Table of Contents

Table of Contents

- What Is the Rule of 40 in SaaS?

- Why the Rule of 40 Should Matter for Agencies Working With SaaS Clients

- 5 Key Metrics That Agencies Should Monitor To Help SaaS Clients Meet the Rule of 40

- How To Use AgencyAnalytics To Support Clients in Meeting the Rule of 40

- Leverage the Rule of 40 To Drive Growth and Profitability for Your SaaS Clients

7,000+ agencies have ditched manual reports. You can too.

Free 14-Day TrialQUICK SUMMARY:

The Rule of 40 states that the sum of a SaaS company’s growth rate and profit margin should equal or exceed 40%. This principle helps these businesses strike an optimal balance, make strategic adjustments, and ensure longevity. This article explains the Rule of 40, along with how agencies should use it to meet SaaS clients’ needs and contribute to overall success.

As it’s often said, growth requires investment.

Just ask any one of your well-established SaaS clients. They’d probably have a story (or two) about reinvesting capital into market research, developing new product features, or increasing their headcount. After all, getting to the next level requires spending.

This laser focus on growth sometimes means reducing or even sacrificing profits in the short term—a daunting thought for many businesses juggling expenses and bills. However, this scenario isn't as grim as it might seem. In fact, when this happens, your SaaS client could very well be on a path to long-term success.

That's precisely what the Rule of 40 takes into account. Instead of hitting the panic button when profits decline, this principle offers a broader perspective. As long as the combined growth and profit rates reach or exceed 40%, it's a strong indicator of a healthy SaaS company.

By understanding the Rule of 40, you'll help these clients achieve stability and sustainable growth. This forward-thinking strategy sets your agency apart, proving your ability to provide deeper insights that are specific to the SaaS world.

What Is the Rule of 40 in SaaS?

The Rule of 40 is a financial metric that helps SaaS companies strike a healthy balance between sustainable growth and profitability. It gained momentum after venture capitalist Brad Feld recalled an eye-opening boardroom conversation about this concept.

More specifically:

The Rule of 40 states that a SaaS company is considered healthy if its combined growth and profitability rates are at least 40%.

While it’s a useful framework for all SaaS businesses, it’s most beneficial to those who have already achieved significant MRR (at least $1M, according to Feld). In most cases, these will be mature software companies, not necessarily those experiencing rapid growth for the first time.

The Rule of 40 is particularly useful when evaluating public SaaS companies, as it provides a clear benchmark for balancing growth and profitability. By maintaining a growth and profitability score of 40% or more, these businesses show what a healthy SaaS business should look like in the long run.

Here’s a more detailed breakdown of the terms in the definition above:

Growth Rate: A SaaS company's monthly or annual revenue growth rate. This percentage reflects how quickly revenue is generated over a sustained period.

Profitability Rate: A SaaS company’s ability to generate profit, often represented by metrics like the EBITDA margin (Earnings Before Interest, Taxes, Depreciation, and Amortization).

What makes this concept interesting is its nuanced approach. Often, business longevity is viewed solely through the lens of income-generating activities. Instead, the Rule of 40 considers that high growth frequently comes at the cost of profitability.

It makes sense, too. At some point, most SaaS companies may heavily reinvest earnings into customer acquisition, product development, or market expansion. Once growth stabilizes, increased profitability is expected to follow.

On the other hand, SaaS companies that have already captured a significant portion of the market may focus on maximizing profits. They might shift from aggressive acquisition to retaining customers, ensuring sales efficiency, or improving the company’s operating performance. According to the Rule of 40, this is still a good trade-off, provided profits are on track as growth slows.

Impress clients and save hours with custom, automated reporting.

Join 7,000+ agencies that create reports in minutes instead of hours using AgencyAnalytics. Get started for free. No credit card required.

Why the Rule of 40 Should Matter for Agencies Working With SaaS Clients

Here’s the big-ticket question: Why does the Rule of 40 matter for agencies specifically?

The answer is simple—because it can completely reshape your approach to supporting the success of your SaaS clients, and in turn, the sustainability of your relationship over the long-term. Understanding this concept will also prepare your agency to answer questions that a marketing leader, internal management teams, or even a SaaS CFO might have.

These may include:

"How should we ensure that our efforts to acquire new customers don’t undermine profitability?"

“What marketing strategies will improve our customer lifetime value (CLV)?”

“Which KPIs should we prioritize to ensure sustainable growth?”

“Are there any opportunities to upsell our existing customer base?”

Relying on surface-level insights may not exactly cut it when you’re trying to find answers to the above. So, what’s the fix?

You’ve got to speak the same language as your clients. And those in the SaaS industry–especially seasoned businesses–may already follow the Rule of 40.

By showing your understanding of this concept, you’re lightyears ahead of competitors who don’t consider this important rule. The result? More aligned strategies, a shared focus, and greater client satisfaction in the long run.

Agencies working with SaaS clients should also pay attention to other financial metrics like free cash flow. Monitoring cash flow can help ensure that SaaS companies have enough resources to reinvest in growth without compromising profitability.

Agency Tip: SaaS leaders may often seek investment or acquisition opportunities as a company matures. Use the rule of 40 to demonstrate business viability, create relevant marketing strategies (according to their current score), and even boost the company’s valuation.

5 Key Metrics That Agencies Should Monitor To Help SaaS Clients Meet the Rule of 40

To ensure clients strike the right balance between revenue and growth, keep these important metrics on your radar.

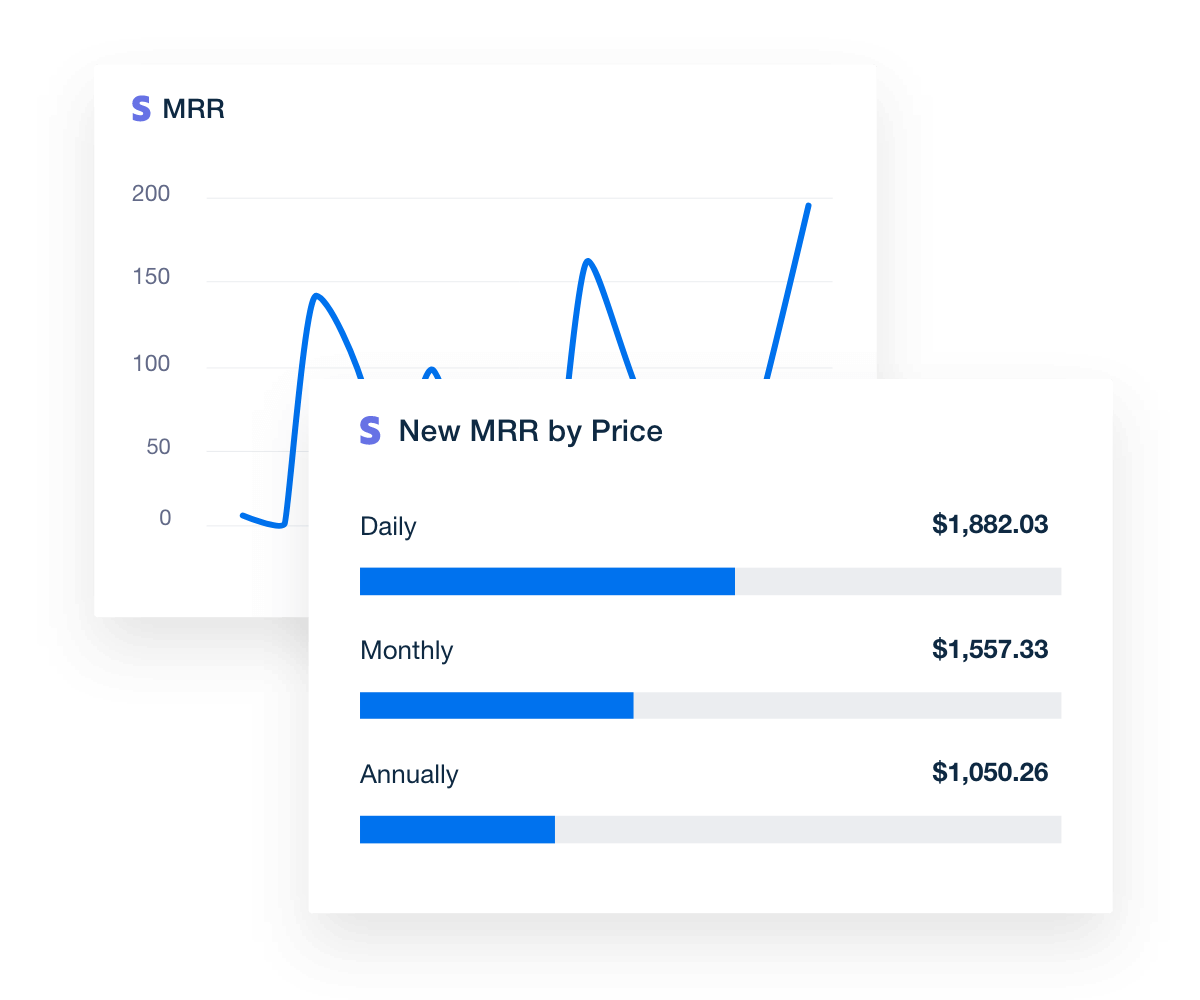

1. Monthly Recurring Revenue (MRR)

Monthly recurring revenue (MRR) is the consistent income that your SaaS client generates every month from subscription-based customers. In other words, this metric shows how much they can expect to receive on a regular, ongoing basis.

Wondering what’s the relationship between MRR and a SaaS company’s revenue growth rate? Here’s a formula for reference below.

MRR Growth Rate = [(MRR this month - MRR last month) ÷ MRR last month] × 100

For example, let’s say your client's MRR was $50,000, which grew to $55,000 the following month. According to the formula above, their MRR growth rate is 10%. In practical terms, this indicates that a SaaS business is generating more recurring revenue than the previous month, which is a positive sign.

It also means their profit rate should be 30% (or more) to align with the Rule of 40.

The numbers don’t lie. Easily showcase data like MRR, total revenue growth, and profitability margin. Gain access to 80+ marketing integrations in AgencyAnalytics–sign up for your free 14-day trial today.

It’s also worth noting that some clients prefer to monitor annual recurring revenue (i.e., MRR multiplied by 12), especially those with a solid base of historical data. To accommodate this preference, simply report on their Annual Growth Rate instead:

Annual Growth Rate = [(ARR this year - ARR last year) ÷ ARR last year] × 100

To boost MRR and hit the growth side of the Rule of 40, your agency might suggest refining your client's marketing and sales tactics or exploring new customer acquisition strategies.

2. Average Revenue Per Unit (ARPU)

ARPU stands for Average Revenue Per Unit (or User in this case), which measures the average revenue generated from each customer over a specific period. Here’s a formula for quick reference (assuming a monthly time frame):

ARPU = MRR (Monthly Recurring Revenue) ÷ Total Number of Users

Suppose you have a SaaS client with an MRR of $50,000 and 1,000 users. According to the above, their ARPU works out to $50. While these metrics may seem favorable, their actual MRR growth rate is actually 5%, which is too low (given that their profit margin is roughly 10%).

This lack of balance could threaten financial sustainability, limiting their ability to reinvest in growth (which includes your services). To remedy this situation, your agency may suggest upselling existing customers or increasing prices to generate a higher MRR and ARPU.

3. Customer Lifetime Value (CLV)

Customer lifetime value (CLV) is the total revenue your SaaS client expects to earn from a customer over the entire duration of their relationship. This includes earnings from subscription renewals, upgrades, or upsells over time.

As a reference:

CLV = Average Revenue per User (ARPU) × Customer Lifetime (in months or years)

For example, if a SaaS company has an ARPU of $200 per month and the average customer lifetime is 24 months, its CLV is $4800.

Here’s a key takeaway: A Higher CLV = More Sustainable Revenue Growth.

A high CLV indicates that customers stay longer and generate more revenue over time. This helps increase MRR without needing to acquire new customers constantly. There’s a snowball effect, too, as it directly contributes to the "growth" side of the Rule of 40 equation.

Calculate CLV for any SaaS client without breaking a sweat. Explore the custom metric feature in AgencyAnalytics–sign up for your free 14-day trial today.

4. Churn Rate

Churn rate is the percentage of customers lost over a given period. Reducing this number helps SaaS clients achieve more subscription revenue without heavy acquisition costs. In turn, this boosts MRR growth, profit margins, and, by extension, their Rule of 40 score.

Here’s how this percentage is calculated:

Churn Rate = (Customers Lost ÷ Total Customers at the Start of the Period) x 100

For example, let’s say a SaaS client starts the month with 1,000 customers. At the end of this period, though, they lose 50 customers due to cancellations or non-renewals. This works out to a monthly churn rate of 5% (higher than usual), which may increase acquisition costs. The result? Reduced growth and profitability.

In these cases, it’s important to focus on retaining customers, especially those with a high monetary value. This increases net retention–the revenue retained from existing customers after accounting for churn, downgrades, and expansions (like upsells or cross-sells). This results in more organic revenue growth, which is an ideal scenario for any SaaS client.

5. Conversion Rate

Conversion rate is the percentage of potential customers who take a desired action compared to the total number of leads generated. More specifically, this may include subscribing to a service or purchasing a product.

Conversion Rate = (Number of Conversions ÷ Total Number of Leads) × 100

A higher conversion rate means more prospects are successfully converted into paying subscribers. Guess what that translates to… you guessed it–MRR growth.

Let's take an example. Say a SaaS client had 1,000 leads in a month, and 50 signed on for a service. Their conversion rate works out to 5%, with each new subscriber adding $100 to MRR.

How To Use AgencyAnalytics To Support Clients in Meeting the Rule of 40

With all these moving parts in motion, your agency needs a system to monitor the critical metrics.

While it’s possible to monitor this data directly through platforms like Stripe or Keap, it’s tedious to do this for every SaaS client. Plus, adhering to the Rule of 40 adds an extra layer of complexity. To keep on the pulse of growth and profitability, your agency needs an agile approach.

That’s where a client reporting tool like AgencyAnalytics comes in! Here’s exactly how to use it and ensure your SaaS client maintains a healthy business.

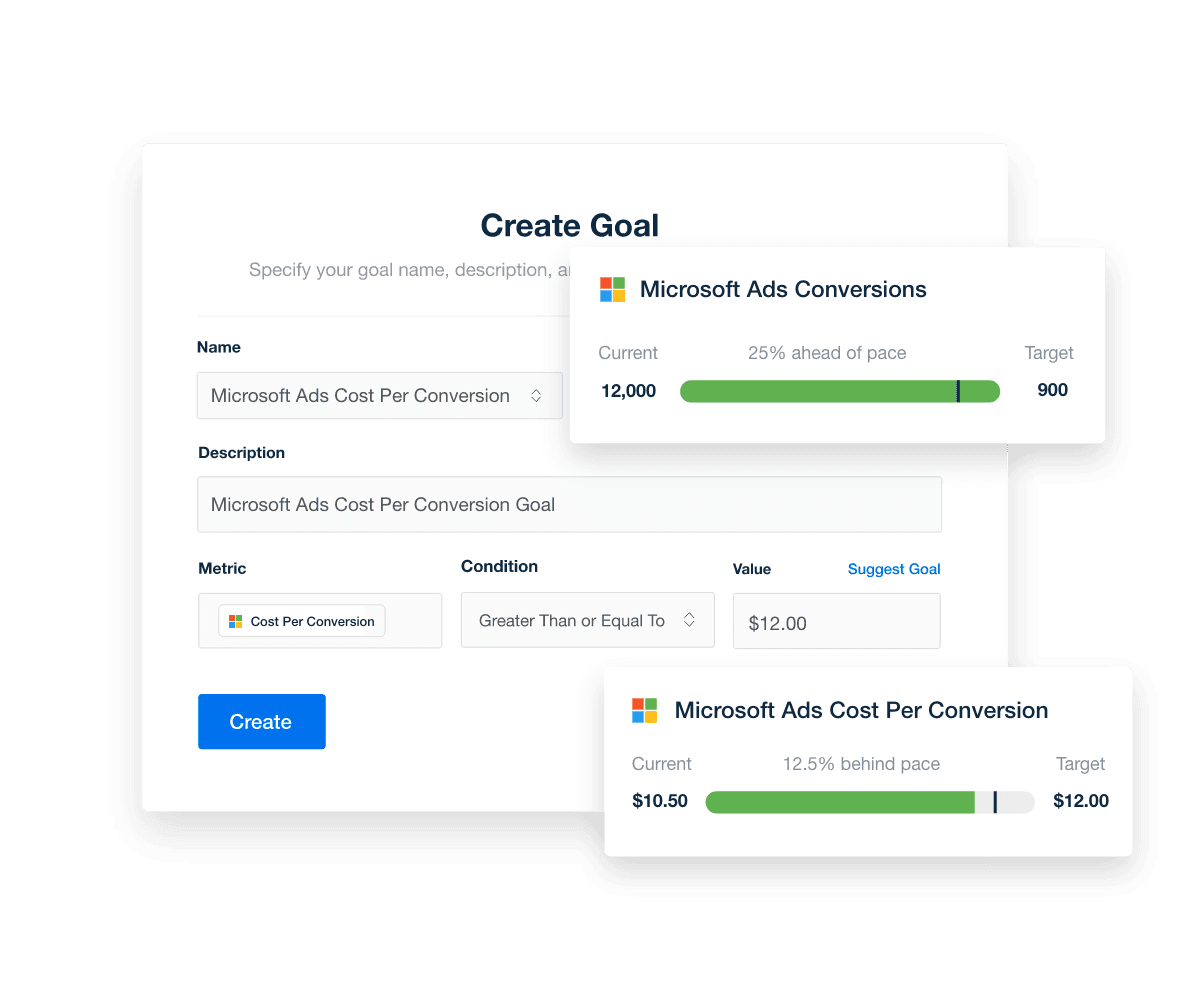

1. Create Dynamic Goals

Wondering if your clients are on the right track? Use the goal feature to set benchmarks and monitor these insights in real time.

Whether it’s revenue targets or conversion rates, this visual progress ensures everything goes as planned. If not, you’re better equipped to make adjustments promptly.

For example, if a client's lead generation rate is significantly lagging, you may suggest increasing ad spend (without affecting profit margins too much).

AgencyAnalytics has made communicating the results of campaigns to our clients exponentially easier! We love being able to customize each report and dashboard to our client's specific goals. Since we offer custom marketing solutions, we needed a reporting tool that could report on those easily.

Christina Cypher, Director of Marketing, Click Control Marketing

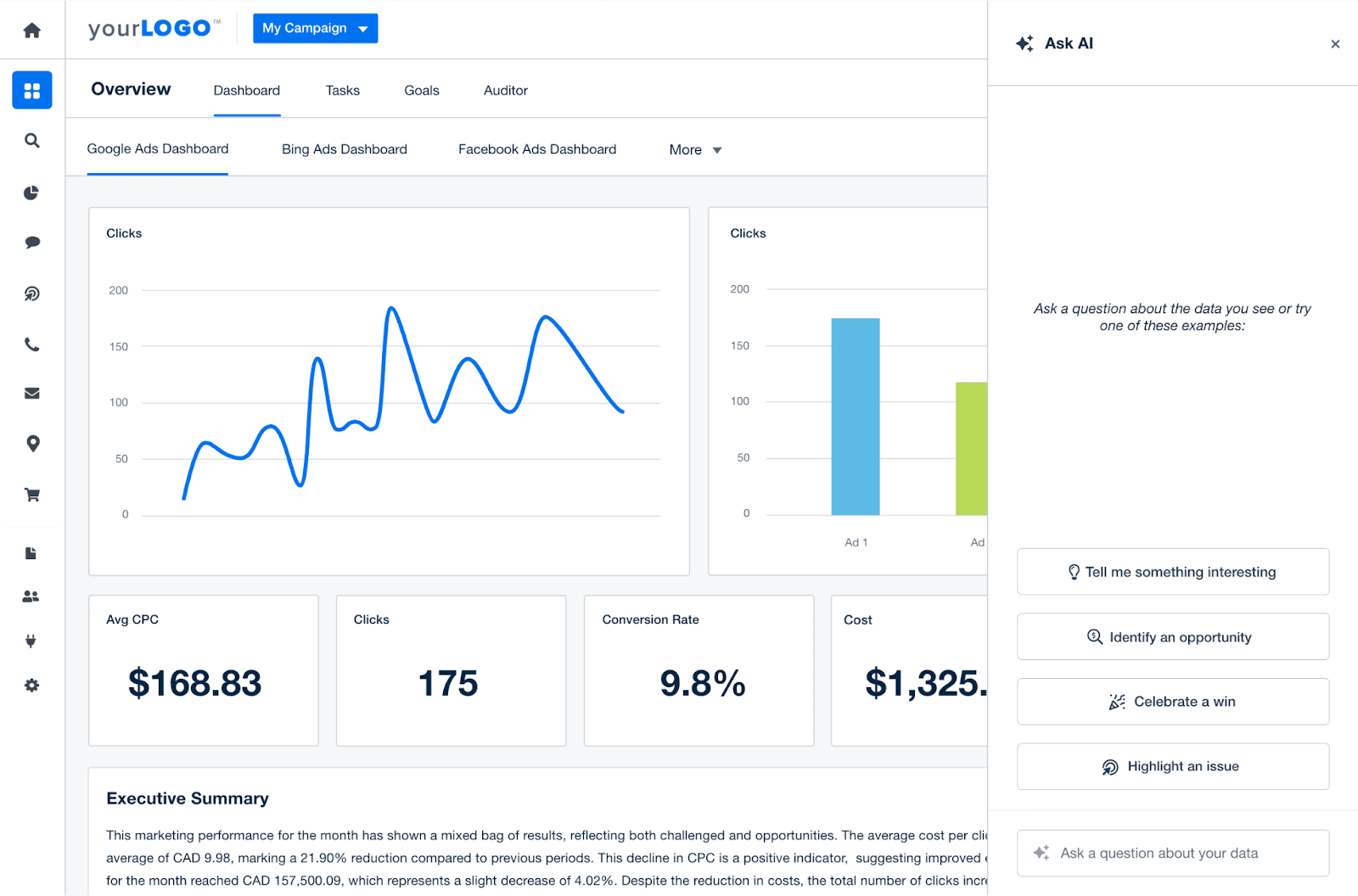

2. Ask AI What’s Happening

Sometimes, your agency needs a quick overview of what’s taken place during the reporting period. To get fast answers, simply Ask AI! It’s our shiny, new feature that lets agencies ask questions about client data, highlight not-so-obvious wins, and explore areas for improvement.

That way, you won’t have to harp over data for too long just to get answers.

In addition to pre-defined AI prompts, here are some relevant questions that are related to the Rule of 40:

“What’s my client’s expected revenue for the month?”

“Did MRR growth increase from last month?”

“Are there any trends showing increased churn that could be impacting revenue?”

“How has the customer acquisition cost (CAC) changed over the last quarter?”

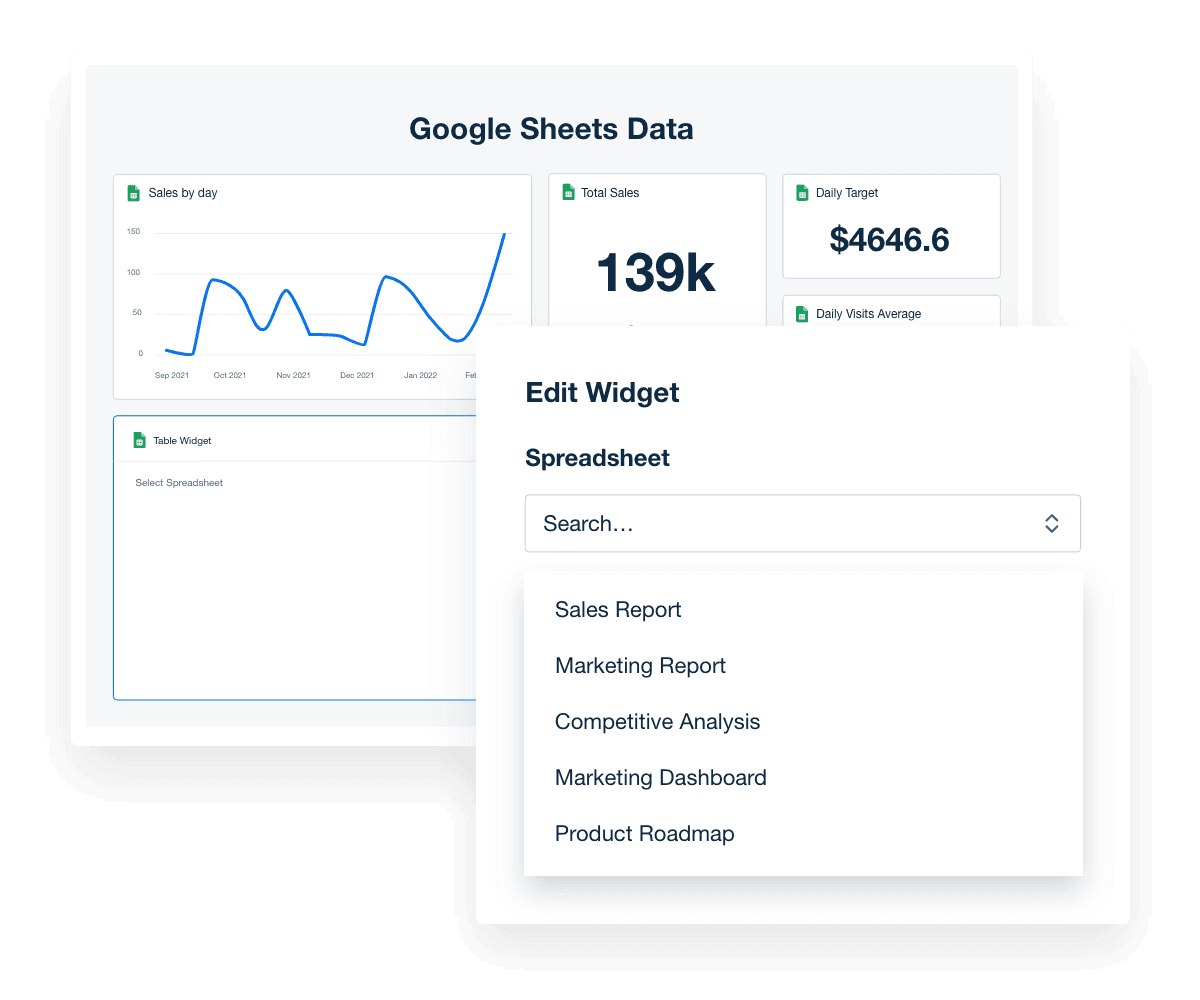

3. Import Data via Google Sheets

Even if your reporting is automated (which it should be), your client may still rely on spreadsheets for budgeting and forecasting. Ideally, this data should be viewed alongside the company’s performance metrics.

No need to toggle between platforms–simply use the Google Sheets integration in AgencyAnalytics.

For example, consider EBITDA margins (i.e., Earnings Before Interest, Taxes, Depreciation, and Amortization), which are often calculated in a spreadsheet. This metric goes beyond simple revenue figures, revealing whether a client is efficiently managing operational costs. If not, it could dent profit margins and Rule of 40 scores.

Once this data is in Google Sheets, all you have to do is import it directly into AgencyAnalytics. That way, your clients have access to the full business performance picture–all in one place.

Leverage the Rule of 40 To Drive Growth and Profitability for Your SaaS Clients

As we’ve covered, the Rule of 40 is a strategic buffer that’s specifically applicable to SaaS clients with mature companies. This principle factors in the impact of growth beyond traditional revenue, providing a more realistic reflection of business health.

Profit is not possible without revenue, but the importance of one over the other depends on the growth stage. During high growth periods, you may have to prioritize revenue over profit to achieve scale. But at some point, the focus has to shift to profit to stay viable.

Maryn Williams, COO, VIEWS Digital Marketing

To sum things up, use the Rule of 40 to:

Determine Growth vs. Profit Allocation: SaaS clients may face tradeoffs between aggressive marketing campaigns (growth) and improving customer retention (profitability). Use this business model to guide clients on when to prioritize lead generation over retention strategies or vice versa.

Choose the Most Relevant Campaigns: Use this SaaS rule to allocate marketing budgets more effectively. For high-growth, low-profit clients, the focus may be retention and upsell campaigns. For profitable clients, it could be a good idea to invest in customer acquisition or explore a new target market.

Track the Right SaaS Metrics: Set the right OKRs or KPIs from the outset. Whether it’s a well-defined MRR target or keeping churn below a certain number, use your knowledge of the Rule of 40 and determine relevant targets.

It doesn’t matter if your SaaS client is prioritizing growth or profit margins. An automated reporting tool like AgencyAnalytics consolidates data, presents visual insights, and does the heavy lifting for you. Try it today, free for 14 days.

Written by

Faryal Khan is a multidisciplinary creative with 10+ years of experience in marketing and communications. Drawing on her background in statistics and psychology, she fuses storytelling with data to craft narratives that both inform and inspire.

Read more posts by Faryal KhanSee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.