Table of Contents

Table of Contents

- My Early Life as an Entrepreneur

- From Auto Repair Shop Owners To Accidental Agency Owners

- The P&L Is a Liar

- The Day I Learned About Profit First

- Everything Changed... EVERYTHING

- My Favorite Profit First Account

- Profit First Isn’t an Excuse to Not Learn Business Financials

- The Trifecta for Owning an Agency That You Love

7,000+ agencies have ditched manual reports. You can too.

Free 14-Day TrialQUICK SUMMARY:

"My goal with this article isn’t to teach you how Profit First works. It’s to convince you that Profit First will help you to run your business in a way where the numbers just make sense and where profit is a decision instead of a hope.” In this article, Brian Walker, co-founder of the marketing agency Shop Marketing Pros, tells the story of how Profit First helped his agency climb out of debt, establish financial processes built to scale, and maintain profitability for the long-term.

I grew up as the child of an entrepreneur.

I love my dad. He was a great man, and he made me who I am today. But he was a terrible businessman.

His businesses struggled, and he worked more hours than even the most “alpha” of entrepreneur influencers claim to work today. And it wasn’t because he was “grinding.” It was because he didn’t know how to run a business. He was forced to work all of those hours to make up for his lack of business acumen.

My dad was the classic entrepreneur. He was in love with the idea of being his own boss. I think maybe somewhere deep within him there was a dream that one day he may have great success and provide an incredible life for his family. I never asked him what his dreams were. But I do know this; he did give us an incredible life, and it was because he was willing to do whatever it took to provide for us. We lived at the bottom of the middle class, but we always had everything we needed.

I look back at one of his businesses in particular. It was an ice plant in a suburb of New Orleans.

We made the ice that is bagged and sold at convenience stores. I say “we” because I grew up working there as a kid. I still remember the first time my dad paid me for working. I was probably 6 or 7 years old at the time, and I helped stack bags of ice for a few hours. That evening he handed me 5 dollars and thanked me for helping. I was hooked.

That business had the potential to be a gold mine, and it is today–just under new ownership.

I often think about how if he’d become the businessman he needed to be what that business could have been. It could have been an empire.

I got my work ethic and my love of entrepreneurship from my dad. I also got my financial and business management skills from him, and that was a disaster.

My Early Life as an Entrepreneur

I’ve been an entrepreneur for as long as I can remember. As a kid, if there was a chance to make a dollar, I was in. As a teenager, I made it more official and started a lawn care business. But my true passion was working on cars. When I graduated high school, I went to UTI in Houston and learned how to be a mechanic.

I worked for the Mercedes dealership for a few years before eventually opening my own auto repair shop. I could write a book about the mistakes I made as a new business owner. I was great at fixing cars but I didn’t have a clue how to run a business. On top of that, my wife and I were terrible at managing our personal finances. My lack of business skills combined with our lack of overall financial knowledge was a match made in Hell.

To say we struggled in business would be an understatement.

One day I was opening the mail at my shop, and I got a sales letter from a company called Management Success. They were a coaching company for auto repair shop owners. The letter had a picture of husband and wife auto repair shop owners sitting in beach chairs under an umbrella with drinks in hand, looking out at the ocean. I wanted that.

I joined Management Success, and I learned a lot from them. Eventually I moved on to another coaching company, where I learned even more about running a business, including how to read a profit and loss statement (P&L) and a balance sheet. But I still struggled to manage cash flow.

In 2008, a 7-month-long road construction project put us out of business. I continued to pay my team but didn’t pay my taxes. Our bank accounts were running dry as it was and then the IRS decided to just reach into our account and take what was theirs. We’d gone as far as we could go, and we knew we wouldn’t be able to make another payroll, so we shut the doors of our auto repair shop.

From Auto Repair Shop Owners To Accidental Agency Owners

During our tenure as shop owners, my wife did all of our marketing, and I built our website. To make a long story short, this eventually led to us starting a marketing agency. We were bankrupt and needed to use every skill we had to keep our heads above water.

The agency grew quickly but before we knew it, we were in the same situation where we were struggling, and I didn’t see a light at the end of the tunnel.

Once again, I sought out coaching. This time I found the Agency Management Institute, which is owned by Drew McLellan, one of the most amazing human beings I’ve ever met.

Drew always preached 3 things to us:

1. Niche down

2. Profit First

3. EOS

I heard him over and over tell us to do these 3 things, but I didn’t listen. Yes, I’m hard-headed.

I knew we needed to niche down, and the niche that made the most sense was auto repair. We tried to niche down a few times, but the general agency work kept coming in, and we were in no position to decline it. My agency continued to struggle, and I eventually left AMI because I couldn’t afford to stay involved.

One of the things that did change during this time was we became much better at managing our personal finances. We started following Dave Ramsey, we implemented the envelope system, and we began our debt snowball.

In 2019 my operations director and I were at FunnelHackers to learn some new ways to market the agency. It seemed like every speaker there talked about niching down. We drew a line in the sand and said we’re not taking another client that isn’t an auto repair shop. That was the beginning of Shop Marketing Pros. We held that line and never looked back.

But we still struggled.

Read More: Overcoming the Top 8 Challenges of Scaling Your Agency

The P&L Is a Liar

Every month when I would go through my financials, the P&L would show me that I’d made a profit. I would look down at the bottom line and it would show me how much money I’d made, but where was it? It certainly wasn’t in my bank account.

All of these years, I’d missed the fact that debt payments, taxes, and distributions didn’t show up on the P&L. You have to use your P&L along with your balance sheet and cash flow statement to truly understand what’s happening.

But the fact is, unless you’re a “numbers person,” it’s difficult to wrap your head around all of this. I understand it now but it’s still not something I can glance at and get an idea of what’s happening in our finances. I have to dedicate time, focus, and do some math.

I knew there had to be an easier way, and there is.

The Day I Learned About Profit First

Early on in the days of Shop Marketing Pros, an auto repair coach, Chris Cotton, really liked what we were doing and started referring his clients to us. He and I had never met in person, so we set up a couple of days where we met at a mutual client’s shop to do a deep dive on that client’s business.

He and our client had their weekly financial meeting, and I was invited to join them. They were distributing money among a bunch of bank accounts, and there was one account with a sizable amount of money in it, and Chris was asking our client what debt he wanted to pay off that month. He didn’t have any debt left.

I remember Chris asking him if he had anything personal that he wanted to pay off, and he did. Chris said, “Well, it’s your money. Take it and pay it off!”

I was in awe of what I saw. They were running the business with what looked very similar to Dave Ramsey’s envelope system, which I’d become so familiar with, except they were using bank accounts instead of envelopes. This was Profit First.

Chris was previously a Profit First Professional, and I knew I needed this in my business. I couldn’t believe that Drew had been telling me to do this for years, and I didn’t listen. If I had, it would have made me hundreds of thousands of dollars–and saved me so many headaches.

Before the day was over I’d hired Chris as my coach to help me implement Profit First at Shop Marketing Pros.

Everything Changed... EVERYTHING

Within a very short time after implementing Profit First in my agency, everything changed.

I’d been on a payment plan with the IRS as long as I could remember. I hated the IRS. I loathed taxes. I actually had fear and a sense of dread when I would hear those 3 letters. But Profit First brought profound change.

When we implemented Profit First, we set up the following bank accounts:

PROFIT FIRST BANK ACCOUNTS | |

|---|---|

Income | Profit |

Taxes | Operating Expenses |

Payroll | Debt Payoff |

Savings | Bonus |

(Side note - my CPA at the time hated this. Your CPA may fight you on this. If they give you too much pushback, fire them and find a CPA who understands Profit First.)

The way Profit First works is that you set percentages for each category where you have created bank accounts.

First, ALL income must go into the income account. Nothing is paid out of the income account.

If you know that you need to keep payroll at 30% of your total income, you distribute 30% of what’s in the income account to your payroll account.

If operating expenses should be 25% of gross, then 25% of the amount in your income account gets distributed to the operating account.

You’ll have percentages that go into every account. If you find that one of these accounts requires more funding than the percentage you have dedicated to it, you know you have a problem in that area you need to fix. Unlike a P&L, where you learn these things after the fact, Profit First shows you the problem areas in real time.

Because Profit First utilizes individual bank accounts for taxes, debt repayment, and profit (unlike your P&L) those three categories that don’t show up on the P&L are accounted for every week when you disperse from the income account. As long as you only take non-payroll funds from the profit account, you’ll always have a handle on where your money is going.

Of course, you must still maintain accounting best practices and you still need to have dedicated time to spend monitoring your business finances. Theft and waste can and will occur when finances aren’t watched over.

My Favorite Profit First Account

You would think the profit account is my favorite. But it’s actually the tax account that I love. I had so much negative history with the IRS that this one account gives me so much peace.

That first year of Profit First, Chris Cotton and I focused on getting that last tax payment plan behind me and it happened faster than I ever thought it could. Dave Ramsey always says, “you either tell your money where to go, or you wonder where it went.” It’s unbelievable just how fast it happens when you tell your money where to go.

Once we had the payment plan behind us, we started stacking cash for the upcoming tax payment. When it came due, the money was there. I wrote a check and paid it before the due date and never thought about it again.

I tend to overfund my tax account. It’s May as I write this, and I could already pay what will be due in March next year. It’s a beautiful thing. Understand, I don’t want to pay the IRS a single penny that I don’t owe them, and I have a great CPA who specializes in agencies and works hard to make sure that I don’t, but I also know that a big tax bill means I was profitable, and that’s a good thing. So when the tax payment is due, I smile as I write the check.

That’s the other beautiful thing about Profit First. Those bank accounts are symbolic. When I distribute money into the tax account, it’s me saying, “This money isn’t mine anymore. It belongs to the IRS.” So when I write the check, it doesn’t hurt. What’s great is when the tax bill is due and I have more than I need. Because then I can write myself a tax refund check, and that money is mine.

The other money that’s mine is what’s in the profit account. Once funds are distributed into the profit account I can do whatever I want with that and be guilt-free about it. Most of that goes towards our debt snowball, and we’ll be 100% debt-free in the next 5 years. And because it’s in the profit account and funds were distributed into the tax account, taxes have already been paid on that profit. It’s incredibly freeing.

Profit First Isn’t an Excuse to Not Learn Business Financials

Running a business using the Profit First method will make you feel like you never need to look at a P&L, balance sheet, or cash flow statement again. That feeling couldn’t be further from the truth.

Profit First is a tool. My history as a mechanic shows me the value of tools and how having the right marketing agency tools for the job makes the job easier and leads to a better overall result.

Business owners love to brag about being entrepreneurs because it’s “cool” to be an entrepreneur. What’s even cooler is being a legitimate expert in running a business. I wouldn’t say that I’m there yet, but I’m a lot closer than I was.

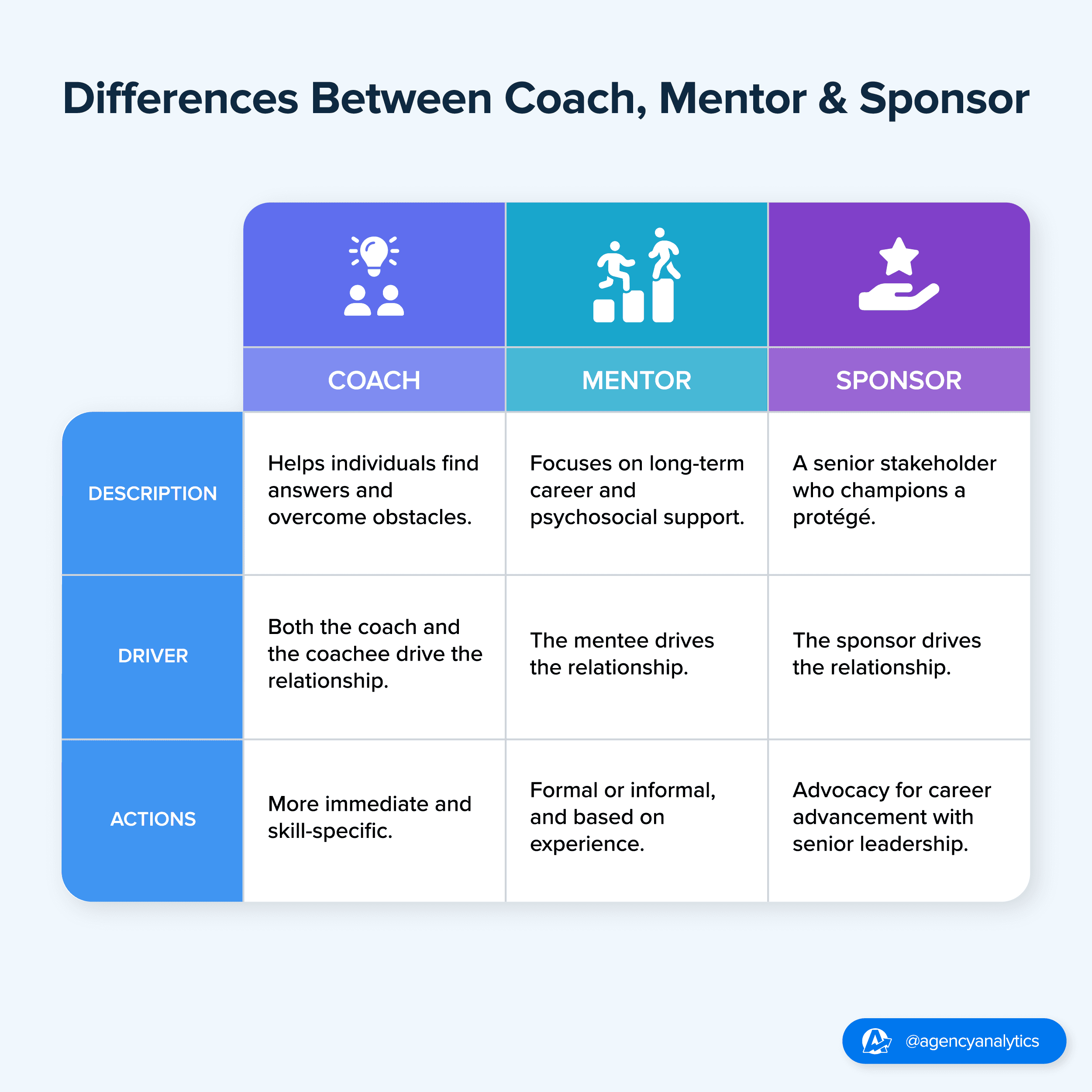

I’ve invested heavily in surrounding myself with the right people, and those people help me craft my expertise. I learn from them every day. I have a business mentor, a CPA, a CFO, a bookkeeper, and a wealth-building coach. All of these people have a specific purpose.

One of the biggest mistakes I see business owners make is to rely on a CPA or a bookkeeper to help them make decisions in their business. That is the job of a CFO, and a great CFO is worth their weight in gold. I’ve worked with a few CPAs and they always talked over my head.

Understand that I’m talking in generalities right now, and there are always exceptions:

Your CPA is there to do your taxes and keep you from paying more than you should while also keeping you out of jail.

Your bookkeeper is there to do data entry and to know what categories each piece of data should go in.

Your CFO helps you to make sense of the numbers and make business decisions based on what the numbers are telling you. I love my CFO!

Your job is to work with all of these people and to become proficient enough to understand them when they’re talking to you and presenting data to you.

Profit First is the first line of defense, and if you do a great job with it, problems won’t get past it and your financial statements will look good when you read them.

If you think Profit First is something that will help you in your agency, start by reading the book Profit First by Mike Michalowicz. I also cannot recommend enough that you hire a Profit First Professional to coach you through the process of implementing it.

The Trifecta for Owning an Agency That You Love

When AgencyAnalytics reached out to me and asked me to share my experience with Profit First, I knew I couldn’t do that without at least hinting at the rest of the story.

Remember, I said Drew McLellan from the Agency Management Institute always preached three things to us. Those were niching down, Profit First, and EOS. This article isn’t about niching down or EOS but I’d be doing a major disservice if I didn’t at least tell you to go seek those things out as well.

Niching down is self-explanatory, but I will say that the riches truly are in the niches.

As far as EOS, learn more about it by reading the book Traction by Geno Wickman. It will change your life.

Profit First made a huge impact on our business and it would have even if we didn’t niche down or implement EOS, but I truly believe these three things are the trifecta for building an agency that you will love.

Written by

Brian Walker, Owner and CEO of Shop Marketing Pros, leads a marketing agency for independently owned auto repair shops. With a background as a Mercedes Benz Master Technician and former Mechanical Division Director for ASA-NC, Brian's passion for fixing things extends to marketing. He loves solving marketing challenges for auto repair shop owners, combining his expertise and enthusiasm to help their businesses thrive.

See how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.