Table of Contents

Table of Contents

- What Is Customer Lifetime Value (CLV)?

- The Importance of Customer Lifetime Value in Setting CPA Targets

- The Customer Lifetime Value Formula

- Factors That Contribute to Customer Lifetime Value

- How to Use Lifetime Value to Set Customer Acquisition Targets

- How To Set CLV Goals for Client Reporting

- How To Build Reports On Customer Lifetime Value

- How To Increase CLV

- Summary & Key Takeaways

7,000+ agencies have ditched manual reports. You can too.

Free 14-Day TrialQUICK SUMMARY:

Customer lifetime value (CLV) measures the total revenue a customer generates over their relationship with a business. Understanding and using CLV helps set effective acquisition goals, optimize marketing spend, and improve client retention strategies. This article covers the importance of CLV, how to calculate it, and its impact on acquisition cost strategies to boost a client's business growth.

As an agency, it’s in your best interest to keep your clients coming back month after month and year after year. Your clients are in a similar position with their own customers–except it’s your agency’s job to help them get new customers and help keep their existing ones happy.

But many agencies (and business owners in general) prioritize customer acquisition over customer retention to the point where retention is often treated like an afterthought. Plus, including the retention value of a customer in acquisition plans can make a huge difference in the acceptable cost per acquisition.

Look at it this way: If an average customer spends $200 on their first purchase, and your client's target is a 2x ROAS, that means your agency has a cost-per-acquisition target of $100.

However, if an average customer spends $2,000 during their lifespan, and your client's CLV to CAC ratio target is 4x, that increases that target cost per acquisition to $500.

Overlooking retention is a huge blindspot because it fails to factor in Customer Lifetime Value (aka CLV or CLTV), which can make or break a client’s bottom line.

This article will give you a better understanding of customer lifetime value and how to set and report on an appropriate CLV to CAC ratio that drives your client's bottom line.

What Is Customer Lifetime Value (CLV)?

Customer lifetime value is one of the most important metrics for customer loyalty.

Also known as Lifetime Value (or LTV for short), customer lifetime value measures how much the average customer spends over the course of the business relationship. Basically, it’s a monetary value that reflects how effectively you and your client manage the customer lifecycle–or at least the last half of it.

As CLV is the total amount someone spends during their time as a customer, let’s take a quick refresher at the six parts that comprise the customer lifecycle:

Reach

Acquisition

Conversion

Retention

Loyalty

Churn

Typically, CLV kicks in at step 4 (Retention) and ends at step 6 (Churn).

The Importance of Customer Lifetime Value in Setting CPA Targets

Studies show that getting a new customer is 5x more expensive than retaining existing customers, which means customer retention is a surefire way to boost ROI and ROAS.

But one of the biggest takeaways about CLV is that it isn’t so focused on how much the customer spends today. Instead, it’s focused on how much they’ll spend in the future for months and years to come (provided that you’re able to retain them, of course).

Where this becomes critical to marketing and business growth is aligning that to an appropriate cost-per-acquisition target based on the total value of a new customer.

Agencies, and clients, often make the mistake of looking at the immediate ROAS of a campaign without an eye to the future revenue. Let’s explore a scenario.

Let’s say your client sells a consumable product for $49. The average customer will go through their current supply within 30 days and typically uses the product loyally for four years.

One way to look at a campaign performance is based on ROAS.

$49 Revenue / $100 CPA = 0.49 ROAS. That doesn’t look very pretty.

However, if you consider the total lifetime value of that client ($49 x 12 x 4), the lifetime ROAS starts to look much better.

$2,352 Revenue ($49 x 12 x 4) / $100 CPA = 23.5 Lifetime ROAS

If your agency is constantly reporting a loss on its marketing efforts, how much longer will it take before the client decides to seek more profitable alternatives? However, if you highlight the total projected revenue that these new customers will generate, the picture starts to look a lot rosier.

The challenge here is that the client needs to wait four years to experience the value of that new client, but that’s part of building for growth.

CLV is a broad indication of how if customers will repeat purchases and keep coming back for more, and it easily translates into a profitable cost to acquire customers.

The Customer Lifetime Value Formula

Keep in mind that there are a few different ways to calculate customer lifetime value, and your results may vary depending on how you do it.

For the sake of simplicity, here’s an easy formula that Hubspot recommends for calculating CLV:

CLV = (Customer Value) X (Average Customer Lifespan)

How to Calculate CLV: An Example

For example, let’s say one of your clients pays $10,000 per month for your marketing services, and your average client sticks around for five years.

$10,000 per month equals $120,000 per year, and using the CLV formula gives you:

CLV = $120,000/year X 5 years = $600,000

Let’s look at the same formula in a typical eCommerce world. If a customer spends an average of $120 per order, orders an average of 7 times per year, and stays loyal to the brand for three years, that formula would look like this:

CLV = $840/year X 3 years = $2,520

Granted, if you don’t have access to that high-level data, you might have to roll your sleeves up and calculate it yourself.

These data points highlight two key thoughts:

Customer or client retention is critical for both your agency and your clients. The longer that clients are retained, the more profitable they become.

Setting CAC targets based on the first purchase severely limits a company's ability to grow.

The 2 Types of CLV Models

There are two main methods of looking at CLV, and your results will depend on the model you use, so let’s take a look at them both.

1. Historical Customer Lifetime Value

Historical CLV relies on pre-existing data. One of the drawbacks of using this model is that it doesn’t consider whether the customer will continue being a customer or not.

It also doesn’t account for differing customer journeys, and it can also be challenging to track which customers are inactive and active, especially if their status changes.

This model can also get overly complicated, especially if you’re calculating historical CLV for multiple customers. It can be challenging to keep your numbers up-to-date (doubly so if you do it manually!).

2. Predictive Customer Lifetime Value

Predictive CLV uses machine learning to forecast customers’ future behavior based on previous data. This is a more efficient way to calculate CLV than historical CLV, and one of the best things about predictive CLV is that it gets better with each purchase or action due to the constant iteration of machine learning.

Factors That Contribute to Customer Lifetime Value

There are a number of factors that contribute to CLV that can affect your numbers, so let’s break down some of the most important metrics you need to be keeping your eyes on in addition to CLV.

AOV vs. CLV

AOV is short for ‘average order value’ and is based on how much a customer spends during a typical transaction. Think of AOV as a single frame, whereas CLV is the entire film that represents the customer lifespan.

The AOV metric is typically used in eCommerce marketing, so agencies should monitor this metric as an indicator of how much a typical customer will spend at a time.

To calculate AOV, divide revenue by the total number of transactions during the given period.

ARPU vs. CLV

ARPU stands for ‘average revenue per user' and is usually measured over a period of a month or a year. This data point takes AOV one step further by considering how often the average customer will purchase during a certain time period, usually annually.

While the ARPU metric is fundamental to SaaS companies, mobile apps, and other subscription-based services, agencies should also monitor this metric as an indicator of their clients’ overall financial health.

To calculate ARPU, divide revenue by the total number of users (or unique customers) during the given time period. ARPU also feeds into MRR (Monthly Recurring Revenue) which sums up the total revenue each month based on all users.

CAC vs. CLV

CAC (customer acquisition cost) is closely related to CLV, in that the customer lifetime value must be greater than customer acquisition costs to be profitable.

Think of AOV as a single transaction and ARPU as a snapshot of a set time period, whereas CLV is the total value brought in throughout the entire customer lifecycle.

What is A Good CAC to CLV Ratio?

While there isn’t a definitive number for CLV, there’s a general rule of thumb when it comes to the ratio of CLV to CAC, which is 3:1.

This means that your customer lifetime value should be 3x as much as your customer acquisition costs.

But this number needs to be adjusted based on the ability of your client to wait for the rest of the revenue to flow in during the customer's lifespan. If they are a larger business, with a steady flow of revenue and good cash reserves, your agency can aim for that 3x target. However, bootstrapped startups may need to see that return sooner rather than later, so that target should likely increase to the 5x or 6x range.

Keep in mind that aiming too high (eg. 10x) will mean that your client will miss out on profitable customers because they've set their CAC targets too low. This brings us to the next section.

How to Use Lifetime Value to Set Customer Acquisition Targets

As discussed earlier, when it comes to setting customer acquisition targets, many businesses make the mistake of using just the cost per acquisition (CPA) as their primary metric. While CPA is important, it should not be the only metric that you use to determine your targets. A more important metric to consider is how that CPA relates to the instream revenue as well as the lifetime value of a customer.

Because LTV takes into account the long-term profitability of a customer, it can help your agency set more accurate–and often more aggressive–targets for your marketing campaigns.

The major difference between using real-time revenue vs lifetime value to create CPA targets is if your client has the patience, and the financial ability, to wait for the long-term revenue benefits.

Let's say your current client is in a cashflow crisis. They need to see results now and they're not interested in waiting for long-term benefits. In this case, focusing on real-time revenue would be a better option.

On the other hand, if your client is patient and has the financial resources to weather a short-term loss for a longer-term gain, then using lifetime value as your metric makes more sense.

In order to set customer acquisition targets using lifetime value, you'll need to have a good understanding of your client's product, customers, and sales cycle. With this information, estimate the average LTV for newly acquired customers.

Once you have an estimate of the average LTV, start to play around with different CPA targets to see what is achievable.

A good rule of thumb is that your CPA should be less than one-third of the LTV. So, if the average LTV for a customer is $1,800, then your CPA target should be $600 or less. However, the longer it takes to realize the lifetime value, the higher that ratio typically needs to be in order to warrant the patience required.

What Happens If You Ignore CAC to LTV Ratios?

Let's take a real-world example. A financial services SaaS company has an ARPU of $1,100/month, and the average new client lasts 6.4 years on the platform. Imagine that the ROAS target for that client is 4x, there are 4 ways to establish CAC targets for new clients.

First Month Revenue: $1,100/4 = CPA Target of $275. In a competitive, high-value market, this could be difficult to achieve.

First Year Revenue: $1,100x12 / 4 = CPA Target of $3,300. Given how competitive and costly the financial services sector is, this could be considered a more reasonable target.

In-Year Revenue: $1,100 x 6 / 4 = CPA Target of $1,650. This formula is a rough average for the full year, since the average in-year lifespan should be 6 months. However, if the client is locked to fiscal years, acquiring clients in November (where there are less months of in-year revenue) would become far more challenging than in January (with a full billable year ahead).

LTV: $1,100 x 12 x 6.4 / 4 = CPA Target of $21,120.

In the example above, the client was focused on revenue generated within the fiscal year, so budgets were constantly being slashed in the later part of the year because the in-year ROAS was far lower than it had been in the months prior.

This was a short-sighted approach that significantly hampered potential growth and left future money on the table every fourth quarter, year after year.

If the focus had shifted to first-year revenue, the lead generation pipeline would have continued to chug along year after year and their client base could have grown exponentially faster.

How To Set CLV Goals for Client Reporting

Once you’ve calculated the CLV for your clients, it becomes a lot easier to set CLV goals because you start putting real numbers down and making projections. In your report summary, you’ll want to make sure to include key metrics such as:

Customer lifetime value (obviously)

Customer acquisition cost (CAC)

Average revenue per user (ARPU)

CLV:CAC ratio

You might also want to include additional metrics such as:

Annual Contract Value (ACV): This metric tracks recurring revenue which means it excludes one-time fees. It’s calculated by dividing total revenue of contracts by total years in the contract.

Average Contract Length (ACL): Calculated by summing up the total of all contracts in months and divide by the total number of contracts.

Questions To Ask Yourself When Setting CLV Goals

The following questions may help you develop your CLV goals for your agency and your clients.

How much am I willing to spend to acquire a customer?

How much should I spend to retain or re-engage my customers?

How much of a priority is customer acquisition?

Am I giving my customers (or clients) what they want?

How To Build Reports On Customer Lifetime Value

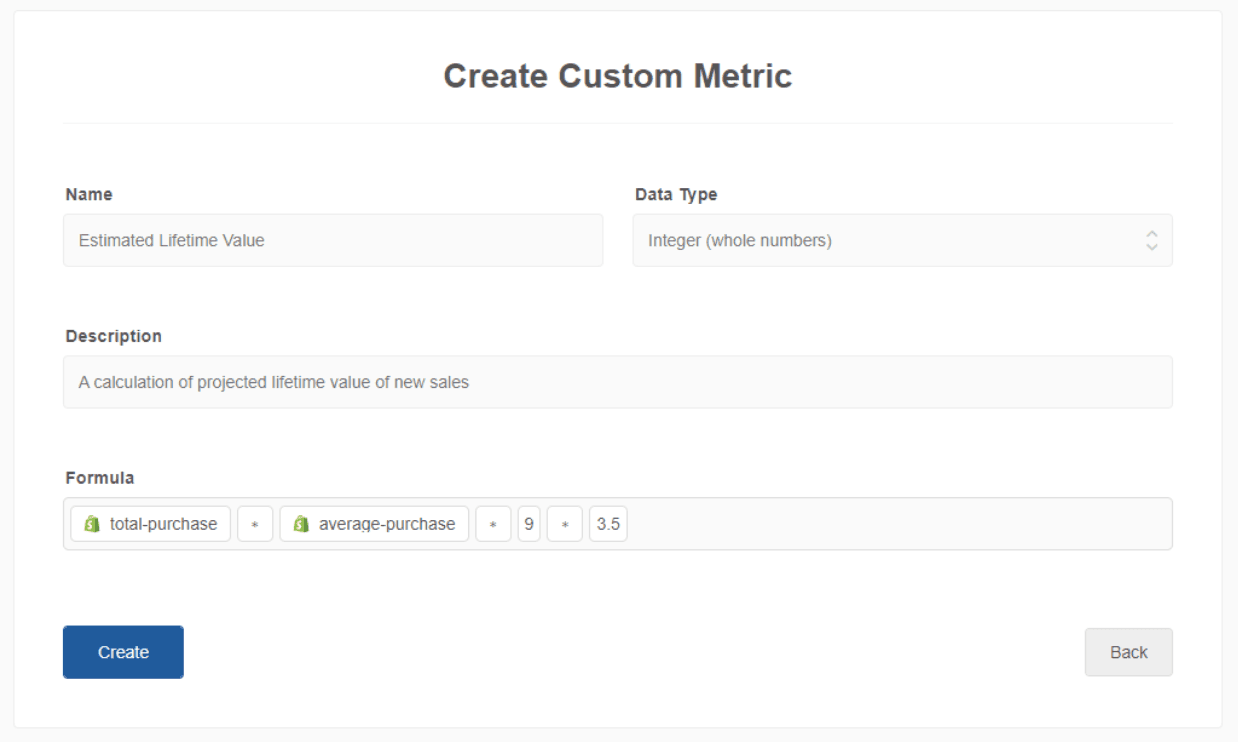

Once you have data to support the purchase patterns and average lifespan of customers acquired, create a custom formula to project the value of current sales in the future. This metric can be a simple estimate using average purchase amounts multiplied by the number of expected purchases in a customer’s life. Or, it can become quite complex by factoring in new vs. return purchase ratios and return rates.

For example, if you know that for every sale made, the customer will likely purchase 9 times more each year for the next 3 ½ years. To illustrate this, create a simple custom metric formula such as:

To get even more granular, include the return vs. new purchaser ratio (for example, if 60% of your clients' sales are from new customers) and the refund rate (such as 12% of orders being canceled or refunded) to create a slightly more complex custom formula.

The end result is a rough estimate of the total lifetime value of customers to help illustrate the current investment in future revenue.

Just like CLV, this simple metric makes your client reports that much more powerful and compelling.

How To Increase CLV

One of the most obvious CLV-related goals is increasing the lifetime value of your customers. But let’s say, for example, you want to increase your CAC target while maintaining the CLV to CAC ratio at 3x. More lifetime revenue automatically shifts that acquisition target higher.

Here are a few ways to increase customer lifetime value, which can apply both to your client campaigns and while you're working on getting more clients for your agency.

Get to know customers: Getting to know the customer base uncovers a goldmine of precious data and information that helps customize your messaging. You should also try to determine where they’re at in the customer lifecycle and make relevant offers to encourage them to stay loyal.

Build trust: This can be as simple as keeping your word or explaining your thought process behind an idea. A relationship is something that builds and grows over time and if you show customers you value them, they’ll likely stick around.

Communication: For agencies, marketing is often a collaborative process that involves a lot of facetime with their clients because many effective marketing campaigns are driven by the expertise or insight of the clients. Make sure to always keep the communication lines open and check in often so your clients know you’re enthusiastic and engaged.

Re-engagement: If your client has a huge mailing list but a terrible open rate, there might be a lot of inactive users who would be perfect for a targeted re-engagement campaign. And if they bite, that will automatically extend their CLV for who knows how long (*checks average customer lifespan).

Summary & Key Takeaways

One of the main benefits of calculating CLV is to keep your cost-per-acquisition ratio low. Having this number in mind will also help you create more efficient campaigns, optimize ad spend, and fine-tune your targeting on paid channels such as Facebook and Google.

Decide which type of CLV model to use (historical or predictive)

Select the best CLV formula

Ensure that customer lifetime is at least 3x as much as the customer acquisition costs (with some rare exceptions)

Keep an open line of communication with consistent reporting and goal-tracking

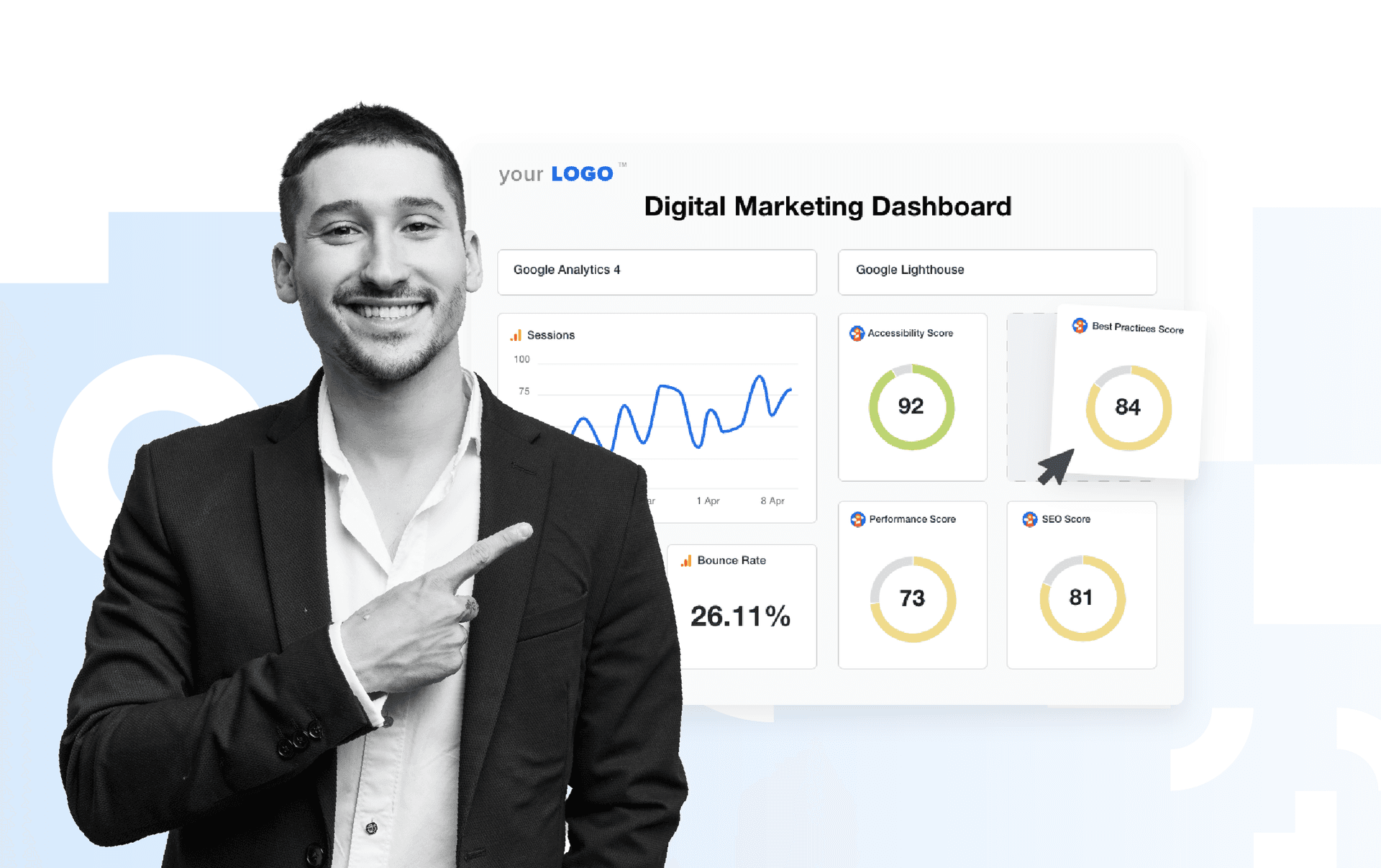

Reporting can be so time-consuming–especially if you’re using manual spreadsheets to do it. Luckily, everything you need to create a report that blows your clients away is only a few clicks away. From simple data storytelling visualizations like bar graphs and pie charts to custom dashboards and fully automated reports, take your client reporting to the next level and reduce marketing costs with AgencyAnalytics.

Put your reporting on autopilot and let the data perfectly illustrate your points so you focus on the data storytelling. Start your free 14-day trial today!

Written by

Michael is a Vancouver-based writer with over a decades’ experience in digital marketing. He specializes in distilling complex topics into relatable and engaging content.

Read more posts by Michael OkadaSee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.