Table of Contents

QUICK SUMMARY:

Marketing agency metrics and KPIs are quantifiable measures that assess the effectiveness of an agency's growth strategies. These include client acquisition, lead generation, win rates, client retention, and revenue growth. They offer insights into how successfully an agency is achieving its growth goals, influencing strategic decisions. This article features insights from various agencies on their key metrics and KPIs, covering sales, marketing, finance, pricing, and customer success, to ensure agency profitability and growth.

Running an agency involves wearing a lot of hats—from sending client proposals, managing client campaigns, reporting on the results…the list goes on.

While the importance of reporting on your client’s results can’t be understated, an equally critical component of running a successful agency is meticulously tracking your own internal metrics and KPIs.

Tracking your agency's Key Performance Indicators allows you to stay up-to-date on client satisfaction, ensures you’re on top of finances, and keeps your team accountable for its sales and marketing efforts.

Having an accurate idea of your own metrics and KPIs also allows you to set goals and know exactly what you need to do to get there—for example, how many qualified leads you need to send your sales team each month to hit your revenue targets.

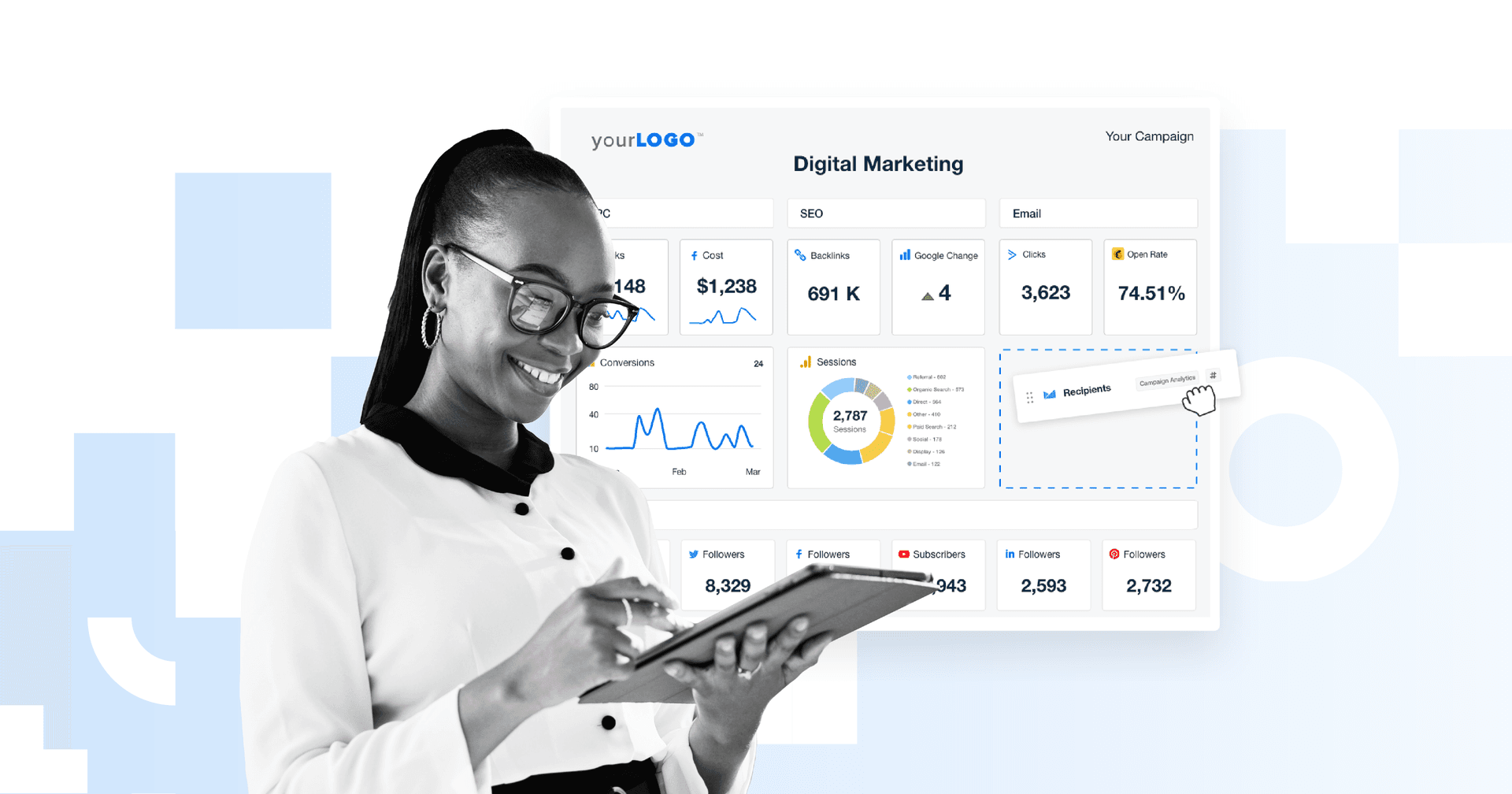

In this article, we asked several digital marketing agencies to share their most important metrics and KPIs to ensure the profitability and growth of their agency—ranging from sales, marketing, finances, pricing, and customer success. In particular, the 10 KPIs we'll discuss include:

Proposals Sent

Net Margin

Cash Flow from Operations

Agency Utilization Rate

Client Retention Rate

Average Churn Rate

Let's get started.

Sales & Marketing KPIs

Starting at the top of the funnel, knowing these metrics and KPIs allow you to set sales targets, forecast revenue, and budget for marketing expenses.

1. Qualified Leads: MQLs and SQLs

Without enough qualified leads to hand over to your sales team each month, growing an agency and maintaining profitability will always be a struggle.

A marketing qualified lead, or MQL, is defined as a lead that has expressed interest in your agency and has the potential to become a customer with the right nurturing, for example with content, case studies, and testimonials. An MQL becomes a sales qualified lead (SQL) after they’ve been nurtured by the marketing team and are ready to talk to sales.

There are a number of ways to automatically track MQLs and SQLs, for example using lead scoring based on company information, online behavior, email engagement, and so on.

The CEO of Hook Agency, Tim Brown, highlights the importance of MQLs and SQLs for his agency:

We really focus on leads, and particularly which ones are MQL's (Marketing Qualified Leads) and SQL's (Sales Qualified Leads) because then we can fix any issues—whether there is a low number of opportunities coming from marketing, or if sales is having a harder time closing deals. Without clarification around the opportunities being created and their quality, it's hard to hold different departments responsible and fix the kink in the "funnel."

As Tim mentions, tracking these two metrics is the backbone of holding other departments accountable and identifying any issues that may be acting as a bottleneck in your funnel.

2. Customer Acquisition Cost (CAC)

Customer acquisition cost (CAC)—defined as the cost to acquire a new client—is essential to budgeting for marketing expenses. In addition to knowing how much it costs overall to acquire a customer, you should know the CAC of each individual marketing channel you're using. Customer acquisition costs are closely related to the next metric every agency should track: customer lifetime value.

3. Customer Lifetime Value (CLV)

Customer lifetime value (CLV) refers to the total amount of money a client is expected to spend during their lifetime of working with your agency. CLV is calculated as the average value of a purchase, multiplied by the number of times they will make a purchase each year, multiplied by the average length of the client relationship.

By knowing both your average CAC and CLV you'll know exactly how much you can spend to acquire a customer, how much you’ll make from the average customer, and how long it will take to reach profitability on a client-by-client basis.

Peter Thaleikis from the web development agency Bring Your Own Ideas highlights the importance of CAC and CLV for agencies:

The critical combination of cost of customer acquisition (CAC) and customer lifetime value (CLV) gives you a strong insight into the health of your business. If your customer acquisition costs exceed your customer lifetime value, your business is in trouble. But even if your lifetime value per customer exceeds your costs to acquire a customer, you might have issues if the customer pays a low amount over a long time. In this case, you will struggle to scale the business as the upfront costs are too high. The CLV is mostly driven by churn. Keeping it under control is as vital as constantly working to reduce your acquisition costs - if either one breaks out your business will suffer.

4. Proposals Sent

Another simple yet crucial KPI to track is the number of proposals sent each month or quarter. Keep in mind that maxing out this number should never be the goal as you only want to focus on qualified leads. That said, having this KPI on hand gives you a sense of how effectively your sales and marketing team are working together.

5. Win Rate

Win rate is another KPI that will keep your sales team accountable and can help you identify potential changes to your pitch that may need to be made. Win rate is calculated by dividing the number of deals closed by the total number of proposals sent for that period.

Karl Sakas from Sakas and Company provided the following insights about proposals and tracking your win rate:

Agencies should target a 50-70% "win rate" for business development proposals. If their proposal-to-close rate is significantly below 50%, they're likely "over-proposing," by sending sales proposals to prospects who weren't a good match. But a higher percentage isn't always positive. If the win rate is 90% or higher, the agency is undercharging; it's time to raise prices, to close fewer (but more-profitable) deals.

Agency Pricing & Finances

Pricing can be one of the most challenging parts of finances to figure out, although the good news is that your pricing isn’t fixed and can always be increased as you get more clients and testimonials.

Here’s what Brian Robben, the CEO of Robben Media recommends in terms of pricing:

I recommend marketing agencies start out being project-based and then experiment with a profit-sharing model. Or get creative to do a mix of both payment plans. Whatever the model, if you provide massive value then you can pretty much set your rate, no questions asked.

6. Net Margin

When it comes to agency finances and pricing, one of (if not) the most important metrics is your net margin. Unlike other business models, agency margins can be notoriously difficult to calculate.

In our Guide to Agency Margins, we highlighted that the average margin for agencies is between 11-20%. If your margins are too low, one of the best ways to improve them is to optimize costs by automating manual workflows.

For example, in our guide to Automated Reporting, we discussed how manually generating reports each month is time-consuming and not necessarily a revenue-generating task, which means it should be automated as much as possible.

As Daniel Dye, the President of Native Rank, noted in a recent case study, by automating their reporting with AgencyAnalytics they were able to save over $360k annually:

Using AgencyAnalytics has helped us deliver better results for our clients while also saving time and resources on reporting and data management.

7. Cash Flow from Operations

Another key consideration regarding finances is when to charge clients, which has a large impact on your cash flow. Fundbox highlights the importance of cash flow for agencies:

Positive cash flow is critical for any small business, including creative agencies. Without access to cash, creative agencies are unable to hire additional employees to help take on ever-increasing workloads. They’re also not as flexible when it comes to being able to invest in new opportunities (e.g., partnerships or new contracts).

8. Agency Utilization Rate

Utilization rate is one of the most important metrics for agencies and service businesses in general to track. Agency utilization rate refers to how much time your employees spend on revenue-generating tasks. Specifically, utilization is the amount of time an employee spends working on client-facing tasks in comparison to their total amount of available work hours.

Agency utilization rate is defined as a percentage and is calculated as follows:

Where:

Billable time is the time an employee spends on client-facing tasks

Gross capacity is the total capacity of the billable team

For example, if you want to calculate the utilization rate of a single employee that works 40 hours per week, of which they spend 32 hours on client-facing tasks, the utilization rate is 80%. You can then average the utilization rate across the entire agency by summing the total billable hours by the total capacity.

As the agency productivity tool Productive.io highlights in their article on utilization:

By knowing and understanding your utilization rate, you can make significant improvements to your company’s profitability.

Customer Success Metrics

Aside from tracking your net profit margins and cash flow, another great way to increase profitability and growth is to closely monitor your customer success metrics.

9. Client Retention Rate

Optimizing your sales and marketing funnel is important, although equally important is retaining clients over the long run, or your client retention rate. Client retention rate is calculated as follows:

The reason that your client retention rate is so important for profitability is that it's often much cheaper to keep a client than find a new one.

As Jack Choros from Iron Monk highlights in our guide to improving client Retention:

It is 70% cheaper to keep an existing customer than it is to find a new one. While the ratio might be slightly different depending on the business model or vertical you’re involved in, the idea rings true in the agency world.

10. Average Churn Rate

Another key customer success metric to track is your average churn rate, which is closely tied to your retention rate. Average churn rate can be calculated as:

Some amount of churn rate is inevitable and to be expected, although a high churn rate is an indication that clients aren't satisfied with a certain aspect of your agency.

As Rahul Gulati, Founder, GyanDevign Tech Services highlights:

I have seen that when agencies take on all sorts of customers, they eventually leave within 2-3 months. You cannot meet expectations of all. So, the best idea would be to understand the client's needs and see if you are the right fit. The best industry standards are 10 percent or below with regards to churn rate.

Summary: Metrics & KPIs Every Marketing Agency Should Track

Aside from tracking your client's results, monitoring your own internal metrics and KPIs is essential to building and growing a profitable agency.

Keep in mind that this list is not exhaustive, although hopefully, these insights from agency owners can provide you with a starting point for your own business.

Also, remember that these metrics are not just meant for management—everyone on the team should be aware of the KPIs that they're responsible for, which ultimately enables a culture of accountability, both individually and collectively.

Written by

Peter Foy is a content marketer with a focus on SaaS companies. Based in Toronto, when he’s not writing he’s usually studying data science and machine learning.

Read more posts by Peter FoySee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.