Table of Contents

QUICK SUMMARY:

Expense management helps agencies control costs, optimize cash flow, and increase profitability. This guide by Brian Walker of Shop Marketing Pros simplifies expense management with practical tips for tracking spending, managing cash flow, and setting policies. It provides strategies that enhance financial stability, reduce stress, and help agencies focus on growth and client service.

Earlier this year I wrote an article for AgencyAnalytics on the topic of Profit First and how it changed my agency. I’m passionate about Profit First and I’m passionate about money management, even though I’m not the most disciplined person when it comes to spending. I’m passionate about it though because I’ve seen the impact it has had on my business, my personal income, my stress levels, and my team.

So when AgencyAnalytics reached out to me and asked me to write an article about expense management for agencies, I knew I wanted to write it, but I also had a bit of imposter syndrome.

I’m far from an expense management guru. I’m a spender, and when I see something I want or feel like the business can use, I buy it. I procrastinate in cancelling subscriptions, and I value my time over anything else, so I often overpay for things that if I spent the time to do it, I could save money in various ways.

I tend to drill things down to the most practical level because I prefer not to get into the minutia. I’m smart but I’m not one of those genius level business people who make a science out of everything.

Yet, my agency continues to grow despite me.

I suspect most of you reading this aren’t looking for overcomplicated ways to manage your agency’s expenses, so I suppose in a way I am the perfect person to write this article. Today, I’m going to share some super easy ways to manage expenses, along with stories about what's worked for my agency, Shop Marketing Pros.

What Is Expense Management?

Expense management may seem like a complex topic. If you do a Google search for “expense management” you’re met with pages of automated expense management software options, expense report apps, expense tracking programs, and more.

You can get as complicated as you want with this, but the truth is business expense management is simply the act of making sure you aren’t paying for things you don’t need, and you aren’t overpaying for the things you do need.

The expense management process typically includes activities such as:

Manual Expense Tracking for Smaller or One-off Purchases: Accounting software typically handles most of the heavy lifting, but some smaller purchases—like office supplies—may still require manual data entry. This guarantees that every expense is accounted for.

Tracking Employee Expenses: Monitoring employee spending on travel expenses, meals, and other work-related purchases is important for staying within budget. Tracking employee spending will help prevent errors and ensure fair and accurate reimbursement.

Creating an Expense Management Policy: A well-defined expense management policy outlines expectations for employee spending, approval processes, and reimbursement timelines. This clarifies company policies and reduces the chances of misunderstandings or disputes.

Communicating With the Accounting Department: Regular communication with your accounting team (whether external or internal) helps maintain accurate expense reports and make sure that expenditures align with company policies. They’ll also be able to identify trends in spend management that could influence compliance.

As I dive into this topic further, I’m also going to talk a bit about how to manage agency cashflow, which isn’t technically an expense management system, but it’s related enough that I’m giving myself permission to go there in this article. The truth is, cashflow and profit are what we are all looking for anyway.

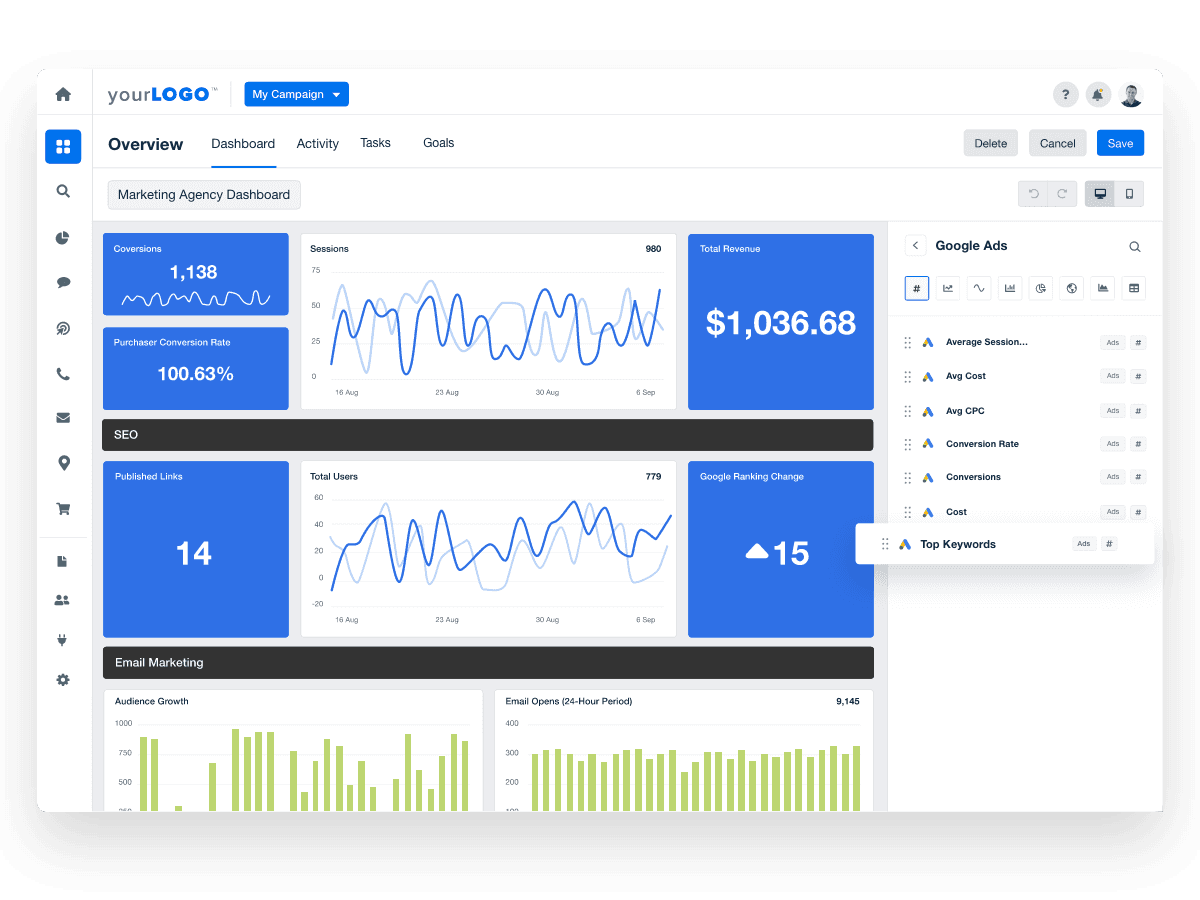

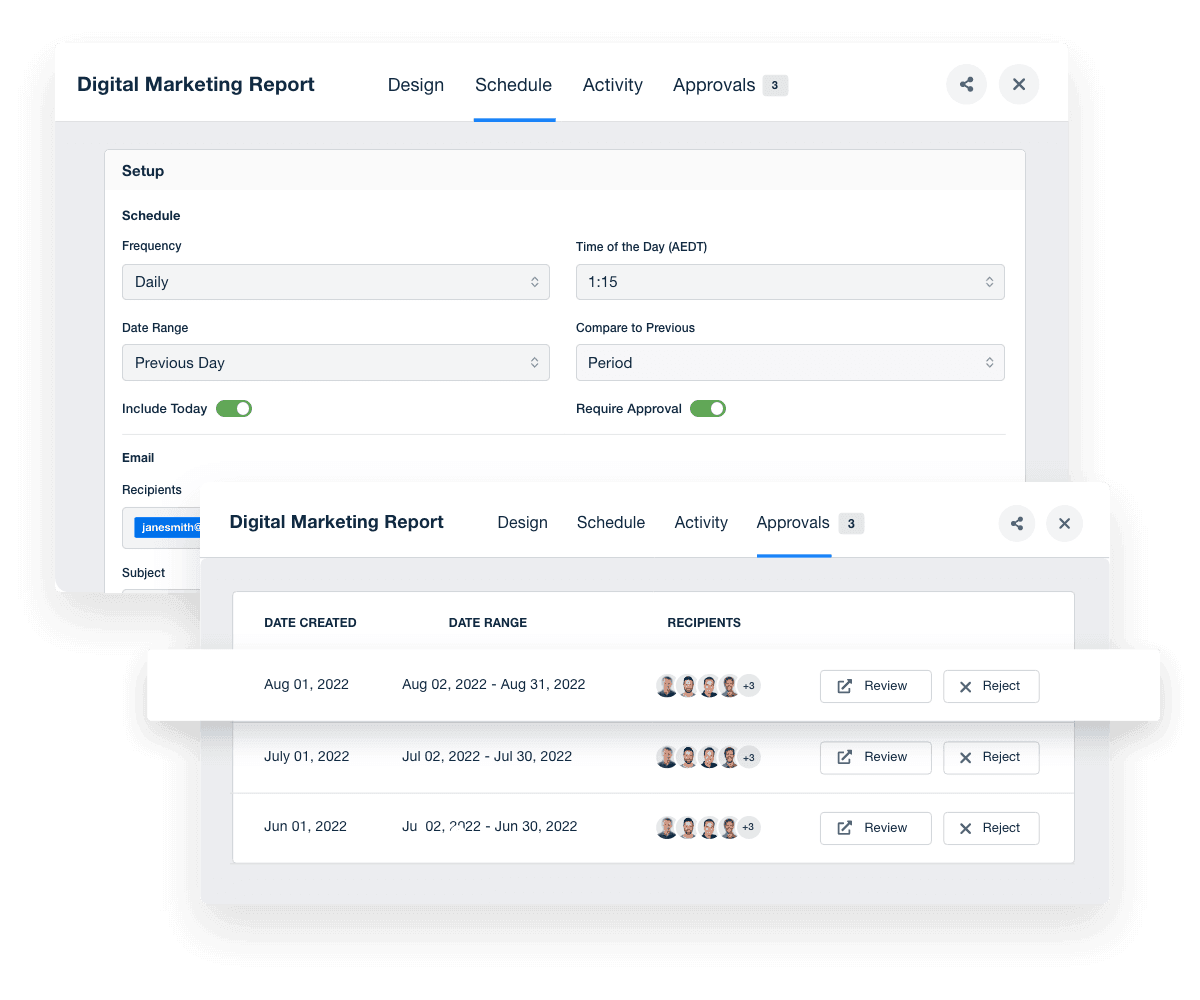

Track financial performance alongside your marketing metrics in one easy-to-use platform. Start your 14-day free trial today and keep your agency’s finances on point!

9 Expense Management Hacks That Transformed My Agency’s Finances

Expense management is a complex process, and the details will look different at each agency. Below I share the 9 things that have helped my agency the most.

In many cases, these processes have been made all the more efficient and effective by my fractional CFO.

While hiring a fractional CFO isn’t for every agency, it was the right decision for Shop Marketing Pros.

It was also a pretty frustrating process as I went through multiple fractional CFOs before finding the right one. I had almost given up entirely on the idea of working with a CFO, but thankfully I gave it another chance.

My current CFO was recommended by a coach I was working with at the time who told me that a few of his clients were working with her and she was producing the cleanest, most organized sets of books he had ever seen. She and her team have lived up to the hype.

She and I meet twice per month. One of those meetings is just a quick run through the finances and the other is a more in-depth look, as well as a deep-dive into our budget vs actual report.

I actually have her doing the same exact thing for my personal finances as I have her doing for my business now. This has been a game-changer!

Now, let’s take a closer look at the most important expense management activities for your agency:

1. Keep Your Eyes On Your Money

I want to warn you that some of the stuff I’m going to cover here is going to sound elementary, but the truth is there’s a chance that many of you aren’t doing the most basic things–I know I wasn’t. A lot of accidental agency owners like myself are amazing marketers and terrible businesspeople.

You will never have a successful agency if you don’t become as good at running a business as you are at marketing, or design, or whatever you consider to be your zone of genius. And the first step here is to actually watch your money.

When I first hired my fractional CFO, she and her team were doing everything for me. Prior to that I was going into Quickbooks every week and categorizing transactions. I was doing a poor job of it, but I was doing it. When Madeline and her team took over, I began to feel so disconnected from my business’ finances.

I told her how I was feeling and she had a great solution for me. She set up an automated report that comes to my email each week that has a list of all of the transactions in spreadsheet form. This comes to me after they have been categorized so I can let them know if I see something in the wrong category. Most importantly, I still see every transaction in my business but it takes me a small fraction of the time that it used to.

On a regular basis, I catch transactions that should not have occurred as well as singular transactions that processed multiple times. In a few cases we have caught payments that appeared to have been completed but never actually processed to our accounts, resulting in missed income, or almost missed income (more on that later).

Brian enjoys the convenience of automated reports landing in his inbox, helping him stay on top of his agency’s finances. Give your clients the same seamless experience with automated marketing reports. Start your 14-day free trial of AgencyAnalytics today and see how effortless reporting can be!

2. Audit Your Recurring Expenses and Subscriptions

Twice per year you should audit your recurring expenses and subscriptions. For me–as the owner–I get used to seeing these subscriptions go through, but I’m not the one actually using those subscriptions. So the question becomes, “Are we still using this and do we actually need it?”

When you dive into this task, go through the last month of transactions and put every subscription or recurring transaction into a spreadsheet. Share that spreadsheet with your team and ask them to look at all of the softwares and services that they use and note whether it is still being used or not.

The first time I went through this exercise I found almost $1500 in recurring charges and subscriptions that we were no longer using. Just a few months ago when I last did this, I ended up canceling over $700 in recurring charges.

The monthly recurring charges are the easy ones. The annual charges are the ones that will get you because they sneak up on you. You must train yourself to catch these as you go through your transactions each week.

Going through this process will save you thousands of dollars each year.

Agency Tip: Although it’s an extra expense, an expense management app will streamline your expense management processes. These tools simplify how you create expense reports and track spending, saving your team valuable time. With automated features for expense reporting and built-in compliance checks, apps like these make expense management important for agencies aiming to stay organized and efficient. Choose a solution that allows employees to easily manage expense reports on the go, ensuring nothing slips through the cracks.

3. Use Multiple Bank Accounts

If you’re following Profit First, you’re already doing this. For those of you who are not, I highly recommend you do.

The reason to use multiple bank accounts in this context is that it categorizes transactions for you by default and you can more closely keep an eye on your operating expenses account, because that will be the account where most of the expense management needs to take place.

That doesn’t mean to ignore your other accounts. You need to keep an eye on all of them. But keeping things separate allows you to, for example, skim your payroll account quickly. Anything out of place will stick out to you because you know you should only be seeing a certain type of transaction in that particular account.

4. Keep Personal Expenses Separate From Business Expenses

One of the fastest ways to allow your expenses to get out of control is to co-mingle your personal expenses with your business expenses. Legal reasons aside, this is a terrible practice. I allowed this to happen in my first business and it was a mess. I had no idea how my business was performing. I also had no idea what my personal income was and I lived beyond my means - to the detriment of my business.

You cannot manage business expenses when you mix in expenses that have no business being there in the first place.

Pay yourself a reasonable salary. Take consistent, planned distributions and pass-throughs on top of your salary. But as the owner your salary, distributions, and pass-throughs should be the only place where your personal funds impact your business.

5. Run Your Business On A Budget

For the first 11 years of my business, we operated without a budget. During that time I had the opportunity to serve on the boards of a couple of non-profits, and we went through their financials each month. We would always look at a “budget vs actual” report and I always wished I had that for my business.

When I started working with my CFO I told her one of my top priorities was to create a budget for the business and to have a budget vs actual report to look at each month. Today we have a pretty solid budget created that allows us to forecast what’s going to happen in the business. We go through this report together monthly.

Having a budget is, in my opinion, the most important part of expense management. Without a budget there is no benchmark to manage against. If you find yourself in a place where you are running a business without a budget, make this the next priority in your business finances, put a date on it, and start operating on a budget.

My favorite part about having a budget is being able to run scenarios. Let’s say I want to hire someone, give someone a raise, or take on a subscription for an expensive software. We can plug the new expense into the budget and see exactly how it impacts our profits.

Know up-front that your first budget will be far from accurate. Refine it as needed and in time it will become one of the most valuable tools in your business.

Read More: Bootstrapping a Business: Tips and Tricks from a 14-Year CEO

6. Utilize Credit Cards

It feels strange to me to be praising credit cards, given that I totally used to be a Dave Ramsey disciple. I believed that credit cards were evil. I still believe that credit cards are not for everyone. If you aren’t disciplined enough to pay that card off–in full–every month, then stay away from credit cards.

That said, the expense management piece comes into play with the fraud protection features, spending limits, and virtual cards.

Any time fraud has occurred on my card, I’ve been immediately reimbursed and issued a new card–and they’ve even allowed the old card to continue to work with trusted vendors. That last part is huge, because now I don’t have to update billing info on all of those vendors.

Allowing me to put preset spending limits on employee cards enables me to give team members autonomy without them being able to take spending too far.

Read More: 6 Steps To Hiring the Perfect Agency Executive Leadership Team

7. Levelize Your Expenses

This is a different way of looking at expense management, but it is expense management nonetheless. I like to level out my expenses throughout the year. I don’t like big abnormalities in my expenses that randomly hit my accounts.

When I started working with my EOS Implementor that was quite an expense to take on. Don’t get me wrong, it’s some of the best money I’ve ever spent, but it is significant and it was broken up into only 4 payments each year, and the payment for the two-day annual is double what the other 3 are.

As much as I know it is money well spent, every time I’d write that check I would question if it was worth it and if I should look at other options. Then one day I asked my implementor if I could take the total amount, divide it by 12, and send a check each month. He said “sure” and I set it up in my online banking to send him a check each month. Now it is out of sight and out of mind, and it allows my cashflow to stay more level.

I did the same thing with a podcast that I advertise on that was billing me quarterly. I asked if we could pay monthly instead and he was happy to do it. Afterwards, he told me he realized it was better for him too as it helped level out his income. And now for me it’s another thing that is out of sight and out of mind.

I like my expenses to be the same month over month and I’m willing to pay slightly more for that to happen. That may not seem smart, but I feel very smart when my profits are consistent all year long. I feel smart when I have zero cashflow issues throughout the year. I’m not a professional money manager, and I would rather have predictability than that tiny bit of extra profit.

Ask your vendors about how they can work with you to level out your expenses. It’s a win-win for them and you.

8. Levelize Your Income

Having levelized expenses doesn’t do much good if your income has wild fluctuations. We used to follow the traditional agency model of chasing RFPs, feeling calm and happy one month and about to starve to death the next. Changing to the MRR (monthly recurring revenue) model has been a beautiful thing.

I’m not saying the old way of doing things is the wrong way, but I am saying I sure sleep a lot better than I used to. Take this one for what it’s worth.

9. Don’t Overlook Managing Your Income

I mentioned earlier in the article that we had a few cases where payments were marked as completed but they had never actually been processed to our account. A couple of these happened for such a long period that I couldn’t reasonably ask the client to get caught up. That income was lost and we’ll never see it.

Make sure that you are reconciling your client’s payments to your accounts. Just because the credit card processor says it was paid does not mean that it was.

We put a process in place where we look at this every month and we found some others where this happened and we were able to catch it right away.

Summary & Key Takeaways

Money management is the thing that will give you more freedom than just about anything else you can do in your business. As Dave Ramsey likes to say, “If you don’t tell your money where to go, you’re going to wonder where it went.”

That works the same in both personal and business finances.

Managing your agency’s expenses and cashflow doesn’t require you to be a financial genius—it requires awareness, intention, and a commitment to improvement. By implementing even a few of the strategies I’ve shared, you’ll start to see benefits to your bottom line, your stress levels, and your ability to focus on what truly matters: growing your agency and serving your clients. Remember, financial freedom isn’t about perfection—it’s about progress. Take control of your agency’s money, and you’ll take control of your agency’s future.

Written by

Brian Walker, Owner and CEO of Shop Marketing Pros, leads a marketing agency for independently owned auto repair shops. With a background as a Mercedes Benz Master Technician and former Mechanical Division Director for ASA-NC, Brian's passion for fixing things extends to marketing. He loves solving marketing challenges for auto repair shop owners, combining his expertise and enthusiasm to help their businesses thrive.

See how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.