Cost Per Acquisition (CPA)

Channel Evaluation

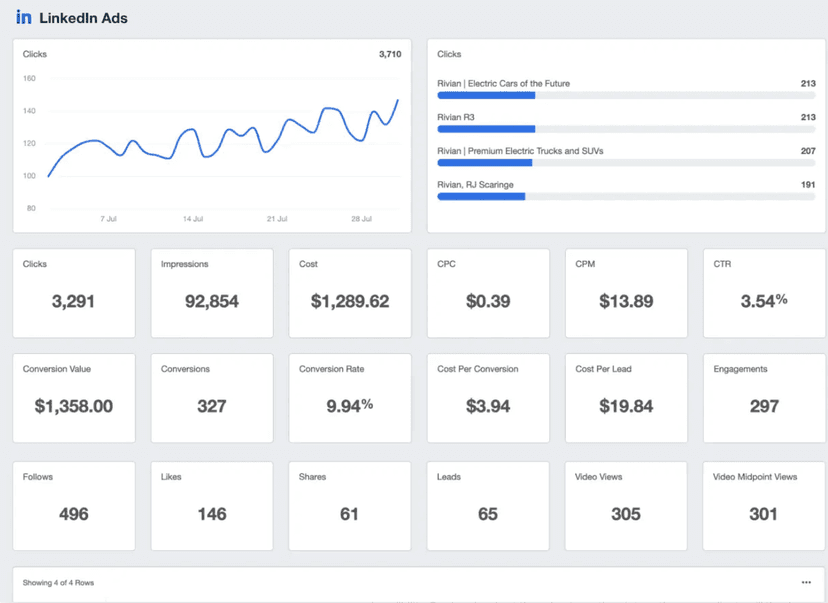

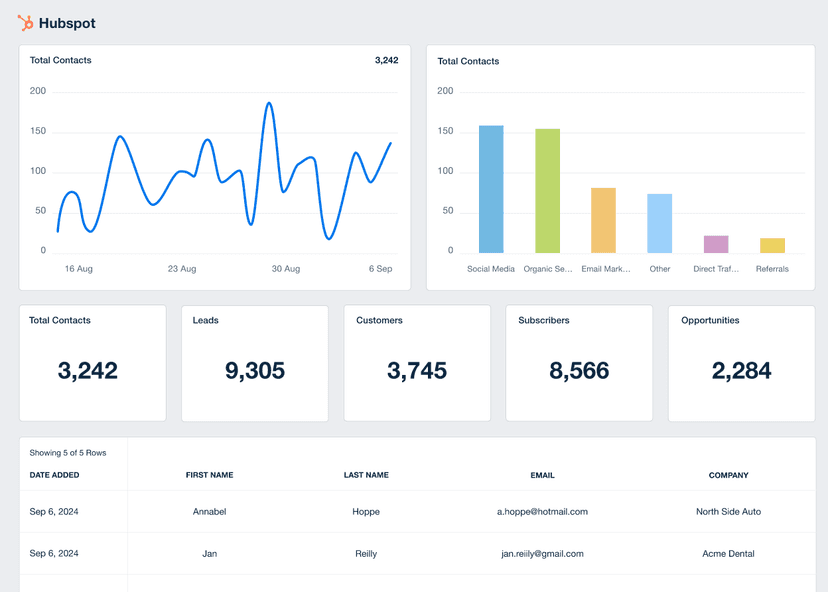

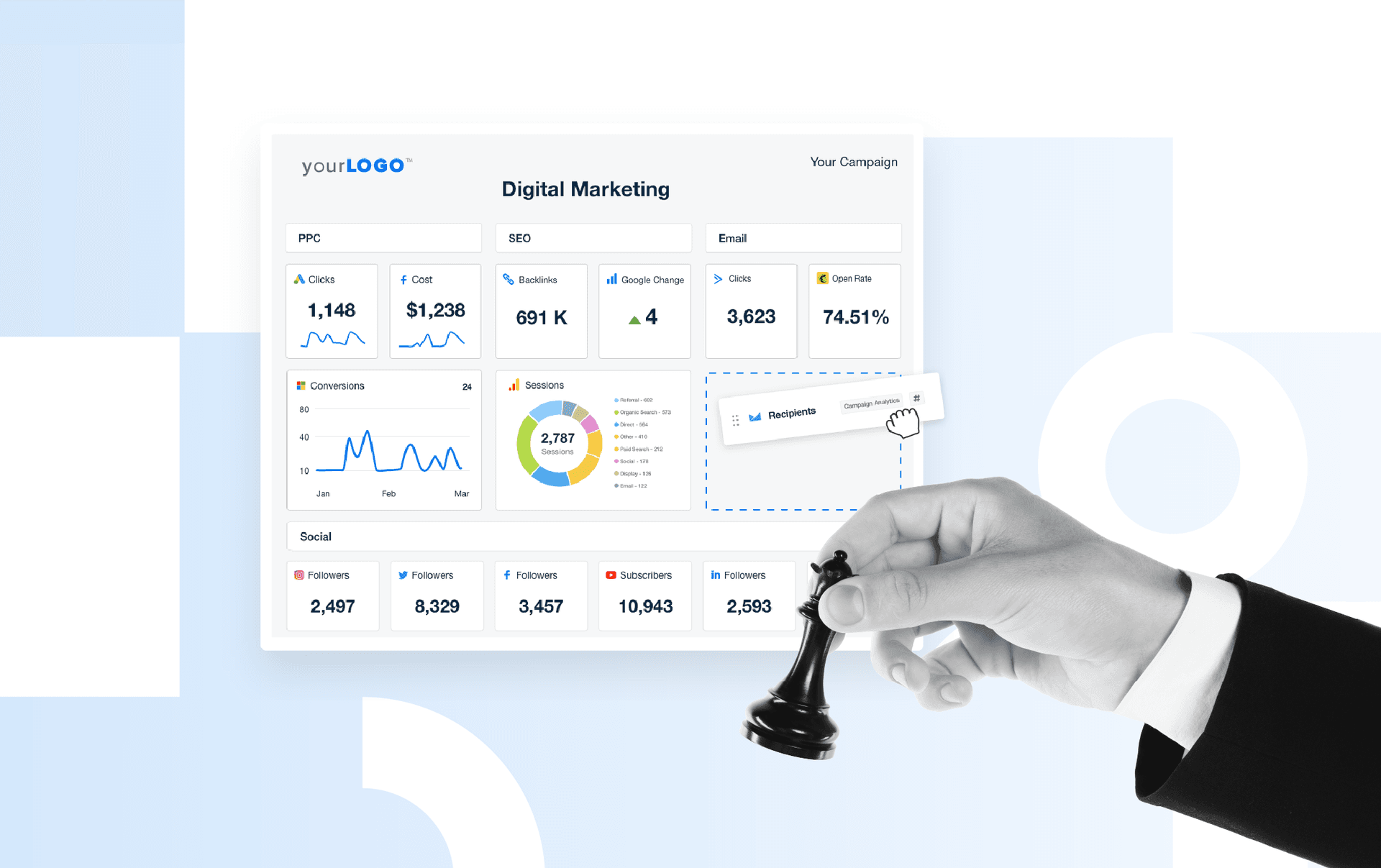

Identify the most cost-effective platforms by comparing the customer acquisition cost across channels like Google Ads, Facebook Ads, and Linkedin.

Budget Allocation

Adjust marketing budgets with CPA as a guide to maximize the efficiency of marketing campaigns.

Prove Your ROI

Include CPA in reports to demonstrate campaign value and efficient use of the marketing budget.

Bid Adjustments

Real-time CPA tracking enables swift adjustments to bidding strategies to better reach the target audience.

Why CPA Matters

Cost per Acquisition is essential for evaluating the efficiency of advertising campaigns. It tells agencies exactly how much is spent compared to the number of customers acquired through the campaign. CPA keeps agencies on course and is directly tied to marketing ROI, ensuring that each dollar is put to good use. A lower CPA often signifies better use of the advertising budget, which is crucial for client satisfaction.

CPA also provides an immediate gauge and feedback mechanism to measure return on investment (ROI), which can be used for target CPA bidding. Real-time feedback helps an agency adjust quickly, saving both time and money. Without knowing the CPA, there's a risk of wasting resources on ineffective marketing efforts or underperforming ad campaigns. With it, advertisers confidently steer toward their goals, optimizing spending for the best results.

Stop Wasting Time on Manual Reports... Get PPC Insights Faster With AgencyAnalytics

How Cost Per Acquisition Links with Other KPIs

Cost per Acquisition is part of a broader network of key performance indicators (KPIs) that offer insights into the overall health of a marketing strategy. Take Average Order Value (AOV), for example. A low CPA coupled with a high AOV suggests efficient customer acquisition and strong revenue generation per transaction. It's the sort of balance that every agency aims to strike.

Similarly, CPA is closely related to Conversion Rates and Customer Lifetime Value (CLV). A high conversion rate often correlates with a lower CPA since more conversions usually mean more efficient use of the advertising budget. On the flip side, understanding CPA in the context of CLV allows agencies to assess the long-term value that new customers bring compared to the total cost of the different marketing channels, providing a more comprehensive view of campaign effectiveness.

Consider all the costs that are involved in acquiring a new customer. This includes advertising costs, sales team costs, proposal development costs, marketing automation software costs, content creation costs, events and trade show costs, and any other costs directly related to acquiring new customers. This provides a clear picture of the Cost per Acquisition and helps optimize marketing strategies and budget allocation.

How To Calculate CPA

To calculate Cost per Acquisition, add up all the costs directly linked to gaining a new customer–advertising, sales, marketing software, and even trade show participation. Then, divide this by the total number of acquisitions. This includes ad spend and associated costs, such as creative development, platform fees, or the agency's PPC management fees. Simple, yet powerful.

Next, determine the total number of acquisitions achieved through the campaign. This is anything from a form submission to a completed sale, depending on the defined conversion goals. To run a CPA calculation, simply divide the total campaign cost by the number of acquisitions.

CPA Formula Example

What Is a Good CPA?

A good average CPA is one that is significantly lower than the Average Order Value (AOV) or Lifetime Value (LTV), ensuring a reasonable Return on Ad Spend (ROAS). For example, if AOV is $100 and CPA is $20, that's a healthy scenario, pointing to profitable campaigns.

What Is a Bad CPA?

A bad CPA occurs when the cost to acquire a new customer is too close to or exceeds the AOV or LTV. While generating at a loss may be acceptable for customer retention or market penetration strategies, it's generally a red flag.

Digging Deeper Into CPA

For a more nuanced understanding, comparing CPA and AOV by channel reveals which provides a better ROAS. For example, if the CPA on social media is $30, but the AOV is $120, while paid search has a CPA of $40 but an AOV of $280, the CPA alone might lead to additional budget allocation into paid social campaigns.

However, these additional insights show that paid search is the more effective channel for driving revenue. This granularity helps fine-tune strategies and optimize spend.

Why Cost Per Acquisition Matters to Clients

For clients, Cost per Acquisition is the yardstick that measures the financial efficiency of their marketing initiatives. Every dollar spent is accounted for, offering a clear view of what the acquisition costs required to reel in each paying customer. With a grasp on CPA, clients better allocate their budgets, focusing more on what works and less on what doesn't.

CPA also offers a snapshot of campaign effectiveness. A favorable CPA implies that an advertising effort is doing its job. Clients may not be experts in digital marketing, but they are in their bottom line. A low CPA speaks a language everyone understands: marketing success and profitability.

Why Cost Per Acquisition Matters to Agencies

For agencies, Cost per Acquisition is less about supporting their client’s bottom line and more about the performance narrative. It’s a metric that showcases the agency's expertise in efficiently managing ad spend. A well-optimized CPA means the agency knows how to pull the right levers at the right time.

Moreover, CPA is a proof point in validating the agency's strategies. A low CPA becomes a compelling case study or testimonial, aiding client retention and new business acquisition. It's not just a number; it's a badge of competence. With a low CPA, agencies solidify their reputation for delivering tangible results.

Automatically Pull Data From {{integration-count}}+ Marketing Platforms To Create Client Reports in Minutes.

Best Practices When Analyzing and Reporting on CPA

Understanding the nuances of Cost per Acquisition lays the foundation for more targeted and efficient marketing strategies. Analyzing CPA from multiple angles equips advertisers to refine their efforts for optimum outcomes.

Track CPA Over Time

Analyzing Cost per Acquisition historically offers insights into seasonal variations or the impact of specific events. A spike in CPA might correlate with a high competition period, helping allocate future budgets wisely.

Channel-Based CPA Insights

Evaluating CPA across different channels like search, social, and email shows which platforms deliver the best value. Assuming the AOV stays consistent, lower CPA on one channel guides the redistribution of ad spend for higher returns.

CPA Across Campaigns

Comparing CPA between various campaigns offers a side-by-side evaluation of their effectiveness. Knowing which campaign has the lowest CPA helps focus efforts and resources more effectively.

Track CPA Anomalies

Detecting unusual spikes or drops in CPA is vital for preemptive action. These anomalies often signal a need for strategy adjustments, whether revising targeting parameters or checking for ad content issues.

Align CPA with Client Objectives

Aligning CPA with client goals ensures marketing efforts directly contribute to their overarching objectives. This alignment helps prioritize strategies that most effectively meet client expectations regarding cost-efficiency and customer quality.

Actionable Recommendations for CPA

Suggest specific strategies to improve CPA, such as optimizing ad targeting, refining campaign messages, or reallocating budgets to more efficient channels. This approach turns data into practical steps for enhancing campaign performance.

FAQs: Cost Per Acquisition (CPA)

From tracking campaign efficiency to setting CPA targets, these FAQs help your agency optimize client acquisition costs and deliver smarter media spend strategies.

Cost Per Acquisition (CPA) measures the total cost to gain a paying customer. Cost Per Conversion includes any desired action—such as a form fill or download—that doesn’t always result in a sale.

Cost-Per-Acquisition (CPA) measures the media spend needed to acquire one paying customer or conversion. Customer Acquisition Cost (CAC) includes the total cost of acquiring customers—covering marketing team operations, sales resources, promotional codes, and advertising spend across an entire marketing campaign.

Each metric serves a different purpose:

CPA evaluates acquisition efficiency at the campaign or channel level.

CAC provides a broader financial metric that includes all costs of acquiring customers.

CPL tracks the cost of lead generation before a purchase conversion occurs.

Agencies should track the metric that aligns with client goals, whether acquiring customers or generating qualified leads.

CPA is important because it shows how efficiently a campaign turns ad spend into paying customers. It’s a bottom-line metric that helps determine if a campaign is profitable and worth scaling.

CPA is calculated by dividing total marketing costs by the number of new customers acquired. It typically includes only final conversions like purchases or signups (i.e., actions that directly generate revenue).

A reasonable CPA varies by industry, campaign type, and revenue impact per single customer. Agencies should compare client results against industry benchmarks, assess relevant keyword groups and ad copy performance, and align CPA with average target ranges that maintain profitability.

According to AgencyAnalytics benchmarks, the average cost per conversion (CPA) on Google Ads is $31.75.

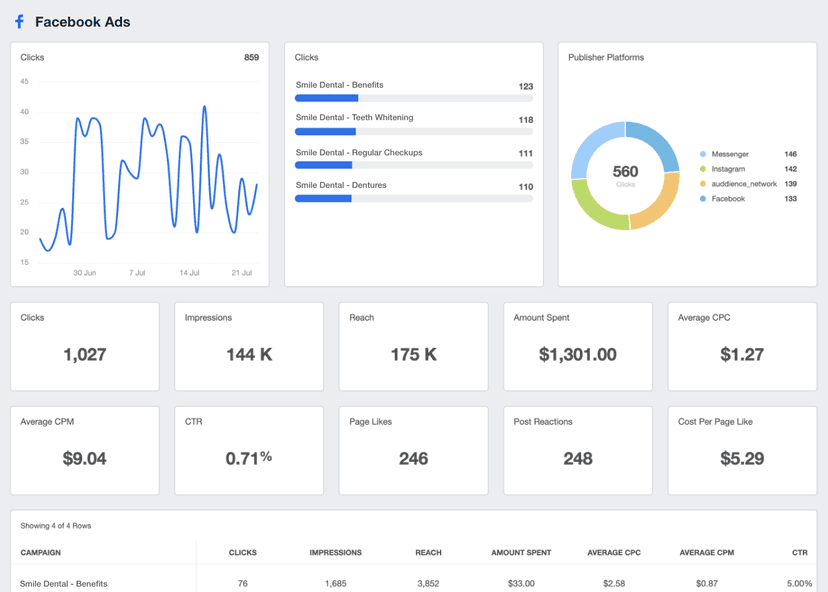

Based on AgencyAnalytics industry benchmarks, the average cost per lead (CPL) on Facebook Ads is $34.99.

Yes. CPA benchmarks vary across industries, campaign structures, and platforms. Agencies can use the AgencyAnalytics Benchmarks feature to compare client acquisition costs against real industry data and set realistic expectations for media spend efficiency.

To reduce CPA while maintaining quality, refine targeting and optimize landing pages. Shift budget to channels that consistently deliver lower CPA and generate higher revenue per conversion.

Quality Score and conversion rate optimization have a significant impact on CPA. High Quality Scores in PPC ads reduce CPC by rewarding relevant keyword groups and ad copy, while improved conversion rates reduce the overall cost of acquiring customers and increase campaign efficiency.

Agencies should base CPA targets on client revenue per conversion, average target CPA ranges, and overall business goals. Setting a CPA target involves balancing aggregate cost, campaign performance, and total advertising spend in the same time period to ensure more sales without reduced ad spend efficiency.

CPA influences marketing ROI by showing how much it actually costs to earn each customer. A lower CPA means more customers for the same budget, which translates to higher profit margins.

Total advertising spend affects CPA by determining scale. If campaigns are optimized for relevant keyword groups, accurate targeting, and high-quality ad copy, more media spend can drive more conversions without resulting in a higher CPA. Poor optimization, expanding beyond the ceiling on known keywords, and sudden increases in spend often lead to higher CPA and reduced acquisition efficiency.

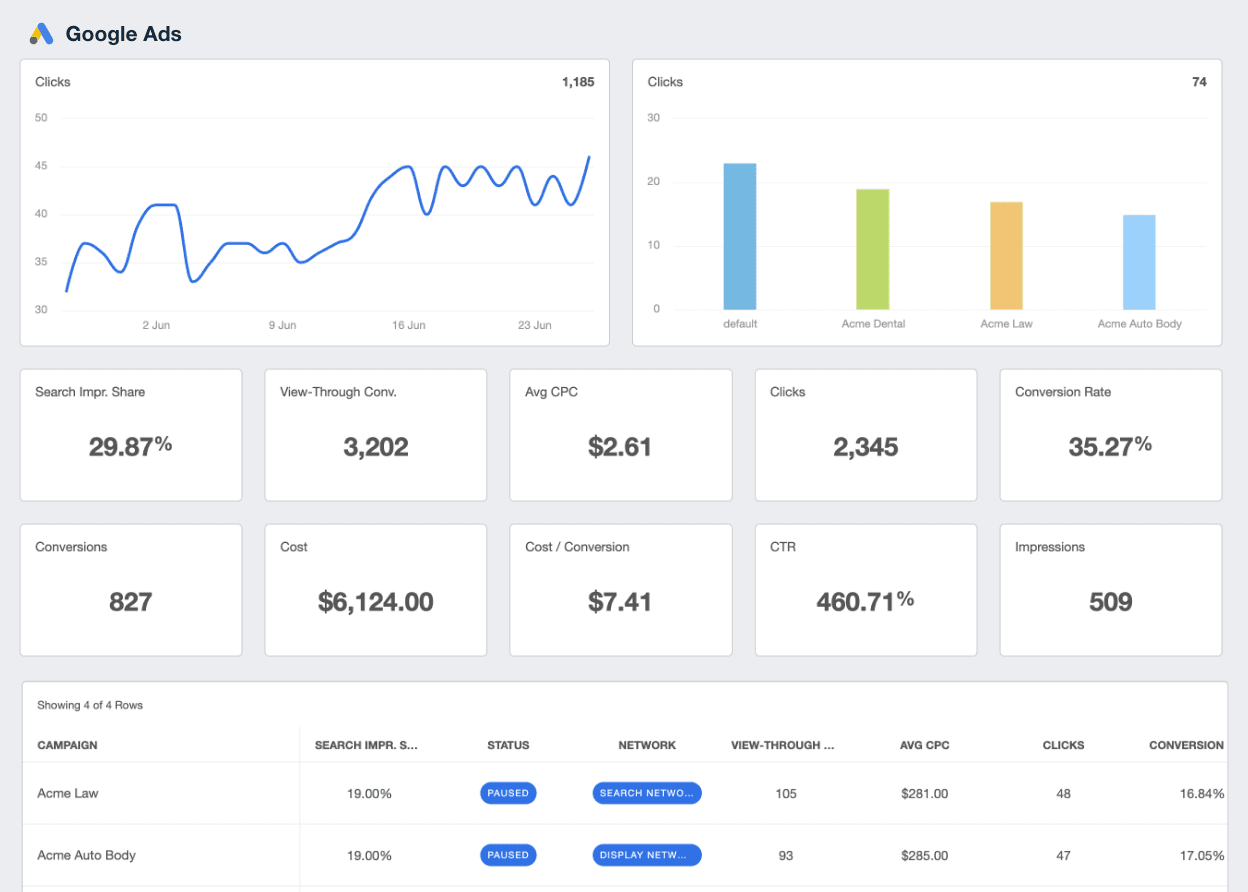

Google Ads Dashboard Example

Related Integrations

How To Improve CPA

Improving Cost per Acquisition isn't just about spending less; it's about maximizing value at every opportunity. Here are three actionable tips to move the needle in the right direction.

Refine Targeting

Sharpen audience targeting to reduce wasted clicks. Use data to understand customer behavior and preferences, then adjust campaigns accordingly.

Optimize Landing Pages

Effective landing page optimization boosts conversions. Use A/B testing to uncover what resonates with audiences, lowering the CPA on customer acquisition campaigns.

Shift Budgets

Continually assess campaign performance to identify underperforming assets. Redirect funds to the campaigns demonstrating a lower Cost per Acquisition with the same–or higher–AOV.

Related Blog Posts

See how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.

![The Ultimate Google Ads Optimization Checklist [Guide & Tips] An Easy to Follow Guide to Google Ads Optimization + a Downloadable Checklist](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fdfcvkz6j859j%2F1RGRDTvZOx2bH3PCJMjDsD%2Fc239f0aed512ea0e761f3713dd6e59ac%2FGuide-to-Google-Ads-Optimization-Checklist.png&w=1920&q=75)