Customer Retention Rate (CRR)

Customer Satisfaction

Gauge how effective products or services are at meeting customer needs.

Product or Service Improvements

Leverage customer feedback to continually improve offerings.

Optimize Customer Lifecycle

Create a strategic focus on keeping customers happy over the long run.

Competitive Analysis

Benchmark performance against competitors and identify opportunities for improvement.

Why Customer Retention Rate Is Important

Customer Retention Rate is a key metric that helps fuel a client’s business via sustainable growth and profitability. It’s an important metric that shows how many new customers remain customers over the long term, reflecting how happy they are with a product or service.

Retaining customers is generally more cost-effective than acquiring new customers, which makes Customer Retention Rate particularly important for new or growing companies as it reflects the long-term viability of the business. Customer Retention Rate is an important factor when determining ROI, primarily due to its close relationship with Customer Lifetime Value (CLV). This metric is especially crucial for customer satisfaction in eCommerce, which heavily relies on word-of-mouth and customer reviews.

Stop Wasting Time on Manual Reports... Get Ecommerce Insights Faster With AgencyAnalytics

How Customer Retention Rate Relates To Other KPIs

Customer Retention Rate has a direct impact on other key performance indicators (KPIs) such as Customer Lifetime Value, and Customer Churn Rate. The most closely related KPI to CRR is Customer Churn Rate (also known as Customer Attrition Rate) because Customer Churn Rate is the inverse of CRR (i.e., the higher the Churn Rate, the lower the Customer Retention Rate).

Other KPIs related to Customer Retention Rate include Unsubscribe Rate, Returning Customer Rate, New vs. Returning Users, and Customer Satisfaction (CSAT) Score. The more information the agency has about where customers are dropping off, and how satisfied they are while interacting with a brand, the better equipped they are to create effective marketing strategies that enhance CRR.

Client retention is the single most important goal of our agency. Without client retention, our agency would not be able to grow.

How To Calculate Customer Retention Rate

Calculating Customer Retention Rate is straightforward. Essentially, the agency is calculating the remaining percentage of customers at the end of a given time period.

First, define the time period to calculate CRR (it is typically evaluated annually, quarterly, monthly, or weekly). Then, find the number of customers the client has at the end of that time period (E). Subtract the number of new customers acquired during the time period (N). Next, divide that answer by the number of customers from the start of the time period. Finally, multiply by 100 to get the CRR as a percentage.

Customer Retention Rate Formula Example

What Is a Good Customer Retention Rate?

A good average Customer Retention Rate typically ranges from 70% to 90% for most industries. A higher rate indicates strong customer satisfaction and loyalty, often resulting from effective marketing strategies and high-quality service.

What Is a Bad Customer Retention Rate?

While CRR varies by industry, A Customer Retention Rate below 70% is often viewed as concerning in many sectors. Such a rate suggests potential issues with product or service quality, customer experience, or competitive challenges that might need addressing.

Setting Benchmarks With Historical Data and Revenue Goals

If widely accepted benchmarks aren't available, marketing agencies commonly rely on historical data to set their own. By analyzing past CRR figures and tracking them against revenue achievements, the agency pinpoints desired retention rates to meet revenue targets for its clients. Additionally, by setting a specific revenue goal and understanding the value of retained customers, it's easy to back-calculate the required Customer Retention Rate.

Digging Deeper Into Customer Retention Rate Insights

Analyzing retention based on customer demographics, purchase behaviors, or acquisition channels provides granular insights. For instance, understanding which age groups or regions have the highest retention helps guide targeted marketing efforts. Assessing the retention rate of customers acquired through different marketing channels optimizes channel investments. It's about making the data work harder, revealing actionable insights hiding beneath the surface.

Why Customer Retention Rate Matters to Clients

Customer Retention Rate is a critical metric for clients focused on sustainable revenue growth. A low CRR indicates they are losing customers due to dissatisfaction, and it’s easier and more cost-effective to retain and re-engage existing customers than to acquire new customers. It also impacts Customer Lifetime Value, which is integral to clients’ long-term success because the longer customers stay, the more revenue they generate for the clients’ business.

Why Customer Retention Rate Matters to Agencies

For agencies, Customer Retention Rate is essential to client satisfaction, revenue stability, and even upselling opportunities. A high CRR is a great selling point to other potential clients as well, and satisfied clients often become advocates for the agency through recommendations and word-of-mouth.

A low CRR indicates client dissatisfaction. It implies unhappiness with the agency’s work, a difficult relationship with the account manager, and even outdated or ineffective campaigns. It could also be a sign that the agency is losing or has lost its competitive advantage, or perhaps the agency grew so fast that clients no longer get that personal touch that made them feel valued, and so they left for a competitor.

The Key Drivers of Customer Retention Rate

Maximize the Customer Retention Rate by understanding and addressing customer expectations. A strong customer retention strategy involves continual engagement and value delivery, ensuring repeat customers see the ongoing benefits of staying with a brand.

The customer success team plays a pivotal role in this process, providing support and building trust. Businesses must also proactively analyze customer feedback and adjust their strategies accordingly to retain customers. Emphasizing these areas creates a supportive environment that encourages customer loyalty and positively influences customer retention rates.

Discover the Client Reporting Platform Trusted by Over {{customer-count}} Marketing Agencies

Best Practices When Analyzing and Reporting on Customer Retention Rate

By scrutinizing CRR from various angles, marketers set a foundation for advertising campaigns that resonate. Follow these best practices for a well-rounded and actionable view of Customer Retention Rate.

Customer Retention Rate Over Time

Assessing CRR over time offers valuable insights into whether customer satisfaction is increasing, decreasing, or remaining stable. The goal should be to see CRR rise over time. If it’s not, detecting problems early prevents them from becoming bigger issues later.

Customer Retention Rate Across Channels

Comparing rates across channels like email, social media, or PPC spotlights where engagement thrives. Aligning the retention rate specific to each campaign makes it easier to pinpoint which initiatives resonate most with customers.

Interpreting Trends and Anomalies in CRR

Investigate sudden changes in CRR. A sudden drop could indicate issues with the product or service, or a new competitor. A sudden spike could indicate improvements in customer service or the success of new loyalty programs.

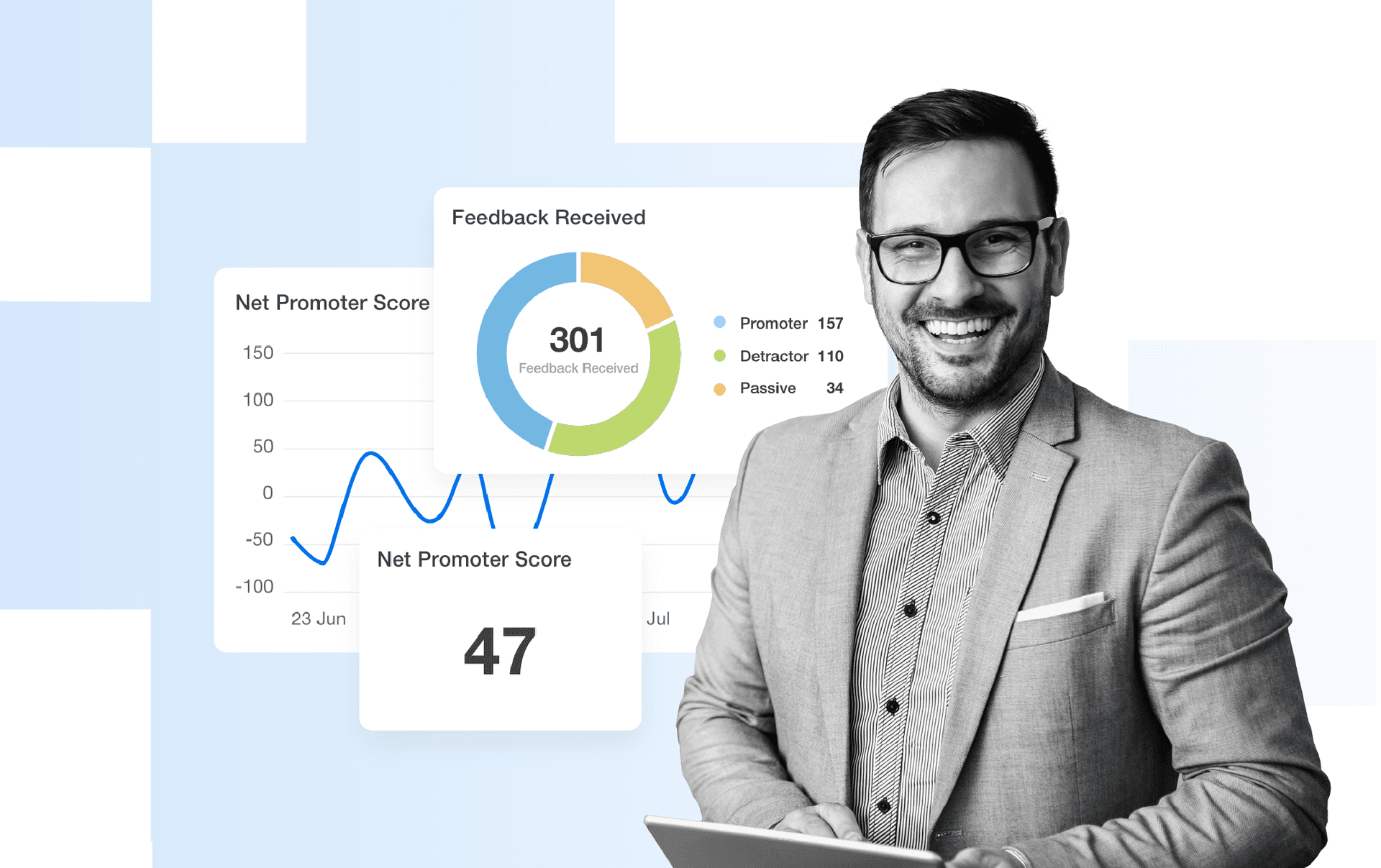

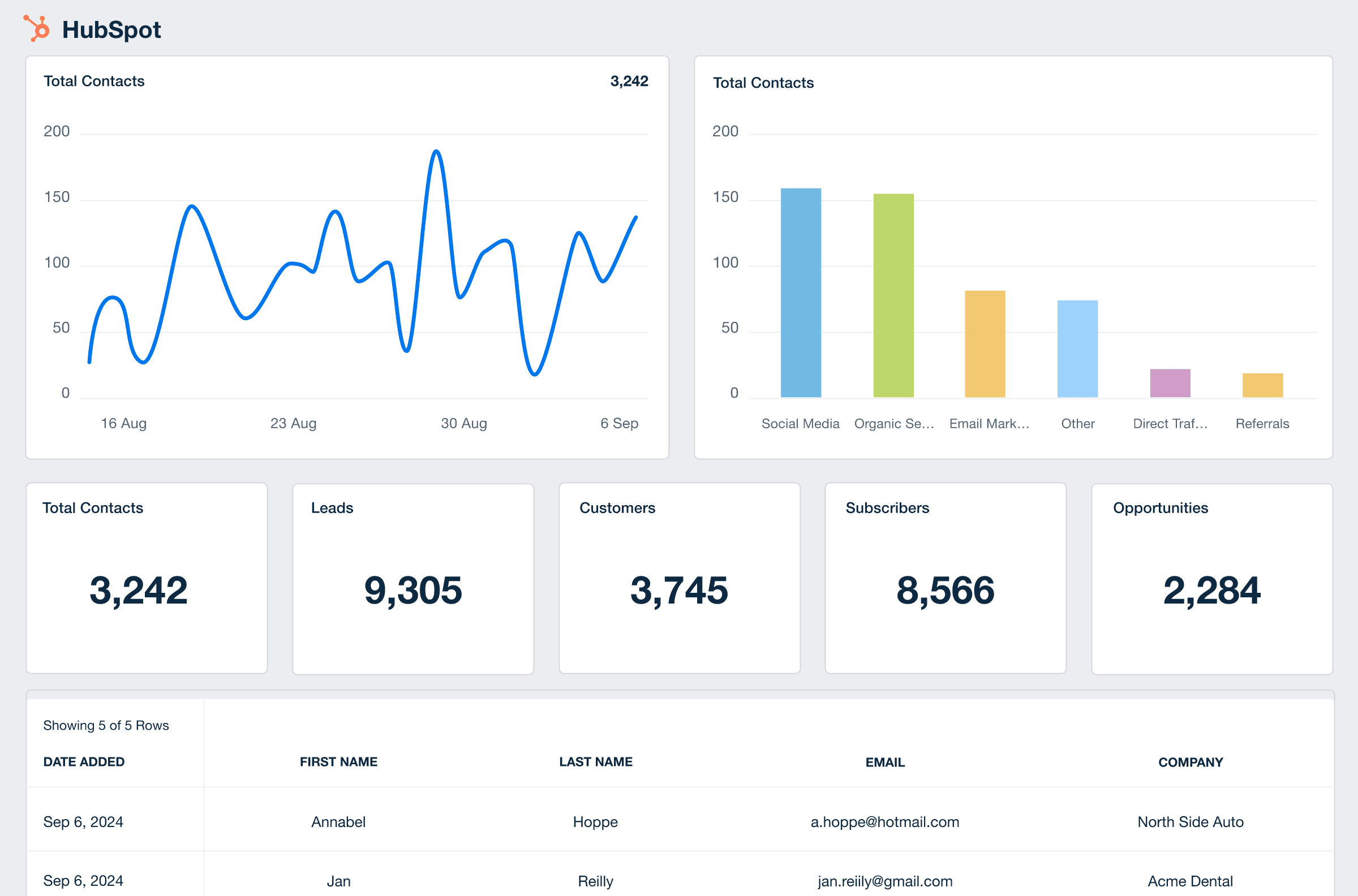

Visualize Performance

Turn those digits into easily digestible visuals. Trends in CRR become more apparent, and it’s easier to quickly grasp how fluctuations in CRR correspond to other metrics or campaign changes.

Place Customer Retention Rate in Context

Numbers in isolation are deceiving. Position the Customer Retention Rate alongside other KPIs to present its true significance and impact on the bigger picture.

Align to Client Goals

Showing how CRR helps clients achieve their goals validates your marketing efforts. Emphasize how CRR is highly cost-effective, as retaining existing customers is generally much cheaper than acquiring new ones.

FAQs about customer retention rate

Still have questions about customer retention rate? Don’t worry—we’ve got you covered.

Customer retention rate is the percentage of customers a business keeps over a given period. It shows how effective a company is at delivering value and building long-term relationships. A high retention rate usually means strong customer loyalty and consistent service.

Agencies improve customer retention by focusing on results that matter to clients—like clear reporting, transparent communication, and consistent performance. Tools like AgencyAnalytics help show impact, which builds trust and encourages long-term relationships.

Retention rate is influenced by service quality, onboarding experience, customer support, pricing, and communication. Agencies tracking performance with consistent, data-backed reports are more likely to maintain client trust and loyalty over time.

Retention fuels growth by reducing churn, stabilizing revenue, and increasing lifetime value. Acquiring new clients is more expensive than keeping current ones. High retention also opens the door to upsells, referrals, and more predictable cash flow.

Customer retention rate measures how many clients stay. Churn rate measures how many leave. They’re inverses of each other, but each tells a different story. Tracking both helps agencies identify risk early and adjust strategy before losing key accounts.

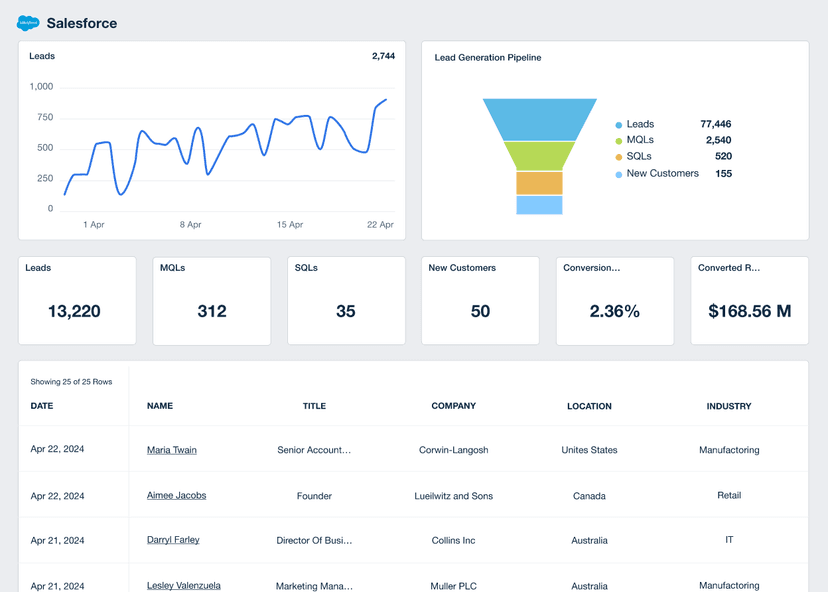

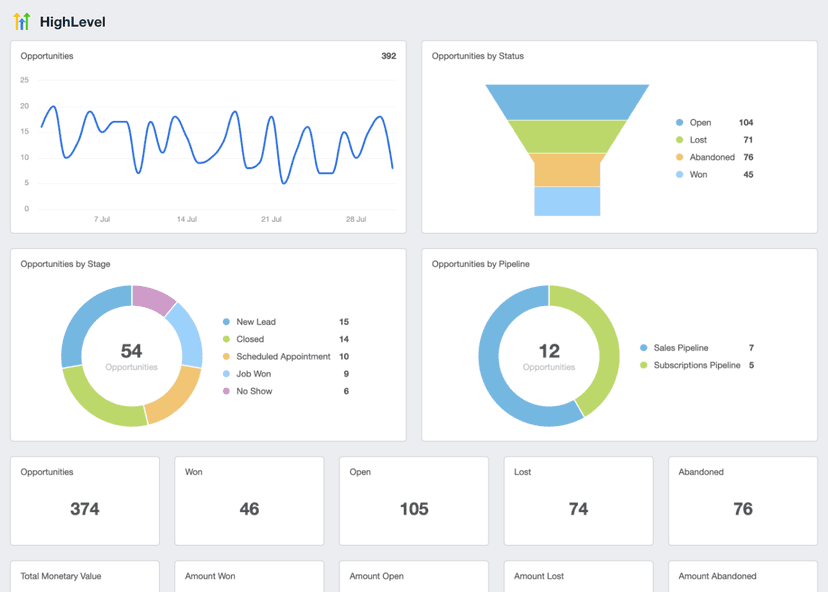

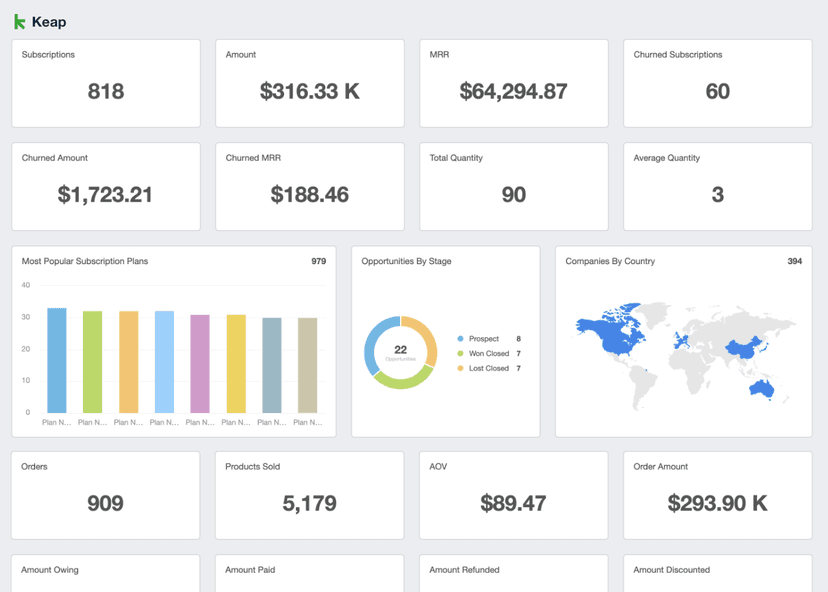

HubSpot Dashboard Example

Related Integrations

How To Improve Customer Retention Rate

Improving CRR leads to happier customers that stick around for longer, leading to positive word-of-mouth and greater CLV. Here are 3 tips for improving CRR.

Outstanding Customer Support

Provide exceptional customer service that ensures customer satisfaction. Listen to feedback and resolve issues quickly in a friendly and knowledgeable way.

Create a Customer Loyalty Program

Reward loyal customers and encourage them to remain customers through a loyalty program that offers incentives or rewards to encourage repeat business.

Get Customer Feedback

Ask customers to fill out surveys and leave online reviews. Listen to what the customers say and use it to make the product, service, and customer support even better.

Related Blog Posts

See how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.