Table of Contents

QUICK SUMMARY:

Understanding the distinction between revenue vs. income helps agency owners make smart decisions to optimize agency operations. While revenue reflects total earnings, income is what’s left after expenses. In this article, you’ll learn the difference between revenue and income, and explore the other key financial metrics that agency owners need to be tracking.

As the global digital advertising market races toward a projected $786.2 billion valuation by 2026, agencies face mounting pressures to get a piece of the pie and increase their revenue.

However, high revenue is only part of the picture of a company’s financial health. Understanding the differences between revenue vs. income empowers business owners to optimize their financial performance in ways that really matter.

Revenue indicates the demand for services, while a company's net income (or net profit) reflects operational efficiency and expense management. This distinction is key: high revenue doesn’t mean much if operating expenses also remain high, potentially leaving you in the red.

In the digital agency world, understanding revenue vs. income is the first step to being able to implement an effective business strategy, manage operating costs, optimize processes, drive sustainable growth, and ensure you remain competitive.

While you’re certainly already familiar with both of these terms, today we’ll be exploring the nuances at greater depth, while also providing some additional (and lesser known) financial metrics that are critical to your agency’s long-term success.

What is Revenue?

Revenue is the total amount of money generated from core business operations. It’s also called gross sales or "the top line" because it’s the first line on a company's income statement.

Growing your agency’s total revenue is essential for long-term financial health. Higher revenue boosts your potential for profit and fuels stability. While aggressive marketing, creative pricing, and market expansion can drive higher revenue, it's only one part of a balanced financial strategy.

Revenue streams can take many forms, such as:

Sales of goods and services

Advertising

Licensing agreements

Service fees

Subscriptions

Rental income

Understanding these sources and how to grow them strategically will help strengthen your agency’s foundation and competitive edge.

What is Income?

Income, net income, or net revenue, is what’s left after deducting expenses. It’s the "bottom line" that shows how much money the agency actually keeps after everything’s paid for. Getting to net income means taking a company's revenue and subtracting several types of costs, from administrative expenses to taxes.

Income can be broken down into two main types:

Gross Income: This is total income before expenses, also known as gross profit, gross revenue, or gross margin. It’s calculated by subtracting the cost of goods sold (COGS) from your revenue.

Net Income: Net income, on the other hand, is revenue minus expenses, which include taxes, interest, depreciation, administrative costs, labor costs, and anything else that falls under the cost of doing business.

Understanding these different types of income helps agencies keep a pulse on their financial health and profitability, showing both where they’re making money and where they can cut costs.

Income vs. Revenue

Total revenue is the amount of money your agency generates through selling your services. This number is represented on your company's income statement. Income (or net income) is what’s left after deducting expenses.

Both are crucial for calculating agency profit margins and understanding your company’s profitability; total revenue gives a snapshot of demand, while net income shows efficiency in managing costs. While the terms revenue and income are sometimes used interchangeably, they are not the same.

Most of the time the actionable metrics are specifically those along the path of revenue. Vanity metrics end up being more of a distraction than a help.

Nathan Hawkes, President, Arcane Marketing

What Factors Affect Revenue vs. Income in an Agency Setting?

In an agency setting, the balance between gross revenue and net income is defined by several factors, both internal and external. Two key drivers of profitability are billing rates and utilization rates, and both have a significant impact on profit impact margins.

Employee costs, including salaries and benefits, represent the largest expense for agencies, forming most of the Cost of Goods Sold (COGS) and a big portion of operating expenses.

After staffing costs, tools and software are the next major expense. According to Promethean Research, the average agency spends 3.7% of its revenue (excluding pass-through costs) on tools.

Let’s take a look at some of the main factors that impact an agency's revenue vs. income.

Internal Factors That Affect Revenue vs. Income

Employee and Contractor Costs: Salaries and fees for staff and contractors often dominate expenses, with some agencies spending up to 70% of revenue on staffing. This impacts net income directly.

Operational Expenses: High-cost locations (e.g., New York, San Francisco) raise rent and operating costs, requiring higher billing rates or premium clients to offset costs.

Client Profitability: Assess profitability by client to allocate resources more efficiently, focusing on high-value accounts to maximize net income.

Retainer vs. Project-Based Clients: Retainer clients provide more stable revenue streams, whereas project-based models may lead to fluctuating income, affecting long-term planning and investment.

Automation and Project Management Tools: Project management tools help agencies streamline workflows, reduce labor costs, and improve profit margins.

Resource Allocation: Assigning teams based on skills and project needs boosts efficiency, helping to maximize billable hours and reduce time losses.

External Factors That Affect Revenue vs. Income

Industry Demand: Economic booms often increase demand for agency services, while downturns may prompt clients to cut budgets, affecting both revenue and income.

Economic Shifts: In challenging economic climates, clients may downsize budgets, impacting revenue and potentially net income if fixed costs remain unchanged.

Pricing Strategy: Competitive pricing pressures, especially from larger agencies offering bundled services, may impact smaller agencies, forcing them to either lower prices or specialize.

Emerging Competitors: New or low-cost competitors often drive pricing adjustments, which may reduce revenue and profits if rates drop too low.

Payment Cycles: Long payment cycles (90 days or more) lead to cash flow issues, impacting an agency’s ability to cover operational expenses and maintain stable income.

Collection Efficiency: Structured collections ensure prompt payment, helping agencies maintain steady cash flow and reduce financial strain.

Data and Analytics Integration: Agencies that leverage data analytics can offer more valuable, data-driven insights, enhancing both revenue and profitability through premium pricing for these services.

Both internal and external factors will affect your agency’s bottom line, also referred to as profit margin.

What Is a Good Profit Margin for a Marketing Agency?

Marketing agencies typically focus on two key profit margins: gross profit margin and net profit margin.

Gross Profit Margin

The percentage of revenue remaining after deducting direct costs tied to service delivery. This includes employee salaries for those working directly on client projects, software, tools, and outsourced services.

Net Profit Margin

This number factors in both direct and indirect costs such as overhead, administrative salaries, rent, utilities, and marketing expenses. It reflects overall profitability after all costs are accounted for.

On average, U.S. digital agencies have a 15% profit margin. Smaller agencies with fewer than 10 full-time employees (FTEs) tend to be the most profitable, while agencies with 10-24 FTEs typically see margins around 15%, and those with more than 25 FTEs usually fall closer to 13%. These figures make digital marketing agencies among the more profitable business types.

As a general rule, margins in the single digits may signal financial challenges, while anything above 20% indicates strong performance. Margins exceeding 25% mean you’re definitely doing something right!

Two additional metrics that further gauge performance:

Net Revenue Retention (NRR) reflects client success and business growth, with a rising NRR indicating stronger long-term client relationships.

Time to Revenue (TTR) measures how quickly a new client generates income, emphasizing the importance of efficient lead generation, project execution, and invoicing. Accelerate time to revenue by making sure core processes are as efficient as possible, from lead generation to project delivery and invoicing.

Understanding and optimizing these margins and metrics will significantly improve your agency's financial health.

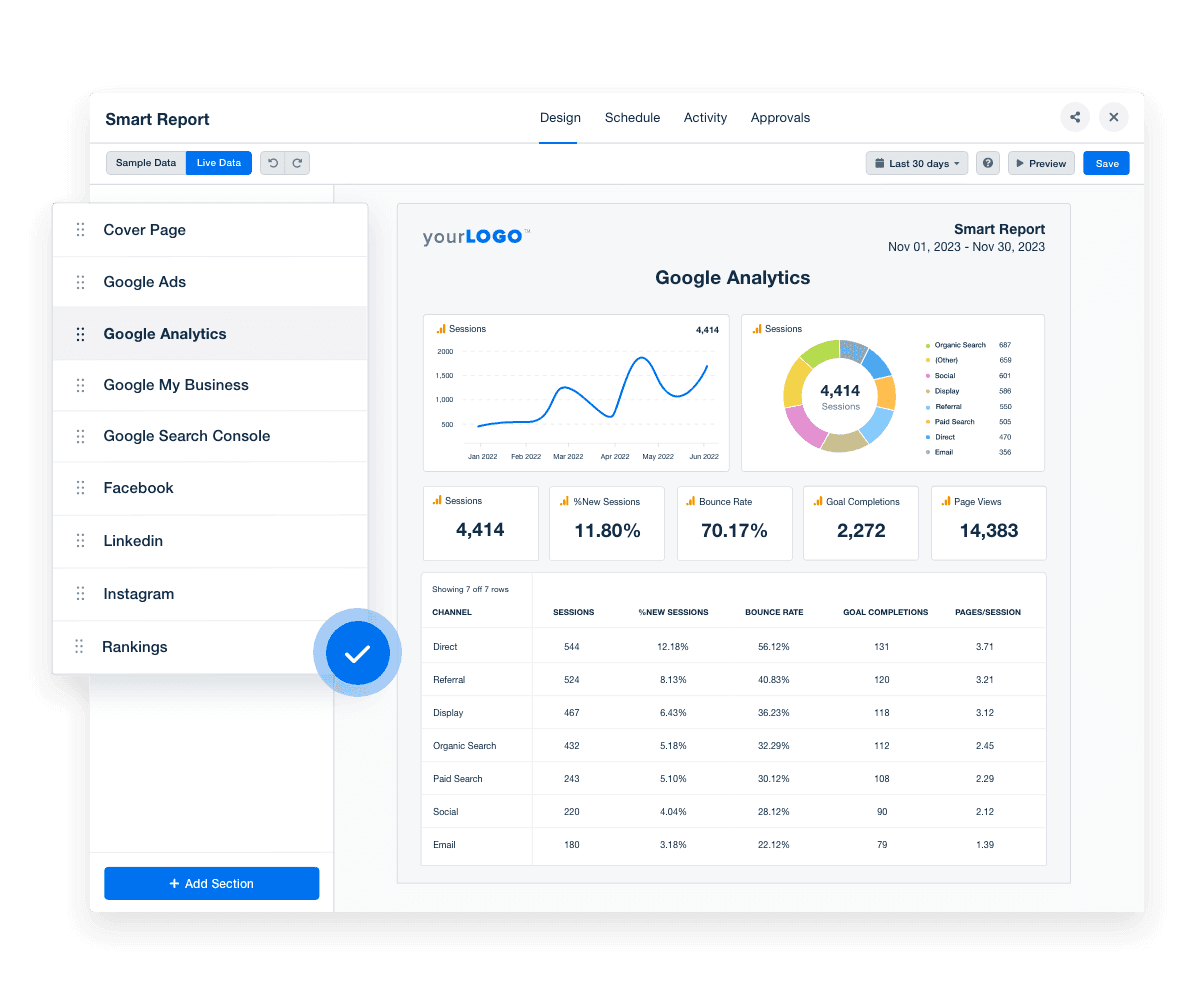

Impress clients and save hours with custom, automated reporting.

Join 7,000+ agencies that create reports in minutes instead of hours using AgencyAnalytics. Get started for free. No credit card required.

Agencies can lose a significant amount of recurring revenue in a recession, and have a difficult time scaling down labor costs. So you’re faced with letting team members go to maintain margin, or eat into your reserves and try to ride out the storm. It’s not a fun place to be.

Ryan Kelly, CEO, Pear Analytics

5 Ways To Maximize Your Agency’s Income

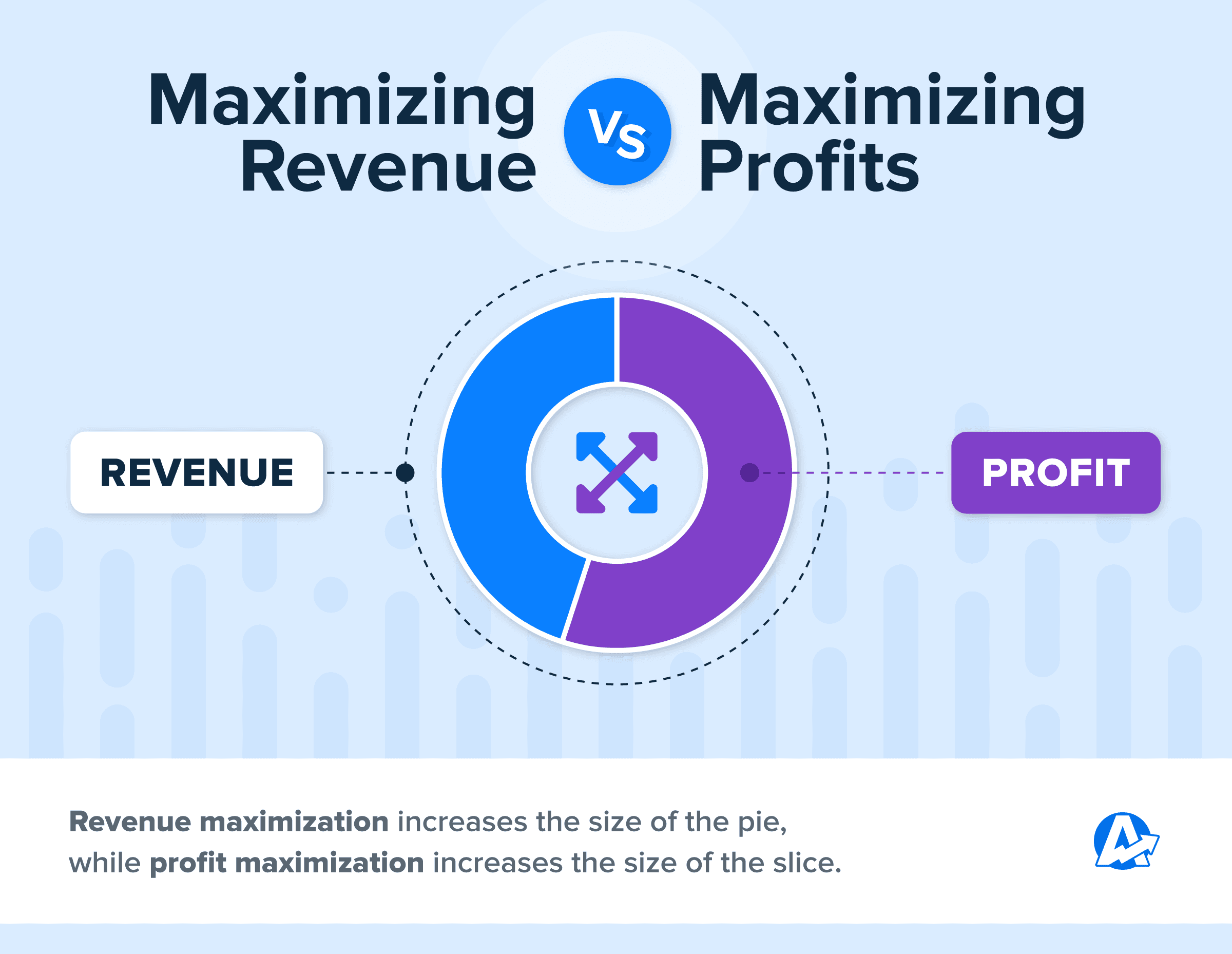

Increasing your agency’s revenue is important, but it doesn’t always translate to higher profits if the costs of generating that revenue are too high. In short, revenue growth is about expanding your potential, but profit growth focuses on making that potential work for you.

We can’t emphasize enough how critical a profitability strategy is. It’s not just about driving sales but also managing costs effectively to ensure that revenue gains actually lead to increased income.

Here are five key strategies to optimize your agency’s income and boost your bottom line.

1. Develop Scalable Processes and Services

To scale effectively, you need consistent systems in place to avoid reinventing the wheel with each new client or project. Developing clear standard operating procedures (SOPs) for tasks like client onboarding or campaign launches will save time and reduce errors.

Consider using templates and checklists like:

These resources are full of valuable information to help define your processes and keep your team aligned as you scale.

Scale smart with Smart Reports–create custom, white labeled client reports in as little as 11 seconds. Try AgencyAnalytics free for 14 days!

2. Reduce Operating Expenses

If your team spends time jumping between multiple platforms or dealing with inefficient internal communication, it’s more than just a productivity issue. Invisible costs will quickly eat into your agency’s profitability, and every minute spent on administrative tasks adds up.

To save money and increase efficiency, regularly review your tech stack and invest in tools that automate time-consuming processes.

Tools for automating reporting, for example, eliminate the manual work of data entry and reporting, freeing up your team’s time for more valuable tasks.

This approach not only reduces administrative costs but also saves billable hours, ultimately improving both your income and your agency’s overall efficiency.

3. Optimize Delivery Margins

Delivery margins are key to agency profitability, reflecting the profit remaining after direct service costs. Optimizing these margins promotes growth and sustainability.

Formula: Delivery Margin = (AGI - Delivery Cost) / AGI

A “healthy” delivery margin is typically 50-60% for agency-wide margins and 60-70% for specific projects or clients. Wondering how to improve your agency’s delivery margin? Here are the key levers that will influence this metric:

Average Billable Rate (ABR) measures how efficiently your team earns revenue.

Formula: ABR = AGI / Delivery Hours To boost ABR, increase prices without changing scope, or reduce production time without lowering quality.

Average Cost Per Hour (ACPH) measures the cost of delivering work.

Formula: ACPH = Total Payroll Costs / Total Hours To optimize ACPH, streamline processes and use more junior staff where appropriate. A healthy ACPH is usually about a third of your ABR.

Utilization measures how much of your team's capacity is spent on revenue-generating work.

Formula: Utilization = Delivery Hours / Capacity. A utilization rate of 50-60% is considered healthy. You can increase your utilization rate by either selling more work or adjusting your team’s capacity to better match available hours.

By managing these levers effectively, you’ll maximize your agency's delivery margins, boosting both profitability and growth.

4. Implement Revenue Marketing

While some marketing campaigns focus on building brand awareness or promoting new products, revenue marketing directs all efforts toward driving revenue growth.

First things first—what is revenue marketing?

Revenue marketing shifts the focus of the marketing team from purely generating demand to driving actual revenue growth.

It involves setting revenue targets for both sales and marketing teams, aligning their efforts to ensure measurable, revenue-driven outcomes.

The goal is to target qualified leads and focus on campaigns that drive conversions, directly contributing to the sales pipeline and bottom line.

Adopting a revenue marketing strategy offers a distinct advantage for niche agencies. By specializing in acquiring high-quality leads and boosting revenue generation, you position yourself as more than just a marketing agency—you become key drivers of your clients' revenue growth too.

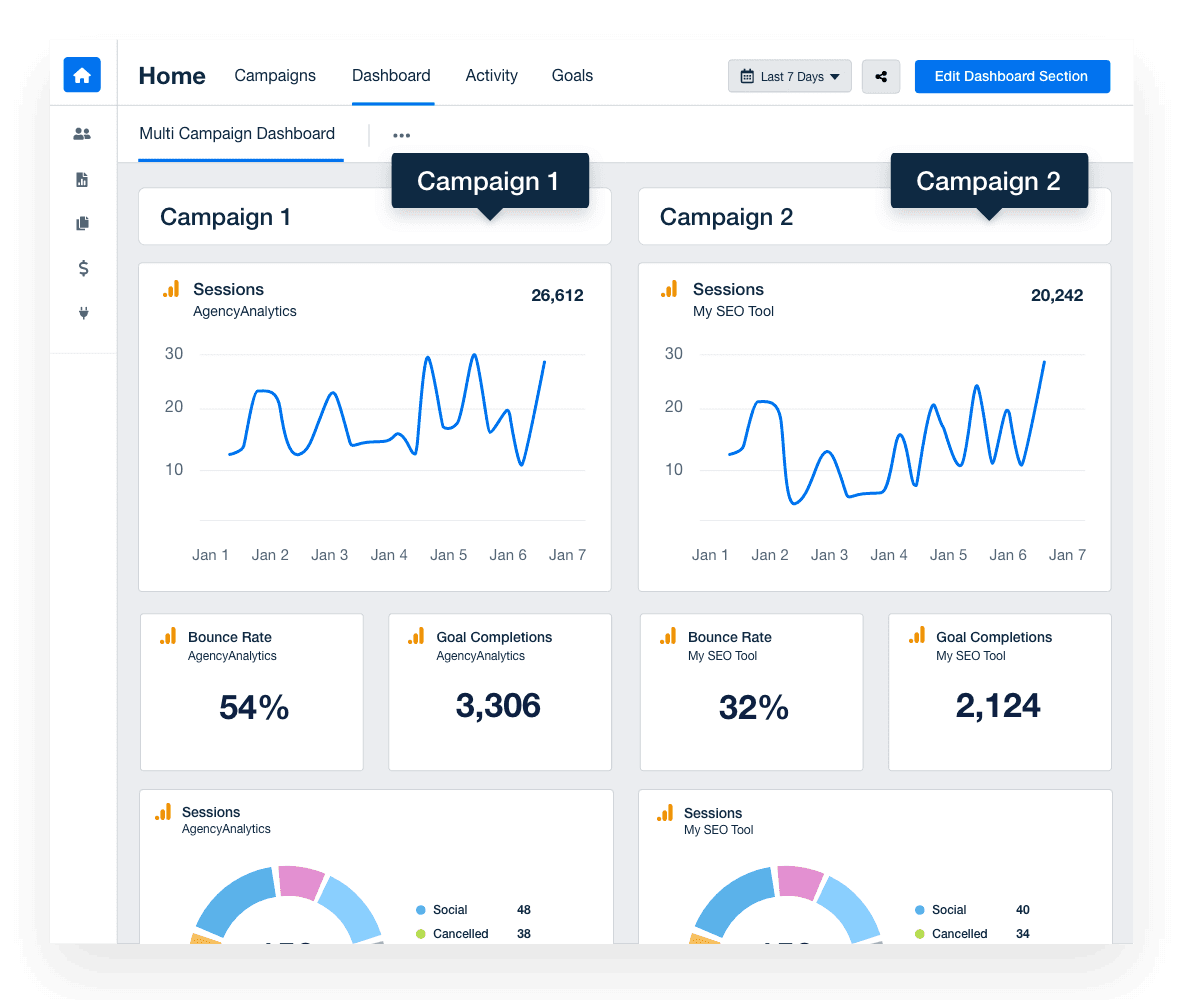

Use multi-client dashboards to keep an eye on all your agency’s client accounts at a glance. Sign up now for your free 14-day trial with AgencyAnalytics!

5. Diversify Your Income With Recurring Revenue Models

Recurring revenue provides steady cash flow for agencies through subscriptions or retainers, creating long-term client relationships and financial stability.

Key metrics like churn rate, customer lifetime value, and customer acquisition cost are essential for tracking the effectiveness of this model.

While some of these may be familiar terms you’ve heard before, we’ll break down the specifics of some lesser-known KPIs that are especially relevant for recurring revenue and income strategies below.

Monthly Recurring Revenue (MRR)

MRR measures how much predictable revenue your company generates per month. This includes income generated from clients with recurring packages and any other product or service generating sales on a monthly basis.

Average Revenue Per User (ARPU)

ARPU helps you understand how much revenue is money generated from your clients on average. It’s also an opportunity to upsell clients for higher-tier recurring packages (if it makes sense for them) and increase overall ARPU.

By optimizing these metrics, you’ll build passive income streams, ensuring consistent sales revenue with minimal ongoing effort—the dream!

Focus on identifying services that will generate recurring income and leverage upsell opportunities to increase ARPU, all while building stronger, more dependable client partnerships.

To learn more about how one agency used AgencyAnalytics to launch a productized service and increase ARPU, read our full article here.

At our company, we firmly believe that the flat rate and hybrid models are the best options for both our clients and ourselves. Other models can lead to racking up meaningless hours or taking unnecessary risks, which can have detrimental effects if the income is solely based on more sales. With the flat rate model, we ensure that we have a sufficient budget to work on the most impactful SEO tasks, always keeping our clients' long-term success in mind. We understand that there is no benefit to us taking short-sighted actions that may have a temporary benefit but ultimately lead to long-term harm. We are dedicated to delivering effective, sustainable results for our clients, and the flat rate model allows us to do just that.

Kurt Schell, President, Lithium Marketing

From Revenue to Income: Turning Growth Into Sustainable Profit

Understanding the distinction between revenue and income is crucial for any agency owner looking to take their business to the next level.

While gross revenue reflects the demand for your services, income shows the effectiveness of your business operations and cost management. By focusing on optimizing both, you build a sustainable marketing agency financial model that ensures long-term growth and stability.

To maximize your agency's profitability, it's essential to implement strategies that streamline processes, reduce unnecessary costs, and track key metrics like profit margins and recurring revenue.

AgencyAnalytics offers a powerful platform to help agencies track these metrics, optimize workflows, and demonstrate ROI to clients.

Ready to take control of your agency's financial health? Try AgencyAnalytics free for 14 days and see how these intuitive reporting tools will transform your business.

Written by

Anya Leibovitch is a B2B SaaS content marketing specialist. She partners with tech companies to design and execute their content marketing strategy. A writer first and foremost, she harnesses the power of storytelling to build and strengthen relationships between companies and the clients they serve.

Read more posts by Anya LeibovitchSee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.