Table of Contents

Table of Contents

- What are customer retention metrics?

- Why client & customer retention is key to business growth

- The 15 key customer retention metrics you need to know in 2025

- Pitfalls to avoid when measuring client retention KPIs

- How to improve customer retention with reporting data: 4 quick tips

- Summary and key takeaways

7,000+ agencies have ditched manual reports. You can too.

Free 14-Day TrialQUICK SUMMARY:

Customer retention KPIs measure how effectively businesses keep customers engaged, loyal, and profitable over time. They highlight the business's overall health, long-term stability, and growth potential. For agencies, tracking both client and customer retention metrics is essential for driving recurring revenue. This article covers key retention KPIs to track, along with common mistakes to avoid and practical tips for leveraging reporting data.

Nothing feels quite as rewarding as seeing your clients win. It’s like a pat on the back when you hear, “Our customers are staying longer, thanks to the work you’re doing.”

The truth is, customer retention doesn’t happen by accident. It’s the result of delivering consistent results, building strong relationships, and continually proving your agency’s value. Yet measuring retention often seems arbitrary. And at times, it feels like another task piled onto running campaigns, meeting deadlines, and managing client expectations.

Ignoring it, though, is a costly mistake. Retention KPIs reveal whether customers are engaged, loyal, and profitable over the long term. They also highlight issues that campaign metrics alone can’t catch, such as rising churn rates or a decline in repeat purchases. It also applies on the agency end, too. When clients stay longer, it leads to more predictable revenue, stronger relationships, and better results over time.

Not sure how to get started? This guide breaks down the retention KPIs that matter most, common pitfalls to avoid, and how to use reporting data to demonstrate long-term value. We’ll also hear real-life perspectives and advice from agency leaders on the ground.

What are customer retention metrics?

Customer retention metrics measure how effectively clients keep their customers engaged and loyal over time. These indicators shift the focus from acquisition to the overall health and sustainability of the business.

Here are a few key things they capture:

Customer loyalty: How often customers return to make repeat purchases or continue using a client’s services.

Growth potential: Whether customers are spending more over time, signaling strong trust and satisfaction.

Business stability: The degree to which recurring revenue is protected, which reduces reliance on constant new sales.

Customer experience quality: Feedback on whether customers feel valued, supported, and satisfied with the client’s brand.

By tracking these metrics, you’ll help clients strengthen customer relationships and create a more predictable path to long-term profitability.

Why client & customer retention is key to business growth

It’s always fun to acquire a new customer–or 1,000 of them–for a client. And showcasing those wins in monthly reports is one of the most rewarding parts of agency life. But the truth is, long-term success isn’t built on acquisition alone. The strongest businesses strike a balance between bringing in new customers and retaining the ones they already have.

To put this in context, think about the importance of client retention strategies at your own agency. For example, if a client pays you an average of $1,000 a month, extending the length of that relationship immediately increases the overall lifetime value. The longer a client stays, the more they rely on your agency… and the better positioned they are to achieve long-term growth. It’s a win-win on both sides.

Retaining existing customers is often less expensive than acquiring new ones. By focusing on personalized communication, upselling, and cross-selling, we have been able to increase the lifetime value of each customer and reduce our overall client acquisition cost.

Adam Binder, Founder & CEO, Creative Click Media

In short, retention makes everything else more valuable. The happier a client’s customers are, the longer they stick around, and the stronger the client’s bottom line results will be. To break this down even more, here’s how the value of new customers compares to returning ones.

New customers

Bringing in new customers drives immediate growth and creates fresh opportunities for your client’s business. Here are a few detailed benefits to consider.

Benefit | Description |

|---|---|

Revenue and growth | They add new revenue streams and expand the customer base, which is vital for any growing business. New customers also provide valuable market insights and open the door to diversifying products or services. |

Brand awareness | Every newly onboarded customer is a potential brand ambassador who may share their positive experiences. This will boost awareness well beyond the client’s existing customer base. |

Competitive advantage | New clients often come directly from competitors, which increases market share and strengthens your client’s position in the market. |

Marketing validation | A steady influx of new customers demonstrates the effectiveness of your marketing strategies and campaigns. |

Recurring customers

While new customers fuel growth, recurring customers are the foundation of long-term success–let’s explore further.

Benefit | Description |

|---|---|

Higher profitability | Research suggests that improving customer retention by just 5% can increase profits by 25% to 95%. Since there's established trust, recurring clients may also be more comfortable spending more. |

Lower costs | Investing in customer retention may significantly lower marketing costs. New customer acquisition often requires paid advertising, outreach efforts, and dedicated resource allocation. |

Loyalty and advocacy | Loyal customers are more likely to stick with your client’s brand and become advocates (once they’re happy with the results). This may lead to new business referrals and favorable online reviews. |

Revenue stability | Recurring clients provide a predictable, steady revenue stream, which makes forecasting and budgeting far more reliable. |

Both new and recurring customers bring unique value. Growth comes from balancing acquisition with retention, ensuring you’re focused on the present while maximizing long-term returns.

Show clients results and keep them coming back for more. Use AgencyAnalytics to automate data retrieval, present easy-to-understand visualizations, and more; try it free for 14 days.

The 15 key customer retention metrics you need to know in 2025

The right metrics provide a clear view of customer loyalty, satisfaction, and long-term value—here are the top ones to know about.

1. Customer retention rate (CRR)

Customer retention rate measures the percentage of customers a business continues to serve over a set period of time. A high number reflects strong loyalty, satisfaction, and consistent value delivery, making it a core indicator of long-term business health. As a quick reference, here’s how to calculate customer retention rate:

CRR = ((Customers at end − New customers acquired) ÷ Customers at start) × 100

How to improve this KPI: To increase customer retention rate, personalize communication and ensure it’s tailored to specific interests (e.g., use segmented email lists). Also, ensure your client’s customer success team consistently follows up after an initial purchase or relevant action. That way, customers feel supported beyond the sale, and long-term loyalty becomes easier to sustain.

2. Purchase frequency (PF)

Purchase frequency goes a step further and looks at how often a customer makes a purchase within a given time period. A higher purchase frequency typically indicates higher satisfaction and loyalty.

PF = Total number of purchases ÷ Number of unique customers

How to improve this KPI: Use targeted promotions, email or SMS reminders, and loyalty programs to encourage repeat purchases.

3. Customer churn rate

Customer churn rate is the other side of the CRR coin–it measures the percentage of customers who stop doing business with your client during a given period. A high churn rate signals problems with product quality, service delivery, or the customer experience.

Customer churn rate = (Customers lost during period ÷ Customers at start) × 100

How to improve this KPI: Collect exit feedback, resolve pain points quickly, and implement proactive retention strategies. Smaller companies can often manage this through one-on-one outreach, while larger businesses should rely on surveys or automated feedback loops to capture insights at scale.

We schedule regular touchpoints with current customers to ensure that we’re meeting expectations, and we identify other ways to support business growth. As stewards of their marketing budgets, we prioritize communication, attentiveness, and results to maintain a healthy partnership.

Jason Willis, Creative Director, Social Firm

4. Customer Lifetime Value (CLV)

CLV reflects the total revenue a client can reasonably expect from a single account. It considers the customer's revenue value and compares it to the company's predicted average customer lifespan. This metric is typically used to identify the most valuable and lucrative customer segments. It’s calculated using the formula below:

CLV = Average purchase value × Purchase frequency × Average customer lifespan

How to improve this KPI: Focus on upselling, cross-selling, and delivering consistent long-term value so customers increase spending over time.

5. Average repeat order value (AROV)

This metric tracks the average dollar amount spent each time an existing customer places a new order. It provides a better understanding of how much revenue repeat customers generate per transaction.

AROV = Total revenue from repeat customers ÷ Number of repeat orders

How to improve this KPI: Bundle products, recommend upgrades at checkout, and personalize offers to increase the average spend per repeat purchase.

6. Average revenue per user (ARPU)

ARPU measures how much revenue each customer generates over a specific period. Unlike average order value (AOV), which looks at individual purchases, ARPU reflects the total spending of an average customer across all transactions. This provides a clearer picture of overall customer value.

ARPU = Total revenue ÷ Total number of customers

How to improve this KPI: Introduce tiered pricing, premium service options, or value-added features that encourage customers to increase their overall spend.

7. Customer satisfaction score (CSAT)

CSAT gauges how satisfied customers are with a product or service. Short surveys typically ask customers to rate their experience on a scale of 1 to 5, offering direct feedback on performance.

CSAT = (Number of positive survey responses ÷ Total survey responses) × 100

How to improve this KPI: Act quickly on customer feedback, improve support responsiveness, and consistently exceed expectations in service or product delivery.

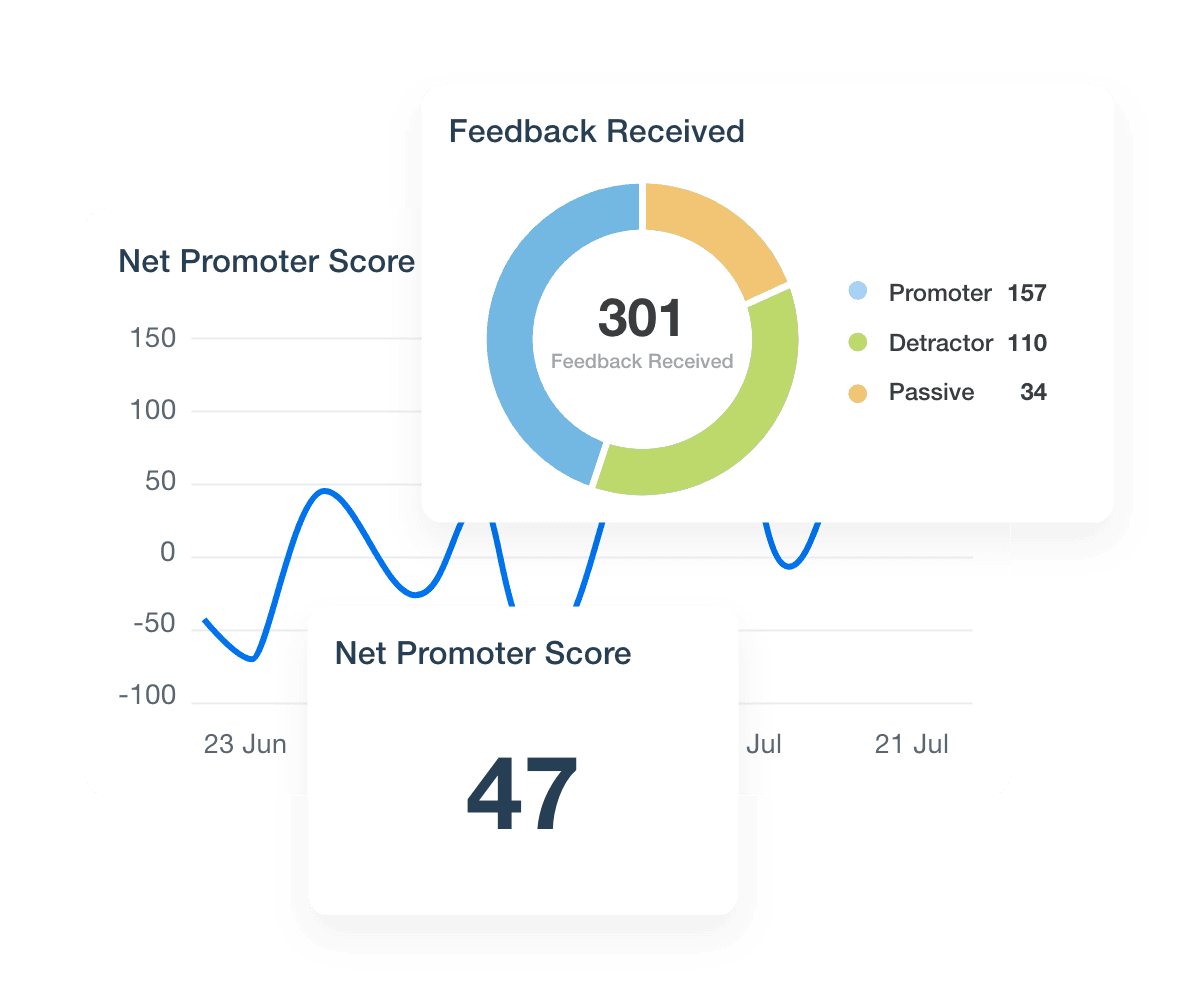

8. Net promoter score (NPS)

Similar to a CSAT score, NPS measures customer loyalty by asking one straightforward question: "On a scale of 0-10, how likely are you to recommend our company to a friend or colleague?" The responses help businesses identify promoters (score 9-10), passives (score 7-8), and detractors (score 0-6). Here’s how to calculate net promoter score:

NPS = % of Promoters − % of Detractors

How to improve this KPI: Engage detractors to resolve frustrations, nurture passives with added value, and turn promoters into advocates through exclusive perks.

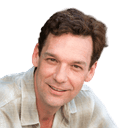

Help clients maintain a healthy loyal customer rate. Measure customer retention insights, monitor feedback received, and visualize NPS data–try AgencyAnalytics, free for 14 days.

9. Repeat purchase rate (RPR)

Repeat purchase rate measures the percentage of customers who return to buy again within a defined period. A higher RPR reflects strong loyalty and effective customer experience strategies.

RPR = (Number of customers with more than one purchase ÷ Total customers) × 100

How to improve this KPI: Strengthen retention campaigns with loyalty rewards, personalized offers, and re-engagement emails.

10. Time between purchases

The time between purchases calculates the average number of days between one transaction and the next. Shorter cycles indicate stronger engagement and customer satisfaction. On the other hand, longer gaps reflect declining interest or missed re-engagement opportunities.

How to improve this KPI: Use well-timed remarketing campaigns, nurture sequences, and seasonal promotions to keep customers interested.

Customer retention KPIs for marketing agencies

Supporting client growth is only half the equation—your agency also needs to measure the strength of its own relationships.

The KPIs below show how effectively you’re building loyalty and long-term partnerships.

11. Average client lifespan

This metric measures how long clients typically stay with your agency. A longer lifespan reflects stronger loyalty and consistent satisfaction with your services.

Average client lifespan = Total months (or years) all clients stayed ÷ Number of clients

How to improve this KPI: Provide proactive strategy reviews, regular performance updates, and personalized account management. It’s also a good idea to reward loyal clients and show your appreciation.

Our most successful customer retention strategy has always been to remain on the hunt for ways to provide additional value. If we've signed a client for a year-long SEO strategy, we aim to go above and beyond at that year mark, perhaps with a free long-form piece of content, a personal introduction to those in related industries, a media buy on the house, or a recommendation to try a few new channels that weren't used in the past. Our goal is to become absolutely invaluable to the client.

Marissa Ryan, Co-Founder, VisualFizz

12. Client communication response time

This metric tracks how quickly your agency replies to client messages or inquiries. Faster responses typically build stronger relationships and higher levels of trust. Measuring this number is tricky (since your team often has other priorities). However, even a rough benchmark helps identify whether clients are waiting too long and where workflows could be improved.

Client communication response time = Total response time to client messages ÷ Number of client messages

How to improve this KPI: Set clear response-time expectations, use automation for quick acknowledgments, and assign account managers to each client account.

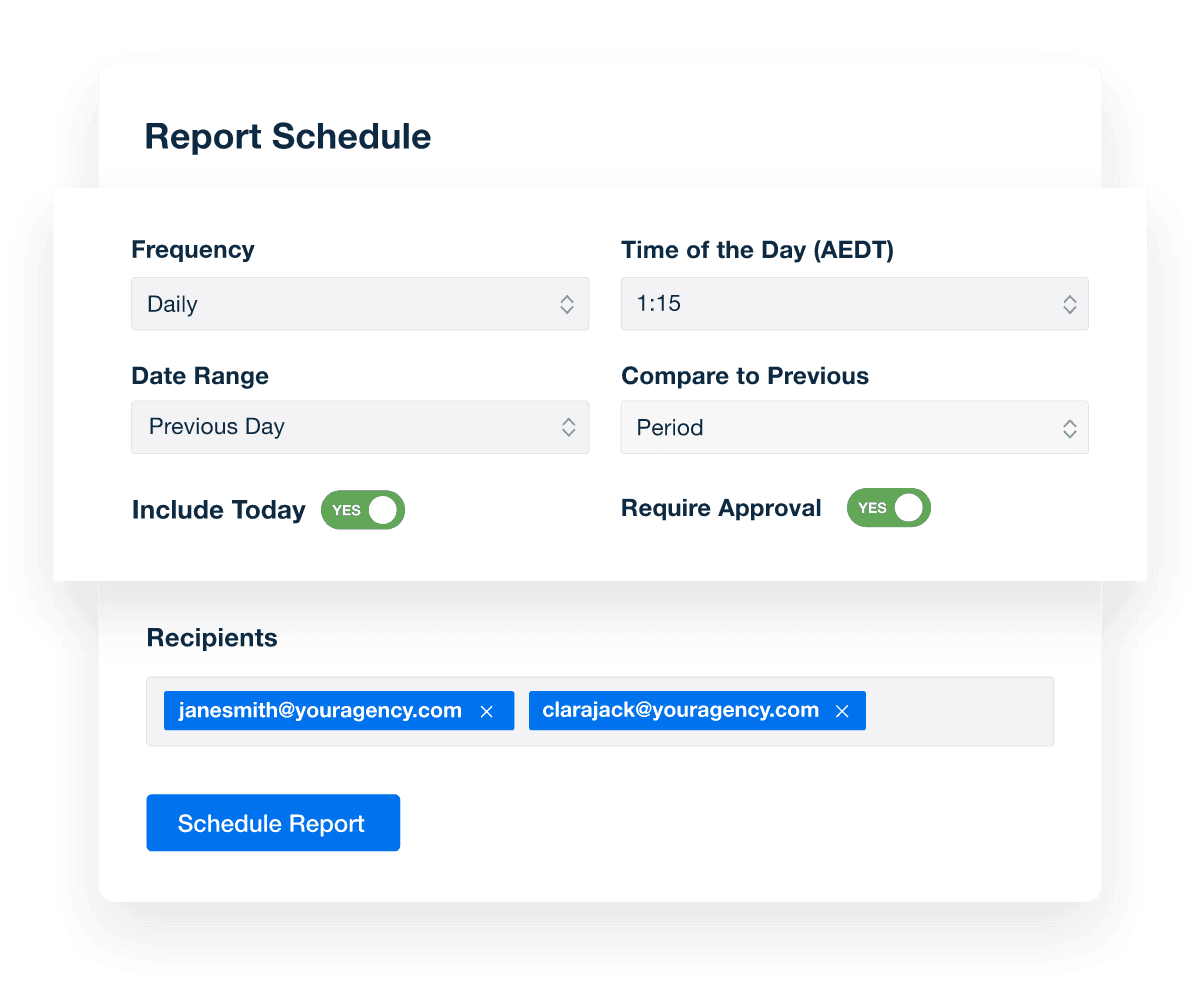

Never worry about whether you’ve sent a client report. Use the scheduling feature to cut down administrative work and improve workflows–try it in AgencyAnalytics, free for 14 days.

13. Marketing report open rate

This metric shows the percentage of clients who open and engage with the reports your agency sends. Higher open rates suggest that clients value your insights and remain invested in your work.

Marketing report open rate = (Number of reports opened ÷ Total reports sent) × 100

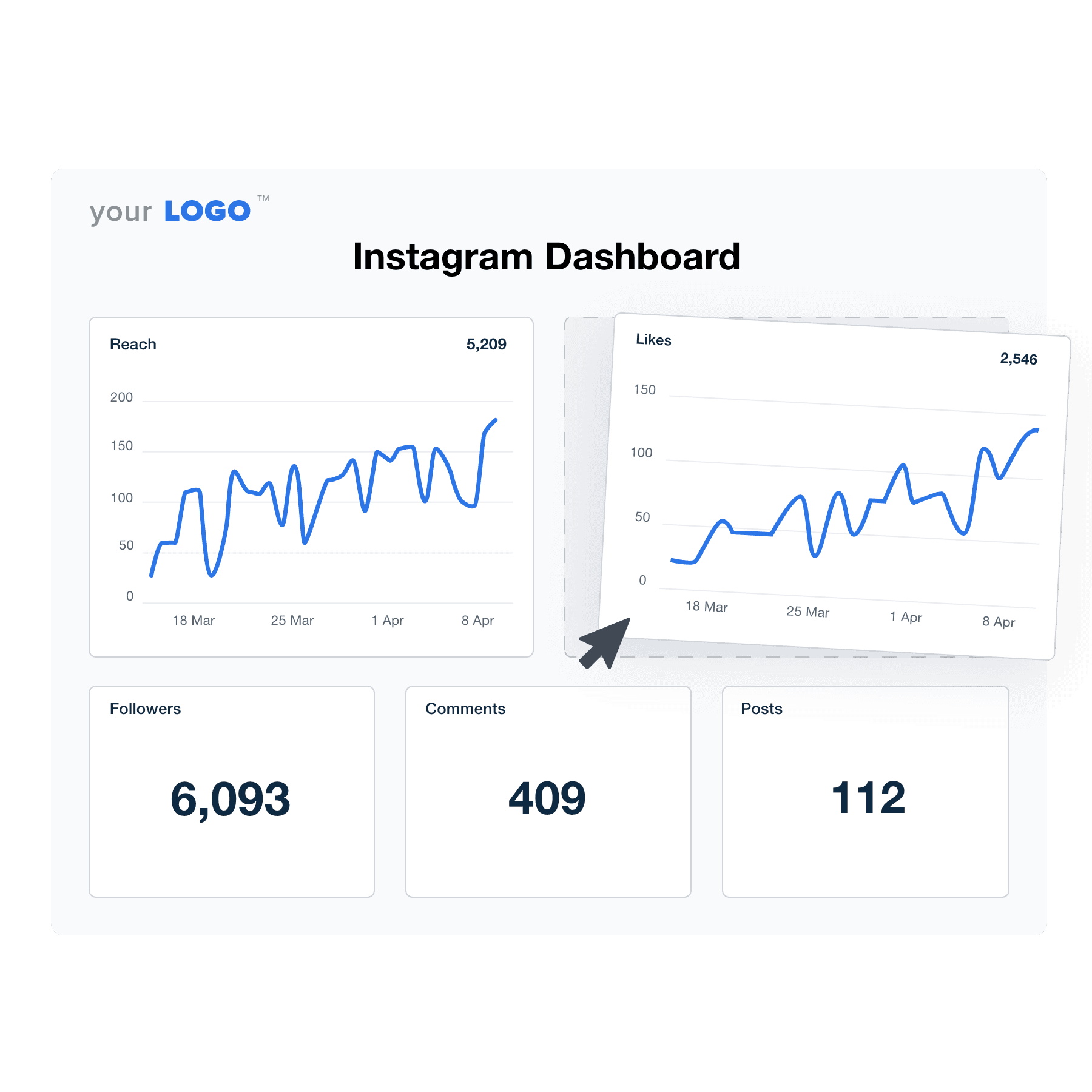

How to improve this KPI: Simplify reports with visuals, highlight the most important metrics upfront, and add a touch of personalization. For faster results, use a tool with a built-in AI feature to generate a quick executive summary and actionable takeaways.

14. Project completion rate

Project completion rate evaluates the number of projects delivered on time and within budget. A consistently high rate reflects operational efficiency and accountability to clients.

Project completion rate = (Projects completed on time ÷ Total projects) × 100

How to improve this KPI: Strengthen project management processes, set realistic deadlines, and use clear communication to manage expectations.

15. Cross-selling and upselling rates

This metric shows how effectively your agency expands existing accounts by offering complementary or higher-tier services. Strong rates indicate satisfied clients who trust your expertise and see your agency as a long-term growth partner.

Cross-selling/ Upselling rate = (Number of clients who purchased additional services ÷ Total clients) × 100

How to improve this KPI: Recommend add-ons that solve real challenges, positioning those upgrades as natural steps toward growth. That said, it’s important to always act in the best interest of the client.

Only upsell services that are absolutely necessary for your clients to meet or exceed their goals. If you don't, then you will erode that relationship over time. Don't sell them fluff because they'll buy it, and neither of you will be better for it.

Jeremy LaDuke, Founder, Epic Nine

Pitfalls to avoid when measuring client retention KPIs

Measuring client retention KPIs offers valuable insights, but it’s easy to fall into traps that distort data or lead to inaccurate conclusions. Here are some common mishaps to avoid.

Mistake #1: Ignoring client feedback

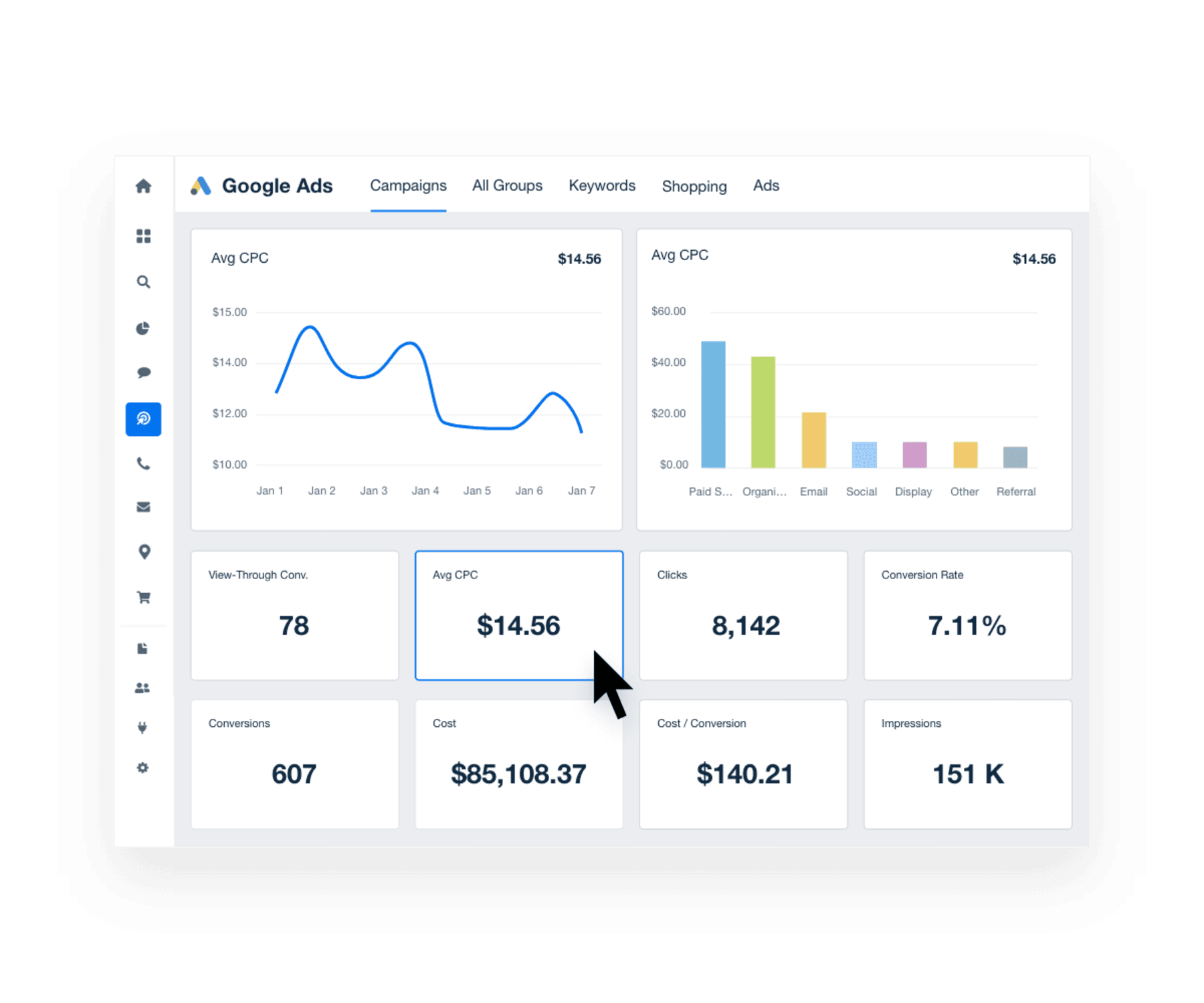

It’s easy to let numbers dominate the conversation, but relying solely on KPIs may lead to missing what a client is actually saying or experiencing. For example, a PPC dashboard might highlight strong ad performance. However, the client may be noticing an influx of unqualified leads. Without acting on that context, you’ll end up optimizing for the wrong outcomes, or worse… damaging the client’s trust in your agency.

A better approach is pairing hard data with regular check-ins. When clients raise concerns, adjust their strategy or refine KPIs as needed. Maintaining an open feedback loop improves outcomes and shows that you’re actively listening.

Mistake #2: Relying on a single data point

While certain retention KPIs may seem important on their own, relying too heavily on one metric creates a distorted picture. For example, a high customer retention rate might look impressive. However, if it’s paired with a low customer lifetime value, it suggests customers aren’t spending enough to drive real growth.

Instead, explain the relationship between retention metrics and why they matter. That may look like connecting purchase frequency with AOV to show revenue impact. It may also mean comparing a monthly customer churn rate with NPS to understand what’s driving customer exits. By adopting this approach, you’ll give clients a more accurate picture of performance and how retention efforts translate into real results.

Mistake #3: Overcomplicating KPIs

It’s tempting to track every retention metric available, but measuring too many at once could overwhelm your client.

A more effective approach is to focus on a few KPIs that directly reflect long-term retention (like the ones we’ve identified). That way, you’ll share meaningful insights that connect to customer behavior, not irrelevant or vanity metrics.

Focus on the "So what?" factor. Make every data point meaningful by explaining its impact on the client's goals. Clients don't just want numbers; they want to know how those numbers affect their success. Show them the value, and your reports will be both powerful and engaging!

Michelle van Blerck, Communications Manager, Digital Freak

Mistake #4: Neglecting industry standards

It’s important to understand how client performance compares to others in their industry. Without that context, retention KPIs could appear strong in isolation but fall short of what competitors are achieving.

Providing this valuable macro context also shows clients whether they’re ahead of the curve, keeping pace, or at risk of falling behind. It also helps your agency to highlight opportunities for improvement and set realistic goals.

Mistake #5: Not reviewing KPIs regularly

Markets shift, client needs evolve, and agency priorities change—retention KPIs should evolve alongside them. When metrics are left unchecked, you may end up tracking outdated numbers that don’t drive meaningful actions.

For example, think of an ecommerce client that transitioned from one-time sales to a subscription model. In this scenario, they may find metrics like repeat purchase rate less useful than churn or net revenue retention. Consistently reviewing KPIs ensures they stay relevant and reflective of the client’s current goals.

Mistake #6: Overlooking the importance of data accuracy

KPIs only work if the data behind them is accurate. Errors in reporting—like double-counting customers, missing cancellations, or mislabeling revenue—could lead to poor decisions and undermine client confidence.

The fix is straightforward: Use a reporting tool that automates data collection, standardizes metrics, and cuts down manual work. With accurate data, it’s much easier to identify trends, catch issues early, and make confident decisions that improve retention.

We love everything about AgencyAnalytics, from fast and efficient dashboard/report creation to data accuracy and collaboration—our agency has seen a bunch of benefits from working with that solution compared with our old setup, and we would not go back.

How to improve customer retention with reporting data: 4 quick tips

Retention doesn’t happen by accident—it’s built on trust, transparency, and proof of value over time. Reporting data is one of the most powerful tools agencies have to demonstrate results, uncover opportunities, and strengthen loyalty. Here are four practical ways to use reporting data and keep clients on board.

1. Highlight ROI clearly

Clients want to know how your work impacts their bottom line (understandably). To make things clearer, share actionable metrics like purchase frequency, CLV, or the existing customer revenue growth rate. When clients consistently see concrete proof of results, it eliminates uncertainty and reinforces your agency’s value.

We prove ROI to existing customers through data in a monthly, quarterly, and annual reporting process. First, we create a set of objectives and corresponding key metrics for each service and then report against those metrics on an ongoing basis. We also require transparency, and we track business goals alongside our key metrics to ensure our efforts are aligned.

Kerrie Luginbill, Chief Strategy Officer, OTM

2. Track metrics in real-time

Real-time tracking gives clients immediate visibility into campaign performance and retention trends. Instead of waiting for end-of-month reports, they’ll see engagement shifts, conversion drops, or an increasing revenue churn rate. It also helps your agency spot potential issues early, allowing you to pivot quickly and prevent small problems from escalating. This level of transparency shows clients you’re actively protecting their results.

Monitor real-time data, track dynamic goal progress, and make timely adjustments when needed. Keep on the pulse of campaign performance–try AgencyAnalytics, free for 14 days.

3. Offer customized reporting

No two clients are the same. An ecommerce brand may care most about reducing its customer acquisition cost, while a SaaS company could be focused on tracking retention metrics.

To account for this variability, customize reports to ensure clients see the metrics that matter most. Whether it’s tailoring dashboards or creating custom metrics, a bit of personalization makes all the difference.

4. Use data to tell a story

Numbers alone rarely inspire action. A report might show a 20% increase in traffic or a drop in churn, but without context, those metrics don’t tell clients what the change means for their business.

For example, instead of simply reporting on an increased repeat purchase ratio, explain how your campaign drove the change and what that means for long-term revenue. This approach helps clients understand the “why” behind the numbers and sets the stage for your recommendations.

Summary and key takeaways

As we’ve covered, customer retention doesn’t happen by chance. It involves fostering trust, actively monitoring performance, and making adjustments when needed. And like most things in marketing, it all boils down to tracking the right data.

To sum things up:

Prioritize relevant KPIs: Focus on retention metrics that clearly connect to business outcomes, such as customer churn rate, loyalty customer rate, and monthly recurring revenue.

Review KPIs regularly: Markets, strategies, and client priorities evolve over time. Revisit KPIs to ensure they’re relevant to your client’s current goals.

Use reporting to prove customer success: Show clients exactly how your work impacts revenue, engagement, and loyalty. Use reporting to highlight wins, long-term trends, areas for improvement, and data-driven recommendations.

Tracking customer retention also applies to your agency. After all, long-term partnerships reduce acquisition costs, create stable revenue, and keep your business thriving. AgencyAnalytics makes it easier to prove your value by centralizing client data, visualizing performance, and delivering professional reports that highlight real results.

When clients clearly see the impact of your work, they’ll have every reason to stay for the long haul. Ready to give AgencyAnalytics a try? Sign up for a free 14-day trial today.

Written by

Paul Stainton is a digital marketing leader with extensive experience creating brand value through digital transformation, eCommerce strategies, brand strategy, and go-to-market execution.

Read more posts by Paul StaintonSee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.