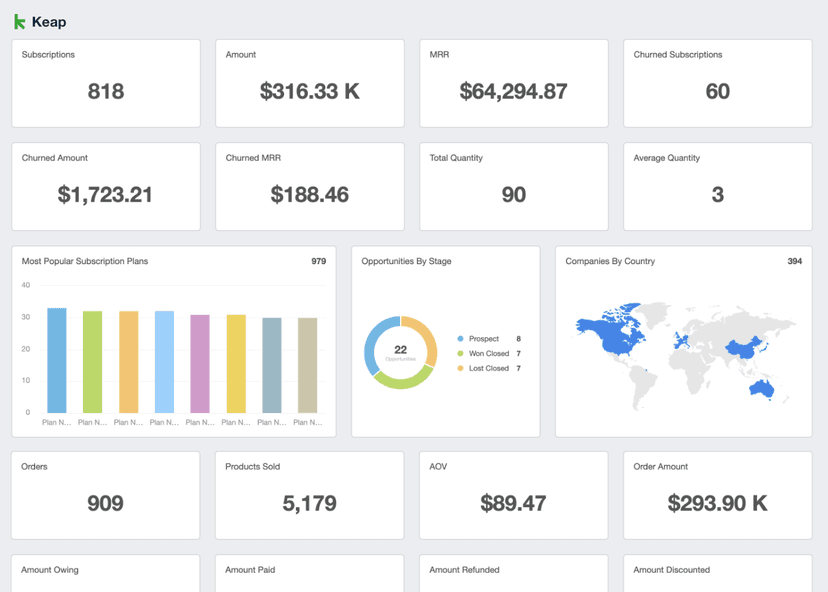

Monthly Recurring Revenue (MRR)

Budget Planning

MRR helps advertisers allocate funds to different marketing channels effectively.

Long-Term Strategies

Steady MRR enables advertisers to focus on marketing efforts with lasting impact.

Client Reports

Highlighting an increase in MRR in client reports directly validates the agency's ROI.

Churn Mitigation

A close watch on MRR helps identify problematic trends early to reduce customer churn.

Why Monthly Recurring Revenue Is Important

Monthly Recurring Revenue stands as a beacon for financial stability. It offers a predictable indication of future revenue, giving organizations the confidence to make strategic decisions, whether scaling operations or investing in new marketing campaigns. The reliability of MRR makes it easier for a subscription business to plan for the future without the uncertainty that comes with one-off sales or unpredictable revenue streams.

MRR isn't just a number; it's a performance indicator. A stable or increasing average monthly revenue signals a business model that resonates with customers. In contrast, a declining MRR prompts a potential need for strategy, campaign, or product reevaluation, serving as an early warning system for potential troubles ahead.

Stop Wasting Time on Reports. Get Marketing Insights Faster & Drive Results.

The Relationship Between Monthly Recurring Revenue and Other KPIs

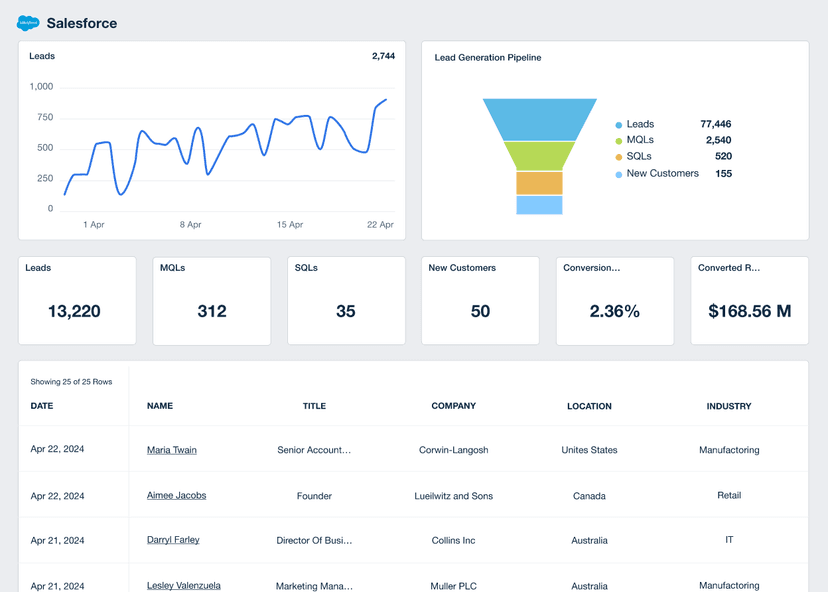

Monthly Recurring Revenue is directly linked to other critical KPIs like Annual Recurring Revenue (ARR), Customer Lifetime Value (CLV), and Customer Acquisition Cost (CAC). A strong MRR usually indicates high CLV from existing customers, affirming that a business's marketing efforts successfully retain customers. However, a declining CLV is often a precursor to a decrease in MRR, signaling the need for campaign adjustments.

High MRR, even if it’s driving revenue growth, loses its luster if it comes with a steep CAC. Maintaining a balanced ratio between MRR and CAC is crucial for bottom-line profitability. These metrics collectively offer a complete overview of campaign performance and guide future marketing investments.

Monthly Recurring Revenue isn’t just a monthly revenue metric; it’s the financial pulse of a business. When MRR stays strong, you’re not just surviving; you’re poised for growth. And in this fast-paced industry, being poised for growth is everything.

How To Calculate MRR

The MRR calculation is straightforward but essential for understanding revenue streams. Calculating MRR considers all recurring revenue generated in a month. When calculating Monthly Recurring Revenue, agencies typically exclude one-time payments, such as setup fees or extra service charges, and focus solely on the income expected from monthly subscriptions.

MRR is the sum of all fees paid every month by subscribers or users of a service. This could include subscription fees, retainer fees, or any other consistent monthly customer payments.

Calculating net MRR for a SaaS business gets more nuanced when factoring in the MRR from the previous month, newly acquired MRR, and churned MRR. Taking this approach when you calculate Monthly Recurring Revenue provides a more dynamic view of how the business performs over time. The goal is to understand the static income and the flux—where the MRR is gaining and losing.

MRR Formula Example

What Is a Good MRR?

A good average MRR indicates financial health and growth potential for a business. Numbers that consistently rise month-over-month generally reflect robust customer acquisition and retention. A growing MRR often means that marketing campaigns are hitting the mark and the business model is sustainable.

What Is a Bad MRR?

A declining MRR, especially for consecutive months, raises a red flag. It usually indicates customer retention or attraction issues, demanding immediate action to evaluate and revise marketing strategies to reverse the trend.

Digging Deeper into MRR

Break down MRR into subcategories such as New MRR, expansion MRR, contraction MRR, reactivation MRR, and churned MRR for a more granular view.

New MRR tracks acquisition revenue, expansion MRR measures upsells, or upgrades, contraction MRR shows the revenue lost from downgrades, reactivation MRR captures reactivated customers, and churn MRR identifies revenue lost when customers cancel.

Analyzing these subsets provides a more nuanced understanding of where revenue is coming from or slipping away.

Why Monthly Recurring Revenue Matters to Clients

For clients, Monthly Recurring Revenue serves as a guide through the world of business finance. It offers a snapshot of the regular, dependable income a company should expect, facilitating better budgeting and financial planning. In addition, a solid MRR figure also gives clients a strong position when seeking investments or negotiating with stakeholders. After all, who doesn't love reliable cash flow?

MRR growth also correlates with customer satisfaction. For clients, this shows that the products or services being marketed have a loyal following, which is a persuasive asset in both short-term sales and long-term brand value.

Why Monthly Recurring Revenue Matters to Agencies

When it comes to managing client campaigns, Monthly Recurring Revenue serves as a potent measure of success. Agencies rely on it to gauge the effectiveness of their marketing strategies in real time. A steady or rising MRR usually signals that customer acquisition and retention campaigns are paying off, justifying the allocated resources and budget.

But it doesn't stop at validation. Tracking MRR changes over time offers actionable insights for refining and optimizing ongoing and future campaigns. For instance, a dip in MRR might indicate that it's time to revisit customer retention strategies or reassess the product-market fit. MRR becomes a dynamic tool for agencies to continually improve and adapt their client campaigns, ensuring a strong return on investment.

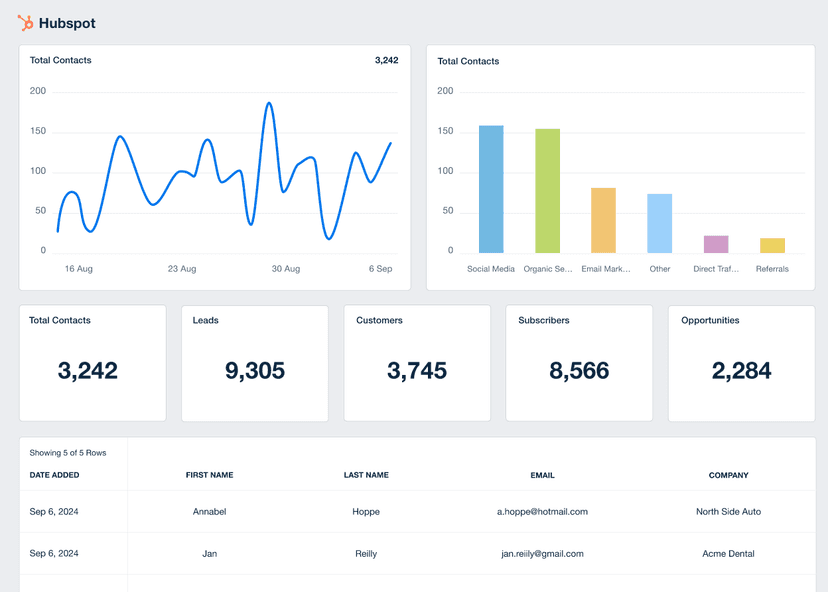

Discover the Client Reporting Platform Trusted by Over {{customer-count}} Marketing Agencies

Best Practices for Analyzing and Reporting on MRR

A deep dive into MRR analysis provides more than just numbers; it provides actionable insights that fine-tune sales and advertising strategies.

Assess MRR Over Time

Measuring MRR over specific time frames—monthly, quarterly, or yearly—helps spot trends for long-term decision-making. This level of granularity enables subscription businesses to pivot their strategies and ensure that they aren't just reacting to market conditions but steering through them.

Measure MRR by Channel & Campaign

Evaluating MRR per marketing channel or campaign identifies the most lucrative sources of revenue. Shift resources to focus on high-performing channels for increased ROI. Whether it's paid search, email marketing, or social media, focusing on the right avenues significantly influences total MRR and generates additional MRR.

Monitor MRR Anomalies and Trends

Fluctuations in MRR aren't always bad, but they demand attention. When recurring payments see an unexpected spike or dip, it's a prompt to revisit current strategies, ensuring that an agency is always one step ahead in maintaining or boosting revenue streams. React to these shifts with targeted strategies to maintain or improve revenue.

Place MRR in Context

When presenting MRR to clients, compare it with key metrics like Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV). This gives a fuller picture of the marketing campaigns' overall financial health and effectiveness. Clients want to know how much revenue the agency generated–and how much it costs to generate it–seeing the sustainability of the campaigns in the long term.

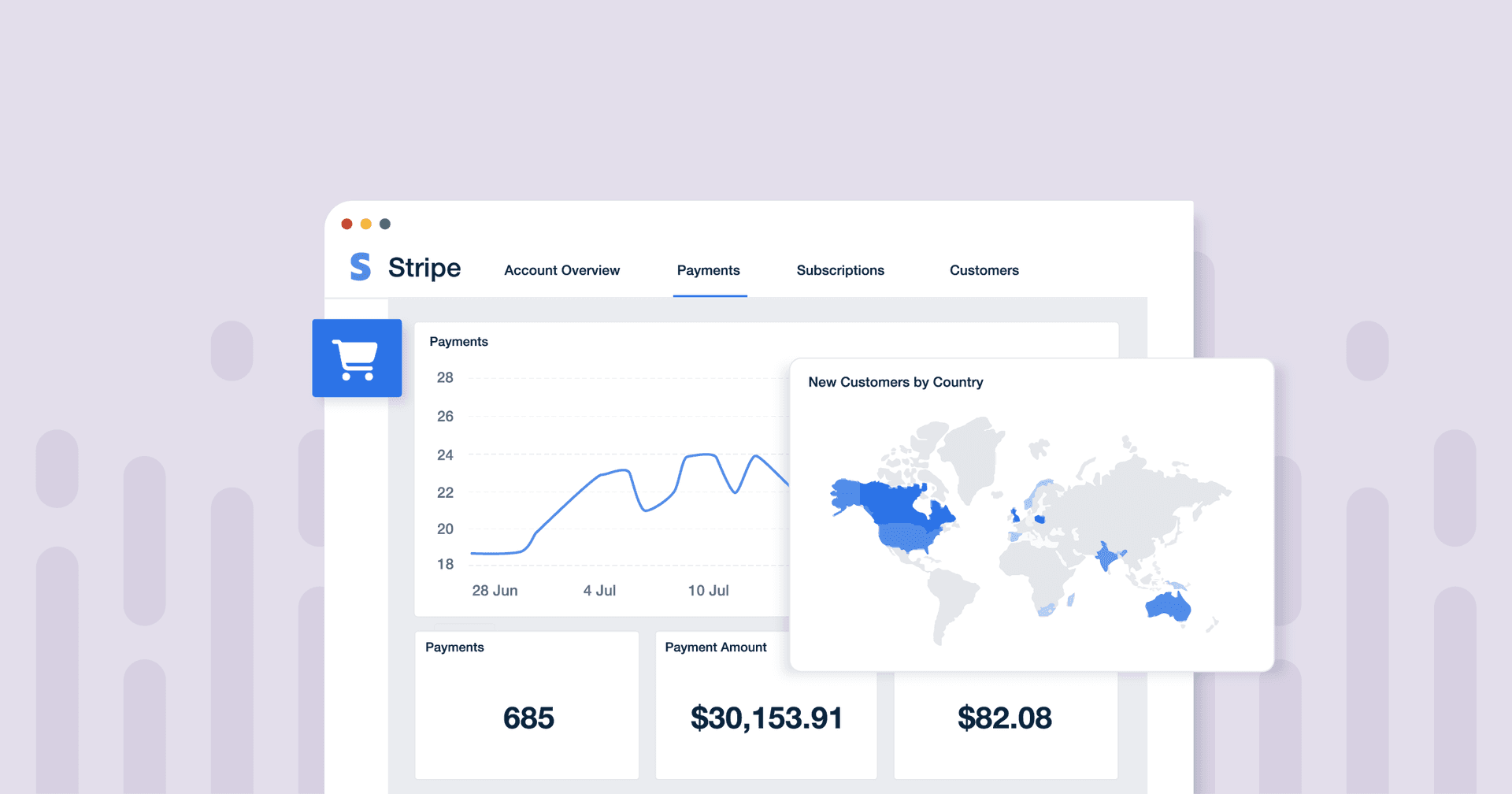

Visualize MRR Performance

A picture paints a thousand words, and this holds true for MRR. Graphs and charts give clients an immediate grasp of trends and anomalies. Tools like time-series graphs show seasonality impacts, growth trajectories, or sudden shifts in revenue. Visual elements make the data easily digestible, so clients don't have to dig through spreadsheets to understand their financial standing.

Align MRR to Client Goals

Every client has unique goals, be it growth, market penetration, or customer retention. If a client aims for fast growth, a steadily increasing MRR would signal that the current marketing strategies are effective. Tying MRR back to specific client goals transforms it from a generic financial metric into a strategic asset for decision-making.

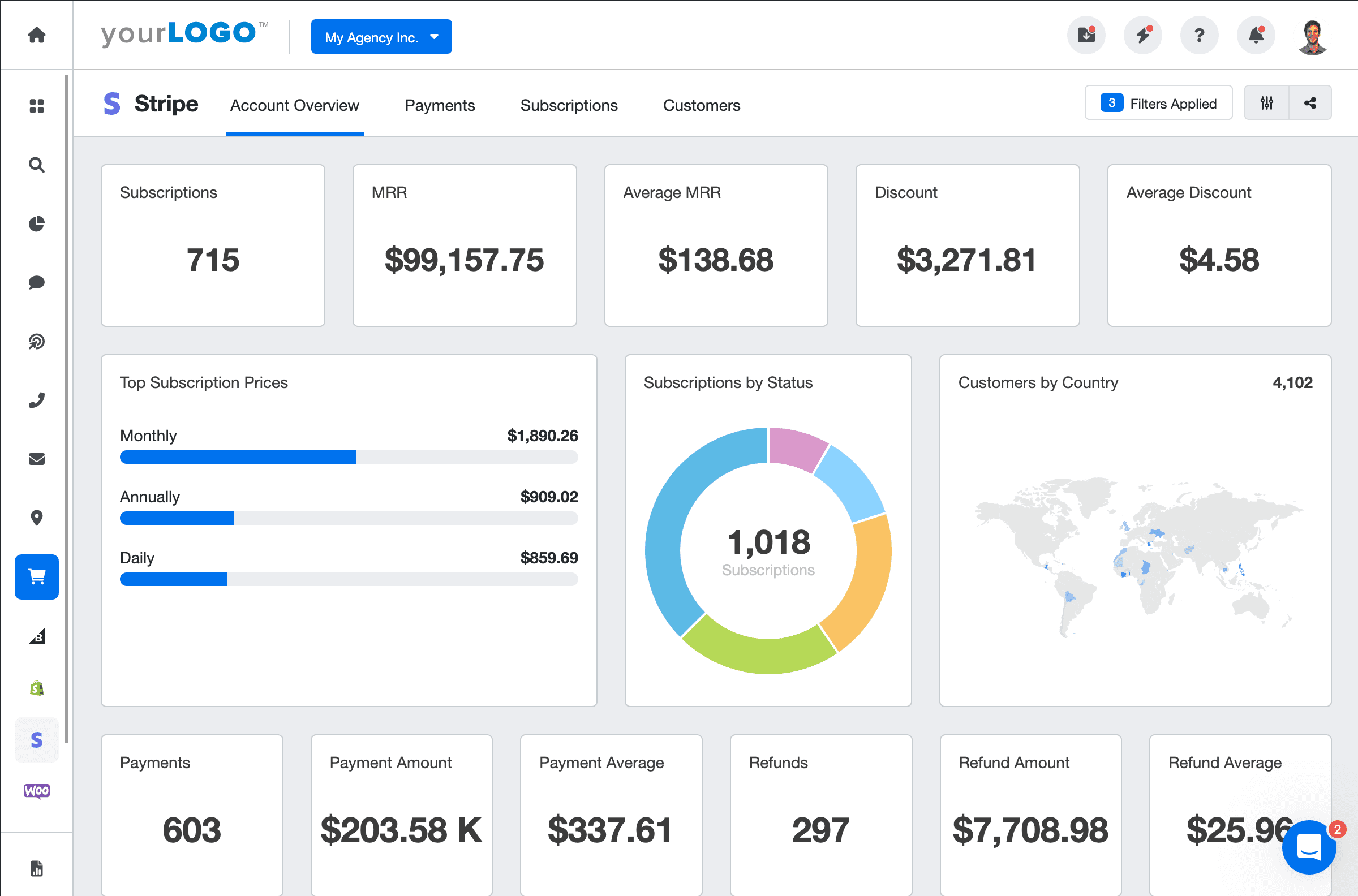

Stripe Dashboard Example

Related Integrations

How To Improve Monthly Recurring Revenue

Improving Monthly Recurring Revenue (MRR) is crucial for sustaining business growth. Here are five tips to send that MRR graph upwards.

Reduce Churn

One of the fastest ways to improve MRR is by reducing customer churn. Make a point to actively engage with customers and address their pain points before they decide to leave.

Upsell Effectively

Increasing the value of current subscriptions has a substantial impact. Identify the top users of the service and offer them additional features at a premium.

Boost Acquisition

Invest in targeted marketing campaigns to bring in new customers. As subscribers grow, so too will Monthly Recurring Revenue.

Related Blog Posts

See how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.