Customer Lifetime Value (CLV)

Budget Allocation

Determine investment based on expected customer revenue to increase overall customer value.

Segmentation & Personalization

Target high-value segments for personalized strategies, even if it means higher customer acquisition costs.

Retargeting Strategies

Use Customer Lifetime Value models to prioritize high CLV customers for engagement.

Product & Service Development

Guide product enhancements using CLV insights to improve customer satisfaction.

Why Customer Lifetime Value Is Important

Customer Lifetime Value quantifies a customer's long-term revenue potential to a business. For agencies, understanding CLV offers a clear picture of potential revenue from each client's customer base. This metric guides strategic decisions, ensuring marketing investments yield optimal returns. In short, CLV is essential for agencies to demonstrate value and optimize client campaigns.

Often used interchangeably with Lifetime Value (LTV), there is a subtle but distinct difference between the two. Lifetime Value (LTV) calculates the total spending by all customers over their engagement with a business, while CLV estimates the financial contribution of an individual customer throughout their relationship with the brand, serving as a focal point for personalized marketing strategies.

Stop Wasting Time on Manual Reports... Get Insights Faster With AgencyAnalytics

How Customer Lifetime Value Relates to Other KPIs

Customer Lifetime Value shouldn’t be a standalone metric, as it’s impacted by other revenue metrics too. For instance, the Customer Acquisition Cost (CAC) directly impacts CLV. If acquiring a customer is expensive, it diminishes the overall Customer Lifetime Value, making it crucial to balance both metrics for profitability.

Moreover, Customer Retention Rate (CRR) plays a role. A high retention rate often signals a higher CLV, as satisfied customers tend to purchase more over time. Lastly, Average Order Value (AOV) intertwines with CLV. Boosting AOV leads to an increased CLV, emphasizing the importance of upselling or cross-selling strategies. Together, these KPIs provide a comprehensive understanding of a campaign's long-term viability and success.

We use the average customer’s customer lifetime value to calculate customer acquisition cost targets in several ways: Setting advertising budgets, optimizing conversion rates, refining customer targeting, and monitoring campaign performance. Overall, understanding customer customer lifetime value is critical to ensuring our agency’s advertising and marketing efforts are efficient and effective.

How To Calculate Customer Lifetime Value

Calculating Customer Lifetime Value provides a clear picture of the long-term revenue potential of each customer. When running a Customer Lifetime Value calculation, one must consider the average purchase value, the average purchase frequency, and the average customer lifespan. Essentially, it's about understanding how much existing customers spend, how often they spend, and for how long.

Customer Lifetime Value Formula Example

What Is a Good CLV?

A good average Customer Lifetime Value is where customers have a high AOV and loyal customers come back for return purchases. It indicates that customers are satisfied with the company’s products/services.

What Is a Bad CLV?

A low CLV is where customers tend to make one small purchase and fail to return. This suggests an overall lack of customer loyalty, as customers aren't generating enough revenue over time.

How To Set CLV Benchmarks

If standard benchmarks are elusive, agencies often set their own by analyzing historical data. By comparing CLV over different periods or against competitors, agencies identify trends and set realistic targets. It's also beneficial to consider factors like industry standards, market conditions, and business growth rates.

Why Customer Lifetime Value Matters to Clients

For clients, Customer Lifetime Value is the crystal ball for future revenue. It's not just about the immediate sale; it's a forecast of the financial relationship with a customer. By understanding CLV, clients gauge the health of their customer relationships.

A rising CLV indicates growing trust and loyalty, while a declining CLV might signal a need for improved customer service or product offerings. Moreover, CLV helps clients allocate budgets effectively. If they know the long-term value of a customer, they easily determine how much to invest in acquisition and retention strategies.

Why Customer Lifetime Value Matters to Agencies

For agencies, CLV is the blueprint for strategy. It's the metric that informs campaign direction, content creation, and targeting decisions. While clients view CLV as a revenue predictor, agencies see it as a tool for optimization.

A deep dive into CLV reveals which marketing channels are most effective or which demographics yield the highest value customers. It's also a metric that showcases an agency's effectiveness. Demonstrating an increase in CLV under an agency's watch is a testament to their strategic prowess.

Key Factors That Impact Customer Lifetime Value

Engaging consistently and effectively with customers, offering personalized experiences, and maintaining excellent customer service are essential for deepening client relationships and driving a higher customer lifetime value.

Brand loyalty is another critical aspect. Sustainable growth relies not just on acquiring new customers but on retaining existing ones. Implementing feedback mechanisms and loyalty incentives are key strategies for increasing retention rates. Beyond repeat purchases, it’s about creating a brand preference that goes beyond price or convenience.

Understanding different customer segments through data analysis reveals which strategies are effective and which need adjustment. This is all about gaining insights into customer behaviors and preferences.

Effective customer lifetime value analysis reveals trends in customer behavior and relationship health.

Finally, identifying and focusing on the most valuable customer segments ensures efficient use of marketing resources. Targeted strategies should be designed to cater to these segments, considering their potential for long-term value.

Discover the Client Reporting Platform Trusted by Over {{customer-count}} Marketing Agencies

Deep Dive Into Customer Lifetime Value

Understanding Customer Lifetime Value from diverse perspectives ensures campaigns hit the mark every time. By grasping CLV's intricacies, strategies are sharpened for maximum resonance.

Channel-Specific CLV

Segmenting CLV by acquisition sources pinpoints the most lucrative avenues, refining channel allocation.

Campaign CLV Insights

Evaluating CLV across marketing initiatives reveals the most impactful efforts, guiding future campaign direction.

Decode CLV Fluctuations

Identifying sudden changes or patterns in CLV often signals market shifts or operational challenges, prompting swift action.

Contextualize CLV with Other Metrics

Customer Lifetime Value gains true meaning when juxtaposed with other metrics. For instance, when CLV is paired with the Cost of Customer Acquisition (CAC), it provides a clearer view of profitability.

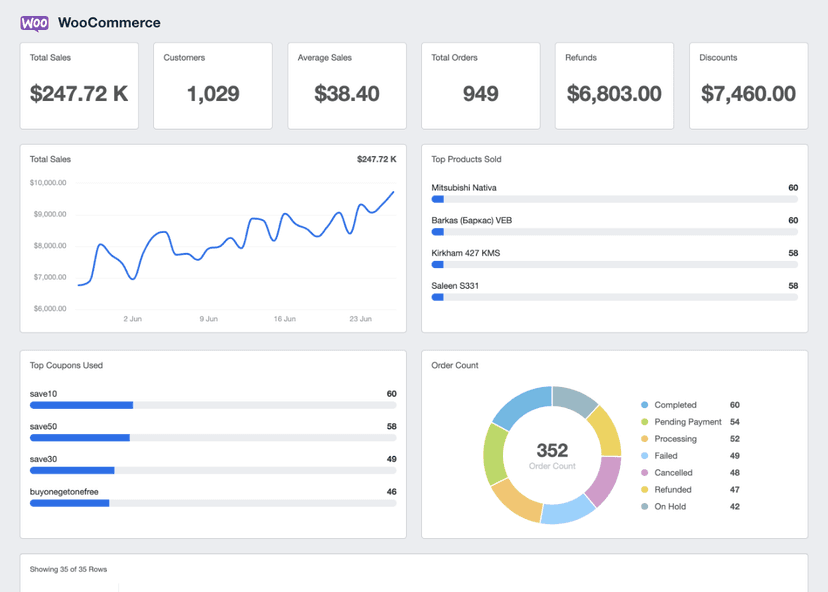

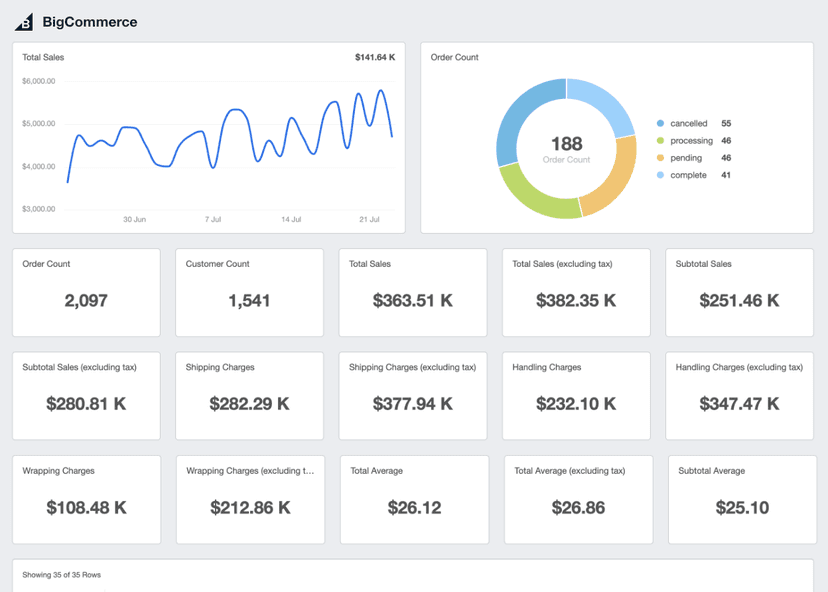

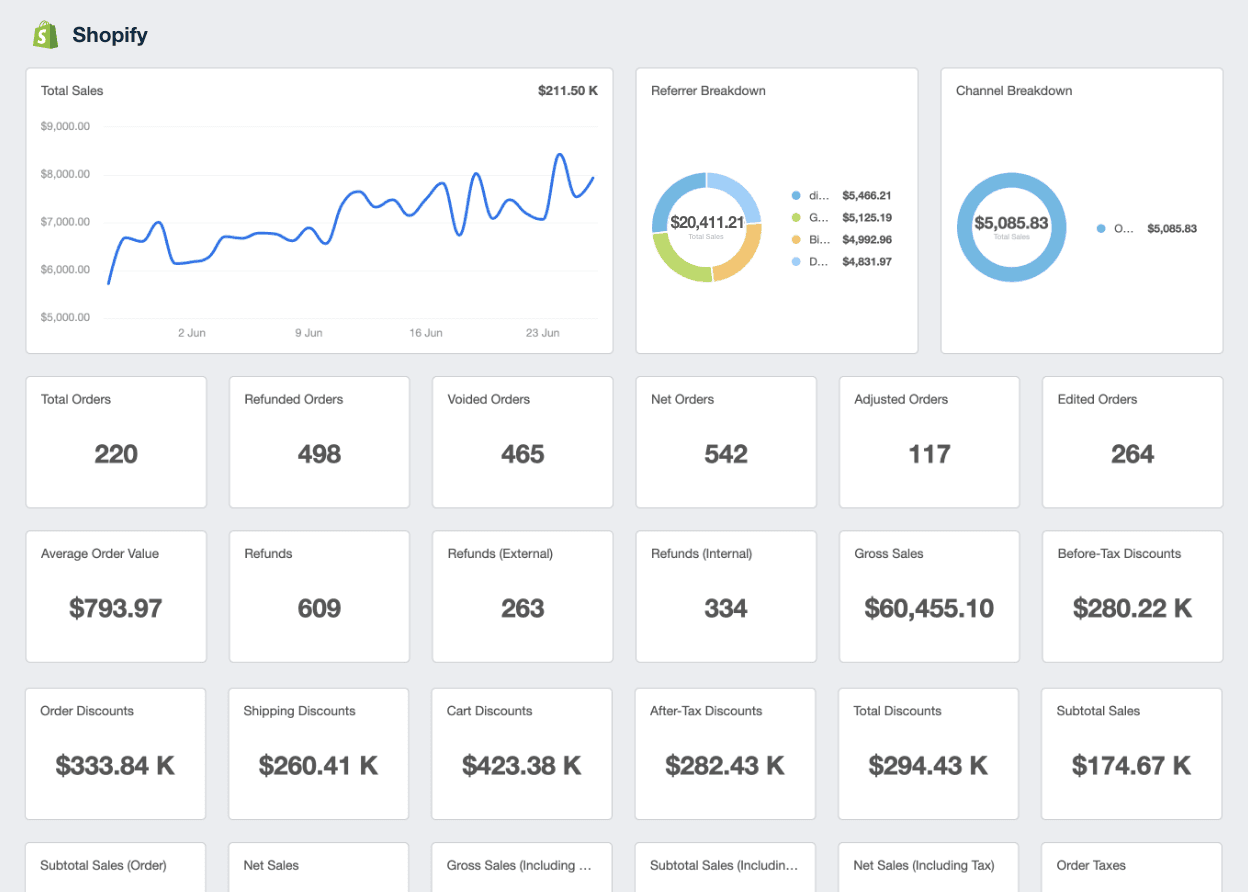

Visualize CLV Performance

Visual representations, be it graphs or trend lines, make data digestible. They highlight patterns, indicate anomalies, and offer a snapshot of performance over time. For clients, visual aids simplify complex data, making it easier to grasp the implications of CLV and its trajectory.

Align CLV with Client Goals

Each client comes with their own set of goals, and it's essential to view CLV through that lens. Be it growing market presence, introducing a fresh product, or tapping into a different audience, CLV targets should be adjusted to mirror these objectives.

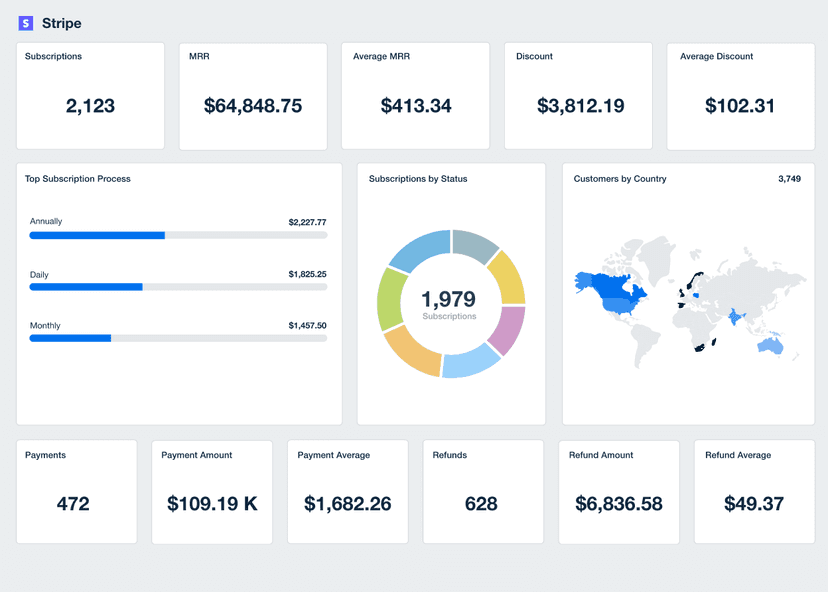

Shopify Dashboard Example

Related Integrations

How To Increase Customer Lifetime Value

Elevating Customer Lifetime Value significantly enhances long-term revenue and opens up new avenues for marketing, as a high customer lifetime value provides greater budget room for acquisition.

Implement Loyalty Programs

Rewarding regular customers encourages repeat business. Loyalty programs, with points or discounts, make customers feel valued and incentivize further purchases.

Enhance Customer Experience

Customers appreciate when they feel understood. Utilize data analytics to personalize product recommendations, ensuring each interaction feels tailor-made for the individual.

Upsell and Cross-Sell

Promote premium or complementary products to increase transaction values among high value customers. By diversifying product or service offerings, customers have more reasons to return and explore what's new.

Related Blog Posts

See how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.