Lifetime Value

Forecast Profitability

Predict long-term revenue by identifying the value of retained customers.

Optimize Customer Acquisition Costs

Balance acquisition costs with expected lifetime revenue from customers.

Enhance Retention Strategies

Identify high-value customers and focus on keeping them engaged.

Personalize Marketing Efforts

Use LTV insights to tailor campaigns toward high-value segments.

Why Lifetime Value Is Important

While Lifetime Value (LTV) and Customer Lifetime Value (CLV) are often used interchangeably, LTV, often called customer lifetime, emphasizes the total monetary value generated by the entire customer base over time, whereas CLV focuses on the revenue brought in by an individual customer relationship throughout their average lifespan. Understanding Lifetime Value is a practical way to balance Customer Acquisition Costs (CAC) with customer value.

If acquisition costs rise, knowing the average Lifetime Value helps keep profitability in check. Retaining existing customers boosts LTV, reduces churn, and ensures steady future revenue. Businesses that track LTV adjust marketing efforts and sales strategies to focus on high-value customers—the ones who make repeat purchases and stay engaged longer.

Stop Wasting Time on Reports. Get Marketing Insights in Minutes With AgencyAnalytics.

How LTV Relates To Other KPIs

Lifetime Value and Customer Acquisition Cost are two sides of the same coin. When LTV is significantly higher than CAC, businesses are healthy, generating more revenue than they spend to acquire new customers. However, high Churn Rates reduce the average customer lifespan, impacting LTV.

Average Purchase Value and frequency also shape LTV. Loyal customers who buy more often or spend more directly improve this metric. Combining LTV with Customer Retention Rates gives a full picture of how sustainable a company’s growth is. This insight helps businesses forecast future revenue and tailor customer acquisition strategies.

Key Factors That Impact Lifetime Value

Several factors directly impact LTV, starting with the quality of customer relationships and onboarding processes. Metrics like average purchase frequency rate are essential in boosting LTV. A strong onboarding experience increases the chances of creating loyal customers, while a poor one shortens the customer lifecycle.

Customer satisfaction plays a crucial role as well. When a customer continues to engage, LTV increases naturally. Meanwhile, customer feedback provides actionable insights that may extend the average customer lifespan. Predicting LTV through past data allows companies to identify customer segments worth investing in, maximizing future revenue.

KPIs are important to clients because they want to understand how much they are spending, what they are spending it on and most importantly, what is the return on their spend. They also want to be able to measure the progress of the marketing campaigns month over month.

How To Calculate LTV

The following Lifetime Value calculation provides insight into how much value customers generate. This Lifetime Value formula highlights the average value each existing customer adds to the business. Businesses use this insight to increase LTV by encouraging larger purchases, boosting purchase frequency, and extending customer relationships.

Lifetime Value Formula Example

What Is a Good Lifetime Value?

A good average customer Lifetime Value ensures long-term profitability and healthy customer retention. If the LTV is at least three to five times the CAC, the business is on solid ground.

What Is a Bad Lifetime Value?

A low LTV indicates that existing customers either don’t stay long or spend less. This may point to issues with customer retention or poor customer experience. If CAC outweighs LTV, it signals inefficiency—businesses spend more to attract customers than they earn back.

How To Set Lifetime Value Benchmarks and Goals

Benchmarks vary across industries, so it's essential to look at past data and segment the customer base. Use predictive Lifetime Value models to identify trends and set targets based on performance across different customer segments. Historical trends, like Churn Rate and Average Purchase Value, also help fine-tune these benchmarks.

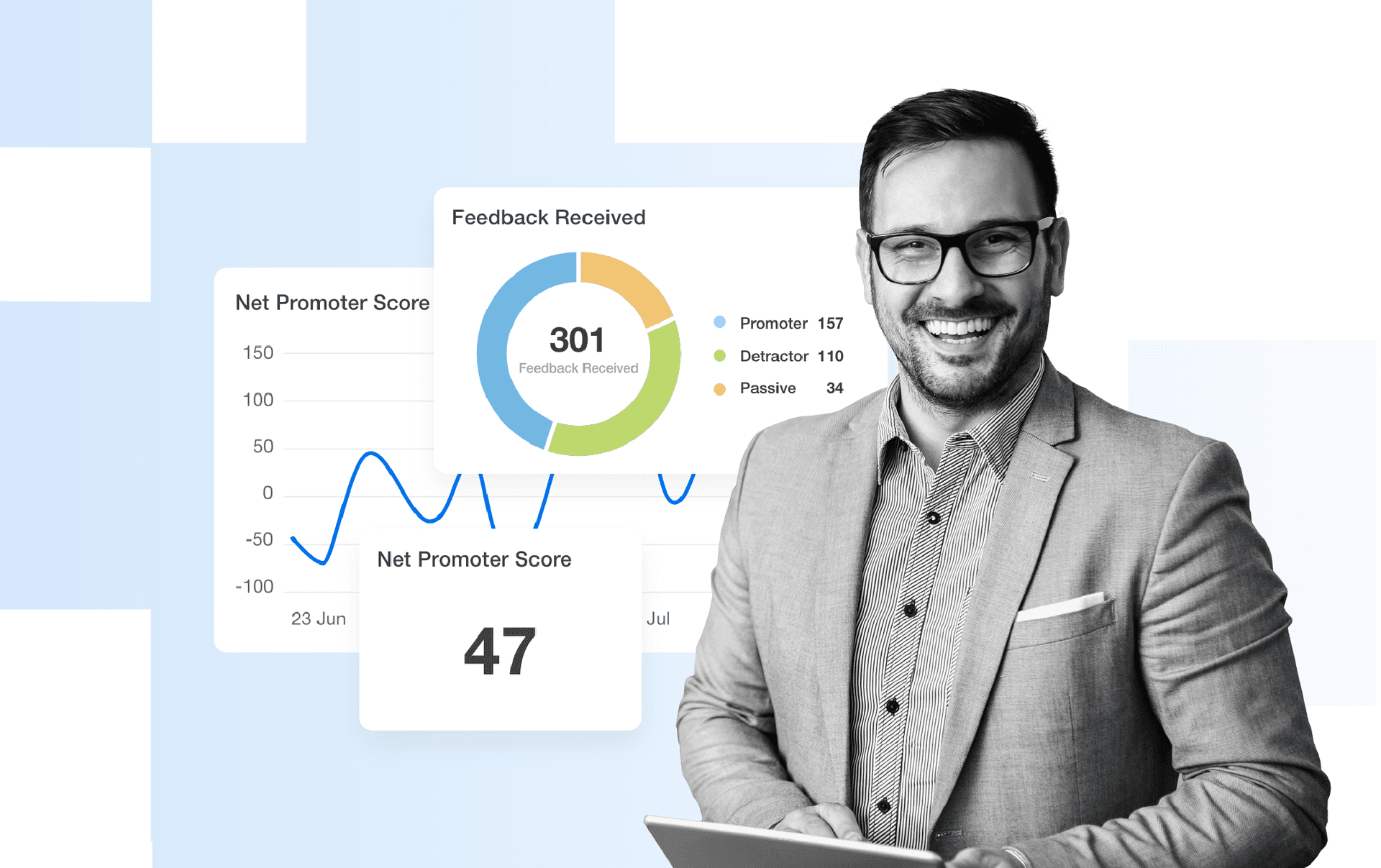

Why Lifetime Value Matters to Clients

With Lifetime Value, clients gain insight into how much value their customer relationships generate over time. This insight informs whether Customer Acquisition Costs are justified and where to focus sales strategies. A high LTV signals strong customer loyalty and consistent repeat business, while a low LTV highlights areas for improvement in customer retention. With LTV data, clients tailor marketing efforts to meet customer expectations, leading to better customer experience and sustained future revenue.

Why Lifetime Value Matters to Agencies

For agencies, LTV is a critical metric that aligns marketing campaigns with long-term profitability. It helps agencies prove the value of their work by showing clients how campaigns improve customer retention and extend the customer lifecycle. Agencies monitor a client’s customer relationships to ensure long-term value and growth.

Additionally, agencies use LTV to manage customer acquisition costs efficiently and ensure their strategies generate more revenue over time. Agencies that deliver on LTV build trust, improve client relationships, and keep clients coming back.

Discover the All-in-One Reporting Tool Trusted by {{customer-count}}+ Marketing Agencies

Best Practices When Analyzing and Reporting on Lifetime Value

Accurate analysis of LTV gives businesses a clear understanding of how much monetary value their customer relationships generate over time. These practices ensure that LTV data reflects true performance and helps businesses align their efforts with long-term goals.

Ensure Data Accuracy

Accurate Lifetime Value calculation relies on precise customer data—including Average Order Value, customer segment performance, and customer behavior. Inconsistent data may distort predictive Customer Lifetime Value models and lead to flawed insights about the entire customer base.

Analyze Over Time

Analyzing trends over time helps measure customer lifetime effectively. Businesses with a higher average lifespan for active customers maintain high Customer Lifetime Value by focusing on repeat business and brand loyalty.

Compare Across Channels and Campaigns

Tracking LTV by campaign helps businesses see which efforts attract high-value customers who increase the client's total revenue. Comparing channels ensures that marketing budgets focus on the ones delivering sustainable customer LTV growth.

Put in Context

LTV works best when paired with Customer Acquisition Cost to gauge profitability. A high Lifetime Value means customers bring in more than what it costs to acquire them, creating a positive impact on the company's total revenue.

Align To Client Goals

LTV analysis only matters if it aligns with client objectives. Focus on increasing customer lifetime and driving future cash flow through stronger customer relationships. Reporting on the entire customer base helps businesses act on insights across every customer segment.

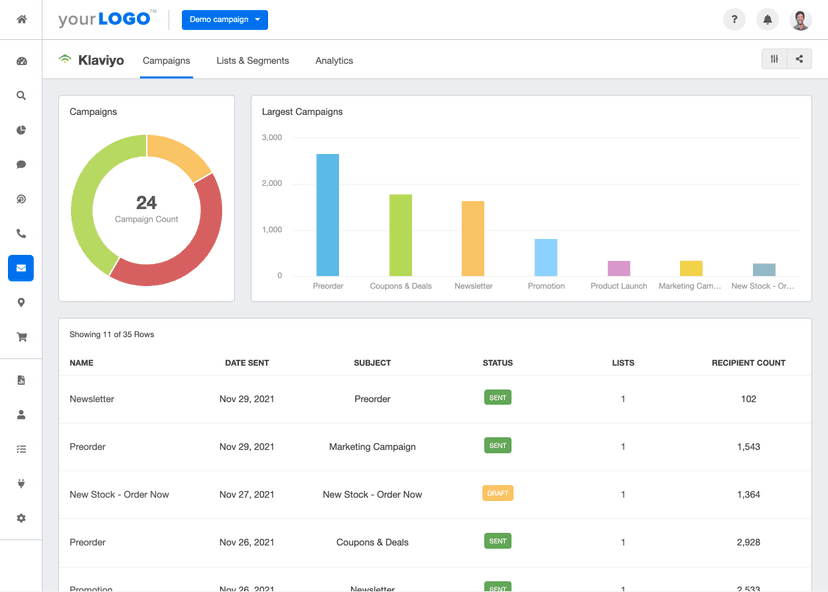

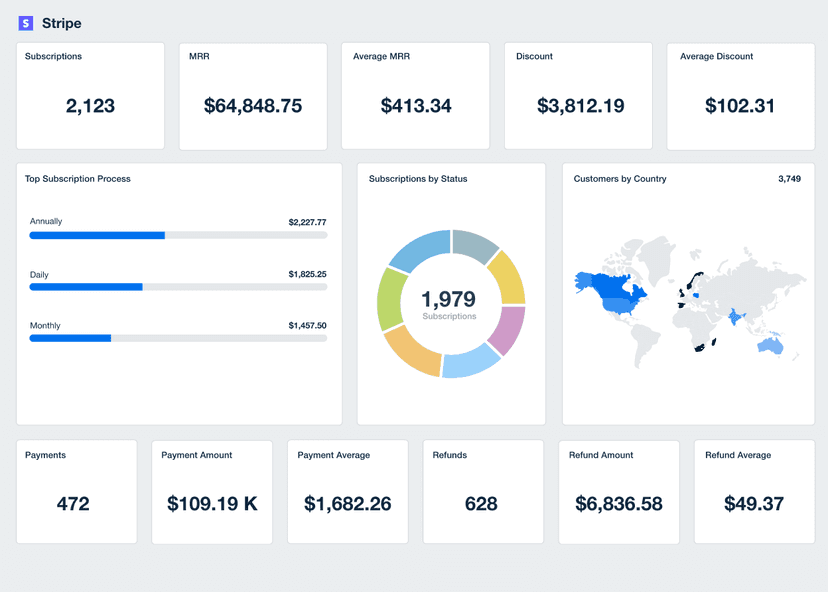

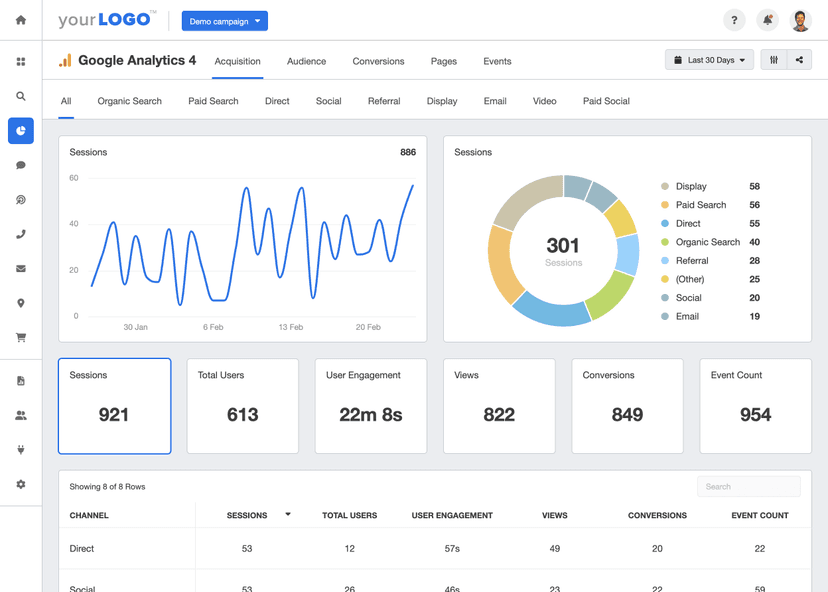

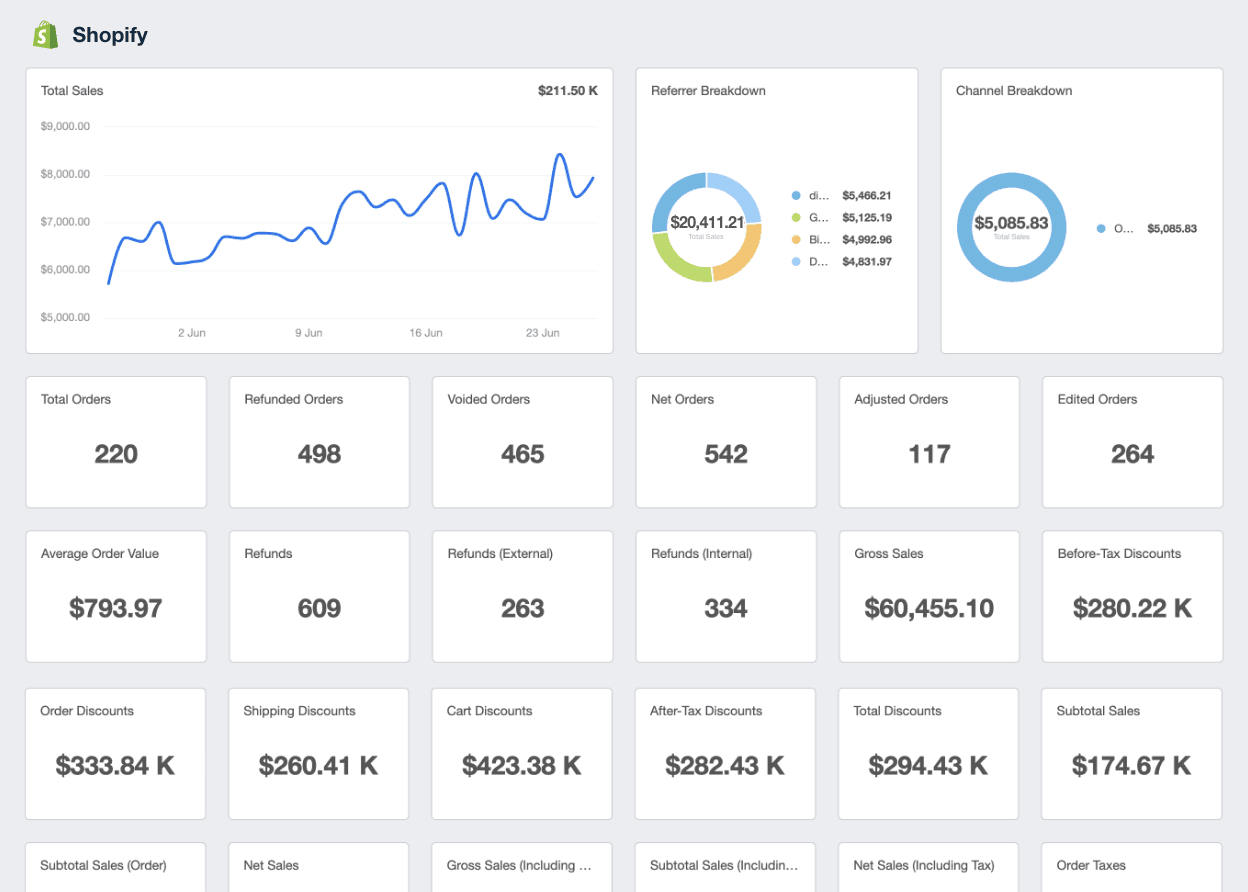

Visualize Performance

Use dashboards to visualize metrics like Average Revenue, Average Order Value, Customer Retention, and LTV growth. Clear visuals help decision-makers understand how each campaign supports long-term objectives and whether they meet targets for high customer Lifetime Value.

With custom reports, we can zoom in on the key performance indicators and metrics that matter most to our clients, making our reporting experience incredibly valuable and directly relevant to their success.

Shopify Dashboard Example

Related Integrations

How To Improve Lifetime Value

Optimizing Lifetime Value requires strategic actions across every step of the customer lifecycle. Here are three actionable tips to increase LTV and build stronger customer relationships.

Focus on Onboarding Excellence

A smooth onboarding process ensures that new customers engage from the start. The quicker a customer finds value, the more likely they’ll continue buying, improving average customer lifetime.

Personalize Marketing Campaigns

Using customer data to tailor emails, offers, and ads boosts customer loyalty and increases repeat business. Tools like Klaviyo and Shopify can enhance personalization and help create high-value customers.

Optimize for Retention

Tracking churn rates helps identify areas for improving customer satisfaction and retention. Offer incentives or loyalty programs to keep existing customers engaged and increase their average lifespan.

Related Blog Posts

See how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.