Table of Contents

Table of Contents

- What is a marketing agency financial model?

- Why digital marketing agencies need financial models

- Key components of successful marketing agency financial models

- Types of marketing agency financial models

- How to build your own marketing agency financial model

- Common mistakes to avoid

- Conclusion & next steps

7,000+ agencies have ditched manual reports. You can too.

Free 14-Day TrialQUICK SUMMARY:

Projected revenues can make your agency’s growth look unstoppable…until a client pays late and your operating costs hang in the balance. This guide breaks down how to build a financial model that factors in revenue generation, cash flow, and expenses so your agency’s growth holds up outside the spreadsheet.

Finance is one of those things that usually slips to the bottom of our to-do lists. Somewhere between inbox zero and finally updating your website (same). The thing is, those numbers decide if growth feels steady or like quicksand. So, while skipping them might buy you a calmer week now, it leaves your agency exposed later.

Let’s change that.

This guide breaks down digital marketing agency financial models into simple parts and walks you through how to build your own—so you can chart growth with data, not doubt.

What is a marketing agency financial model?

It’s essentially a working picture of how money moves through your business: what’s coming in, what’s going out, and what’s left behind at the end of the month. Unlike financial statements, which record what has already happened, a marketing agency financial model projects what might happen next.

Why digital marketing agencies need financial models

Financial models let agencies test different scenarios without putting your business on the line. They’re also the easiest way to spot when “great news” is actually bad math.

A $20K/month client should warrant a victory lap, but pile on three rounds of revisions, extra freelancers, and lost weekends, and suddenly it doesn’t feel like such a big win. Seasonal spikes pull the same trick. Black Friday sends revenue sky-high, but ad spend and overtime kill your margins.

Without a financial model, you can’t see if recurring revenue streams truly cover salaries, if acquisition costs leave room to reinvest, or if a new service adds margin or just workload. So, those shifts stay hidden until they surface in payroll and profit. By then, it’s often too late to change course. With a model, you see timing and true margins before you commit, so you can double down on what grows your agency and stop bleeding margin on the rest.

Know your numbers! Understand deeply about the cost of doing business and delivering the work at your desired level. Once we understood our processes, workflows, and staffing needs for every project and initiative, we were able to price our services with profitability.

Rodrigo Campos, Founder & CEO, Splurge Media

Key components of successful marketing agency financial models

Marketing agency financial models don’t have to be complicated, but they do have to be accurate. Scaling is messy. Clients drag their feet on payments, costs creep, and resource allocation gets stretched faster than your patience on a Monday morning.

Breaking the model into five pieces makes the chaos manageable:

Revenue forecast: What’s likely to come in?

Expense projection: What will it cost to deliver?

Profitability calculation: What’s left over?

Cash flow analysis: Will the money arrive in time?

Balance sheet: What’s our overall financial health?

Revenue forecast

Revenue is the fun part to picture. Retainers, project work, maybe even a new service or product launch—it’s basically your agency’s version of daydreaming about the best-case scenario. But forecasting isn’t about stuffing spreadsheets with numbers you hope will happen. It’s about pressure-testing the story before you rely on it.

Let’s say your pipeline shows four new retainers worth $60,000 combined. Looks like smooth sailing toward your sales targets, right? Not necessarily. If two don’t start until next quarter and another is waiting on final client approvals, those smooth waters start to look a bit choppy.

Agency tip: Always model churn and delays. It’s easier to course-correct when you’ve built in a buffer than to scramble after the fact.

Expense projection

If forecasting is the dream, expenses are the reality check that pulls you back down to earth. Operating expenses like payroll, freelancers, and software subscriptions have zero chill—they’ll knock on your door every month, full pipeline or not.

Take a $12,000/month social media management retainer. It looks like a huge win for your agency, and it is, but that’s not the end of the story. Add up $4,000 for strategist and coordinator salaries, $3,000 for ad spend, and yes, even office supplies, and those profit margins shrink fast.

Agency tip: Split expenses into fixed vs. variable. Fixed costs (like salaries or rent) stay steady, while variable costs (like ad spend or freelancers) shift with each account. Knowing the mix lets you pressure-test cost structures and land on a pricing model that won’t come back to bite you.

Profitability calculation

Revenue shows what came in, expenses show what went out, but profitability answers the only question that matters: did the work actually pay off?

That global campaign might look great on your website, but if approvals take forever and scope keeps creeping up, it might not be worth the ego-boost. Meanwhile, a smaller SEO client paying $6,000 on time every month may be far more profitable (albeit less brag-worthy).

The lesson: bigger isn’t always better. Tracking profitability at the client level (alongside metrics like customer lifetime value) reveals which accounts put you in the green and the ones that lean red.

Want to learn more about boosting net profit? Read more: Cash and Profit Optimization for Agencies.

Winning back that billable time is important to our agency's growth because time is our most valuable resource. As a small agency, we don't have the luxury of having a lot of overhead. We need to be efficient with our time in order to be profitable. When we spend time on manual tasks, such as report generation, we are taking away time from more important tasks, such as developing and implementing marketing campaigns for our clients. This can lead to missed deadlines, unhappy clients, and lost revenue.

Ben Paine, Managing Director, Digital Nomads HQ

Cash flow analysis

Profitability says you’ll make money eventually. A cash flow statement tells you if that money will actually be in your account when payroll hits next Friday.

Plenty of agency owners learn this the hard way. You send a $30,000 invoice due net-30, but the client pays in 60 days. In the meantime, that “money” just sits in accounts receivable while you’re covering $25,000 in payroll costs, ad platform fees, and vendor bills. Suddenly, “profitable” feels a whole lot like “panic.”

Agency tip: A rolling 13-week forecast model, like the one in our article How to Manage Agency Cash Flow, keeps you out of that trap. It maps money in and money out week by week, so you’ll know if cash will be there when payroll and invoices land—or if you’ll be stuck doing the credit card shuffle.

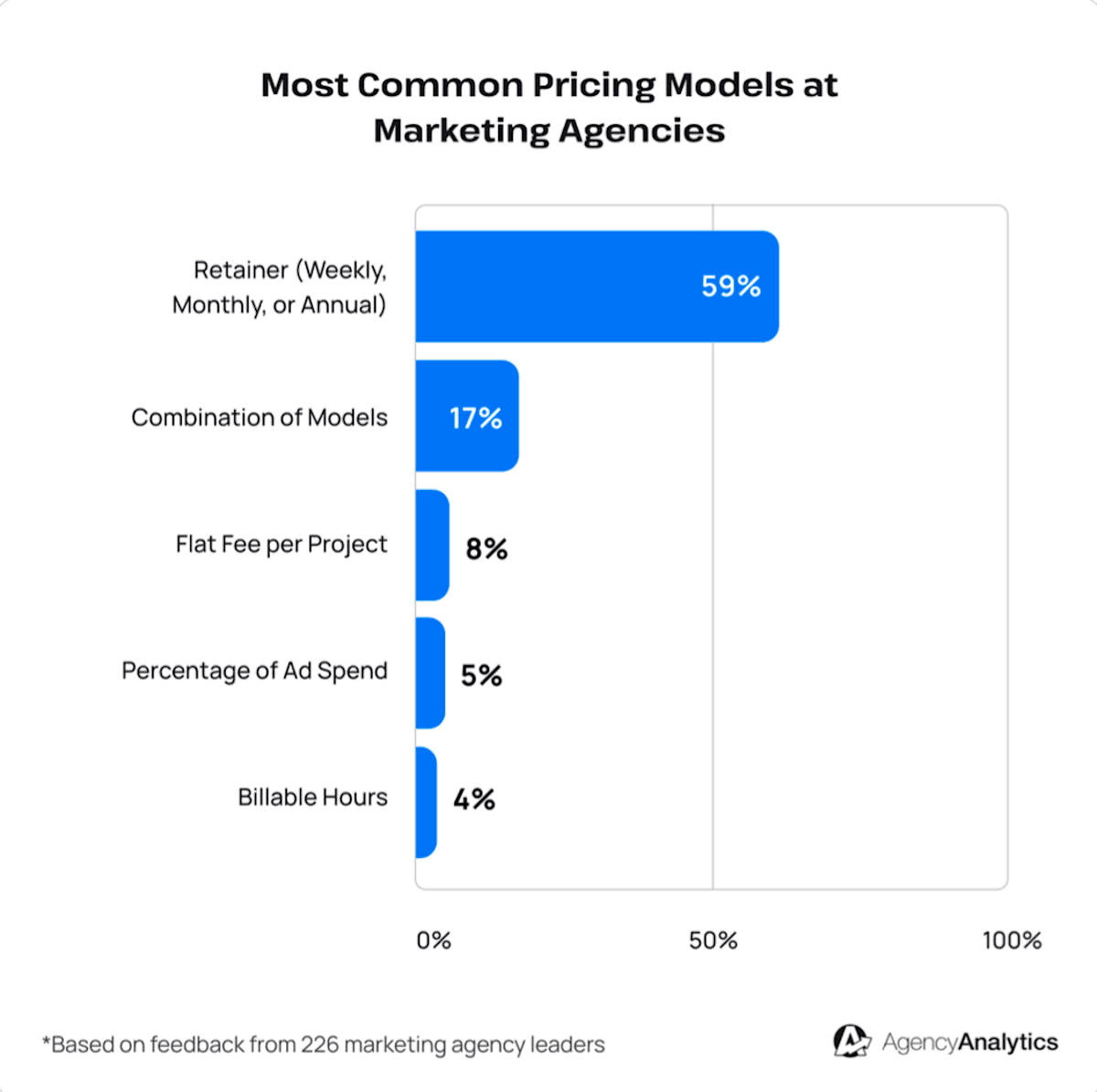

According to the 2025 Marketing Agency Benchmarks Report, the majority of agencies bill via monthly retainers, making it much easier to predict cash flow.

Curious to learn more about how agencies are managing their billing in 2025? Download the full report and see for yourself!

Balance sheet

Unlike forecasts, expenses, or cash flow, the balance sheet doesn’t track movement. It’s a still frame of what your agency owns and what it owes on a given day. On one side are assets: cash, intellectual property, laptops, and office equipment. On the other side are liabilities: taxes, loans, and unpaid invoices.

In plain English? It shows whether your agency can ride out a client pressing “pause” over the holidays or the usual summer slowdown. It’s also the first stop for lenders and investors deciding if you’re built for growth. Keep it current, and you’ll know if you’re ready to raise funding or just stacking financial Jenga blocks on a wobbly table.

Types of marketing agency financial models

Once you know the core pieces (revenue, expenses, profitability, cash flow, and the balance sheet), the next step is putting them to work. Different financial models let you compare scenarios side by side, giving you a fuller view of your business model and grounding decisions in actual performance.

Revenue forecast models

This model is tactical. Instead of a single top-line number, you build a layered view of revenue by client type, contract length, or service line.

A profitable agency doesn’t waste time chasing money it has already earned.

Michael Quinn, Co-Founder, Marketer Medley

For example, you might track:

Monthly recurring revenue from SEO retainers

One-off projects like website builds

Commission-based models from ad spend

Comparing these streams shows whether your forecast leans too heavily on one type of work. Maybe existing clients bring steady monthly revenue, while new clients spike and dip. A model makes those patterns clear so you can adjust your business plan before things get lopsided.

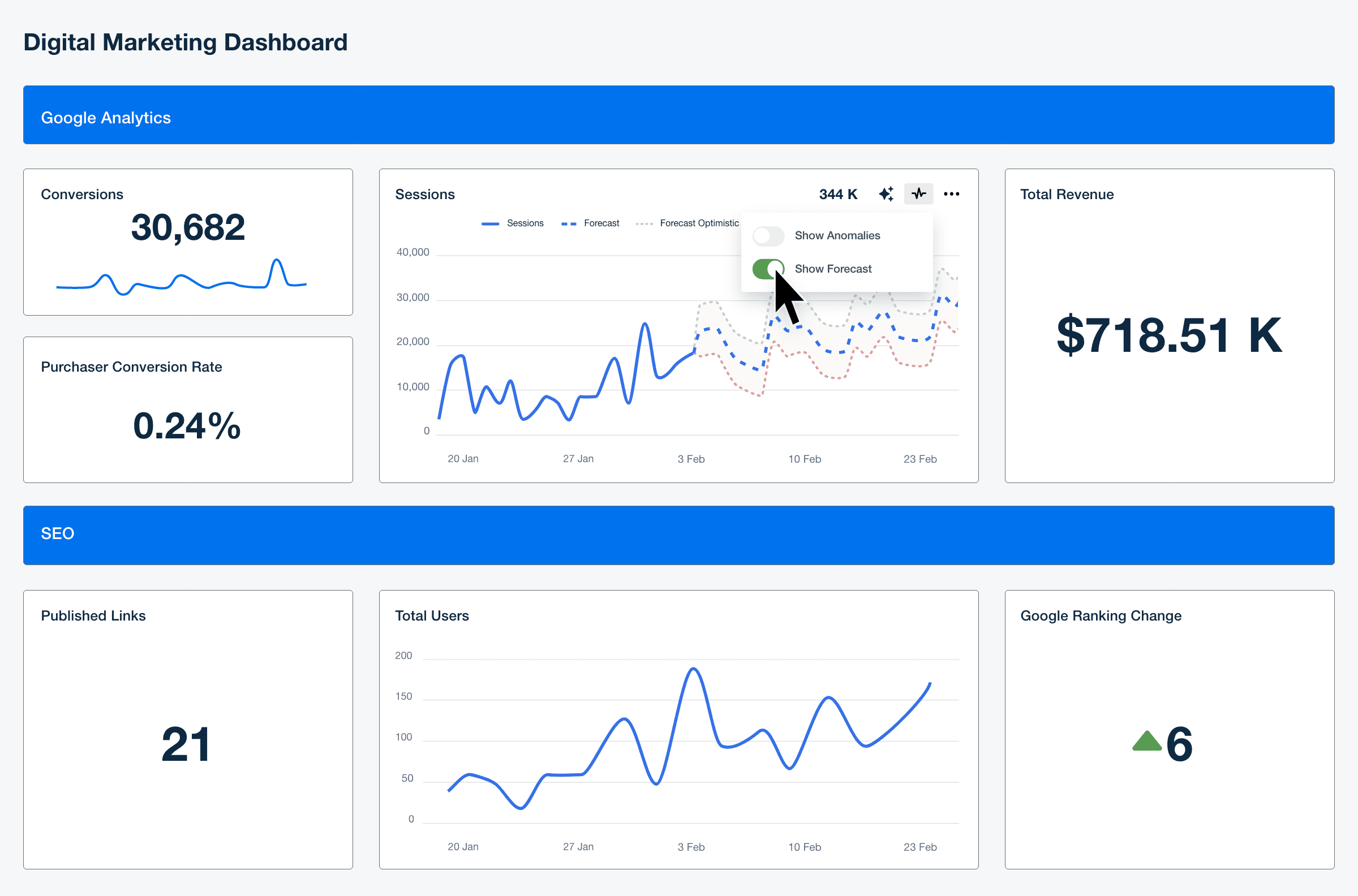

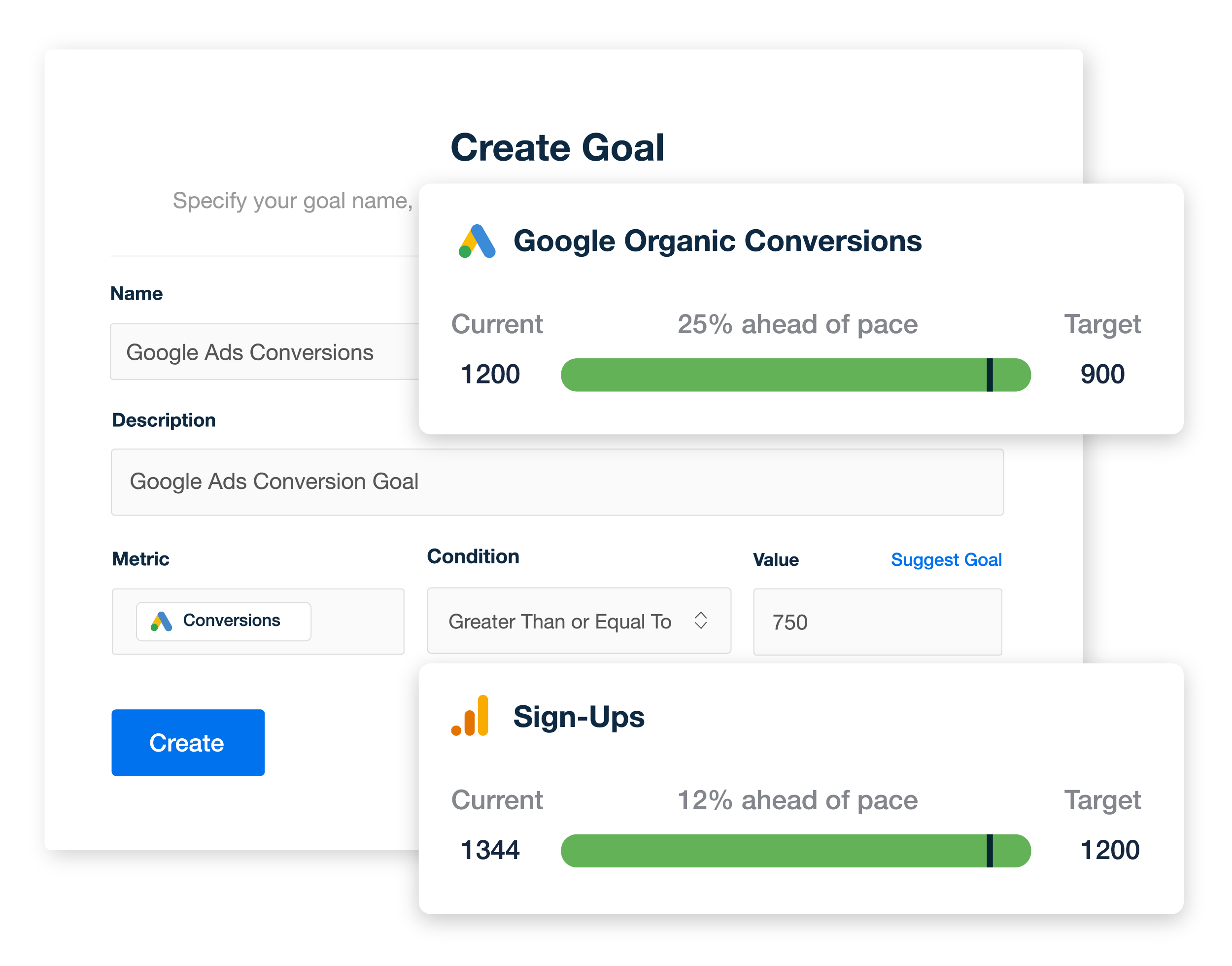

Want to see campaign trend forecasts and anomaly alerts side-by-side with your projection assumptions? Try AgencyAnalytics free for 14 days and pull in live data like traffic, conversions, ad spend, and SEO metrics into your forecasting view.

Expense & profitability models

Salaries climb with each hire, tools stack up as teams grow, and outsourcing the gaps adds even more weight. This model ties those costs back to revenue and shows how different pricing structures affect agency earnings.

Hourly rate model: Great for flexibility, not so great for predicting what actually hits your bank account.

Retainer-based model: Reliable and steady… until scope creep shows up and eats the margin.

Fixed fee model: Clear and upfront. You set a price for the whole project, but like retainers, it’s risky if timelines drag or revisions pile up.

Hybrid model: A mix-and-match approach (retainer + project or hourly) that gives you stability without boxing you in.

The takeaway? Decisions that look good in theory don’t always translate to profit. Testing them through this model helps you choose the mix that drives long-term agency success, rather than short-term wins.

Scenario & growth models

This model is where you play out the “what ifs” against shifts in costs, revenue, or even market trends, to see how resilient your financial planning really is.

Here are some questions worth running through your model:

What if a big client churns earlier than expected?

What if labor costs rise faster than revenue?

What if customer acquisition costs spike right as you’re planning to scale?

What if you bring in specialized services to deliver new campaigns, but client invoices aren’t paid on time?

The payoff of using this model is freedom to experiment on a spreadsheet instead of real life. Build out three versions—base, worst, and stretch—to uncover how fragile (or resilient) your plan really is.

Agency tip: As you’re stress-testing projected revenues, connect the dots with campaign data. Track SEO growth, ad spend, and website traffic in one place with an AgencyAnalytics dashboard. Start your free trial today.

How to build your own marketing agency financial model

A financial model isn’t a crystal ball or a punishment from your accountant (though it may feel like it). It’s the cheat sheet that shows if growth is real or just wishful thinking. Here’s where to begin:

Forecast total revenue: Start with what’s signed, not what’s “verbally agreed.” Layer in retainers, projects, start dates, churn, and seasonality. If two clients don’t kick off until next quarter, it's better to see the gap now than when rent on your shiny new office is due.

Map expenses: Split costs into fixed (salaries, rent, benefits) and variable (ad spend, freelancers, software). Tie delivery hours to each client so you know if that shiny retainer is paying for itself or if you’re subsidizing it with your weekends.

Calculate profitability: Subtract delivery costs from revenue at the client and service level to see how much revenue each account brings in versus how much it costs you to deliver. Remember, bigger isn’t always better.

Layer in cash flow and a balance snapshot: Track when money lands versus when bills clear using a 13-week cash view. Don’t forget one-off expenses like taxes or annual renewals. Then take a quick balance sheet snapshot to see if your agency can handle a slump or if cash is already stretched thin.

Once those pieces are in place, the next question is how to actually build the model. Financial models may run on formulas, but you don’t have to start from scratch (or give yourself flashbacks to high school algebra) to build one. Here are a few options:

Templates (Excel/Google Sheets): Free, flexible, familiar. Great for smaller teams running lean. The downside? One bad formula can tank your totals. If that Intro to Excel class wasn’t your thing, this probably isn’t either.

Pre-built frameworks: Think of these as agency Mad Libs. Drop in your numbers, and they’ll spit out churn rates, retention stats, and neat little graphs. They’re quick, they’re tidy, but also a little cookie-cutter. If your services don’t fit the mold, you’ll spend more time wrestling the template than learning from it.

Financial modeling automation tools: This is the grown-up option. They pull in live data, track revenue against costs, and ping you the second margins start to slip. More expensive, yes—but also less babysitting, fewer late-night spreadsheet crises, and way more sleep.

Whichever route you take, the process itself doesn’t change. The real question is: do you want control, shortcuts, or sleep? Templates give you the first, frameworks the second, automation the third. Pick what keeps you sane and let the model sweat the margins.

Common mistakes to avoid

Even the best financial models can tank if they’re built on shaky habits. And it’s rarely the spreadsheet’s fault. Here are a few pitfalls to watch for:

Treating best-case as guaranteed. Counting a verbal “yes” as revenue makes growth look safer than it is. Forecast only what’s signed, treat the rest as upside.

Forgetting hidden costs. Skipping health benefits, paid time off, and payroll taxes makes profits look shinier than they really are. Build them in from the start, and you’ll get numbers you can actually trust.

Ignoring client-level detail. Looking at totals alone hides the truth. Client-level detail shows you exactly which work drives profit and which work you can afford to let go.

Assuming contract terms equal reality. Whether it’s payment schedules, project timelines, or client retention, plans almost always take longer or cost more than contracts suggest. Build the real-world version into your model, not the fantasy one. (For more on late payments, read about 11 Common Agency Cash Flow Problems.)

Letting the model gather dust. A financial model isn’t “set it and forget it.” Treat it like a living tool, and it’ll give you the valuable insights you need to plan your next move.

Agency tip: Anchor updates to a small set of agency metrics like client retention, billable hours, or net margin, so the model stays manageable. For a deeper dive, Top 10 Marketing Agency Performance Metrics and Key Performance Indicators to Track offers a clean rundown of the ones that matter most.

Conclusion & next steps

Getting your finances in order may not earn you a shiny award like a big campaign, but it’s what keeps the lights on. The right financial model gives you structure without leaving you bleary-eyed over a half-updated spreadsheet every quarter.

Start small: Map your recurring revenue, factor in the cost of your next hire, and stress-test one “what if.” Build the habit of updating it on a monthly basis, and you’ll shift from gut feel to grounded strategy—no YouTube Excel crash course required.

Written by

Kali Armstrong is a freelance content writer with nearly a decade of experience crafting engaging, results-driven copy. From SEO blogs to punchy short-form pieces, she combines strategic insight with authentic messaging to captivate audiences and drive results.

Read more posts by Kali ArmstrongSee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.