Table of Contents

QUICK SUMMARY:

Discover practical ideas for how to grow a digital marketing agency, featuring 23 innovative tactics aimed at boosting agency scale and efficiency. Essential for agency leaders, this article provides key strategies for enhancing agency operations and client value, fostering significant growth in the competitive digital marketing landscape.

It's common knowledge to all agency owners: running a digital agency can be tough.

You have to worry about hiring, selling, accounting, payroll, marketing, account management, lead generation—the list goes on. Oh yeah, and you need to get results for your clients, or they'll move on and may not say the nicest things. Even the most successful agencies encounter obstacles along their journey. It's essential to skillfully navigate these challenges; they're valuable opportunities to grow, thrive, and emerge even stronger.

Luckily for you, we've put together 23 tactics to grow & scale your digital agency to make your life a little easier. Sure, you may already be doing a few of these things, but you'll likely find at least one gold nugget that helps take your digital marketing agency to the next level. Whether you're looking to streamline repetitive tasks

The list is broken up into five categories:

Let's get started.

Improving Your Internal Marketing & Sales

1. Pick a Niche for Your Agency

As discussed in our article on choosing a niche for your agency:

Digital marketing agencies have become a commodity. There are 500,000 agencies worldwide and one of the best strategies to stand out is by focusing on serving a single niche.

This is absolutely true, and there are plenty of agency success stories out there to prove it:

NPE Fitness offers marketing services to gym owners and personal trainers

Terrayn focuses exclusively on the Cannabis industry

Rankings.io specializes in SEO for attorneys

:Delmain is an agency that focuses on dental practices

Picking a niche allows you to brand yourself as the expert in that industry and helps you separate from the pack. As an agency owner, it also opens up other opportunities (like speaking at industry-specific conferences).

Here are some ideas of potential niche industries to explore to help grow your digital marketing agency:

Massage Therapists

Personal Trainers

Tattoo parlors

HVAC

Water Damage

Rehab Centers

Auto Shops

Insurance Agencies

Optometrists

Restaurants

Think outside the box as well. It doesn't have to be an industry-specific niche; maybe you're just an expert in a specific marketing vertical, like marketing for Shopify stores or lead generation for local service providers. Even target a specific vertical and niche. Anything to help you distinguish yourself from the other thousands of full-service agencies and get more clients.

2. Create a Lead Magnet for Your Agency Site

The vast majority of visitors to your agency's website won't convert to leads. There are a number of reasons: they may not be ready to commit, they may not be sure what services they need, or they may not trust your company yet.

In spite of these challenges, you still need a strategic approach to lead generation, otherwise you'll risk remaining stagnant in the digital agency life cycle.

By offering them an alternative to an intimidating phone call, you let your agency website collect their business information and move them toward becoming clients.

Be creative with your lead magnets and offer something of value to your new leads, like doing an SEO audit that points out some flaws in their website's technical SEO or offering virtual events to address some of your clients basic pain points.

3. Walk the Walk When It Comes to Web Design

Regardless of whether or not you specifically offer web design, it's imperative to have a clean and professional website to attract new clients. Your website is how people perceive your company online.

It doesn't have to be expensive, either. There are a number of agency-ready WordPress themes available for next to nothing. As a matter of fact, here are 58 themes to get you started.

4. Reduce Your Lead Response Time

If you're collecting leads from your agency's website, it's essential that you get back to potential clients as quickly as possible. It's too easy to let them just sit there for a day or two before getting back to them. In fact, the average response time to a lead is a whopping 47 hours! These potential customers are shopping around, and your agency won't be the only one they stumble on.

Firms that try to contact potential customers within an hour are seven times more likely to close the deal than those that tried even an hour later.

5. Set Up Outbound Sales and Fill the Pipeline With Leads

So many start-up digital agencies are afraid to pursue outbound sales. It seems counter-intuitive when you can just put out a few paid ads to get some leads. Finding customers within your target audience using paid ads is often harder and more expensive than it sounds, so you're limiting yourself by not considering outbound for customer acquisition.

We recommend checking out Alan O'Rourke's post over at BrandPitch. It goes into detail on his process of building a sales funnel through outsourcing and vetting leads and then reaching out to them through cold emails. Using visual tools like Slickplan to map these processes also helps to streamline outreach and ensure consistent lead management.

It works even for agency owners to target a specific niche because your prospectors will have clearer targets.

While it's not for every agency, you should consider building an outbound sales funnel. You no longer have to hire an expensive Sales Development Rep and they can deliver huge returns for your agency; especially if you're just starting out and don't have many client referrals yet.

6. Turn Visitors Who Haven’t Converted Into Leads

There are a number of platforms like Leadfeeder that match visitor IP addresses to a database of companies. They essentially tell you who has visited your website even if they haven't converted to a lead. While it doesn't match every single visitor due to dynamic IP addresses, you'll often be able to recover a large percentage of lost leads.

Use this information to track down the decision-makers through LinkedIn. If somebody at that company has visited your site, there's a good chance they're looking for a marketing solution.

Give them a call to assess their needs. But be careful about how you connect the dots between their visit and your outreach. You may impress them by knowing that they visited your website, or you may creep them out!

Read more: 15 Discovery Call Questions Your Agency Needs To Be Asking

7. Build Case Studies From Successful Clients

Client case studies are undoubtedly one of the most popular and effective promotional tactics used by marketing agencies. Use them as lead magnets on a website, part of an email drip campaign, or sales assets for your team members to close more deals.

Find an existing client and tell their story with a case study. Make sure you lay out specific strategies you used and back everything up with data. Create multiple case studies based on buyer personas. That way, you'll have an extensive portfolio of client work and quantifiable results.

If that sounds like too much work there is also a service available called Case Study Buddy which will make beautiful case studies for you. It's run by Joel Klettke who's well-known in the content marketing world.

What to see some examples of how to build a case study? Check out these AgencyAnalytics Customer Success Stories.

8. Be Your Own Best Client

If you have all of this web and marketing talent, why not put it to use on your own product? That's exactly what two agencies did and it worked out pretty well for them:

37signals started as a web agency that saw an internal need for project management software. They created Basecamp to suit their own needs and it's turned into a massive success.

Coudal Partners was once a creative agency that started Field Notes as a side project. The rest is history!

Side projects can be a fantastic learning experience for your agency as a whole. Use them as a testing ground for new ideas, and write about the journey in your blog. It could be the next big thing! Just don't forget about your client work.

9. Start Blogging Even if You’re Not an SEO Company

Even if you don't offer SEO, your agency can benefit from ranking for certain terms. What about "PPC agency your city" or "creative agency your city"? Ranking for those keywords with high purchase intent will drive hot leads to your website. And anyone with an SEO background will quickly share with you all of the long-term benefits SEO has to offer.

Guest blogging is a popular off-page SEO strategy and a great way to build quality links to your agency site to improve your organic presence. But remember that guest posts are all about showcasing your agency's expertise, not just getting a link to your site.

That being said, SEO is far from the only reason to create engaging and informative content, be it on your site or as a guest post. By writing for reputable publications you position yourself as an expert in your field. "Guest posting is dead" articles pop up once or twice a month, but it's far from reality.

Reducing Client Churn

10. Use NPS Surveys

If you're not aware, NPS stands for Net Promoter Score. Essentially it's a survey you send out to your customers asking them to rate your service on a scale of 1-10.

The basic idea is to send out this survey to clients a little while into their contract to see how they feel about your service. There are three basic groups and here's how you should handle them:

Anybody who scores 1-6 is considered a detractor and may be ready to leave your agency at any moment. Consider them high priority and get to the bottom of why they scored so low (e.g., dissatisfaction with client work, long agency response times)

Anybody who scores 7-8 are considered passive and are somewhat satisfied with your service but have something holding them back from scoring higher. Find out what you can do to improve their experience and try and deliver it with the goal of improving client relationships.

Anybody who scores between 9-10 are considered promoters and love your service. Leverage them for case studies and set them up with your referral program if you have one. It has the potential to make a huge potential for your agency's brand reputation.

NPS is a great way to pinpoint customers who may be on the brink of leaving. If you don't ask, you may never know.

You can also use NPS for a number of other things. What about offering a bonus to the employee with the best score for the year? Be creative where it makes sense!

11. Build Out Recurring Revenues Over Campaigns

Robin Leonard of Xenai Digital wrote in an article:

Brands will realise that consistency is king and they will need a digital agency to run the social media and website functions all year round, with creative agencies that pitch for campaigns to overlay and enhance. The answer is to build recurring revenues in a retainer style relationship where you bill monthly for a fixed set of services (for example, X published blogs per week, Y Facebook posts per day etc).

He says to get out of 'campaign' thinking and to move towards charging recurring revenue. Recurring revenue is the key to the success of SaaS businesses and can be critical in building a thriving digital agency as well. It ensures you get paid every month. While this may seem obvious to many agencies, some are still left pitching new campaigns every quarter.

There are many tools at your disposal to manage recurred billing with clients, see: Recurly, Chargebee or ChargeOver.

12. Send Letters & Gifts to Clients

Building relationships is important to keep clients around. It helps with communication and they're more likely to listen to your recommendations if they like you. Gifts and letters are a great way to build rapport and get on their good side.

When you sign a new client consider sending a handwritten letter as part of your client onboarding process. No, you don't need to relearn cursive and go to the post office. There are services like Scribeless that will write and send the letter on your behalf.

If they're a valuable client, make them feel valuable by sending over gifts. Forget about fruit cake gift baskets – send something memorable that their entire team will talk about. See this is why I'm broke for some fun ideas.

13. Client Staff Intake Training

Be Top Local explained it perfectly in their SEO case study:

"When you're about to spend $8,500 in marketing dollars to make the phone ring, the last thing you want is to lose leads to a busy phone line."

Be Top Local set up a system where leads are followed up within five minutes and the staff receives a commission for every appointment booked to incentivize results.

At the end of the day, your goal as an agency is to help your clients make more money. If they're more profitable using your services, they'll stick around. Offer training to client employees to gracefully handle calls and turn them into results for your client. Ensure that phone calls are never left on hold for long and are handled in a professional, friendly manner.

By offering this type of training you not increase efficiency, but go above and beyond where other agencies are willing to go.

14. Be Laser-Focused on Results

A good agency will focus on being data-driven and getting financial results for their clients as opposed to vanity metrics. Clicks, likes, impressions, etc., mean NOTHING if they don't turn into profit at the end of the day.

When you first take on a client you should be certain that you can turn a profit on your services – if you can't, there's no point in providing the services. By ensuring that your client is profitable, there's no good reason for them to leave your agency.

AgencyAnalytics gives our clients clarity and confidence because of how easily we can communicate our efforts and results to them on a frequent, consistent basis.

Lane Anderson, Founder & CEO, London Road Marketing

Everything is measurable these days: Facebook even has a way to measure in-store visits and sales from their ad platform. If you report on the vanity metrics, be sure that they're somehow translated into money in your client's pockets.

Scaling Systems & Processes

15. Automate Your Marketing Reports

How much time do you spend on reporting? Some agencies have said that reporting takes up to a week of their employee's time every month after manually putting the reports together and answering client questions.

Client reporting can be one of the most effective ways to reduce churn and keep customers over the long run. To achieve this and increase your retention rate, it is crucial to keep clients in the loop with the state of their campaigns and the results they're getting. Reporting is also a great opportunity to upsell new services; especially if you're giving them great news.

Use AgencyAnalytics to build reports and automate them to go out every day, week, or month. Integrate everything you need like SEO audits, PPC analysis, social media reporting, and more. And by giving clients access to a custom-branded dashboard, you could even eliminate manual reporting and streamline repetitive tasks!

Choose from 80+ marketing platforms to pull into your live marketing dashboards. Flip them into white labeled, client-ready reports in minutes! Try AgencyAnalytics free for 14 days.

Thanks to templated and automated reports, we no longer have to spend hours and hours on a monthly basis on analytics. This saved time is compounded each time we sign on a new client.

Graham Lumley, Director of Marketing, Blackhawk Digital Marketing

Pick from over 15 marketing dashboard templates to automate your data-retrieval process, like the:

And choose from our client report templates for you to create automated reports fast, including:

16. Build a Client Onboarding Process

Create a scalable and repeatable client onboarding process (including a client onboarding questionnaire) to get the information you need and save yourself headaches down the road. Edit that checklist to suit your agency and ensure that each step is followed when a new client comes on board.

Use our client onboarding checklist for free!👇

17. Systemize Proposals & Contracts

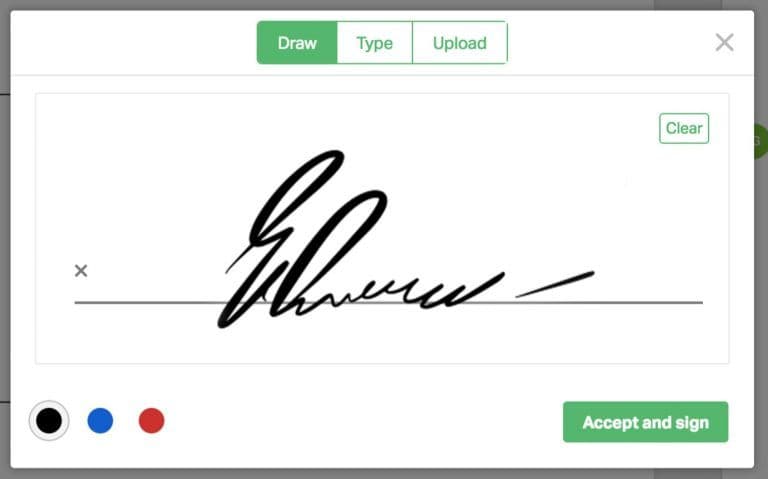

You probably have a proposal template in place for lead generation but customizing each one takes hours. What about if the client asks for edits? How do you handle the signature process?

Using software like PandaDoc or Jotform Sign can speed up and systemize that process for you. It helps shorten your sales proposal turnaround times by creating templates that allow collaboration between multiple parties.

They notify you within your CRM when the client opens the proposal so you know to follow up. Once the client is ready to sign they can do so within the PandaDoc software. Integrate your payment gateway to give them the option to pay right after signing!

There are also a number of other features like:

Managing HR documents when you hire new employees

Streamlining legal approval for agency partnerships

Quote management to help you price your services and calculate agency profit margins

P.S. another tool to checkout for proposals is Qwilr, which allows you to create stunning proposal websites instead of sending docs back and forth.

You can also check out our social media proposal, SEO proposal, and PPC proposal guides, or use one of the popular proposal templates available (for free) to all AgencyAnalytics customers:

18. Streamline Appointment Scheduling

In this day and age, there's no reason to waste time going back and forth with clients to book a meeting time. It's a time hog to find a time that suits both parties and it isn't a value-added activity. Time to cut it out!

There are a couple of tools you can leverage to streamline appointment booking:

Calendly is a tool that allows you to share a link that lets people book meetings according to your availability. It automatically sets reminders before the meetings and shares a Google Hangout URL if you'd prefer to video chat.

x.ai is an AI-powered assistant who will automatically schedule meetings on your behalf at the best time and location for both parties.

Growing Your Team

19. Outsource as Long as You Can

The beauty of running a digital agency these days is that almost everything can be outsourced. You can truly be a "full service" agency as a one-man freelancer if you know how to hire through Upwork or Freelancer. While the majority of outsourced talent may not work out, it's worth it for the few who do. When you find the right people it's a goldmine: high-quality work for a relatively low cost.

When growing an agency, outsource almost everything until there's enough work to hire a superstar in-house. Leverage those superstars to be your agency's core competencies. If you're lucky, some of the people you outsource can turn into location-independent superstars. It's all about taking the time to find the right people.

20. Leverage Internships

Internships are incredibly common in the marketing community. While unpaid internships are unfair and a recipe for exploitation, you can hire a number of interns for a fraction of what a full-time employee will cost and get high-quality work. Many interns are hungry to prove themselves as marketers and may surprise you with their determination.

Just like outsourcing, the fantastic thing about hiring interns is that you will find a few superstars along the way. Those high-performing interns can become the foundation of your agency and may determine your core competencies.

"Don't tell people how to do things, tell them what to do and let them surprise you with their results." - George S. Patton

Enhancing Your Service Offerings

21. Partner With Other Agencies

There are very few agencies that exist that are truly "full-service" in-house. In order to offer a complete package to clients, it can be very beneficial to partner with another agency owner.

This allows you to tap into other companies' expertise and portfolio without taking on much-added risk. Plus, it may also lead to a shared long term vision and more hands on deck to achieve those goals.

There are two ways that you can set up partnerships that make sense:

White label other agencies' services. This works well if you're looking to have another agency manage smaller projects like PPC or reputation management. Here are seven services you can white label to increase the revenue of your agency.

Quarterback the relationships between clients and agencies. This works better for large projects like entire web design makeovers, strategic planning, etc. Your agency can generally work out a finder's fee system when you pass the lead over to them.

22. Think About Alternative Marketing Channels

Don't pigeonhole yourself as a basic digital agency offering web design, SEO, and PPC. There are so many other marketing channels available that you can upsell and become experts in. Here are a few new services ideas that have the potential to make a huge impact:

Experiential marketing

Native advertising such as StackAdapt

Spotify Ads (or other podcast sponsorship opportunities)

Content discovery networks

Influencer marketing

A great thing about many of these is that businesses don't have the time to learn them in-house. If you can have expertise in one or multiple, of these channels you can get lower CPAs than traditional advertising and kill it for your clients.

23. Offer Corporate Training

Research by the Society of Digital agencies found that there was a substantial increase in the number of companies that no longer work with outside agencies. These companies haven't given up on marketing altogether. Instead, they've brought it in-house. Many companies now want complete control over their own data and employees instead of handing it off to another company.

This trend is looking to continue, but you can still take advantage of this opportunity by offering corporate marketing training. This type of education is a big need as colleges and universities are still slow to catch up with the digital world.

If you have some superstar employees, think about leveraging them into teachers. For example, they could offer an SEO training course for clients who want to tackle that aspect of their digital marketing on their own. They already have the knowledge and experience that you need.

A few companies are already doing this, like Brainstation, but the demand is high and corporate pockets are deep. Training is also a great alternative for small business owners who can't afford your monthly fee.

Impress clients and save hours with custom, automated reporting.

Join 7,000+ agencies that create reports in under 30 minutes per client using AgencyAnalytics. Get started for free. No credit card required.

FAQs About Growing Your Digital Marketing Agency

Whether you're landing your first client or scaling your team, these FAQs break down practical ways to grow a digital marketing agency that lasts.

To get more clients for your digital marketing agency, you need a system—not just hustle. Start by building a strong agency website that clearly outlines your marketing services and highlights case studies from successful clients.

Use lead magnets like free audits or guides to attract potential clients. Promote your expertise on social media platforms and in content marketing to build trust with your target audience. Make sure your onboarding process sets expectations early and reinforces the value you offer.

The most effective way to grow is by combining strategic outreach, a steady stream of valuable content, and referral incentives for existing clients who bring in new leads.

Growing a digital marketing agency takes more than simply onboarding more clients. To efficiently scale your marketing agency, focus on three core pillars: process, positioning, and people. Start by refining your service delivery with repeatable workflows—such as templates and reporting tools—to save time and reduce errors.

Sharpen your positioning so potential clients understand what makes your digital marketing agency different. Then build the right team to deliver consistent results and scale services. Content marketing, social media, and lead magnets will help drive inbound interest, while a well-planned sales process turns leads into new clients.

As you grow your digital marketing services, don’t ignore internal operations: refining your onboarding process and expanding your tech stack go a long way in long-term agency growth.

If you're not consistently adding new clients, expanding revenue streams, or hitting growth benchmarks, it’s time to evaluate your strategy. A digital marketing agency that’s stuck at the same size for 6–12 months—with flat lead generation or declining referrals—may be losing market relevance. Look for signs such as high churn, over-reliance on a single area of service, or clients pushing back against pricing.

Sluggish growth can often be traced to an outdated offer, weak positioning, or an inconsistent onboarding process. The best way to reset your trajectory is to clarify your niche, focus your marketing efforts, and ensure your team is aligned behind scalable processes.

The most effective way to build client relationships is through proactive communication, transparency, and achieving measurable wins. Begin with a seamless onboarding process that ensures clients feel supported from the start. Utilize performance dashboards to monitor marketing KPIs and deliver regular updates aligned with their objectives.

Be honest when things don’t work—and ready with a solution. Use social media, virtual events, and content marketing to keep educating and adding value. A digital marketing agency that consistently shows up, delivers valuable insights, and communicates clearly will earn trust faster and retain clients longer.

Strong client relationships are the foundation of agency growth.

Content marketing is one of the most effective ways to grow a digital marketing agency. It builds trust with your target audience, showcases your expertise, and improves visibility in search engines. High-quality blog posts, lead magnets, and SEO-optimized landing pages help attract potential clients searching for solutions.

For example, a blog post about search engine optimization is one way to build relationships and position your agency as a leader in the field.

Use your agency blog to answer real questions from business owners, explain your marketing strategy, and share case studies. Promote every piece on social media platforms to drive engagement. This approach brings in a steady stream of warm leads and supports your overall agency growth efforts—without relying solely on outbound outreach.

Lead magnets are valuable resources offered in exchange for a prospect’s contact info. For digital marketing agencies, effective lead magnets include downloadable guides, SEO audits, social media checklists, and email templates.

They help attract potential clients who are actively researching solutions and can be a first step in your sales funnel. The best lead magnets are tightly aligned with your services and demonstrate your expertise. For example, an SEO checklist positions you as a go-to agency for organic search strategy.

Promote your lead magnets via your agency website, blog posts, and social media to grow your email list and build authority.

A smooth, structured client onboarding process sets the tone for every client relationship. It ensures new clients feel confident in your marketing agency from day one and helps your house team hit the ground running. A poor onboarding experience—missed emails, vague expectations, or disorganized kickoffs—can lead to early churn.

Use the onboarding phase to define goals, assign tasks, integrate tech tools, and align on timelines. Automating parts of this process (for example, using a client onboarding checklist) helps you scale as you grow your digital marketing agency. A refined onboarding process leads to happier clients, better outcomes, and more referrals—fueling sustainable agency growth.

To grow your digital marketing agency without burning out your house team, focus on operational efficiency. Standardize services, utilize automation tools to minimize manual tasks, and create templates for repeatable work. Hire strategically—not just to fill roles, but to expand capacity in your most in-demand services.

Use automated client reporting software and custom marketing analytics dashboards to speed up client updates and reduce the hours spent preparing for meetings. Clear processes and smart delegation help avoid bottlenecks. Finally, prioritize high-value work and offload tasks like admin or manual data entry.

Sustainable growth isn’t about hustle—it’s about scaling smarter.

Yes, AgencyAnalytics offers free proposal templates to help digital marketing agencies streamline their sales process and close more deals. These include editable templates for SEO proposals, PPC campaigns, social media marketing, digital marketing strategy, and website design and development.

Each template is designed to help your team present services clearly, highlight client benefits, and build trust from the first interaction. They also help standardize your approach—so you can grow your agency without reinventing the pitch every time.

Existing AgencyAnalytics customers will find these templates inside your account dashboard. They’re optimized for client conversions and built with marketing professionals in mind.

Conclusion

That's it for our guide to 23 clever ways to grow a digital marketing agency. While there's no one-size-fits-all approach to growth, try a few of these tactics and see what works for you! Focus on what matters to your business instead of wasting time on reporting. Automation = scalability for digital agencies. Start using the agency tools out there that will help you scale.

Written by

Paul Stainton is a digital marketing leader with extensive experience creating brand value through digital transformation, eCommerce strategies, brand strategy, and go-to-market execution.

Read more posts by Paul StaintonSee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.