Table of Contents

QUICK SUMMARY:

Cash flow problems are one of the top challenges to marketing agency owners. These challenges stem from a a variety of issues such as volatile economies, rising inflation, and cautious spending by customers. This guide explores the roots of cash flow crises and offers strategies for efficient management, emphasizing the importance of adapting to economic shifts for business owners.

According to the AgencyAnalytics 2023 Benchmarks Report, 13% of agencies cite cash flow problems as the number one challenge their agency is facing today. It makes sense: marketing agencies are facing a volatile economy, rising inflation, and a customer base that’s starting to pinch pennies.

In a strong economy, an ad-hoc approach to cash flow may work, but in lean times, proper cash flow management becomes crucial.

Today, we take a deep dive into what causes a cash flow crisis and how to avoid poor cash flow management.

Why Cash Flow Management Matters

Healthy cash flow helps an agency survive rocky periods without stretching itself too thin financially. For example, If a major client cancels their contract, having enough cash flow allows you to continue to pay your employees during this period, avoiding any implications of a cash flow crunch.

Importance of Positive Cash Flow

As a marketing agency owner, maintaining a consistent positive cash flow is vital for your agency’s long-term growth and sustainability, especially in a highly competitive industry.

Financially stable agencies can:

Expand to new markets by investing in lead generation opportunities.

Maintain operational agility by quickly adapting to market changes or client demands without financial stress.

Fund ongoing training and development programs, ensuring that your team stays ahead of industry trends.

Gain a competitive advantage through positive vendor/debtor relationships.

Build a financial safety net, which can be a lifesaver during seasonal downturns or unexpected crises, offering a buffer against uncertainty.

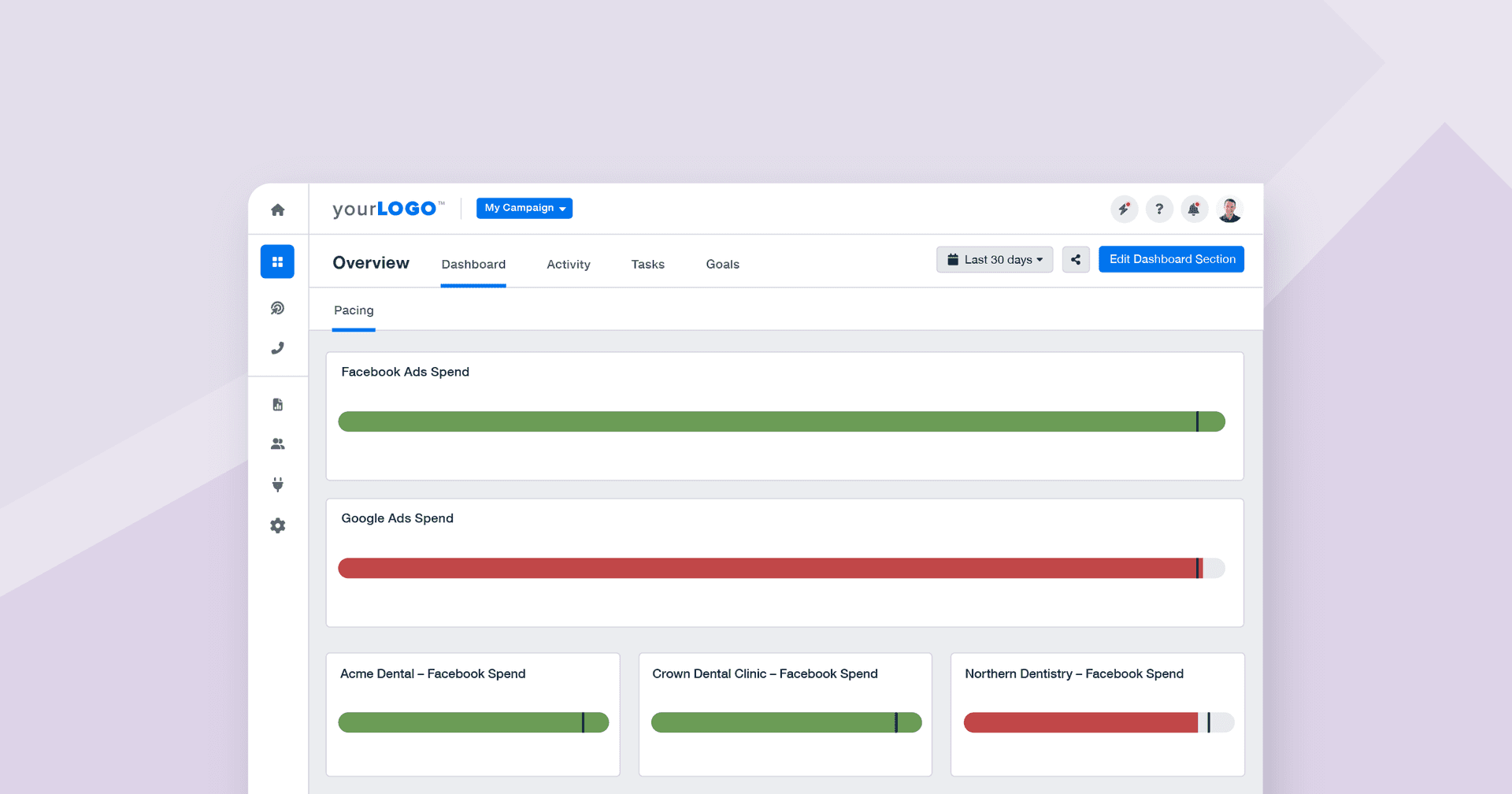

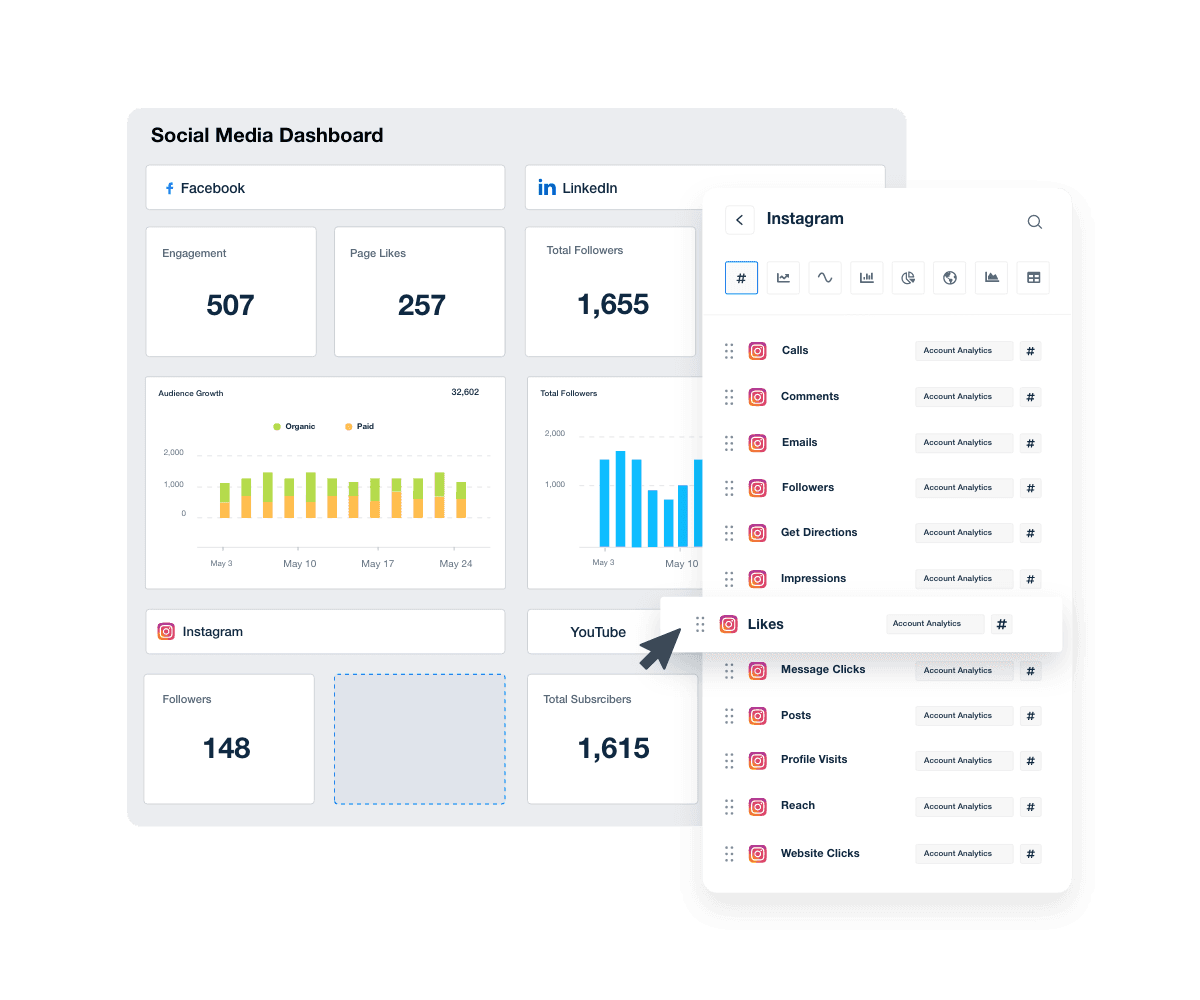

Invest in innovative tech. From AI-powered content marketing solutions that empower your writers to customizable marketing dashboards that allow your team to quickly share key metrics with clients, agencies with a positive cash flow can access top tech as soon as it comes out.

Healthy cash flow enabled us to take advantage of an opportunity for growth when a client reached out to us for an on-site video podcast. Quickly, we assembled our podcast host as well as a team of professional videographers, editors, and the like, so that we could take advantage of this unique opportunity. As such, we're now able to offer this service to a wide range of clients.

Danny Star, CEO and Founder, Website Depot

Consequences of Negative Cash Flow

A negative cash flow statement signifies a precarious financial state where outgoing expenses surpass incoming revenue. This imbalance leads to immediate and long-term challenges that reverberate through every aspect of agency operations.

Employee Turnover: Lack of financial stability often leads to delays in salary disbursement or benefits, reducing employee morale and increasing turnover.

Accumulating Debt: To cover operating costs, agencies may resort to loans or credit, leading to a cycle of debt that can be difficult to break free from.

Vendor Relations: Cash flow problems make it challenging to meet payment terms with vendors. This can strain relationships, possibly leading to less favorable terms in the future.

Client Service Impact: Struggling to meet operational costs may result in cutting corners in client projects, affecting quality and tarnishing your agency's reputation.

Agencies can lose a significant amount of recurring revenue in a recession and have a difficult time scaling down labor costs. So you’re faced with letting team members go to maintain margin or eat into your reserves and try to ride out the storm. It’s not a fun place to be.

Ryan Kelly, CEO, Pear Analytics

Addressing negative cash flow problems requires immediate, strategic action to prevent its detrimental impact on both short-term operations and long-term growth.

How To Solve Common Agency Cash Flow Problems

Running into cash flow problems is extremely stressful and can happen to any agency, even a results-driven one. It's easy to become myopic and lose sight of cash flow problems and potential solutions when the pressure is on. We've rounded up a list of the most common cash flow problems agencies face, and a solution for each that will keep you afloat.

Problem 1: Forgetting to Create a Cash Flow Budget

Like all small business owners, marketing agency leaders are busy. While it’s easy to forget to run a cash flow forecast each month, this can lead to serious cash flow problems, especially if your agency hits a financial bump in the road. Without knowing how much money is coming and going, it’s difficult to plan for long-term growth and avoid late payments.

The Solution:

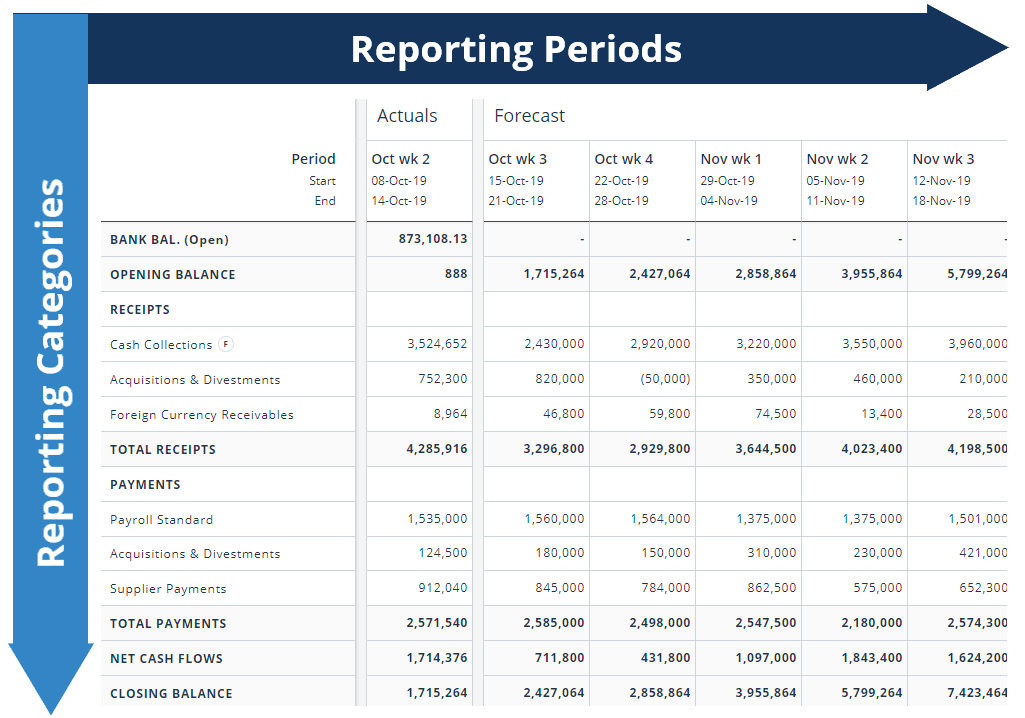

Make this a priority early on. Decide the length for your cash flow forecasts (one month, one quarter, or one year), and set reminders for that time period to ensure you’re reviewing cash flow statements regularly.

This will give you an idea of what the next period will look like for your agency, ensuring you won’t spend money you don’t have.

I have my pulse on how much cash is in the bank account, along with other numbers, and we're updating that weekly. It gives me a better sense of where the company is financially.

Dan Delmain, Founder of :Delmain

Problem 2: Ignoring Substantial Overhead Costs

If your agency has a positive business cash flow at the moment, it’s easy to justify a pricey lease agreement for a brick-and-mortar office or hiring more full-time staff. While these costs could seem reasonable at the time, a financial downturn could shift your cash flow position down the road, leading to significant cash flow problems and potential late payments.

The Solution:

Managing cash flows is essential. Conduct regular overhead reviews and identify where you may be able to save. A rising number of marketing agencies are opting to become fully remote to save on rental costs, for example.

Agencies can also save by hiring contract workers instead of full-time employees. Set up regular expenditure reviews to keep a consistent eye on expenses, debt obligations, and savings. Having a line of sight makes it easier to have cash reserves available for difficult months.

And don't forget about hidden costs, such as the billable hours lost to manual client reporting.

By streamlining our reporting process and freeing up more billable time, we have been able to take on more clients and expand our service offerings. With more time available to focus on campaign management and strategy development, we have been able to deliver more personalized attention and support to each of our clients, which has helped us build stronger relationships and drive better results.

Daniel Dye, President, Native Rank, Inc.

Problem 3: Delayed Receivables Collection

Your agency could have a number of high-grossing clients, but if they’re not paying on time, you’re still not able to pay your expenses, leading to cash flow problems and late payments.

For example, let’s say you’ve just landed a large eCommerce startup that’s signed up for a $5,000 monthly service, but they’re late with payments every few months. Though the long-term commitment is appealing, their unreliability could quickly become a liability.

The Solution:

While sending invoices on time is key, it’s also important to get your account managers to stay in constant contact with your clients, especially those who are slow to pay. Have them follow up on invoices and regularly review what has been paid and what’s still outstanding.

Here are a few other tips on how to get clients to pay on time:

Offer Early-Payment Discounts: Use incentives like a "2/15 Net 30" model to motivate clients to pay early, framing it as a discount for prompt payment.

Automate Collection: Use tools like Freshbooks and Stripe to set up automated payment collection. Also, automated reminders for unpaid invoices can increase the likelihood of prompt payment.

Clarify Your Invoice: Make sure your invoices are straightforward and professional. The simpler it is to understand what is due and why, the faster you'll get paid.

Invoice Early: Send out invoices well before they're due, allowing clients time to process them within their own billing cycles.

Foster Client Relationships: Building strong relationships can make clients more likely to pay on time. Focus on open communication and proactive client reporting.

Offer Varied Payment Plans: Allow for different payment options or installment plans to make it easier for clients to manage costs.

We have had to overhaul our billing policy and put stricter payment terms in place with clients because, unfortunately, we've been burned more than once by clients that we put our trust in to pay us and pay on time. Once legal gets involved, nobody wins, so it's better to get paid upfront for the work that you do or get a deposit to protect yourself from similar situations.

Molly Lopez, Founder & CEO, Sparo

Problem 4: Expanding Too Fast

Sometimes, agencies take off quickly, growing at a breakneck pace. While this is an impressive accomplishment, it also leads to problems. Agency owners need extra team members to meet demand–but may not have the cash flow to pay their salaries just yet.

The Solution:

Agencies expecting to scale quickly should look at funding options before they’re needed. Getting an overdraft or short-term loan is a good idea, especially if you know exactly when your client will pay. If you need long-term options, consider opening a line or credit or finding investors.

When I started :Delmain, it was 100% bootstrapped. I didn't have any money, any clients, or industry contacts. A little bit of seed capital would have allowed me to hire way faster and fast-track investments for our own marketing and sales.

Dan Delmain, Founder of :Delmain

Problem 5: Your Profit Margins Are Too Low

Understanding your profit margins is an essential part of managing cash flow. If your margins are too low, this means your take-home (or net) profits aren’t high enough to be sustainable.

Common factors that lead to low profit margins include pricing that’s below industry standard, high salary or contract payments, excessive operating expenses, and projects that eat up more time than intended (see more on scope creep below).

The Solution:

Calculate your profit margins and then review your pricing structure and monthly costs. Have your staff track all hours to ensure accurate billing, and consider eliminating services that are no longer profitable. Finding a way to deliver the same quality of work in less time can free up extra cash.

Work out your cost first, then add whatever margin you would like to make on top. Never take on a client without knowing your campaign costs, otherwise, you may find yourself working for free.

Joshua George, Founder, ClickSlice

Problem 6: Scope Creep

Scope Creep is the Pandora’s Box of the marketing industry. It refers to situations where clients change project requirements without any notice and often leads to more work for the same pay.

If your agency agreed to write a 20-page website for a client, for example, scope creep could mean the client begins adding more pages or expecting your staff to do more research than originally agreed on. This eats into your profits, affecting your cash flow.

The Solution:

Effective communication is key when dealing with scope creep. Ensure your agency fully understands your client’s expectations for each project. Once a project starts, keep a close eye on hours. If your agency is at risk of running over the client’s original expectations, pause the project and let them know, explaining that they’ll be billed extra if work continues.

It can be tempting to simply bow to every demand, no matter how unreasonable it may be, just for the sake of keeping a client happy. However, this could lead to an unhealthy work environment for you and/or your employees—not to mention lost revenue. Striking that delicate balance between retaining clients while also protecting your business's values is often tricky but essential to success.

Michael Quinn, Founder, My Site Ranked

Problem 7: Seasonal Business Fluctuations

While this depends on the market, most agencies experience slow periods in the summer and during the holiday weeks in December, leading to a different cash flow cycle during these times.

The trouble is that many of your agency’s expenses remain the same all year long, leaving you scrambling to pay employees and keep the lights on during those leaner phases.

The Solution:

It’s essential to plan ahead for slower months and save up cash reserves to ensure you’re still able to pay your expenses. Agencies could also use these slower seasons as a time to expand into different markets to diversify their revenue.

Another strategy is to consider new package options that clients can sign on for in early December that begin in January. This allows you to secure revenue even during traditionally slow periods.

Balancing the allocation of time, personnel, and financial resources can be challenging, particularly when priorities or availability fluctuate. Regular communication and monitoring of resource utilization help us identify any imbalances or gaps early on. We remain flexible and responsive, adjusting resource allocation as needed to ensure equitable contributions from both sides.

Gia Ching, Managing Director, GCC Consulting

Problem 8: You’re Overly Dependent on One or Two Clients

It’s the scenario every agency dreads. You’ve got one major client providing 90% of the work. Suddenly, that client announces layoffs and, in an effort to reduce their budget, pauses their contract with you. There goes the majority of your revenue.

Relying too heavily on one or two clients can cause significant cash flow problems if those clients ever leave.

The Solution:

To avoid cash flow problems, use the revenue from your big clients to grow your customer base. Invest in lead generation, social media campaigns, or innovative tech that will appeal to new clients. Diversifying helps spread out receivables, allowing for healthier long-term growth.

Agency Tip: Your largest client should account for less than 15% of your revenue coming in. Try and think of ways to diversify your revenue streams. Determining the best course of action depends on your agency’s niche or industry. However, there are a few areas to consider, like building off of your current services (upselling clients) or creating new ones altogether. For example, creating a proactive process that lets clients know you’re thinking about their potential business problems (with a solution) before they’ve even happened.

Problem 9: Covering Unexpected Expenses

Your agency is doing great. You have a positive business cash flow with enough to cover all expenses for the next quarter. But all of a sudden, your agency gets caught up in a serious legal or other issue that drains your monthly budget, leaving you unable to pay staff and facing major cash flow problems.

Unexpected expenses can jeopardize your agency’s financial stability, especially if you don’t have proper cash balances to avoid cash flow challenges.

The Solution:

Agency leaders should prepare for unexpected expenses, either by saving a portion of revenue every month or by exploring funding options, like a line of credit. Cash reserves help your company survive legal issues, equipment breakdowns, or any other unforeseen costs.

Keep a close eye on your finances and be prepared for when things go wrong. Keep a buffer in reserve so that when things go south, you have enough capital on hand to make it through the storm while being able to help your staff and the clients.

Joseph Anthony, Digital Marketing Manager, Imageworks Creative

Problem 10: Your Pricing Strategy Is Below the Industry Standard

Creating a solid pricing structure is a complicated process. Lower fees mean more clients, but higher fees lead to financial stability and fewer cash flow problems.

For agencies that aren’t able to strike the right balance, suboptimal pricing could lead to reduced cash flow and an inability to invest in the technology and staff needed to scale. Other than underpricing your services, other pricing issues could include inadequate retainers, inconsistent invoicing practices, and lengthy payment cycles.

The Solution:

It’s important to review pricing strategies at least once a year to avoid poor cash flow. While staying competitive is important, agencies should also ensure their pricing aligns with rising inflation and the cost of business.

For a better understanding of how much you should be charging, take a look at your margins, timesheets, and project fees. It’s also useful to research what your competitors are charging to get a better look at the market.

We used to price so low because we were afraid of getting undercut. And it was actually detrimental to the growth of our business.

Mark Jamieson, Managing Partner, WSI eStrategies

Problem 11: Your Clients Keep Leaving

Client churn is a serious problem for marketing agencies. Without a stable customer base, it’s difficult to comfortably scale while creating a stable cash flow.

Long-term clients are ideal, especially when looking to increase revenue. Research shows that the likelihood of upselling to an existing client stands at 60 to 70%, compared to closing a new prospect, which stands at 5 to 20% (even with a killer pitch deck!).

Although client churn is sometimes unavoidable, if it’s happening too often, there’s likely something wrong on your end. Common causes of customer retention issues include:

An inability to connect with your client

A breakdown of communication

Lack of transparency and trust

Inconsistent results

The Solution:

Focus on client retention by choosing clients whose needs and values align with your agency. Ensure you communicate effectively and prioritize each client. Customers expect prompt responses, regular check-ins, and metrics providing consistent results. If you're able to deliver, you can likely avoid cash flow problems.

With AgencyAnalytics, we're able to focus the client on longer term goals rather than a month vs month comparison of a few metrics. This increases the length of time clients want to work with us and has reduced churn significantly.

Michael Wisby, CEO, Two Trees PPC

Looking for a way to thoroughly demonstrate value to your clients? Deliver comprehensive marketing reports with data from more than 80 marketing integrations. Sign up for your AgencyAnalytics 14-day free trial today.

How To Improve Cash Flow for Sustainable Growth

While your agency may be dealing with some stressful cash flow issues, it’s never too late to turn your financial position around.

Here’s how your agency can improve its cash flow:

Create a Streamlined Billing Process

Having a number of clients who owe you $20,000 means very little if you can’t pay bills or cover payroll. Creating an efficient billing process is part of any successful agency management strategy. To revamp your billing:

Establish an invoicing organizational system that helps you keep track of paid and unpaid invoices.

Ensure that clients understand when they have to pay. While most contracts are usually net 30 (meaning the company has 30 days to pay your invoice), some are net 45 or more. If possible, negotiate with your clients for a shorter net period, or offer a small discount for early payment.

Consider changing to a per-project invoicing schedule instead of invoicing at the end of the month.

Establish clear points of contact for invoicing and accounts receivable, both internally at your agency and externally with your clients.

Make it as easy as possible for your clients to pay you. Remove any hurdles within the payment process and consider taking multiple forms of payment to increase accessibility.

Leverage Client Retainers

Let’s say you’ve just landed a new client who needs you to manage a social media campaign. You’ve priced the project at $5,000 but are unsure about how dependable this client will be when it comes time to pay up.

In situations like this, client retainers are a great pricing strategy and an excellent way to avoid cash flow problems. By asking for a small upfront fee, you’re creating a cash reserve.

This ensures a steady cash flow and more predictable income. Client retainers also allow you to avoid using your agency’s funds for any client-related expenses necessary to get the work started.

Diversify Your Services

If your agency is focused on one particular area of the market with projects that tend to run long, consider adding services with a quicker turnaround time to pepper in some more frequent cash influx. If your agency delivers more “one and done” services (like building websites), consider adding complementary services that require frequent updating or replenishment (like SEO-optimized blog posts).

This opens your company to new clients and opportunities, leading to increased revenue and the ability to retool your pricing strategy.

Know Your Financing Options and Use Them Well

Preparation is the key to solving most of the cash flow problems faced by small business owners. Even if your agency is thriving, it’s important to look at financing options. In fact, this is the best time to get a loan or attract investors. Not only will you be prepared for any cash flow issues in the future, you’ll also get more favorable rates if you can show profitability.

If your agency is forced to commit to high-interest loans, consider refinancing by opening a line of credit or pursuing a small business loan instead.

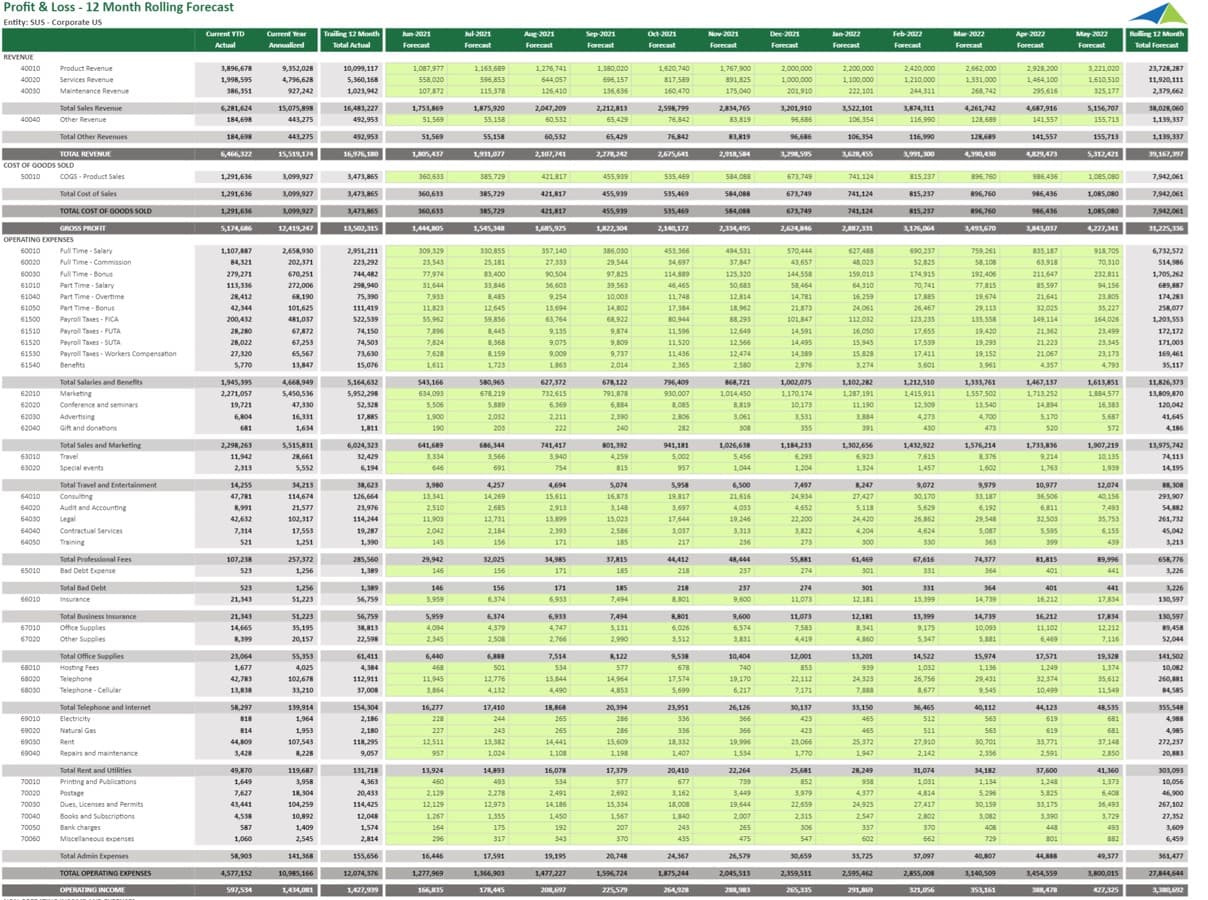

Constantly Monitor Cash Flow

Reviewing your cash flow isn’t just useful during a crisis, it’s also a great preventative measure to avoid cash flow issues. Agencies should schedule weekly or monthly reviews to ensure they know exactly what’s coming in and going out, a task that’s especially important if you’ve taken on debt. Make sure you know what you’re paying and how much.

:Delmain employs a 12-month rolling profit and loss statement as a strategic instrument for forecasting the upcoming year. This approach transcends short-term focus, offering a comprehensive look at sales metrics, expenditure on goods, and overall gross profit. It not only reveals current financial standing but also helps in setting future profit goals.

Consistent reviews will also help you catch any billing increases or rising interest rates that could endanger cash flow. If you’ve subscribed to a service at a promotional rate, for example, this will help you identify when that rate increases and by how much, preventing any lost funds or draining of cash reserves.

Ensuring Long-Term Growth

Cash flow is essential for agencies looking to scale. Without a cash reserve, regular cash flow reviews, and a diverse range of long-term clients, it’s difficult to deal with unexpected expenses and economic downturns.

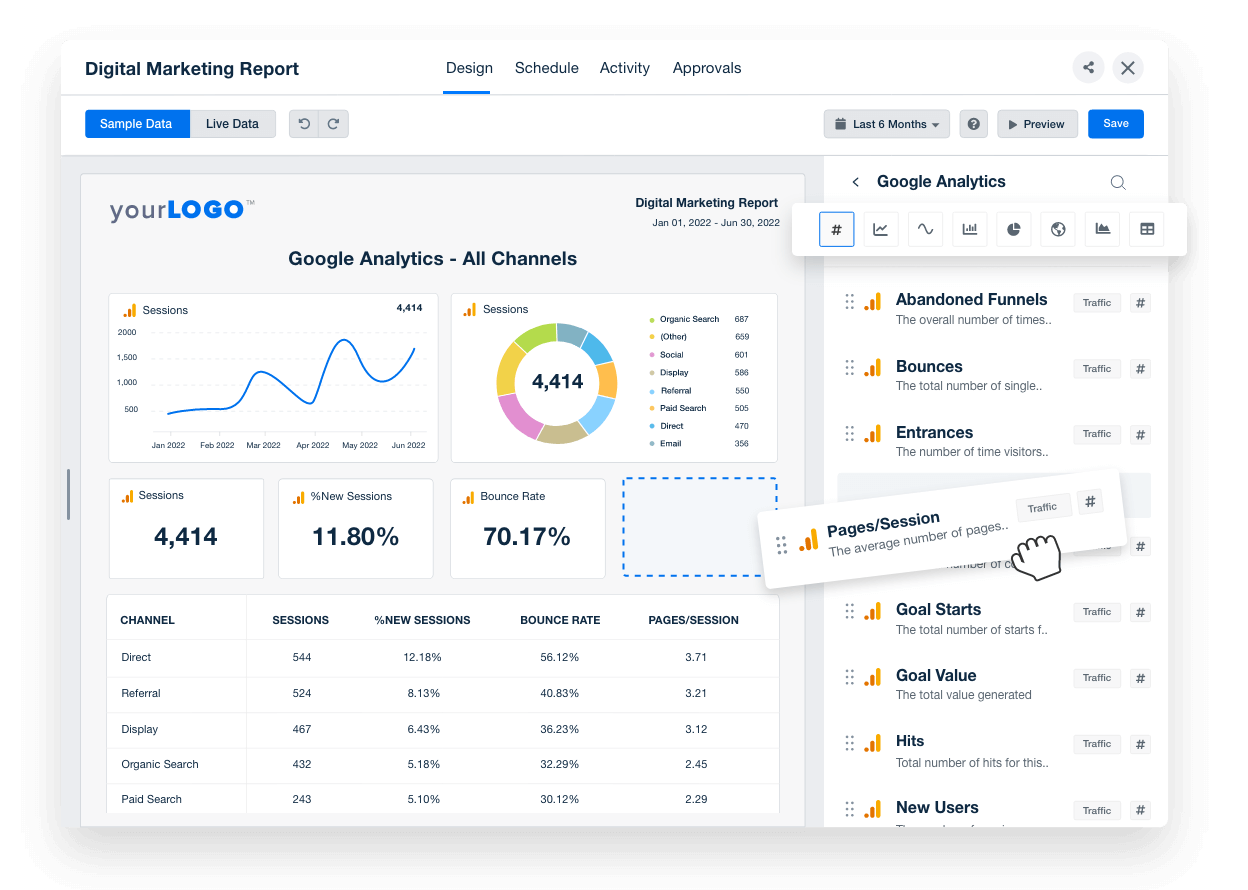

One of the best ways to ensure a positive cash flow for the foreseeable future is to hang on to the clients you’ve got. That’s where AgencyAnalytics comes in. Effortlessly showcase your agency’s value to clients with comprehensive, white-labeled marketing reports that paint the full picture of their ROI. Drag and drop data from more than 80 integrations and create your report in minutes flat.

Sign up for your free 14-day trial and join more than 7,000 customers using AgencyAnalytics today.

Written by

Rita Poliakov is an experienced content writer with a knack for storytelling. As a former journalist, she's a skilled researcher, interviewer, and grammar nerd.

Read more posts by Rita PoliakovSee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.