Table of Contents

QUICK SUMMARY:

Financial modeling automation leverages technology to streamline budgeting processes by automating scenario analysis and forecasting. This approach accelerates decision-making, reduces errors, and provides dynamic insights into financial outcomes. In this article, David Appel, Global Head of SaaS for Sage, shares how financial modeling automation helps agencies optimize budgeting, enhance profitability, and make informed decisions that drive growth.

Ever found yourself awake at night, wondering about the financial health of your marketing agency? You're not alone. As an agency owner or head of operations, the nagging questions are all too familiar:

Are we managing our finances effectively?

Where are the bottlenecks in our budgeting processes?

Are we leaving money on the table while trying to scale?

Can our current strategies support our agency's growth?

In marketing, profitability is what keeps your agency running smoothly. It's much more than just the numbers. It's about empowering your team and staying ahead of the curve.

We know the late-night frets and the hurdles you face in managing your agency's money. So, in this guide, we'll break down a possible solution called financial modeling automation — a key part of building an effective marketing agency financial model.

We'll explain how it simplifies budgeting and boosts profits for your agency. From analyzing different scenarios to using real-time data, we'll show you how automation will make your job easier and your agency more successful.

Let’s get started.

What is Financial Modeling Automation?

Before we dive into our actionable tips, let’s first lay out what financial automation is so that we’re all on the same page.

Financial modeling is essentially about creating a detailed summary of a company's financial performance, expenses, and earnings. It's like a blueprint that helps anticipate how certain decisions or events might impact your agency's financial future.

Now, for the important part–automation. Financial modeling automation turbocharges this process with technology. Instead of manually updating spreadsheets and crunching numbers, automation tools do the heavy lifting for you, making the whole process faster, more accurate, and much less of a headache.

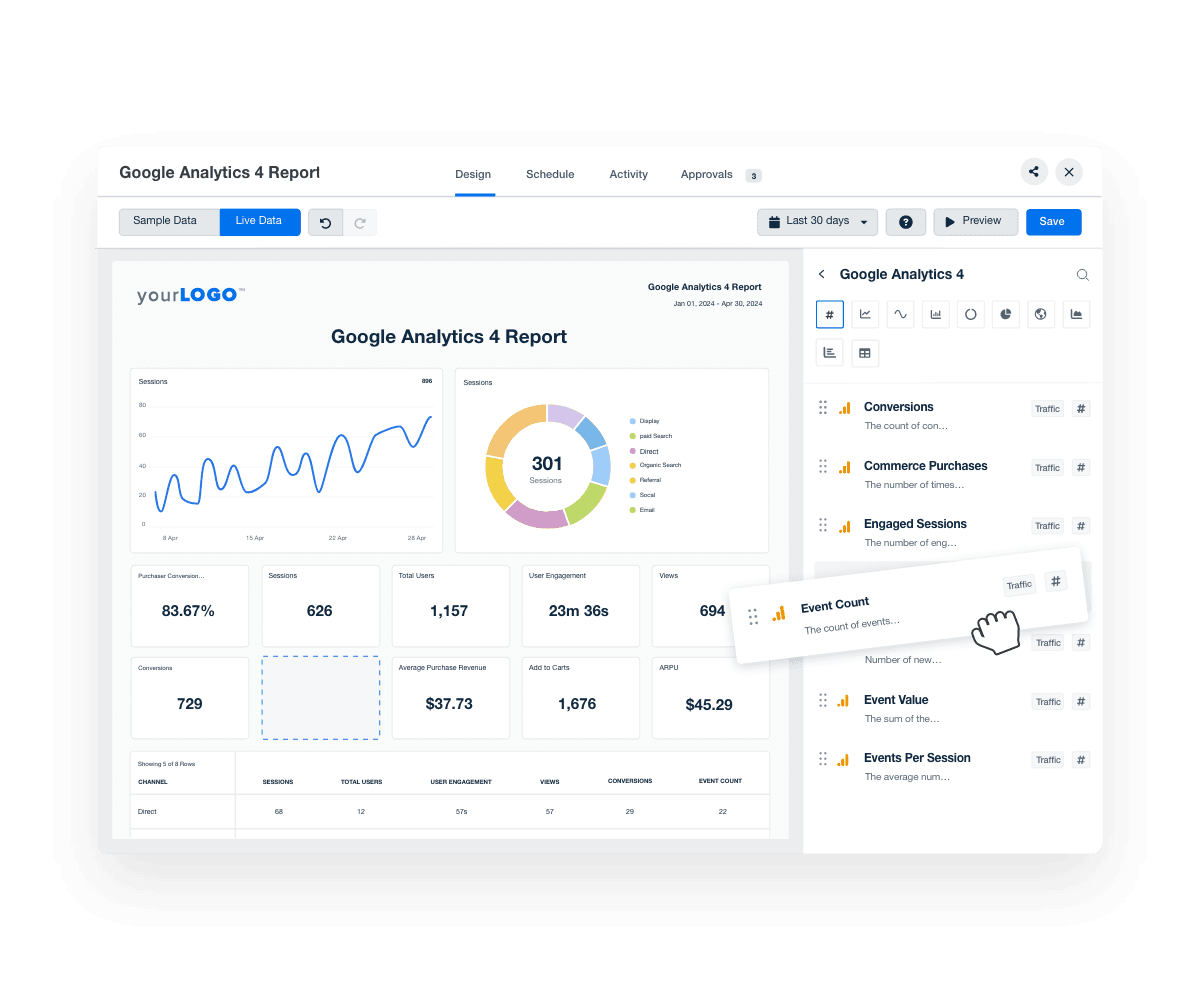

Save time and improve efficiency by automating your agency’s marketing analytics reports. Generate white labeled reports in as little as 11 seconds–sign up for a free 14-day trial with AgencyAnalytics.

How Financial Modeling Automation Streamlines Budgeting

Now that you have a better understanding of what financial modeling automation is, let's see how this tool makes budgeting easier for your marketing agency.

Dynamic Scenario Analysis Optimizes Budgeting Decisions

Budgeting decisions and tracking ad-spend often feel overwhelming, but dynamic scenario analysis, powered by financial modeling automation, helps clear the fog. This approach lets you explore different "what-if" situations, showing how each decision might affect your agency's finances. By trying out various scenarios, you’ll make smarter choices, spot risks, and find ways to boost your agency's profits.

Say you're thinking about offering a new social media management service. Using dynamic scenario analysis, it’s easy to model scenarios by adjusting key variables like pricing, client acquisition rate, and resource allocation.

For example, use your collective previous data to predict how offering your services at different price points affects revenue or how increasing your social media marketing budget impacts client acquisition.

Real-Time Data Integration Ensures Accurate Budgeting Insights

As multiple client projects unfold, you’ll be trying to keep an eye on data from numerous sources to ensure that each project remains as profitable as possible. This means reviewing accounts receivable reports, out-going spend reports from various platforms, and monitoring time-tracking data to determine how much time is being spent on each client.

Instead of drowning in spreadsheets, real-time data integration pulls this data from everywhere and updates your budget instantly, giving you a clear view of your agency's finances right now.

This makes it possible to adjust your budget immediately, whether it's boosting spending on a successful campaign or cutting back on a less effective one.

Helps Identify and Reallocate Resources for Maximum ROI

Let’s talk about getting the most out of your budget. With financial modeling automation, it’s easy to pinpoint exactly where your agency's resources are making the biggest impact.

Here's how it works: Tools such as ERP software create a centralized data point and allow automation to get to work. It shows which clients or marketing efforts are profitable and which areas need review.

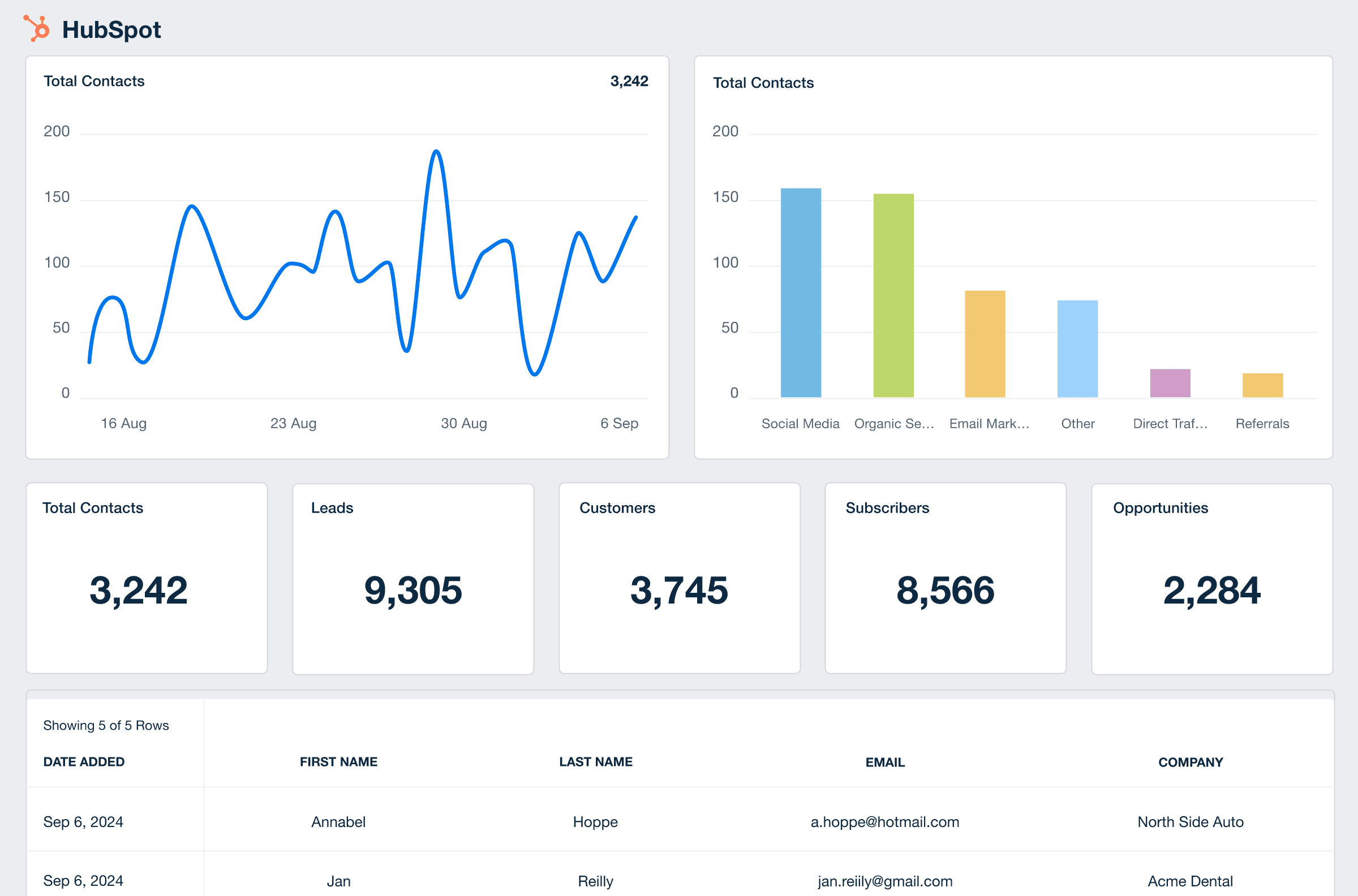

As you’re examining financial forecasts, keep an eye on the agency lead pipeline with a HubSpot dashboard. Discover the benefits of AgencyAnalytics free for 14 days.

Scenario Forecasting Aids in Proactive Budget Adjustments

Scenario forecasting, part of financial modeling automation, helps you plan ahead and adjust your budget before things go sideways.

With scenario forecasting, you’ll simulate different scenarios based on market trends or client behavior. This tool lets you see how each scenario might affect your agency's finances.

For instance, predict the financial impact of investing in new technology or expanding into a new market. This way, you’ll make informed decisions about where to allocate your budget.

However, scenario forecasting isn't just about planning for the future; it also helps you react quickly to unexpected changes. Whether it's a sudden economic downturn or a shift in marketing preferences, scenario forecasting means that you’re prepared and able to adjust your focus to stay on track.

Automated Reporting Enhances Collaboration and Transparency

Automated reporting takes the hassle out of sharing financial insights with your team. Instead of manually compiling data and creating reports, automation does it all for you. This means everyone who needs it has access to the same up-to-date financial information.

With everyone on the same page, collaboration flows effortlessly. Your whole team is aligned and working together towards common goals. And that unity streamlines your budgeting efforts and breaks down silos between teams.

So, what does all this mean? It means your team won’t waste billable hours creating manual, error-prone reports. Instead, they’ll make informed financial decisions, keeping your agency agile.

Best Practices for Leveraging Financial Modeling Automation

Now that we’ve looked at the advantages of financial modeling automation, it's time to explore how to successfully implement it into your business.

Embrace Scenario Modeling and Driver-Based Forecasting

Scenario modeling and driver-based forecasting will give you a glimpse into possible futures and help you make smarter decisions. Here’s how you can do both:

Scenario Modeling:

Step 1: Brainstorm different scenarios that could affect your agency's finances. Think about things like losing a major client, unexpected changes in the market, or a sudden increase in demand for your services.

Step 2: Quantify the potential impact of each one using key financial metrics like revenue, expenses, and profitability. Use historical data, market research, and expert insights to inform your projections.

Step 3: Use tools like financial modeling to play out each scenario and see what might happen over time. This helps you get a clearer picture of what could go down and how it could affect your agency's financial situation.

Step 4: Don't go it alone. Get your team and other financial experts involved. Working together means you'll develop better scenarios and make more informed decisions.

Driver-Based Forecasting:

Step 1: Identify the key drivers or factors influencing your agency's financial performance. Look at things like the number of new clients you're getting, the money you're making on each project, the amount you're spending on marketing, and the hard work your team is doing.

Step 2: Get the data on each driver and see how changes in those things affect your overall money situation. Look for patterns and connections to help you understand what's really going on with your agency's finances.

Step 3: Use your drivers to predict where your agency's money is headed in the future. You can use regression analysis, trend analysis, or other statistical techniques to forecast things like how much money you'll make, how much you'll spend, and how much profit you'll rake in.

Integrate Marketing Data With Financial Data

When you connect your marketing data with your financial data, you're linking what you're doing to promote your business with how much money you're making. This helps you spot what's bringing in cash and what's falling short. With this insight, you’ll allocate your marketing budget where it counts.

Look for tools or software that smoothly sync your marketing and financial data. The use of professional services automation tools will help here. By incorporating enterprise resource planning (ERP), you’ll view your financial data alongside your CRM data and HR data, giving you a full overview of your business, long-term expenses, and resource allocation.

Next, make sure that everyone on your team knows how to handle the data. Set up clear processes for collecting, organizing, and checking your data for accuracy.

Last but not least, use data visualization tools to see what's happening at a glance. Use dashboards or reports to compare your marketing and financial numbers. This will help you spot trends, find opportunities, and make smart choices for your company's future.

Implement Rolling Forecasts for Continuous Planning

Break free from the yearly budget cycle and embrace rolling forecasts. This means updating your financial projections regularly, whether it's monthly, quarterly, or even more frequently. By staying current with your forecasts, you’ll spot trends early and steer your agency in the right direction.

To do this, you should adequately leverage technology to automate the rolling forecast process. Many financial planning tools will help you crunch the numbers and generate reports effortlessly.

Once you've got rolling forecasts up and running, don't just set them and forget them. Keep a close eye on your projections, regularly reviewing and adjusting them based on new information and insights. This proactive approach allows you to remain future-proof.

Final Thoughts

So there you have it—our complete guide on financial modeling automation, filled with many tips and tricks to help you get started. From streamlining budgeting processes with dynamic scenario analysis to integrating marketing data for better insights, we've covered it all.

By embracing financial modeling automation, you empower your agency to make smarter decisions, seize opportunities, and confidently navigate challenges.

Written by

David Appel is Global Head of the SaaS Vertical for the largest technology company on the London Stock Exchange, Sage. Over time as a Sales and GTM leader, his organizations have earned the business of >2,000 SaaS and Software companies, growing at 40%+/year. He previously ran Direct Sales at Bill.com, led NetSuite’s Software Vertical, and was part of IBM’s Corporate Development team.

See how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.