Table of Contents

QUICK SUMMARY:

Learn how to optimize cash flow and profitability using Frank Cowell’s Seven Capabilities Framework. This guide breaks down key financial attributes—from invoicing and accounts receivable to accrual accounting and monthly reviews—so your agency funds its own growth, scales sustainably, and stays ahead of the competition.

Scaling an agency requires more than great marketing, a strong sales team, or even a world-class offering. As Revenue Ranch founder Frank Cowell has outlined in his Seven Capabilities Framework, agencies that grow sustainably and profitably follow a structured path, mastering one capability at a time.

When an agency reaches Cash and Profit Optimization, every other piece of the business should already function like a well-oiled machine. The right clients, efficient operations, a strong sales process, and a reliable lead generation system all create momentum.

As Frank tells AgencyAnalytics, cash and profit become inevitable when you’ve built an agency the right way—when you’ve nailed each capability in the right order.

A healthy business, by default, has momentum behind it. It has a clearly defined True North, an execution plan to get there, a World-Class Offering with strong margins, a Systematic Sales Process, a steady flow of leads, and an empowered team.

By the time you reach this stage, cash flow and profit aren’t just something you “manage”—they’re now a potential for yet another strategic advantage.

Frank Cowell, Founder, Revenue Ranch

Financial strength is the difference between an agency that reacts to opportunities and one that creates them. Agencies with optimized cash flow will move faster than the competition—acquiring more clients, hiring better talent, and scaling faster.

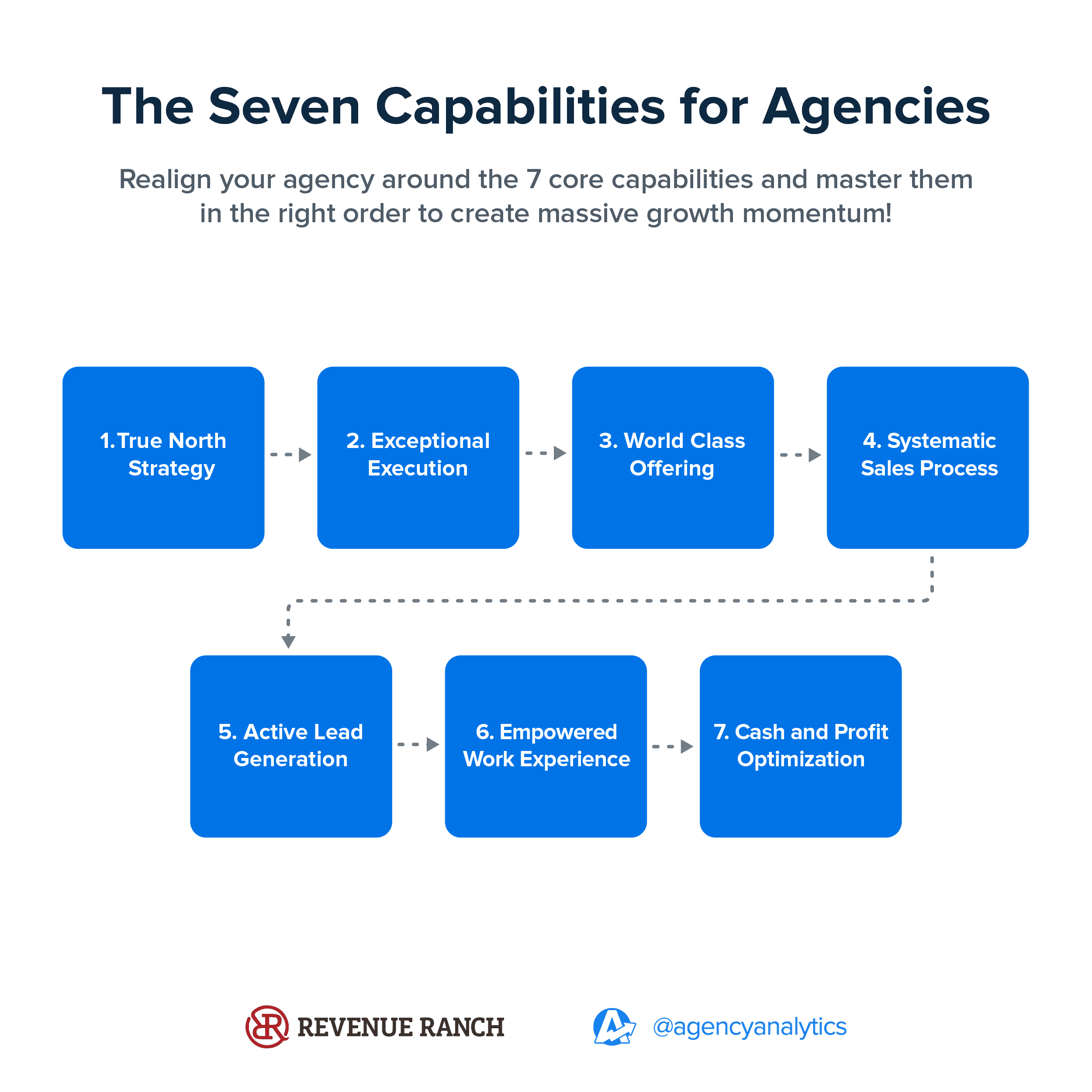

How the Seven Capabilities Framework Creates Profitability by Design

Agencies ready to optimize cash and profit don’t get there by accident. They must master the previous six key capabilities in Frank’s Seven Capabilities Framework first to create a business model designed for long-term profitability:

True North Strategy → Clear direction, differentiated business activities, and values ensure that you’re building a company that is magnetic to ideal clients and employees.

Exceptional Execution → Strong planning and management protocols get the entire organization approaching growth and problem solving in the same way.

World-Class Offering → A profitable offering that clients rave about and never want to leave is the heart of your revenue engine.

Systematic Sales Process → A structured selling system helps you consistently close the best clients at the best prices.

Active Lead Generation → A steady flow of “hand raisers” ensures that your revenue is predictable.

Empowered Work Experience → An empowering work experience ensures your people will be the best they can be both personally and professionally.

“At this stage, if you're doing the other six capabilities well, a healthy pile of cash and a healthy profit margin should almost be inevitable,” Frank says.

Cash and Profit Optimization isn’t about cutting costs or reacting to financial challenges. It’s about creating a system that ensures stable, scalable, and predictable profitability.

The Key Financial Attributes of Cash and Profit Optimization

Frank emphasizes that Cash Flow and Profit Optimization will naturally result from a well-run agency. They’re not things an agency leader manages at the end of the process.

To create a business that funds its own growth, agencies must follow seven key financial attributes.

These attributes create a self-sustaining financial structure. Agencies that master these seven areas avoid financial surprises and gain the freedom to reinvest, scale, and take advantage of new opportunities.

Let’s examine each one in detail.

1. Standardized Process for Invoicing and Cash Collection

Revenue doesn’t mean anything until it’s collected. Without a clear, repeatable process for invoicing and cash collection, agencies waste time chasing overdue payments instead of focusing on growth.

“A process to invoice and collect needs to be standardized and consistent,” Frank says.

Without structure, invoicing becomes an afterthought, collections become uncomfortable, and agencies end up financing their clients’ businesses instead of their own.

Build a Process That Ensures Cash Flow

A strong invoicing and collection system removes guesswork, hesitation, and human error.

Frank lays out three must-haves:

Automate invoicing to ensure invoices go out on time, every time.

Train clients to follow payment terms before work starts.

Implement a structured follow-up process for overdue payments.

Agencies that fail to establish these systems experience cash flow gaps that slow down hiring, marketing, and growth.

Train Clients To Pay Before the Work Begins

For recurring services, agencies should bill in advance, not after the work is done.

For recurring service models, payment is due at the start of the service month—not at the end. That means we have to train our clients that the invoice is going to come 30 days before that.

Frank Cowell, Founder, Revenue Ranch

Here’s how agencies should structure billing:

Billing Model | Common Agency Approach | Optimized Agency Approach |

|---|---|---|

Recurring | Invoice at the start of the month, due later. | Invoice a month prior, due before the service month starts. |

Project-Based | 50% upfront, 50% on completion. | 40% upfront, 30% at midpoint, 25% near completion, 5% on final delivery. |

Hourly Work | Invoice after work is completed. | Require pre-paid blocks of time or a credit card on file. |

Agencies that shift payment timelines reduce cash flow stress, prevent financial surprises, and ensure work isn’t completed before payment is received.

Remove the Emotional Barrier To Asking for Payment

Many agencies hesitate to follow up on overdue invoices, worrying that doing so will damage client relationships. However, for Frank, that’s far from an optimal business approach.

“If they’re late, they’re late,” Frank says. “I can’t tell you how many agency founders I meet where, for some reason, they’ve normalized in their mind that, ‘Yeah, this client’s taken 45 days to pay, but they’re good for it.’ I don’t care if they’re good for it or not. That’s not the arrangement you made with that company.”

Clients who delay payment aren’t doing agencies a favor by eventually paying—they’re breaking an agreement. Agencies must handle collections with the same priority as delivering services—a non-negotiable part of running a profitable business.

Automate Without Losing Oversight

A strong invoicing process combines automation with human accountability. Frank explains that doesn’t mean that humans aren’t involved. It means automating the tasks and the process so that humans can’t forget to do their part.

Agencies should:

Use accounting software to generate and send invoices on a set schedule.

Automate reminders for upcoming due dates and overdue invoices.

Assign follow-ups to a team member so unpaid invoices don’t slip through the cracks.

A standardized invoicing and collection process will ensure financial stability, reduce stress, and allow agencies to focus on growth instead of chasing payments.

2. Keep Accounts Receivable Balance Low

An agency’s accounts receivable (AR) balance reveals how much money is tied to unpaid invoices. A high AR balance means clients use the agency’s money to fund their operations—a position no agency should be in.

Agencies must control their cash flow by keeping AR low. Frank says a low AR balance signals a financially stable agency that collects payments on time and minimizes outstanding invoices.

How To Measure AR Balance the Right Way

Frank explains that an agency’s AR balance should be relatively low compared to its revenue. He avoids setting a rigid percentage, instead focusing on trends:

Generally speaking, how I looked at it was anything in the “current” bucket was fine. But as soon as something went late, like “0 to 30 days late,” I wanted that bucket to be relatively low. And if it was “more than 30 days,” that bucket had better be tiny.

Frank Cowell, Founder, Revenue Ranch

In other words, invoices still within terms (not past due) are manageable, but late invoices should never pile up. Agencies that track AR trends spot potential cash flow issues before they escalate.

AR Status | Ideal Scenario | Red Flag |

|---|---|---|

Current (Not Late) | Normal balance, based on billing cycles. | None |

0-30 Days Late | Minimal outstanding invoices. | A growing balance indicates delayed payments. |

30+ Days Late | Should be almost non-existent. | A large balance here means serious cash flow issues. |

Why Agencies Can’t Afford To Let AR Pile Up

Too many agencies normalize late payments. Frank warns against this mindset:

If you’re an agency with clients that regularly go over 45 days where there’s a payment or two still outstanding—but you’re still doing the work—you’ve got to re-examine your relationship with this situation. There shouldn’t be any reason why you’re letting that happen.

Frank Cowell, Founder, Revenue Ranch

Letting late invoices slide creates serious financial risks:

Payroll Problems: If cash isn’t collected, paying employees becomes harder.

Scaling Issues: Growth slows when working capital is locked in unpaid invoices.

Power Imbalance: Clients see agencies as flexible on payment terms, which leads to further delays.

An agency should never be in a position where clients control the agency’s financial stability.

Impress clients and save hours with custom, automated reporting.

Join 7,000+ agencies that create reports in under 30 minutes per client using AgencyAnalytics. Get started for free. No credit card required.

Already have an account?

Log in3. Intake and Paying of Bills Is Standardized and Consistent

Managing cash flow isn’t just about collecting revenue—it’s also about controlling outgoing payments. Agencies that fail to standardize how they receive and pay bills risk cash shortages, missed payments, and financial disorganization.

Just like invoicing and collecting cash that’s owed to you, you need a process to receive and pay bills that’s standardized and consistent.

Frank Cowell, Founder, Revenue Ranch

A well-managed payment system ensures agencies always know what’s due, when it’s due, and where cash is flowing.

Why Agencies Must Standardize Bill Intake and Payments

Every agency relies on outside vendors, contractors, and service providers. Whether it’s software subscriptions, advertising spend, or freelance support, failing to manage these expenses properly creates financial blind spots.

Agencies that standardize bill intake and payments:

Avoid Late Fees and Penalties: Paying bills on time prevents unnecessary costs.

Maintain Strong Vendor Relationships: Reliable payments build trust with critical partners.

Improve Financial Visibility: Knowing exactly what’s due allows for better cash flow forecasting.

Frank has seen too many agencies spend money just because it’s sitting in their bank account.

Cash flow isn’t just what’s in the bank—it’s affected by what’s allocated. Treat monies received like it’s locked in a room with a guard until it’s time to release it to you once you’ve “earned it.” Managing this is important as you scale.

Frank Cowell, Founder, Revenue Ranch

Frank means that when a client pays an invoice, that money enters the agency, but it’s not free to use however you want. It needs to be allocated—some of it goes toward payroll, some toward vendor payments, some into a reserve for taxes, and some into reinvesting in growth.

The guard at the door represents financial discipline. Before money leaves the room, the agency needs to:

Ask Where It’s Going: Is this payment already spoken for?

Check Priorities: Does this expense support growth or just add overhead?

Only Release What’s Necessary: Keep cash reserves intact instead of draining them.

Agencies that skip this step often spend based on their current bank balance instead of their actual financial obligations. That’s how they end up short on cash when payroll hits or when a big vendor invoice comes due.

Never assume money is available just because it’s in the account. Make sure every dollar has a purpose—and never let spending outpace revenue.

Set Up a Process for Managing Expenses

A standardized process ensures bills are reviewed, approved, and paid efficiently. Frank explains that agencies should establish a single intake system where all vendor invoices are entered into a centralized platform as soon as they arrive. Leadership or finance must review and approve payments before they are made to ensure that expenses align with business priorities.

Recurring expenses—such as software subscriptions and office rent—should be automated through scheduled payments to maintain consistency. Monthly expense reconciliation is also essential, allowing agencies to compare outgoing payments to cash flow and adjust as needed.

Frank adds that agencies must separate the authority over incoming revenue from outgoing payments to prevent financial mismanagement. If one person controls both, financial mistakes—or even fraud—become much harder to detect.

“In any given business, the money-in authority versus money-out authority should be separate,” he says.

4. Ensure You Have Accrual Accounting in Place

An agency’s profitability on paper doesn’t always match reality. Agencies that rely on cash-based accounting often misinterpret their financial health, making decisions based on misleading numbers.

Frank stresses the importance of accrual accounting, explaining that it aligns income and expenses with when they occur, not just when cash moves in and out of the bank.

Accrual accounting is when you line up expenses and income to the period in which they physically occur. If a business isn’t using accrual accounting, the P&L (profit and loss statement) becomes almost useless.

That said, I don’t recommend it until about $1m in annual revenue, give or take—there’s additional work required to implement this both in the month-to-month and at the end of the year when you will likely want to report on a cash basis for tax purposes.

Frank Cowell, Founder, Revenue Ranch

Without it, agencies may think they’re having a great month when revenue just hit the account early. Or they might believe they had a bad month even if they were profitable on paper.

What’s the Difference Between Cash and Accrual Accounting?

Accounting Method | How Revenue Is Recorded | How Expenses Are Recorded | How It Impacts Profitability |

|---|---|---|---|

Cash Accounting | When cash is received | When cash is paid out | Can make some months look highly profitable while others look unprofitable. |

Accrual Accounting | When work is completed (not when paid) | When expenses are incurred (not when paid) | Gives an accurate financial picture by matching revenue and expenses in the right periods. |

Frank gives a clear example of how cash-based accounting distorts reality:

“Let’s say a client pays you $100,000 for a $200,000 project as a down payment, and the project lasts four months,” Frank explains. “If you record that entire $100,000 in one month, it looks like you had a huge revenue month. Yay! But the next month, when there’s no new payment, it looks like you had a poor revenue month. Boo! That’s not reality.”

With accrual accounting, that $100,000 is spread across the four months of work, ensuring financial reports reflect actual business performance.

Why Agencies Need Accrual Accounting To Scale

Agencies that want to grow profitably must track their numbers accurately. Without accrual accounting, it’s not impossible to measure key financial metrics like gross profit, client acquisition costs, and operational efficiency, but it is more difficult and less accurate, generally speaking.

If I were to consult with a business doing, say, $2 million in revenue and accrual accounting wasn’t in place, I couldn’t trust the P&L. I wouldn’t know what was actually happening in the business.

Frank Cowell, Founder, Revenue Ranch

To transition to accrual accounting:

Work with an accountant who specializes in accrual-based financials.

Use accounting software for accrual reporting (e.g., QuickBooks, Xero).

Recognize revenue when work is completed, not just when payments come in.

Track expenses when they’re incurred, even if they’re paid later.

You may think accrual accounting is just for large agencies, but it’s actually necessary for any $1M+ (give or take) agency that wants to make financial decisions based on reality, not just cash flow timing.

5. Close the Books in a Timely Manner Each Month

Financial reports are only useful if they’re accurate, up-to-date, and reviewed regularly. Agencies that don’t close their books in a timely manner operate in the dark, making decisions based on outdated numbers.

The books need to be closed in a timely manner every single month. That means reconciling accounts, applying accruals, and reviewing financials so leadership has a clear picture of cash flow and profitability.

Frank Cowell, Founder, Revenue Ranch

Without this process, agency owners and leadership don’t know if they had a profitable month, where cash is tied up, or whether they’re overspending.

What Does “Closing the Books” Mean?

Closing the books means finalizing all financial transactions for the month and locking in the numbers so they can’t be changed. This includes:

Reconciling Bank Accounts: Ensuring all payments, invoices, and expenses are recorded.

Applying Accruals: Matching revenue and expenses to the correct month.

Verifying Accounts Receivable and Payable: Making sure outstanding invoices and bills are accurate.

Reviewing the P&L: Checking revenue, costs, and profitability.

Locking the Period: Preventing accidental changes to past financial data.

“If your books aren’t closed, you’re making decisions based on incomplete data,” Frank says. “You might think you’re profitable when, in reality, you have unpaid invoices or unexpected expenses that haven’t hit yet.”

Agencies that close their books on time have a financial pulse on their business. They know how much profit they made last month, what cash is available to reinvest, where expenses are increasing and need attention, and whether they’re on track with revenue targets.

Waiting until the end of the quarter—or worse, the end of the year—to assess profitability leaves agencies scrambling to fix financial problems too late.

To avoid delays, agencies should:

Set a deadline for month-end close (e.g., by the 5th of each month).

Automate bank feeds, invoicing, and expense tracking as much as possible.

Assign clear ownership—who is responsible for closing each financial category?

Schedule a monthly financial review to analyze results.

6. Conduct a Monthly Finance Review With CEO/COO

Closing the books is just the first step—analyzing the numbers and making informed decisions is what drives profitability. Agencies that don’t conduct a monthly finance review miss opportunities to optimize spending, improve cash flow, and increase profitability.

Frank emphasizes that leadership must be actively involved in financial performance.

“There should be a monthly review with the CEO and COO that includes insights around gross profit and expense optimization,” he says.

What Should Be Covered in a Monthly Finance Review?

The monthly finance review aims to identify trends, catch inefficiencies, and make data-backed decisions.

It’s not just about seeing whether we made money. It’s about understanding what’s happening in the business. Is the offering profitable, which is the gross profit? Where is the money going? Are we spending effectively? Are we getting an ROI on investments to acquire new revenue?

Frank Cowell, Founder, Revenue Ranch

For example:

If gross profit is low, leadership may need to increase prices or improve operational efficiency.

If AR is high, the finance team must tighten collections and follow up on overdue invoices.

If acquisition costs are climbing, the agency may need to refine marketing spend or improve sales conversion rates.

If administrative expenses are rising, leadership must assess whether costs are justified or need to be reduced.

How To Implement a Monthly Finance Review

Agencies should schedule finance reviews at the same time each month—ideally by the 10th after the books are closed (on the 5th). Each department head should bring insights into their budget, clarifying where resources are used most effectively. Documenting action items ensures financial optimizations aren’t lost, and follow-ups drive accountability.

7. Have an Accurate Understanding of Your P&L’s Key Financial Metrics

A profit and loss statement is a real-time scoreboard that shows whether an agency is running profitably. Agencies that don’t track and understand their P&L operate on gut feeling instead of data, which makes it nearly impossible to scale profitably.

Frank emphasizes that leaders must go beyond simply looking at top-line revenue and instead focus on the key financial metrics that determine long-term success:

If you don’t have an accurate understanding of your P&L, you have no idea what’s actually driving profitability. You could be growing revenue while making less profit and wouldn’t understand why it’s happening.

Frank Cowell, Founder, Revenue Ranch

Key Financial Metrics Every Agency Leader Must Track

Frank explains that three core financial metrics determine an agency’s financial health:

Metric | Why It Matters |

|---|---|

Cost to Deliver Services | Direct costs tied to fulfilling client work include salaries for client-facing employees and contractors and fulfillment-related expenses. A healthy agency ensures this cost stays controlled while maintaining service quality. |

Selling Expenses | The cost of acquiring new clients, including marketing, advertising, and sales team compensation. If acquisition costs are too high, an agency might over-invest in lead generation without seeing enough return. |

General & Administrative Expenses (G&A) | There are overhead costs required to run the agency, such as office expenses, software, executive salaries, and administrative staff. Understanding G&A ensures the agency isn’t spending too much on non-revenue-generating activities. |

“A lot of agencies focus too much on revenue growth without looking at what’s happening underneath,” Frank says. “They don’t realize that if their cost to deliver services is creeping up, their margins are shrinking even as revenue increases.”

Why Gross Profit Margin Is the Most Important Indicator of Profitability

Many agencies track net profit but fail to monitor gross profit margin—the percentage of revenue left after direct service delivery costs. This metric is critical because it determines how much money remains to cover overhead and reinvest in growth.

For example:

An agency with $500,000 in revenue and $250,000 in service delivery costs has a 50% gross profit margin.

If service delivery costs increase to $300,000 without raising prices, the gross profit margin drops to 40%, significantly reducing profitability.

Frank warns against ignoring these shifts:

Gross profit margin is what tells you if your business model is actually working. If that number is trending down, you have to take action—either by increasing prices, improving efficiency, or cutting unnecessary costs. I’ve seen too many firms allow this to go on for too long.

Of course, you don’t want to have a knee jerk reaction if you had one bad month or two. But as soon as it shows up as a trend, you can’t ignore it.

Frank Cowell, Founder, Revenue Ranch

Leaders who review the P&L monthly will catch trends early, whether that means adjusting pricing, improving service efficiency, or controlling overhead costs. Selling expenses should always be measured against revenue growth to ensure sustainable acquisition costs.

At the same time, general and administrative expenses must remain proportional to agency size and revenue to prevent unnecessary overhead from eating into profitability.

If you know your numbers, you’re in control. If you don’t, you’re just guessing.

Frank Cowell, Founder, Revenue Ranch

Profitability by Design, Not by Accident

Agencies that optimize cash and profit do more than increase revenue—they build a financially strong, self-sustaining business. Each of the seven financial attributes of Cash and Profit Optimization ensures predictable cash flow, disciplined spending, and sustainable profit growth.

“This isn’t about ‘managing finances’—it’s about building a business that funds its own growth,” Frank says.

Agencies that master these financial principles gain the freedom to reinvest in top talent, improve client acquisition, and scale with confidence. Those that don’t remain stuck in a cycle of cash flow uncertainty, unpredictable growth, and financial stress.

One way agencies create built-in profitability is by using the Profit First methodology. Instead of paying expenses first and hoping for leftover profit, agencies allocate profit as soon as income is received. By distributing revenue into dedicated accounts for profit, taxes, payroll, and operating expenses, agencies prevent overspending, ensure financial stability, and create long-term profitability by design.

As Shop Marketing Pros CEO Brian Walker explains:

Profit-first will help you run your business in a way where the numbers just make sense and where profit is a decision instead of a hope.

Brian Walker, Owner & CEO, Shop Marketing Pros

By combining Frank Cowell’s structured financial attributes with profit-first cash flow discipline, agencies create a model where revenue fuels growth—without financial stress.

Now is the time to take control—examine your cash flow processes, P&L accuracy, and financial review cadence to build a foundation for stability and long-term growth.

Written by

Francois Marchand brings more than 20 years of experience in marketing, journalism, content production, and artificial intelligence (AI). His goal is to equip agency leaders with innovative strategies and actionable advice to succeed in digital marketing, SaaS, and ecommerce.

Read more posts by Francois MarchandSee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.