Table of Contents

QUICK SUMMARY:

Managing cash flow is key for marketing agencies to maintain operations, plan for the future, and scale effectively. This guide shares expert insights on balancing income and expenditures, highlighting the importance of monitoring cash flow to meet financial obligations and make strategic decisions. Learn from successful agency owners how to manage, monitor, increase, and navigate through cash flow challenges, ensuring the sustainability and growth of your agency.

It’s rare to find a growing marketing agency that hasn’t endured some kind of cash flow crisis at some point since its conception. This is because everything your agency does revolves around cash flow management.

Can you hire more staff?

Cover overhead?

Be selective when you take on more clients?

Purchase new software or attend a conference in another state?

Managing cash flow is a crucial aspect of agency management that needs to be closely monitored.

If you’re growing your agency, ensuring consistent positive cash flow is crucial for long-term success.

We sat down with three marketing agency owners to get their take on the importance of proper cash flow management–how to maintain it, how to monitor it, how to increase it, and how to get out of a crisis.

Be sure to bookmark this guide and refer back to it as you grow your digital marketing agency as we cover:

Why Monitoring Agency Cash Flow Statements Is Important

A healthy cash flow at a marketing agency is all about balancing the amount and timing of money coming in and going out of the business. It includes income from clients, payments to vendors and staff, capital investments or expenditures, and other expenses related to running the agency.

Cash flow management helps you meet your financial obligations. It helps you plan for the future. And it helps you decide when you need to push the accelerator or pull back–depending on what’s going on in your industry or amongst your team.

–Dan Delmain, Founder of :Delmain

“It makes the world go ‘round,” says Tim Akers, Founder of Akers Digital, an agency that focuses on the outdoor industry space, and it’s no different for agencies.

Dan Delmain bootstrapped his Portland-based digital agency, :Delmain, from the beginning and has managed cashflows carefully as he scaled his business to a 22-person team. He says that cash flow management helps you know when to:

Meet your financial obligations

Plan for the future

Know when to push on the accelerator or when to pull back

“Cash is king,” adds Dan. “Cash flow is paramount to every business.”

Trevor Shirk, CEO & Founder of Terrayn Dispensary Marketing, works with 300 dispensaries across the US and Canada and says he wouldn’t be at this size without monitoring his agency’s cash flow.

“It’s so important because it helps us understand what we can invest in and what we can’t,” he says. “I also hold myself personally responsible for handling it so I can make payroll, retain my employees, and keep the business running.”

Signs of Cash Flow Management Problems

Building an agency structure that delivers great services with a great team is one thing, but if you don’t have healthy cash flow management, it doesn’t mean much for your business’s longevity.

For example, successful agency owners understand that they need to spend money in order to make money. This couldn’t be more true when it comes to balancing how much to charge for PPC services with how much it costs the agency to deliver those services.

“You can create an agency that has a boutique model but if your goal is going for mass numbers, you need to have a diverse client base,” Trevor says, noting the difference between building a smaller agency and growing a sustainable large-agency model.

Watching Out for Early Warning Signs

But there are some early warning signs that your agency could be heading into cash flow problem territory. Warning signs are:

Clients not paying on time

Paying your vendors too quickly

Hiring too many people too fast

Not having finance options in place

Improper agency pricing (discounted services)

No cash reserves available to weather unexpected storms

Inaccurate financial records or forecasts

Stagnant or plateaued growth

But running short of cash is not the only cash flow problem that can hamper an agency’s growth. Sometimes, being too strict on expenditures can slow down the marketing agency’s growth engine and lead to unfavorable cash flow statements.

Finding a Balance Between Being Risk Averse and Investing in Growth

For Dan Delmain, he’s been fortunate not to run into any cash flow management problems because of always making conscious decisions. However, he admits his cautious approach may have kept him focused on the present and not as much on the future.

“I came into this first entrepreneurial journey very bootstrapped,” Dan explains. “I was very conscious of making sure that there was always cash in the bank before I made decisions. So we haven't had an issue in terms of cash flow management, because we've really focused on making sure that money is there.”

However, he warns about be too money-aware, as it can be a double-edged sword that can work against you:

There is a detriment to being a little bit too risk-averse, and maybe I needed more of a balance between making more investments into the company versus making sure we're cash positive.

–Dan Delmain, Founder of :Delmain

How To Avoid Cash Flow Management Problems & Get Out of a Crisis

Are you trying to get new clients but not attracting the ones you want? Are clients a bit behind in paying their monthly invoices? Or do you have unpaid bills sitting around? Maybe you’re not monitoring your expenses as frequently as you should be?

Any one of these issues could lead you toward a cash flow crisis before you know it. Luckily, it’s possible to bounce back and solve your cash flow problems, and agencies like Terrayn have.

For example, identifying anomalies that are easier to spot when you set time aside to plan ahead.

Trevor says because they weren’t monitoring their payroll closely, there were times when they had to deliver 3 paychecks in one month, which started affecting their cash inflows.

“We would be going payroll to payroll during a normal month, and then all of a sudden, a third hit, and we were like, “Wait a second. What happened?’ We didn’t realize that the way these months fall, we’re going to have a 3-payroll month.”

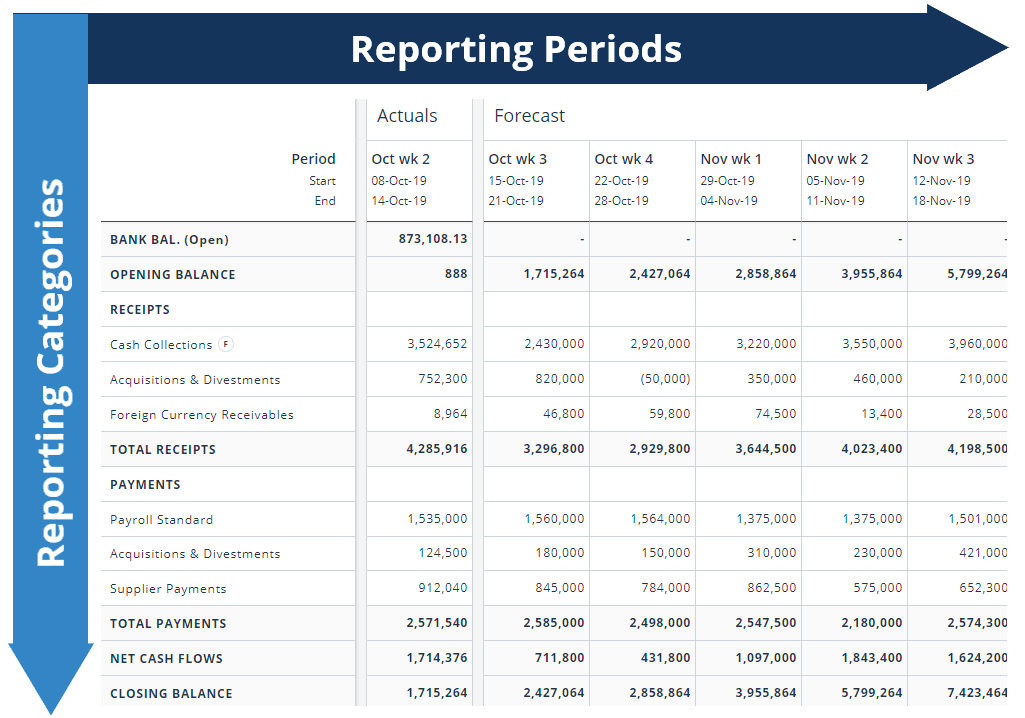

1. Adopting the 13-Week Cash Flow Model To Regularly Check In

“We mismanaged cash probably two or three times where payroll became a really big deal. We weren’t monitoring it very closely or the days the system would pull the money out of our bank account,” Trevor explains. “We also invested in a lot of new tech solutions for our clients, so we knew we needed to switch to a different cash flow model to be able to monitor all of these important dates.”

“We ran into the issue of overcommitting,” says Trevor. “And the way we overcame that moving forward was with a 13-week cash flow model.”

Trevor researched what private equity companies do when their business is running out of cash and how they turn it around. The new cash flow model–which gets updated weekly–has helped him get a clearer view of expenses coming down the pipeline and figure out how much working capital he has. In the end, this has helped him make better business decisions.

But determining a solution to solve cash inflows will be different for every agency. Some may need to keep a closer eye on payroll, whereas others may need a complete overhaul of their business plan.

One of the fundamentals that all three kept coming back to is that it’s crucial to forecast and plan accordingly. Flying by the budgetary seat of your pants can work for a young, small agency–but it will eventually get you into trouble.

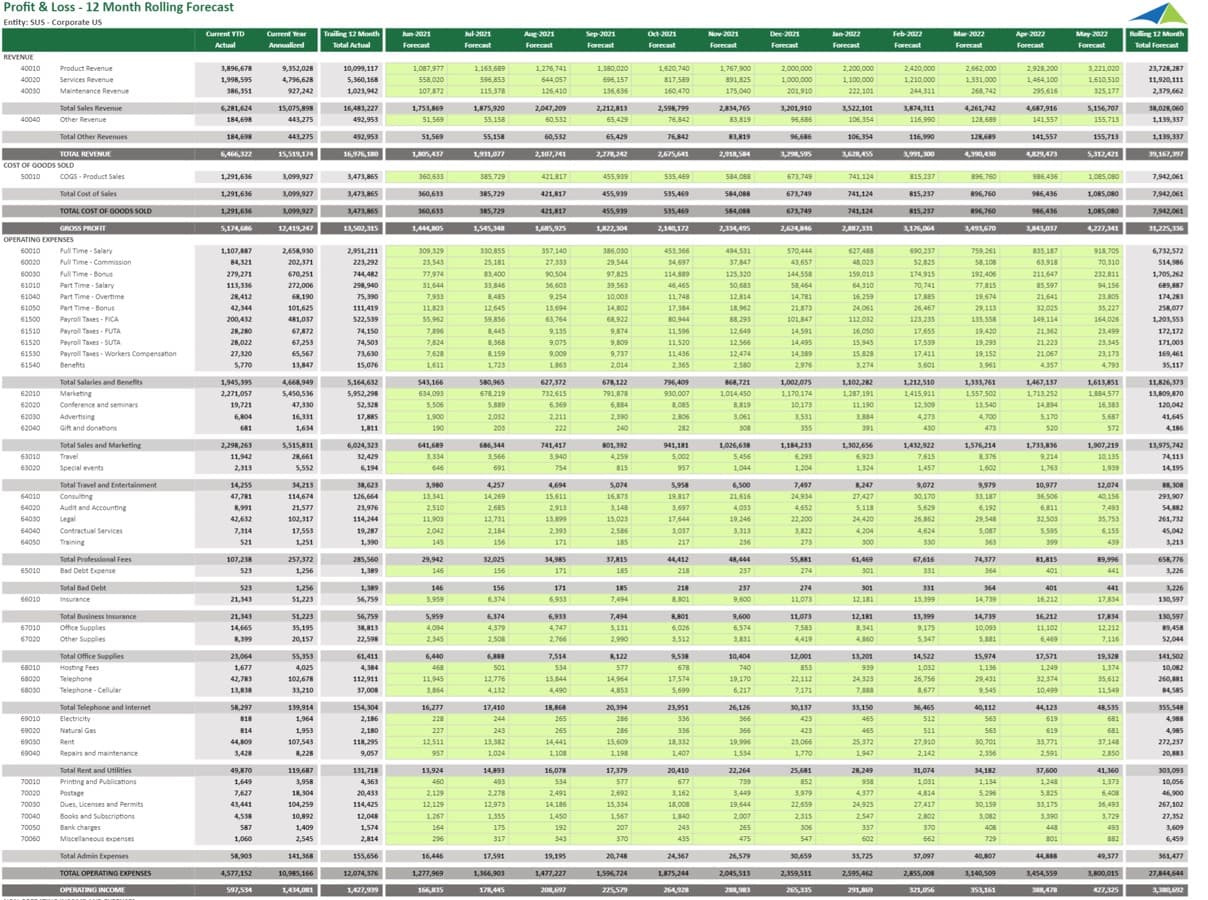

2. Trending Out With the Rolling 12 Profit and Loss Statement Model

Delmain uses the rolling 12 P&L statement to help trend out the next 12 months. It’s a very useful tool to make more long-term plans instead of having a myopic view of the shorter term. It provides insights into sales, cost of goods sold, gross profit, and what kind of target profit number they’re trying to achieve.

Looking at their cash in the bank and cash on hand has also helped them avoid the pitfall of running out of money. It also gives a more accurate overview of net cash flow.

I have my pulse on how much cash is in the bank account, along with other numbers, and we're updating that weekly. It gives me a better sense of where the company is financially.

–Dan Delmain, Founder of :Delmain

15 Ways To Manage Marketing Agency Cash Flow

On the surface, increasing cash flow sounds pretty straightforward–more money coming in, less going out. But that can be easier said than done.

Below are 15 strategies successful agencies use to ensure they have a positive cash flow as they scale their business:

1. Develop a Cash Flow Forecasting Model

Developing a cash flow forecasting model helps you understand if you have enough cash to run your agency and expand it. Are there certain payments that you know are consistent? Are you aware of a large-budget client coming down the pipeline in your next quarter? Are you equipped to predict what a future cash flow looks like?

This is all about trying to see into the future to understand the expenses that will happen and the revenue that the agency is expecting to receive. By using and updating a forecast, it’s easier to see deviations–such as revenue not coming in at expected levels or expenses coming in higher than expected–which can be early warning signs of an impending crisis.

Cash forecasting helped Dan create a 3, 5, and ten-year growth plan. For Trevor, it helped create a predictable model that fueled his quarterly planning. And for Tim, tools like Live Plan, which he uses to create a 12-month forecast for his agency, have helped him understand who he can hire and when.

“It’s helped us plan out our future cash flow and even plan out our next hires,” he explains. “It’s helped us say, ‘Alright, this is how much this person is going to cost. Do we have the cash to do that?’”

2. Analyze Your Cash Flow Needs

Increasing your cash flow statement requires an initial analysis of your agency’s needs. It’s important to understand the revenue your business has generated and how much is being used in a given period.

To do a cash flow analysis, compile a list of your cash sources (money coming in) and cash expenses (money going out). Does your agency have needs that are non-negotiable?

For example, maybe you have a videographer that requires updated equipment to do their job (hopefully a one-time expense). Or maybe you’ve implemented software (a recurring expense) that’s required to fulfill client contracts.

Getting clarity on your company's cash flow needs is essential for maintaining a financially sustainable business.

3. Establish a Budget

Aside from your clients’ budgets, you also need to consider your agency’s budgets. Establishing a budget helps you plan where and when you should spend money on your business.

Your budget should include things like fixed and variable costs, when certain payments are due, and which are mandatory versus optional. This gives you insights into exactly how much working capital you have to spread across the business needs, leading to a more accurate cash flow statement.

4. Audit Your Expenses

Once you have an established budget, review it regularly and compare it to your actual numbers. This shows you where you’re over or underspending. It also shows where you could cut back on unnecessary expenses on your cash flow statement, like subscriptions or travel, for example.

Your agency should also have an expense procedure in place. It should go into detail about who is in charge of the corporate credit cards, expense allowances, travel expense policies, signing authority, credit card reconciliation, and more.

“We audit our credit card statements all the time,” Trevor says. “It’s helped us catch things like if someone charges an Uber or a Lyft after returning from a business trip because they forget to switch the credit card back to their personal one. Or things that may be a little out of what allowance they have.”

Not only does monitoring the expenses give your agency a better handle on cash flow, but it creates a cleaner paper trail for tax records, investors, or even a future sale of the agency.

5. Create an Emergency Fund

Having enough cash on hand allows an agency to respond quickly to changing market conditions, take advantage of opportunities as they arise, and be more selective when it comes to client acquisition.

Sufficient cash reserves also help agencies manage their finances more effectively and provide a cushion against unexpected costs, such as sudden increases in expenses or a decrease in revenue. This is especially important for agencies that operate in volatile markets or those that work with clients with unreliable payment cycles.

Setting money aside ensures that the agency can continue operations even if there is a dip in income due to slow months, or unexpected economic changes such as a pandemic or a recession.

Tim emphasizes how important it is to keep an eye on every business decision you’re making–especially early on. For example, he created a cash flow forecasting model that involves splitting the Akers Digital profit into thirds to prepare for unexpected expenses.

“It depends on your business model, but any money we have coming in, we set aside one-third as a bonus, another third for taxes, and a third for a growth fund,” he explains. “This builds up an account for when cash flow is tight and you may need to dip into that emergency fund. Even for personal finances, I recommend getting that started early.”

When you have enough cash in the bank or cash on hand, it helps you avoid a pitfall of, ‘Uh oh. We ran out of money. What are we going to do?’

–Dan Delmain, Founder of :Delmain

6. Forecast Your Cash Flow Needs

Determine what expenses are a priority for your business in order for it to grow. You may find yourself in a situation that requires a cash flow strategy for survival. No business owner wants to find themselves unable to pay their employees, suppliers, rent, or other expenses.

Trevor recommends keeping an eye on what the billion-dollar companies (Amazon, Google, Facebook, etc.) are doing in terms of their balance sheets to get an idea of where the industry is headed.

Many of these goliaths in the industry are already trimming back staff to better prepare themselves to weather the economic storm that is approaching.

Holding on for too long when you see the early signs of a pending problem can make things worse down the road.

He also suggests agency owners take a look at who their strongest employees are when making those difficult decisions.

“You have to have those hard conversations as a team that are like, “Well, who’s not an A or B player?’ Because we need to trim the headcount,” he says. “Because it doesn’t serve anybody if the ship sinks.”

He compares it to his experience in the military:

“We would triage the casualties. You have to save the life. So that means you might have to put a tourniquet on and stop the bleeding of a leg. And that's hard to do as a business owner because I’m the person who hired these people,” Trevor shares.

On the other hand, Dan has remained working with past employees on different terms. He recommends that if you have to let good people go because of cash flow statement issues, look for ways to keep them within the agency ecosystem.

“We only had to let go of one person because of over-staffing and that was also right when Covid hit in 2020,” Dan explains. “Even though it was an unpleasant experience, the byproduct of that was this person moved to a freelance role and they continued to work with us for another 12 months.”

He reminds himself of the old adage “slow to hire, quick to fire” when it comes to letting an employee go.

“As business owners, we all do this. They delay, they agonize, and then two months later, they say in retrospect they wished they would have done it earlier,” Dan says. “It’s really tough as a business owner but it’s to the detriment of the company the longer you let it linger.”

7. Regularly Review Your Business Performance

Oftentimes, agencies get caught up in helping their clients' businesses grow and neglect to look after their own business growth. Putting specific KPIs in place highlights where you’re exceeding, meeting, or falling short of your goals. This makes it much easier to make cash flow projections and keep the ball rolling.

Tracking your agency’s performance on a formal and regular basis shows you what your current market looks like and if there is a possibility to find new customers or business opportunities. It can also be an early predictor of things starting to cool off in the near future.

Consider things like your business goals. Do you want to grow your team or will you work on refining internal processes? You’ll need to determine what success looks like for you, develop the KPIs to keep you on track, and then review what’s working and what isn’t.

8. Diversify Your Revenue Streams

Aim to onboard clients that have a variety of budgets. You don’t want to focus solely on large ticket clients in case you lose one, and it massively impacts your business. And the same goes for small ticket clients.

As you scale your agency, it’s important to look at how much income is coming from a particular client.

“Early on, our client base was diverse, but there was a high percentage of revenue based on one client. That’s always a risk,” Trevor explains–noting that if that one client leaves the agency, it can instantly send the entire company into a cash flow crisis. “If you’re serious about growing your business, you must have diverse client budgets. That way, if you lose one or two clients, you don’t really feel it.”

I’ve heard of other agencies or brands closing their doors due to being tied to one specific industry or client. Whether it’s due to the Pandemic or not, that diversity is important.

–Tim Akers, Founder of Akers Digital

No matter what business you have, everyone wants to increase their revenue coming in. But first, you must understand (and optimize) where your money is coming in from.

Agency Tip: Your largest client should account for less than 15% of your revenue coming in. Try and think of ways to diversify your revenue streams. Determining the best course of action depends on your agency’s niche or industry. However, there are a few areas to consider, like building off of your current services (upselling clients) or creating new ones altogether. For example, creating a proactive process that lets clients know you’re thinking about their potential business problems (with a solution) before they’ve even happened.

9. Productize Services To Predict Revenue

Offering product-like services helps you get regular and more predictable revenue that you know you can count on. It’s a great way to get paid upfront as you work with a client–something that will help immensely as you scale your agency.

“Three or four years ago, we had this wonky, hourly, a la carte, you-get-to-decide-what-you-want-to-do type of services. People were pulling their hair out on the team. It was an absolute invoicing nightmare,” says Dan.

Since then, they’ve implemented ‘Good,’ ‘Better,’ and ‘Best’ service packages that have not only helped streamline their processes but also productize them.

“It’s so much easier,” Dan laughs. “The communication alignment amongst team and partners works really well for us. And we were definitely late to that party.” Plus, it makes it much easier to forecast future revenue.

The services that Terrayn offers are on a similar package-type model that allows their clients to self-select what fits them best at their stage of business.

“We have tiers that allow us to flex clients if they hit economic tough times,” he explains. “We try to be that partner that has your back. We tell them, ‘Let’s bump you down to this, and that way, you won’t lose any of the results but we can continue to work together and figure this out.’”

Akers Digital offers flexibility in ad spend budgets which help them generate more opportunities for upselling clients.

“We do a percentage of ad spend which has helped us scale up or scale down. If we do a good job, they’re going to spend more money on ads,” Tim says. “When we make more, they’re making more.”

10. Negotiate Flexible Payment Terms for Agency Expenses

Optimizing your agency’s payment terms is the most direct way to increase working capital. Keeping track of each payment shows you exactly what you owe, to whom, and when each payment is due.

It also frees up more working capital that you funnel into other investments to kick-start your business growth.

“I find it really easy to get caught up in paying for things and investing in other things, and before you know it, you’re paying bills that don’t necessarily need to be paid right away,” Trevor adds.

Simply put, you want to balance assets and liabilities while managing your cash flow effectively in order to fulfill short-term operating costs and debts, as well as set your agency up for future success.

If an invoice isn’t due for 90 days, but you pay it upon receipt, you’ve effectively given up three months worth of working capital that could have been used for other growth projects.

11. Collect Payments Quickly and Securely

On the other hand, you need to optimize payment collections. Otherwise, your cash flow projections won't actually materialize.

If your clients aren’t paying on time, you need to track down unpaid invoices and follow up on late payments–as it directly affects the cash your agency has to work with.

Create invoice payment terms to ensure your agency receives payment within a reasonable time. This is also where you include late fees so your clients don’t feel like they’re being hit with unexpected charges.

It takes time to manage cash flow and figure out a payment collection system that works best for your agency (and your clients). Do you want to ask for payment upfront before handing over deliverables? Or do you want to send an invoice after the fact? Either way, you need a secure, and automated system that you can rely on as you scale your agency. It's the only way to end up with healthy cash flow statements.

“Something that helped to manage cash flow was to invoice on a monthly basis,” says Dan. “We also send it 30 days in advance before we complete the work. That way, we always have cash coming into the bank and then there are triggers if they’re delinquent on their invoice.”

He’s also found another strategy to save on small costs that add up over time.

When you’re collecting payments from your clients’ credit cards, see if you can pass on the costs involved.

For example, Dan prefers using an ACH (Automated Clearing House) form to get the payment upfront, but if the client insists on paying with a credit card, they’ll pass the additional credit card processing charges to the client so they’re not responsible for that extra cost.

12. Consider Financing Options

Are you considering all of the financial ways to accelerate the growth and operating cash flow of your agency? As with any business, there are always startup costs and then regular recurring costs. Researching all of the different sources of funding for your agency makes the difference in how fast your business grows.

Self-funding / Bootstrapped

If your expenses are manageable, you may have been able to make this option work. However, it also comes with the risk of long-term debt, losing personal savings, not earning a paycheck for yourself, and of course, a negative cash flow statement.

Small Business Loans

Getting the necessary funds from the bank is another route agency owners take when managing cash flow. However, you always want to consider the interest rates and terms and conditions as they can make a major impact on the success or failure of your agency.

Venture Capital from Investors

Obtaining venture capital is an option that can sometimes be time-consuming as investors want to get to know your business model and understand who and what they’re investing in. Although they offer the finances you may need, there are downfalls to consider as well, like losing a share of your company in return for their investment. Plus, it may even lead to reduced cash flows in the bigger scheme of things.

When I started :Delmain, it was 100% bootstrapped. I didn't have any money, any clients, or industry contacts. A little bit of seed capital would have allowed me to hire way faster and fast-track investments for our own marketing and sales.

–Dan Delmain, Founder of :Delmain

13. Maximize Tax Benefits

Be sure to take advantage of any potential business expenses that could be written off as a tax benefit.

However, don’t forget to monitor cash flow and keep track of these expenses throughout the year because, as Tim Akers (and Eugene Levy) puts it, they’re not actually free.

“A lot of small businesses think, ‘I own a business, so this is going to be a write-off.’ And it actually means you’re losing profits,” Tim explains. “Just because the business pays for it, doesn’t mean it’s free.”

Consider this example:

If you spend a dollar, you’re not necessarily getting a dollar back from the government. You might be getting back 20 to 40 cents, depending on your agency’s corporate structure, location, and tax rate.

But that also means if you sit on additional profits without reinvesting that money back into the future growth of the agency, you are giving the government 20% to 40% of your growth fund.

$10,000 in pre-tax money to invest in the business this year could quickly be reduced to $8,000 in post-tax money to invest in the business next year. What could your agency have done with that extra $2,000?

The goal is always to maximize your deductions as much as possible in order to lower your agency’s taxable income and reduce tax liability. Working with a tax firm or accountant ensures you capture all of your expenses and that you’re deducting every possible allowance under your state tax law.

Key Takeaways

Cash flow is the lifeblood of any agency. It can be tricky to manage and it’s rare to find someone who hasn’t come across some kind of challenge as they scale their business.

However, analyzing your needs and getting clear on your goals puts your agency on the path to long-term financial success.

And as Trevor puts it, “if your goal is to grow your agency, you have to take risks and invest in your business. If you’re someone like me who has never seen a bad idea or like most founders who chase a shiny object when they see it, you’ll end up overspending before you know it. You’re going to make mistakes like hiring the wrong people or investing in the wrong tech, but that’s just part of the game.”

Save time and money by streamlining your agency’s client reporting processes and reinvesting it back into your business. Start your Free Trial today!

Written by

Richelle Peace is a writer with a degree in Journalism who focuses on web content, blog posts, and social media. She enjoys learning about different topics and sharing that knowledge with others. When she isn’t writing, Richelle spends time teaching yoga, where she combines mindfulness, movement, and her passion for wellness.

Read more posts by Richelle PeaceSee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.