Net Present Value

Campaign Investment Evaluation

Determine whether a campaign is financially viable by comparing expected cash flows.

Budget Allocation Decisions

Prioritize campaigns with higher projected profitability based on prior NPV calculations.

Channel Investment Decisions

Compare the financial impact of investing in channels such as social media, PPC, or email campaigns.

Campaign ROI Analysis

Evaluate the profitability of marketing campaigns by comparing projected earnings generated to costs.

Why Net Present Value Is Important

Net Present Value reveals whether a campaign generates financial gains over time. By incorporating the time value of money, it provides a realistic assessment of long-term profitability.

Marketers rely on NPV to ensure that resources are directed toward initiatives with the highest potential return. It identifies which strategies contribute to long-term financial growth, helping to justify budget allocations and anticipate future costs.

In reporting, NPV demonstrates measurable value and ROI to stakeholders. This reinforces confidence in campaign effectiveness and supports transparent communication of financial outcomes.

Stop Wasting Time on Manual Reports... Get Insights Faster With AgencyAnalytics

How Net Present Value Relates To Other KPIs

NPV complements other KPIs by providing a financial lens on performance. Take Return on Investment (ROI), for example. While ROI gives a percentage return, NPV gives the exact dollar value of profit and makes it easier to see if a campaign is worth the money spent.

Customer Acquisition Cost (CAC) is another key factor. If it’s cheaper to gain customers, more profit stays in the budget, which increases NPV. Similarly, Average Order Value (AOV) and Conversion Rate boost revenues. In turn, this has a positive effect on NPV.

By combining NPV with these KPIs, marketers gain a more complete view of profitability. This makes it easier to make smarter decisions and decide on campaign priorities.

Key Factors That Impact Net Present Value

Several factors influence Net Present Value (NPV) and the profitability of marketing campaigns. Revenue growth is a primary driver–naturally, campaigns that generate consistent or increasing cash inflows improve NPV. On the other hand, rising costs (such as ad spend or production expenses) will often lead to eroded profitability.

Also, consider the discount rate used to calculate NPV (i.e., the rate at which future cash flows are adjusted to reflect their present value). A higher rate lowers NPV, so it’s especially important to rely on realistic financial modeling, consider current market conditions (e.g., inflation rates), and produce a fairly accurate discounted cash flow.

Additionally, look at the impact of operational costs. Unexpected increases (e.g., for ad delivery or placements) reduce net cash flow and NPV.

Professional reports help communicate the results of marketing campaigns, website performance, and other key metrics to stakeholders such as clients, management, and investors. This helps demonstrate the value of the work being done and provides a clear picture of progress towards goals and objectives.

How To Calculate Net Present Value

Net Present Value helps evaluate if a campaign generates more revenue than it costs, considering the time value of money. A positive NPV indicates profitability, while a negative NPV suggests this marketing effort may not be financially viable. More specifically, it's the difference between Total Present Value of Revenue and the Initial Cost.

Total Present Value of Revenue refers to the sum of future cash inflows (e.g., projected revenue from a marketing campaign). Discounting future cash flows means adjusting to reflect their value in today’s dollars.

Initial Cost refers to the upfront expense of the campaign. This investment may include ad spend and production costs.

NPV Formula Example

What Is a Good Net Present Value?

A positive NPV indicates the campaign generates more revenue than its cost (after accounting for the time value of money). A higher, positive Net Present Value reflects strong potential profitability and demonstrates the effectiveness of the marketing campaign.

For best results, focus on high-value audiences, strategic positioning, and campaigns with strong projected returns. Also, remember to control ad spend and keep an eye on other anticipated costs.

What Is a Bad Net Present Value?

A negative NPV suggests that the cost of a campaign outweighs the revenue it generates–even after adjusting for the time value of money. This suggests the project is financially unviable and could result in a financial loss.

These situations often highlight issues such as overspending, underperforming campaigns, or unrealistic projections. It may be a sign to reassess marketing strategies, budgets, or resource allocation.

How To Set Net Present Value Benchmarks and Goals

Start by analyzing historical data from similar campaigns to identify trends and establish baseline expectations. It’s also helpful to back-calculate the NPV required to meet revenue or profitability goals. This means determining the desired cash inflows, subtracting expected costs, and accounting for the discount rate.

When possible, consider external factors like market conditions, seasonal demand, and industry-specific benchmarks. It’s also a good idea to revisit these numbers (especially discount rates) to ensure they’re still relevant.

Why Net Present Value Matters to Clients

Net Present Value (NPV) offers clients a clear picture of profitability. Unlike other metrics that focus on performance (like Reach or Clicks), NPV ties directly to financial outcomes. Essentially, it shows whether campaigns generate more revenue than they cost.

Additionally, NPV simplifies decision-making. It quantifies long-term benefits and shows how an initial investment contributes to financial growth. By focusing on cash inflows and outflows, clients can evaluate whether marketing strategies deliver tangible ROI.

Why Net Present Value Matters to Agencies

For agencies, NPV provides a lens to measure success beyond surface-level metrics. It allows an in-depth understanding of how campaigns impact a client’s bottom line, making it easier to demonstrate value and justify budget allocations.

NPV also acts as a strategic tool for optimizing campaign performance. By analyzing the cash flow drivers behind NPV, it’s easier to identify high-performing strategies and refine underperforming ones. It showcases an agency's ability to deliver sustainable financial outcomes and solid expertise.

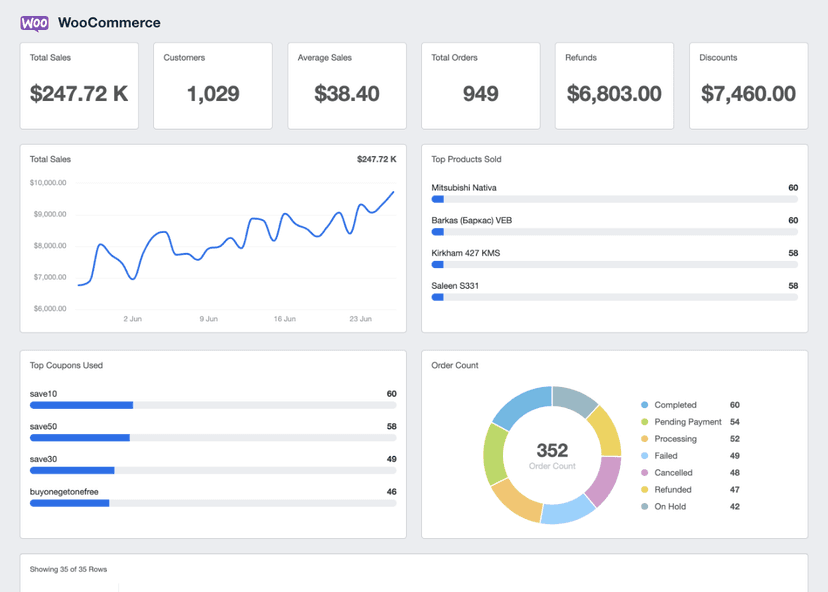

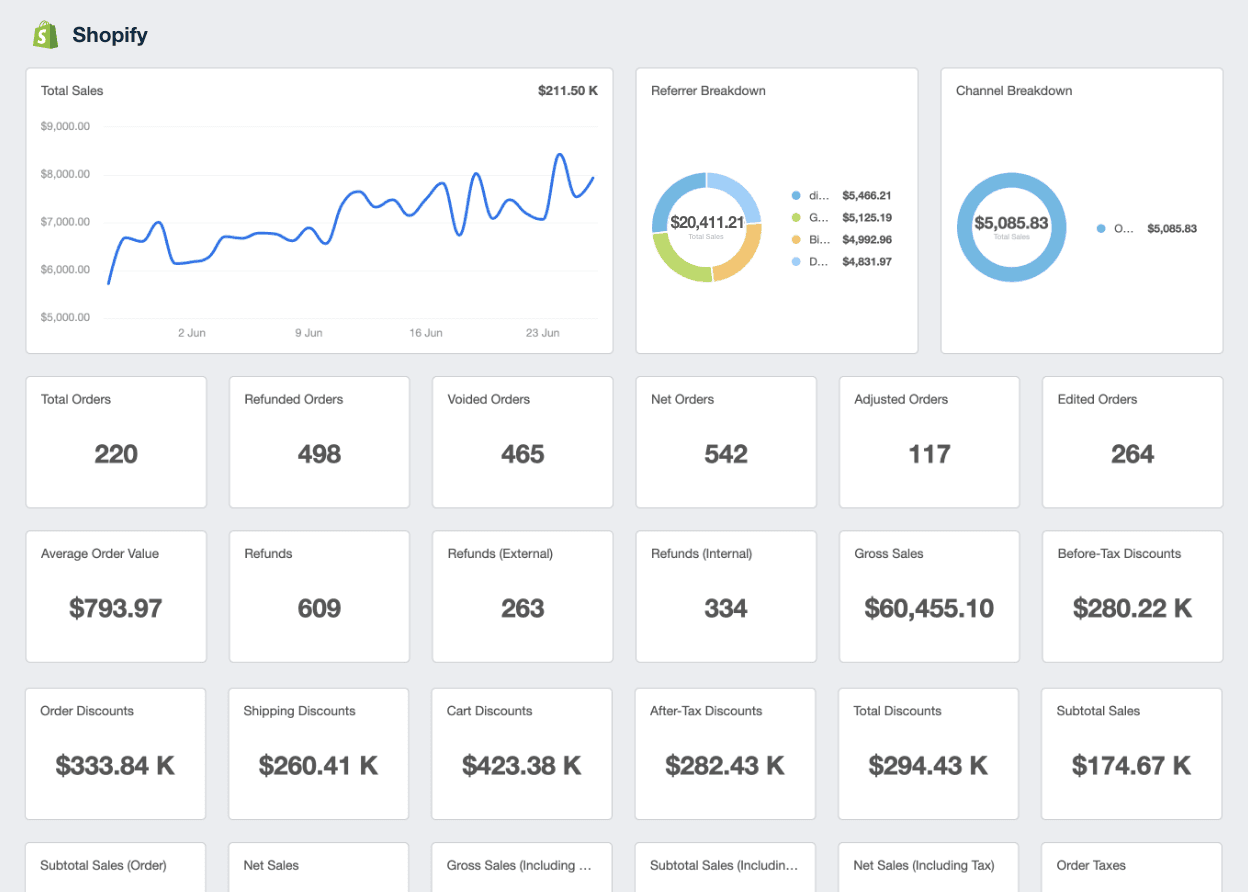

Save Time and Streamline Your Agency’s Shopify Reporting

Best Practices When Analyzing and Reporting on Net Present Value

Net Present Value is essential for assessing project profitability and guiding investment decisions. Use these reporting tips to communicate key findings more effectively.

Ensure Accurate Data

Validate all cash flow inputs and discount rates to avoid calculation errors–precision is essential for reliable insights.

Analyze Trends Over Time

Compare NPVs across multiple projects or periods. This way, it becomes easier to spot long-term profitability trends and risks.

Compare Across Scenarios

Run NPV calculations using various discount rates and cash flow forecasts to account for uncertainties and market dynamics.

Measure Across Different Projects

Use NPV to compare projects, allocate resources toward high-value opportunities, or consider alternative investments.

Highlight Any Notable Variances

Address any anomalies or unexpected variances in cash flow predictions and their impact on NPV. Use this data to make adjustments when needed.

Include Actionable Recommendations

Share recommendations for marketing investment options or improvements, ensuring clients understand the projected financial outcomes.

KPIs allow us, as an agency, to demonstrate our value to the client. Ultimately, what is their ROI from our efforts? When you can clearly demonstrate this month over month, it increases your retention rate and keeps clients paying you month after month.

Shopify Dashboard Example

Related Integrations

How To Improve Net Present Value

Enhancing NPV involves optimizing cash flows, adjusting discount rates, and refining data accuracy. Use these actionable tips to improve NPV for better financial outcomes.

Optimize Cash Flows

Streamline operations and reduce unnecessary costs to increase future cash inflows. Efficiency translates to higher profitability.

Use Realistic Assumptions

Ensure that cash flow projections and discount rates reflect current market conditions to maintain accuracy, especially if this data is used for long-term decisions.

Reevaluate Discount Rates

Periodically adjust the internal rate to align with present-day economic factors. This leads to a more accurate NPV analysis.

Related Blog Posts

See how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.