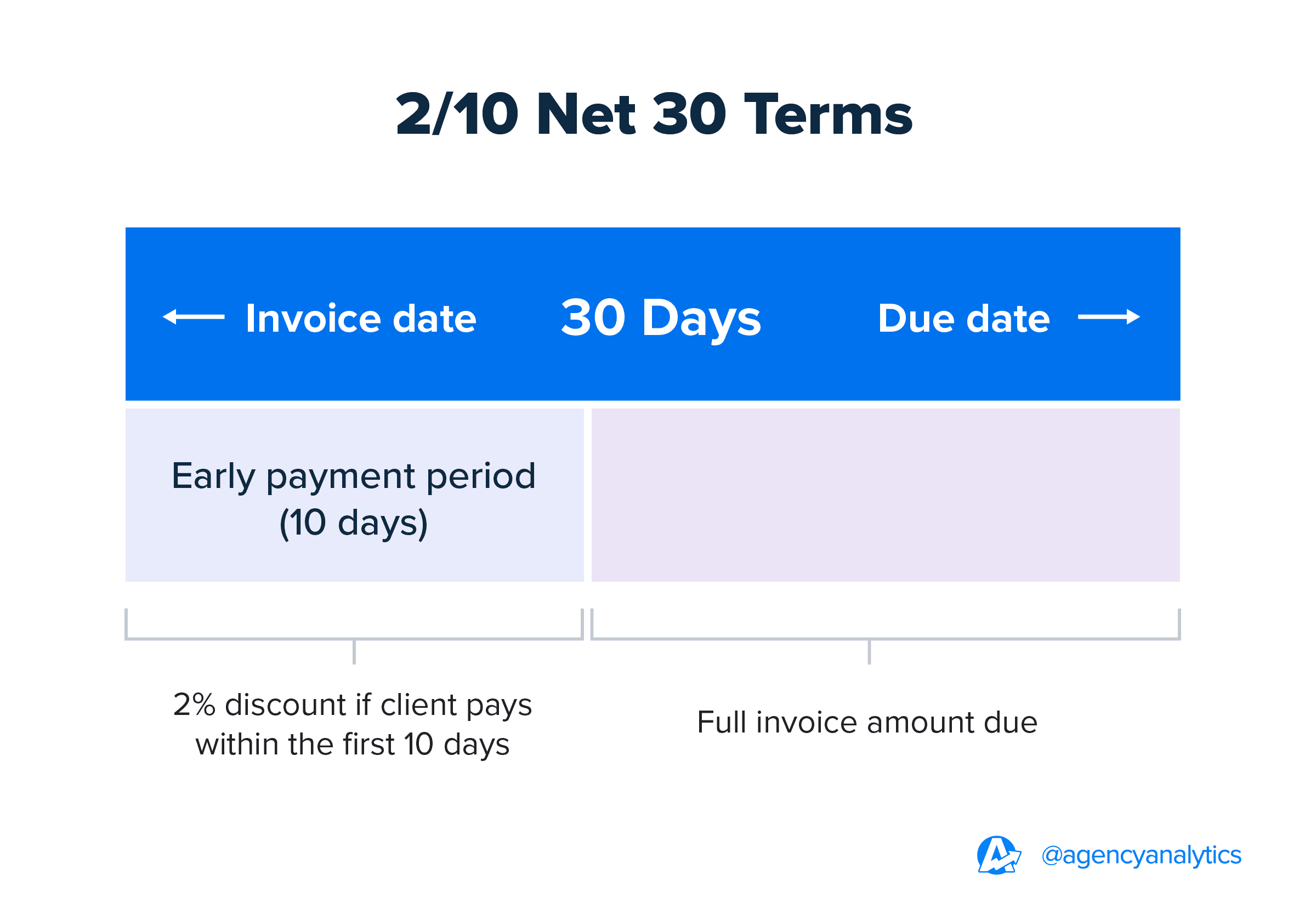

Many agencies use early payment discounts, like 2/10 Net 30, to encourage faster payments while offering Net 30 terms. This means a client gets a 2% discount if they submit full payment within 10 days instead of waiting the full 30-day payment period.

This approach benefits both the agency and the client:

For Agencies: It improves cash flow, reduces late payments, and minimizes time spent chasing invoices.

For Clients: It provides an opportunity to save money on their invoices, increasing customer loyalty over time.

If your agency is experiencing cash flow problems, an early payment discount offer is a strategic way to speed up receivables without disrupting client relationships.

Set Clear Expectations Upfront

Net 30 only works if everyone is on the same page from the start. That means laying out your payment terms in your contract and reinforcing them during onboarding. Be clear about when invoices go out, when they’re due, and what the consequences are for late payments.

Automate Reminders and Follow-Ups

Chasing down payments is frustrating and time-consuming. Automating invoice reminders helps keep payments top-of-mind for clients, reduces manual follow-up work for your team, and minimizes the risk of overlooked invoices.

Set up reminders to go out a few days before the due date, on the due date, and immediately after if payment hasn't been received. Keep the communication professional but firm.

Protect Your Cash Flow With Contract Clauses

Without the right safeguards in your agreements, Net 30 can leave you exposed. Protect your agency by including contract clauses that give you options if payments are delayed.

Consider clauses that enable your agency to stop work if payment is not received within a certain time frame, charge the client interest on overdue amounts, and pursue the client for collection and legal costs if necessary.

David Pagotto, Founder and Managing Director, SIXGUN

Build a Financial Buffer

Even with perfect processes, payments may still come in late. A healthy cash reserve helps absorb payment delays without putting your projects or team at risk.

Aim to build up at least one to two months of operating expenses in reserves to cushion against late payments and unexpected expenses.

Keep an Eye on Payment Patterns

Chronic late payers signal deeper issues. Monitor these patterns and be ready to revisit the relationship—or the terms. Sometimes a conversation will help reset expectations, but in other cases, it may be best to stop extending Net 30 terms to that client—or to phase out the relationship entirely.

Tracking payment trends helps you identify potential cash flow risks early before they become major problems.

Stop Letting Net 30 Hold Your Agency Back

Net 30 payment terms might feel necessary for doing business, especially if you've been working with enterprise clients or following industry norms. But as agency leaders know all too well, delayed payments stall growth, add unnecessary stress, and force your agency to cover financial gaps that shouldn't exist in the first place.

The agencies we spoke with have all come to the same conclusion: predictable, upfront payments create healthier businesses. Whether shifting to retainers, weekly billing, or direct debit pay-in-advance, the most successful agencies build systems that protect their cash flow and free up their teams to focus on delivering results—not chasing invoices.

If you’re locked into Net 30, get proactive. Shift your billing cycle forward, automate reminders, enforce your contracts, start offering early payment discounts, and build cash reserves to give your agency breathing room.

Net 30 may have been the standard. But it's time for agencies focused on growth, stability, and sustainability to set a new one.

Written by

Francois Marchand brings more than 20 years of experience in marketing, journalism, content production, and artificial intelligence (AI). His goal is to equip agency leaders with innovative strategies and actionable advice to succeed in digital marketing, SaaS, and ecommerce.

Read more posts by Francois MarchandSee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.