Table of Contents

Table of Contents

- Marketing Agencies' Positive Outlook for the Future

- Agency Revenue Changes Over the Past Year

- Top Agency Concerns in a Shifting Digital Marketing Industry

- Predicting Agency Revenue Expansion for 2025

- Agency Service Expansion Plans for the Coming Year

- Most Promising Marketing Channels This Year

- Forecasting Reduced Campaign Spending

- Looking Forward

7,000+ agencies have ditched manual reports. You can too.

Free 14-Day TrialQUICK SUMMARY:

The 2023 Annual Marketing Agency Benchmarks report provides key insights into the growth and strategies of marketing agencies. It highlights the resilience and optimism of agencies, with 84% of leaders expressing positivity about the future. The report covers revenue growth, expansion plans, and marketing channel strategies, offering data to guide agencies in a changing market.

Welcome to Part Three of the Agency Benchmarks Report.

As a forward-looking agency leader, you understand the critical importance of staying ahead of the curve. Explore predictions for the digital marketing industry in 2023 and gain a competitive edge by aligning your strategies with industry-wide expectations. From revenue predictions and expansion intent to marketing channel insights and top concerns, we've crafted this report with your agency's strategic decision-making in mind.

In Part One of the Benchmarks Report surveying 121 marketing agency leaders, we examined challenges such as client acquisition and barriers to agency growth. Part Two explored agency management best practices. Here, we explore the sentiments, projections, and aspirations of agencies for the next two years.

To see exactly how agencies have evolved and adapted since then, explore the most recent 2025 Marketing Agency Benchmarks Report.

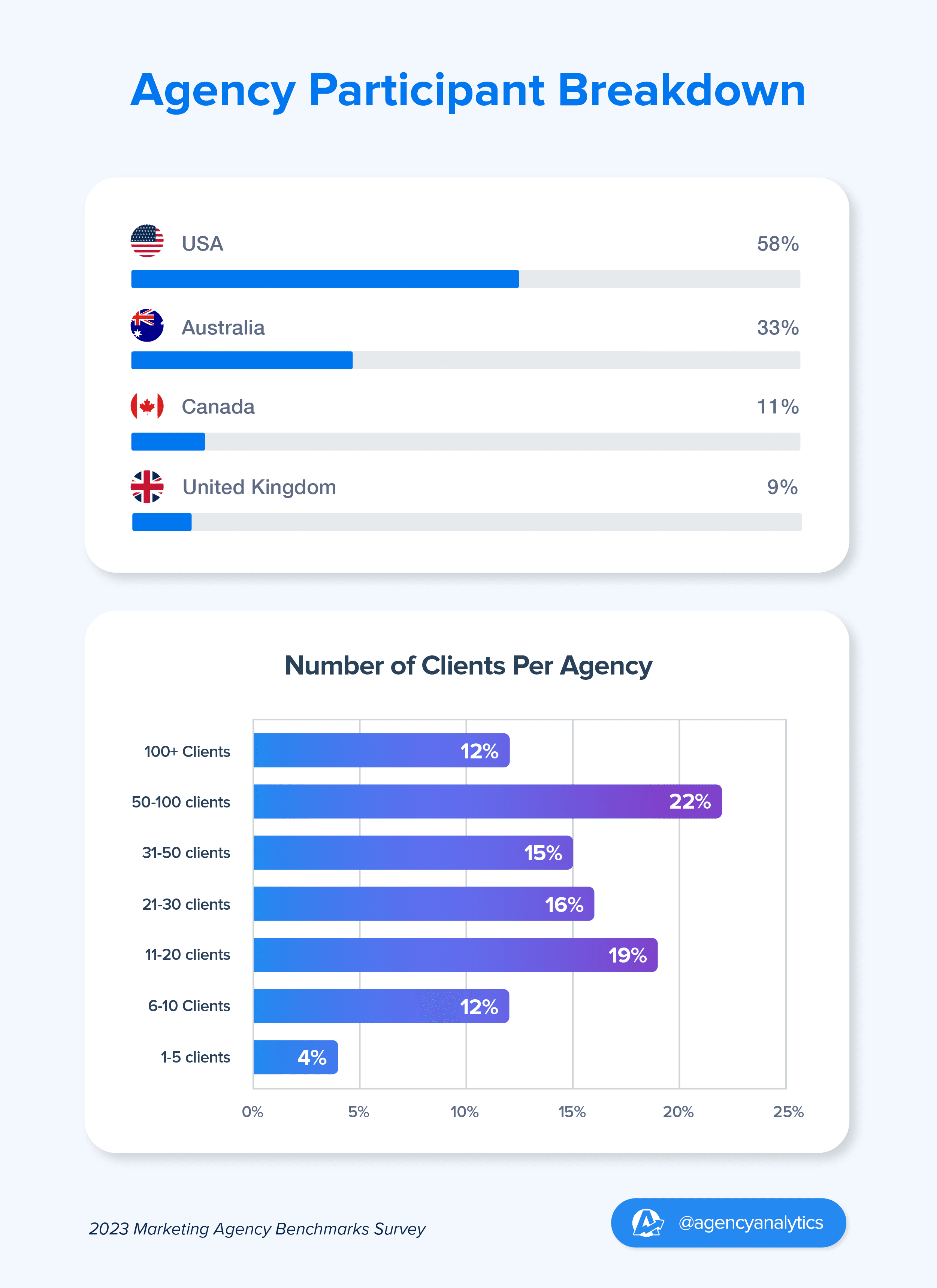

2023 Agency Participant Breakdown

Out of 121 agencies surveyed in the 2023 Agency Benchmarks Survey:

46% of agencies have between 6-20 full-time employees

22% of agencies serve 50-100 clients

The agencies are primarily located in the US (58%), Australia (33%), Canada (11%), and the United Kingdom (9%)

Marketing Agencies' Positive Outlook for the Future

Let's begin the report with an exploration of agency owners’ growth sentiments for the next two years–are they optimistic about the next two years in the marketing industry? By tapping into the collective expectations, aspirations, and outlooks of agency leaders, we gain valuable insights into the industry's trajectory and the prevailing sense of optimism.

In the aftermath of the global pandemic and the subsequent economic recession, the marketing industry faced a landscape riddled with uncertainty. Campaigns were paused, budgets slashed, and strategies had to be reimagined overnight. Yet, the latest survey results highlight the remarkable resilience of marketing agencies.

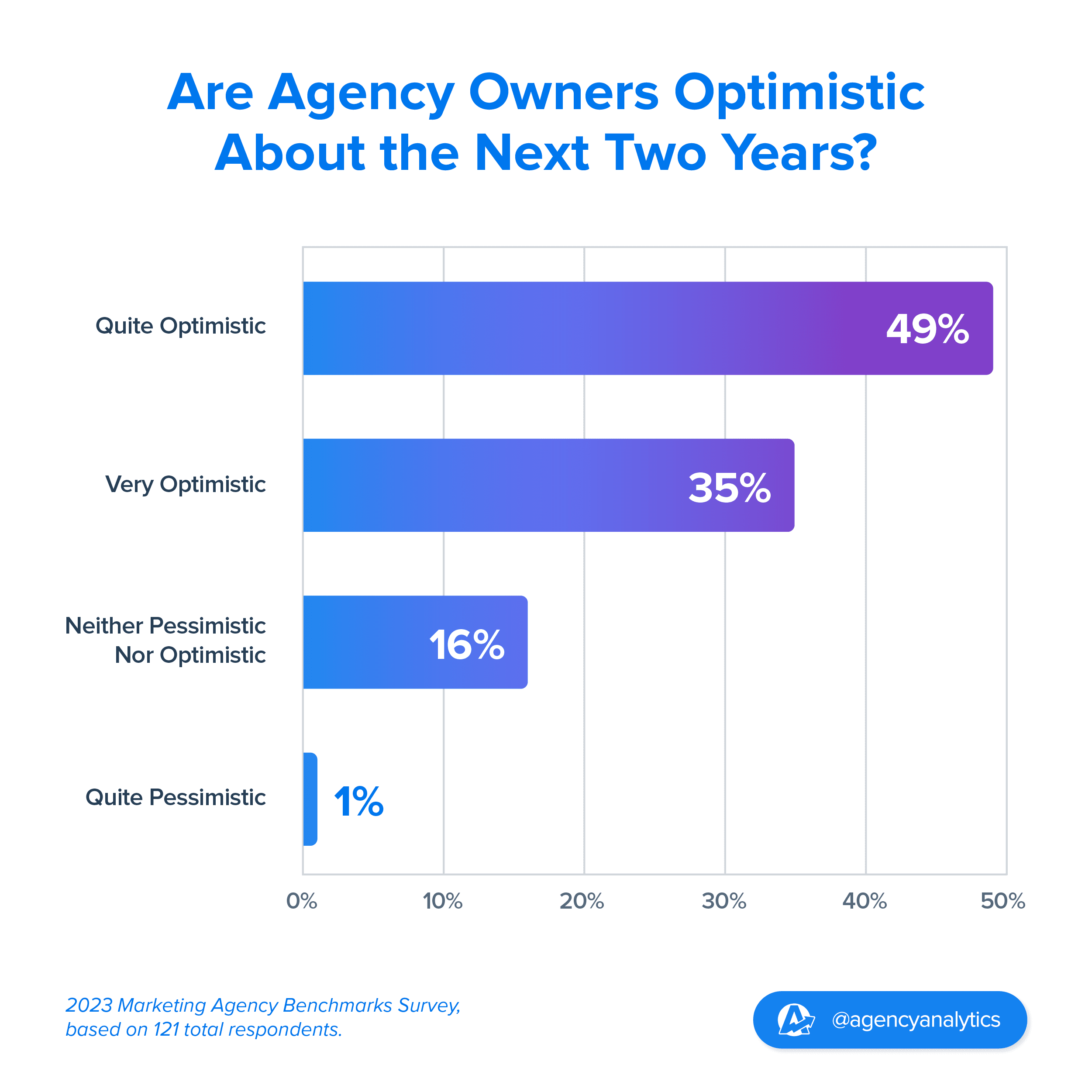

An impressive 84% of agency leaders are now expressing varying degrees of positivity about the future. This isn't just a fleeting sentiment; it's a resounding wave of optimism coursing through a sector that's adeptly navigated some of its most challenging times.

35% of agency owners say they are "very optimistic" about their agency growth in the next two years

49% stand "quite optimistic" about their agency growth in the next two years

16% are neither pessimistic nor optimistic about their agency growth in the next two years

1% are “quite pessimistic” about their agency growth in the next two years

Given the profound disruptions and shifts in consumer behavior over the past years, such a positive outlook for the next two years is not merely hopeful—it's a testament to the industry's adaptability and innovation. Many agency owners are seeing their hard work and determination pay off, as they finally glimpse a light at the end of the tunnel.

Of the 84% of agencies who expressed levels of optimism toward the future, 35% of them were “very optimistic,” and 49% said they were “quite optimistic” about the next two years in the digital marketing industry.

This level of positivity and confidence reflects an expectation of significant growth and success for marketing agencies overall.

Meanwhile, nearly 16% of agencies maintained a neutral stance, neither leaning towards pessimism nor optimism. Perhaps this balanced perspective indicates a wait-and-see approach or a level of uncertainty about the future as technologies advance and change how digital marketing agencies operate.

Less than 1% of agency owners expressed pessimism towards the next two years in the context of marketing agencies and growth. While this represents a minority, it highlights a small group with concerns or reservations about future prospects.

These growth sentiments capture the collective heartbeat of marketing agency leaders and set the tone for the rest of our report as we delve into their revenue performance, expansion intent, and top concerns.

Agency Revenue Changes Over the Past Year

Digging into the data reveals intriguing links between last year's agency revenue fluctuations and the optimism for growth in the next two years. By understanding these connections, we can pinpoint the key elements shaping both current achievements and future aspirations.

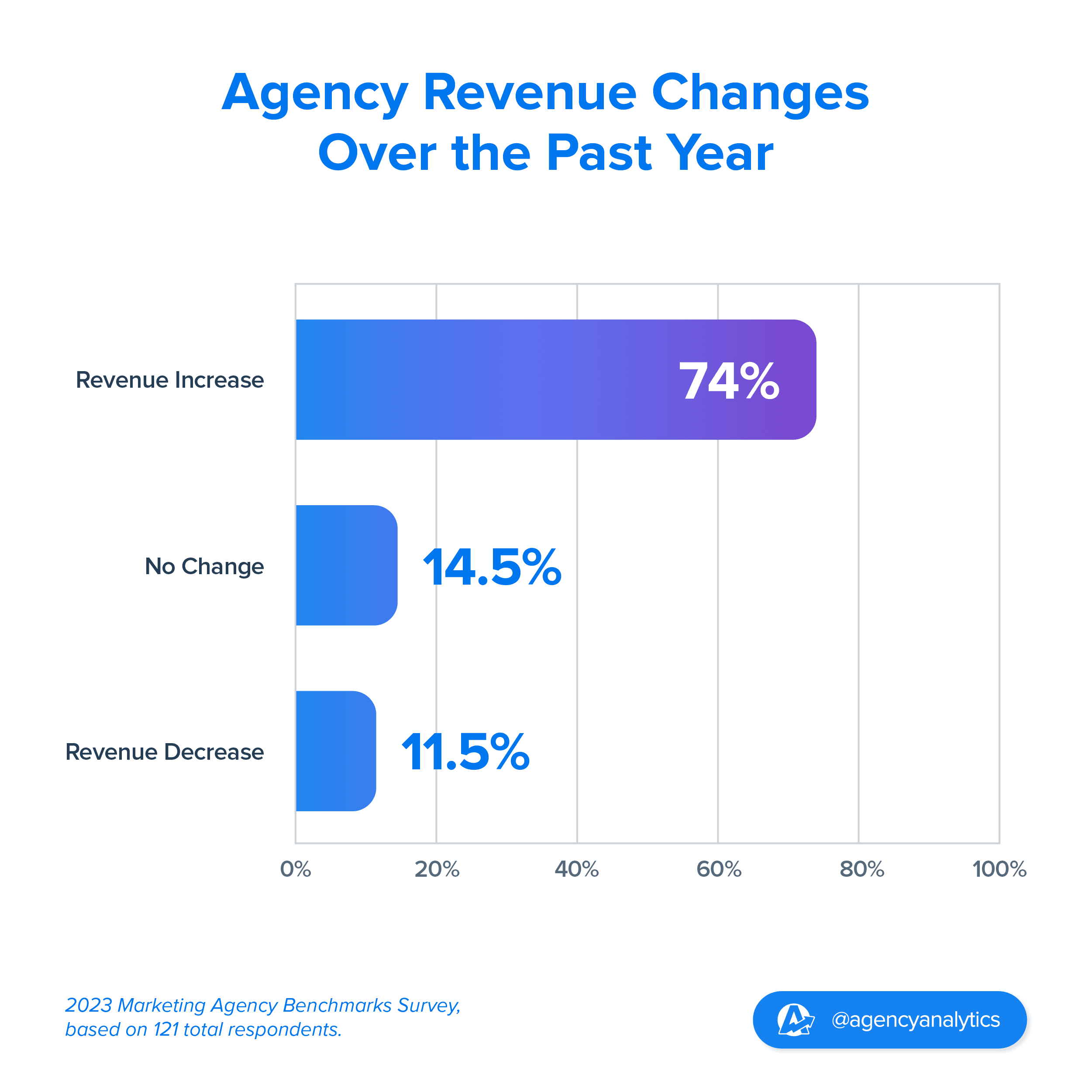

According to the data from the 2023 Marketing Agency Benchmarks Survey, it is evident that the majority of agencies have experienced positive revenue growth in the past year, with 74% of agencies experiencing growth. Here’s the breakdown:

49% of agencies had a revenue surge of 25% or more in the past year

25% of agencies experienced an increase in revenue by 25% or less in the past year

14.5% of agencies had no revenue change in the past year

8.5% of agencies experienced a <25% decrease in revenue in the past year

3% of agencies experienced a >25% decrease in revenue in the past year

Given that 2022 marked the beginning of the reopening of the global economy, this significant uptick in growth for many agencies wasn't entirely unexpected. The resilience and adaptability of the marketing industry have been on full display as agencies made up for lost time, capitalizing on the renewed economic momentum.

The survey results show that agencies with strong revenue growth over the past year are channeling their optimism and momentum towards even loftier goals ahead. Meanwhile, those with steadier, more modest gains are just as optimistic, harnessing their solid base, and positioning themselves for deliberate and sustainable expansion in the future.

Read More: How To Recession-Proof Your Agency

Robust Revenue Growth Fuels Optimism and Ambitions for Future Expansion

Of the agencies surveyed, nearly 3 out of 4 agencies (74%) reported revenue growth over the past year. It’s no surprise that this upward trend would foster optimism, and the results confirm this sentiment. Marketing agency owners who saw revenue growth in the past year consistently expressed a positive outlook for their growth prospects in the upcoming two years.

The Resolute Stance of Stable Agencies

A little over 14% of agencies surveyed reported no change in their revenue, indicating stable financial performance. While not experiencing growth, these agencies were able to maintain consistent revenue levels, suggesting steady operations and a solid customer base.

Interestingly, based on the data, agencies that marked "No Change" in their agency revenue over the past year display a notable level of optimism regarding the next two years. Despite not experiencing a significant increase in revenue, these agencies remain positive about their prospects.

Agencies Eye Future Growth in the Face of Revenue Declines

A mere 8% of agencies reported a revenue decline of less than 25%. Interestingly, agency owners who reported revenue declines also display optimism. This strongly suggests that such decreases in revenue are attributed to transient, uncontrollable factors, like economic downturns, which they anticipate will rebound in the near future.

While the exact reasons for an agency’s revenue decrease vary–ranging from resource constraints to strategic pivots or niche market operations–it's evident that these agencies expect to surge ahead and achieve growth in the near future.

Navigating Significant Declines

3% of the surveyed agencies grappled with a pronounced revenue decline of 25% or more. Beyond the immediate numbers, this paints a picture of these agencies navigating complex financial terrains. These agencies will not just need to adopt strategic countermeasures but also delve deep into introspective evaluations of their business models, client relationships, and market positioning. Addressing such a decline isn't merely about recovery; it's about reimagining the agency’s approach.

As we proceed further into this report, we will continue to analyze these connections and explore the strategies that agencies employ to ensure their continued growth and success.

Top Agency Concerns in a Shifting Digital Marketing Industry

While optimism and growth aspirations are prevalent, agencies must also confront the ever-evolving challenges of the digital sphere. Our survey delved into the most pressing concerns they face.

Tackling these challenges directly is paramount for agencies aiming to stay ahead, ensuring they harness growth opportunities and thrive in an industry that's in constant flux.

The survey results offer a comprehensive view into the pulse of the industry, highlighting the multifaceted challenges agencies face:

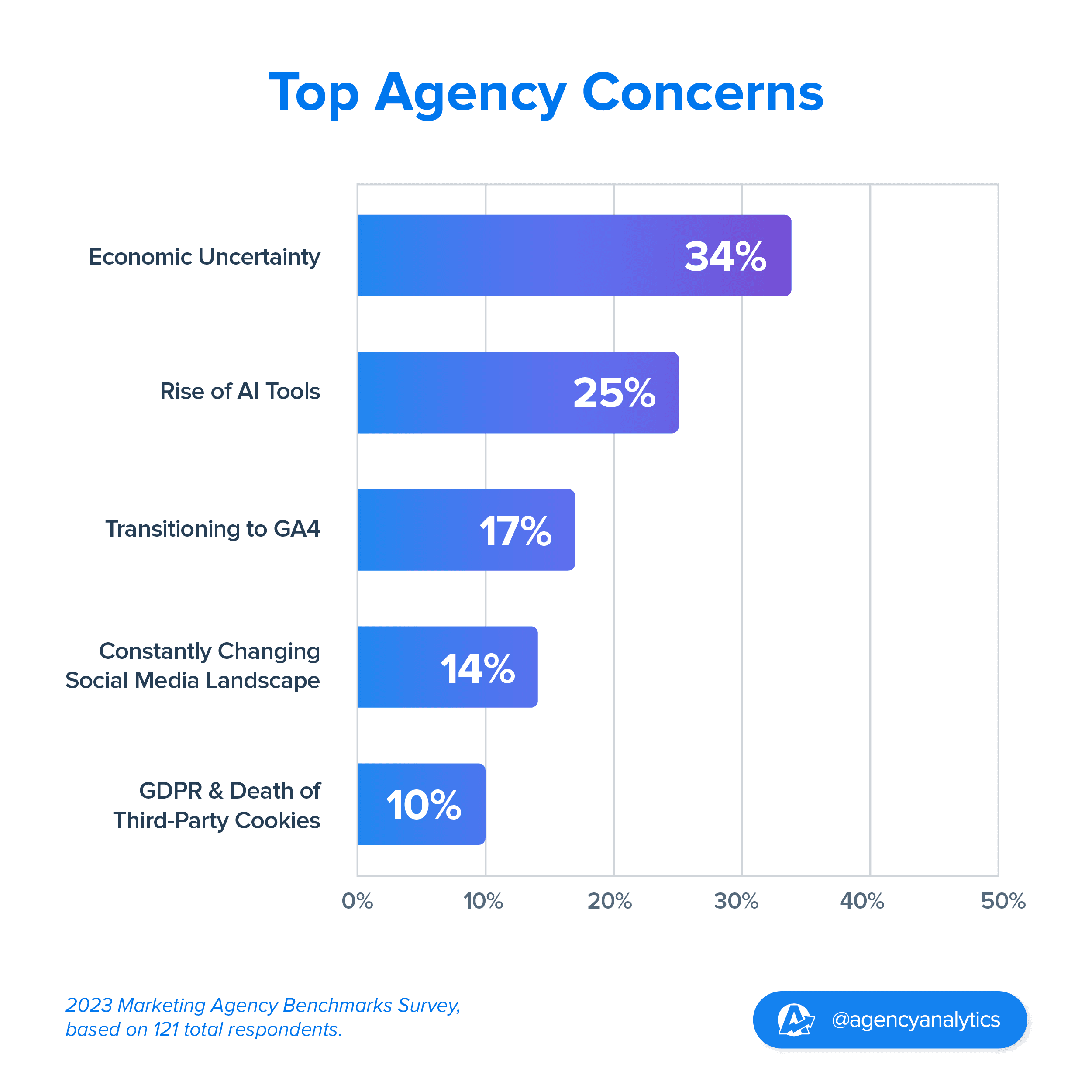

34% of agency owners listed economic uncertainty as a top concern

25% of agencies listed the rise of AI tools as a top concern

17% of agencies are concerned about transitioning to GA4

14% of agencies marked the ever-changing social media landscape as a top concern

10% of agencies said that the GDPR and the death of third-party cookies was a top concern

Strategies for Digital Marketing Resilience When Navigating Economic Uncertainty

The survey findings highlight that a notable portion, comprising 34% of the respondents, is worried about the influence of economic uncertainty on the digital marketing landscape. These concerns arise due to the dynamic nature of the market, where economic conditions can be unpredictable and subject to fluctuations.

The broader global situation, marked by events such as the conflict in Ukraine, rising interest rates, inflation, and bank failures, contributes to this landscape of uncertainty. During uncertain times, businesses may face budget constraints, leading them to be cautious about their marketing spend.

The impact of economic uncertainty is not limited to financial aspects alone; it also extends to consumer behavior. During uncertain economic periods, consumers might change their purchasing habits, priorities, and preferences. Agencies need to closely monitor these shifts in consumer behavior to ensure their marketing strategies remain relevant and effective.

In times of economic uncertainty, maintaining open and transparent communication with clients is crucial. Clients may be anxious about the impact of economic conditions on their businesses, and agencies can offer reassurance by proactively sharing insights and strategies to address the challenges at hand.

Ultimately, agencies that proactively adapt and respond to economic uncertainties can turn challenges into opportunities. By being attentive to market changes, consumer behavior, and budget considerations, agencies can position themselves to thrive and deliver exceptional results for their clients.

Read More: How To Create a Budget Pacing Report to Track Client Ad Spend

The AI Revolution in Digital Marketing

A significant 25% of survey respondents pinpointed the escalating role of artificial intelligence (AI) tools in digital marketing as a top concern.

The evolution of AI is undeniable. As its capabilities expand, it's reshaping the marketing landscape with predictive analytics, personalized content, and automated tasks. For agencies, this presents both an opportunity and a challenge. Embracing AI means not just integrating new tools but understanding their nuances, potential pitfalls, and the best areas of application.

While (in its current state) AI offers data-driven insights and automation, the human element—creativity, intuition, and strategic foresight—remains vital. The future of successful digital marketing lies in harmonizing AI's precision with human ingenuity.

Moreover, as AI influences consumer interactions and campaign outcomes, agencies must be vigilant. Regular assessments of AI's role in campaigns will be essential, ensuring strategies evolve with the technology and consistently deliver optimal results.

The Not-So-Smooth Transition To Google Analytics 4 (GA4)

The transition from Universal Analytics to GA4, highlighted by 17% of survey respondents, presents both challenges and opportunities for agencies:

Implementation: Agencies must update tracking codes, establish new data streams, and ensure GA4's compatibility with current marketing tools for each of their clients.

Data Continuity: GA4 doesn't inherit historical data from Universal Analytics, complicating year-over-year comparisons and in-depth analyses.

Adaptation: GA4 introduces fresh functionalities, from new data modeling techniques to event-based tracking, necessitating a shift in reporting and analytical approaches.

Yet, the silver lining is GA4's user-centric design. It provides richer insights into user interactions, empowering agencies to fine-tune their strategies and enhance customer engagement.

Here are some additional useful resources for agencies navigating the GA4 migration:

Embracing Social Media Evolution

Around 14% of survey respondents expressed their concerns about continual changes to social media platforms. The fast-paced environment of social media presents unique challenges for marketing agencies, requiring them to adopt agile strategies, maintain constant vigilance, and stay up-to-date with the latest industry developments.

Two main challenges include:

Adapting clients’ social media strategies in the face of constant platform updates, algorithm changes, and new feature roll-outs that impact how content is displayed and distributed.

Staying on top of emerging trends on social media as they can swiftly reshape user behaviors and preferences, making it vital for agencies to stay attuned and capitalize on relevant opportunities.

Amidst the frequent shifts, agencies face the challenge of adapting to new posting formats and exploring innovative ways to engage with their active user base. Notably, the emergence of Threads vs. X (formerly known as Twitter) adds to the complexity, prompting agencies to think quickly on their feet to maintain effective audience interaction.

Navigating GDPR and Third-Party Cookie Changes

Around 10% of the agencies surveyed shared apprehensions regarding the influence of GDPR regulations and the gradual elimination of third-party cookies in the digital marketing arena.

These significant shifts introduce challenges concerning data privacy, tracking capabilities, and targeting options, urging agencies to revamp their strategies to continue obtaining data-driven insights into their clients' marketing performance.

As data becomes more restricted, agencies are compelled to find innovative solutions to maintain their ability to understand customer behavior and deliver targeted marketing efforts effectively. By navigating these regulatory changes with creative approaches and compliance, agencies can uphold their commitment to data protection while still harnessing valuable information to drive successful marketing campaigns.

It becomes increasingly apparent that agencies face myriad challenges and decisions that shape their strategies for the future. Understanding the factors that concern marketing agencies is just the beginning, as the impact of these challenges influences various aspects of their operations.

Predicting Agency Revenue Expansion for 2025

Having delved into the challenges, it's time to shift our gaze to the horizon. What does the financial future hold for marketing agencies?

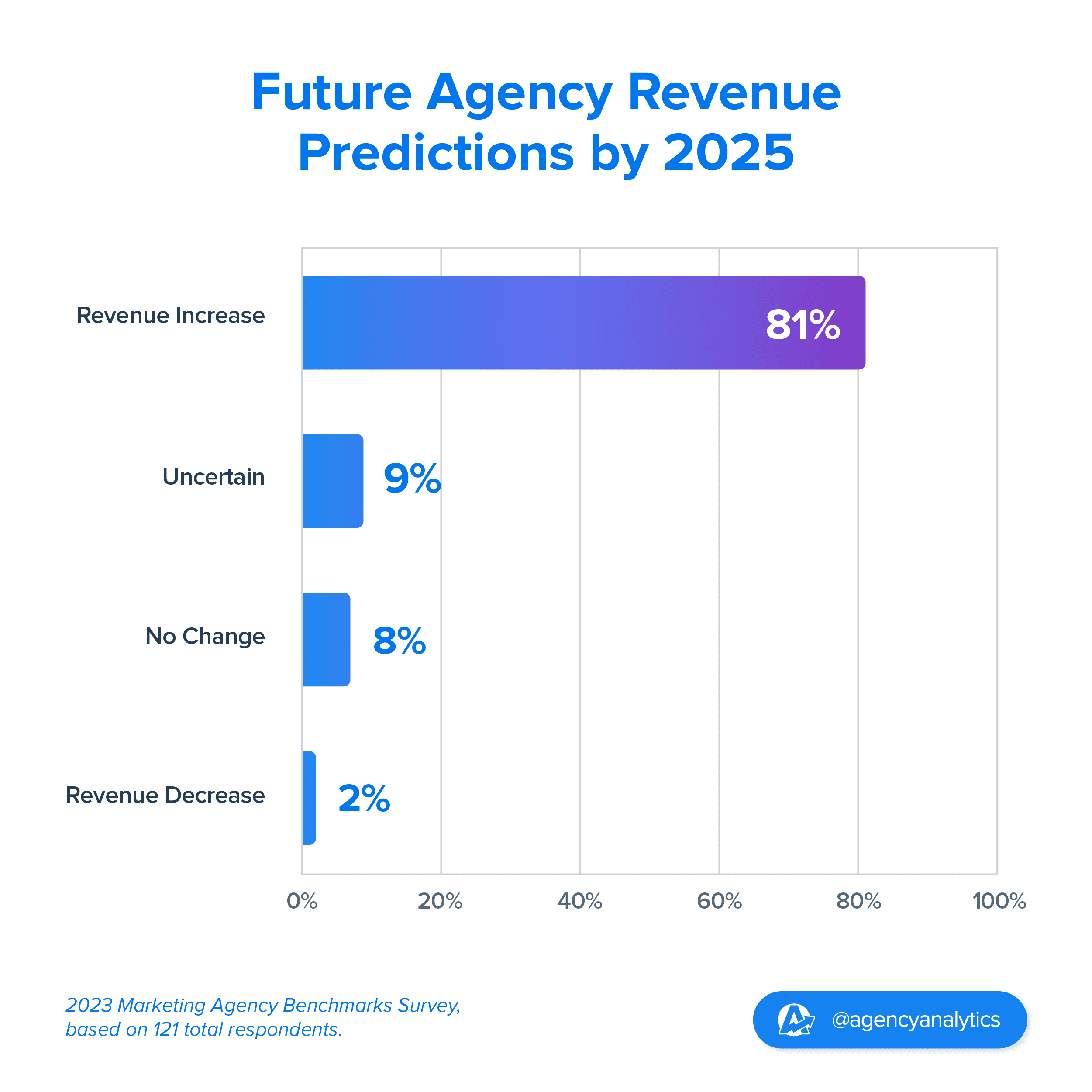

Of the surveyed marketing agency owners, 81% are banking on revenue expansion by 2025. The breakdown is as follows:

67% of agencies predict 25%+ revenue growth

14% of agencies expect revenue growth >25%

8% of agencies expect to maintain current revenue levels

2% of agency owners expect a revenue decline of less than 25%

9% of agencies are uncertain about agency revenue changes

These figures underscore a prevailing optimism. The lion's share of agencies are gearing up for significant growth or at least some upward trajectory. While a few tread cautiously, the overarching sentiment is one of ambition and positive anticipation for the years ahead.

Of the 81% of agency owners who predicted upcoming growth, 67% of them anticipate significant expansion (of 25% or higher), and 14% of agencies expect a modest revenue expansion of less than 25%.

Such forward-looking optimism is not just a testament to the resilience of these agencies, but also a barometer of the rate of change in the marketing industry. As digital transformation accelerates and consumer behaviors shift, agencies that anticipate and adapt to growth are poised to lead the charge. This proactive growth mindset will be pivotal in shaping the future of marketing, ensuring agencies remain agile, innovative, and indispensable.

Roughly 8% of agencies project their revenue to hold steady, neither growing nor declining. This underscores robust stability in their business operations and client relationships, even as they navigate growth plateaus.

2% of the surveyed agencies forecast a minor dip in revenue, while 9% remain resolute despite not having a clear revenue projection for the next two years. Such uncertainty is often rooted in tangible challenges, be it evolving market conditions, industry shifts, or intrinsic business dynamics that influence their scaling potential.

The direct correlation between past agency revenue changes and future growth sentiments underscores a clear trend: agencies that have thrived in the past are confidently forecasting robust growth ahead. This isn't mere optimism; it's a strategic move by successful agencies to harness their present momentum, setting both ambitious and pragmatic targets for sustained success.

Agency Service Expansion Plans for the Coming Year

Let’s now dive into agencies' future strategies concerning their service offerings. By examining intentions to expand, reduce, or maintain their current services, we'll further illuminate the connection between revenue expectations and aspirations for service expansion in the subsequent sections.

As we look at the data on agency service expansion plans for the upcoming year, the majority of survey respondents are gearing up to diversify and amplify their service offerings.

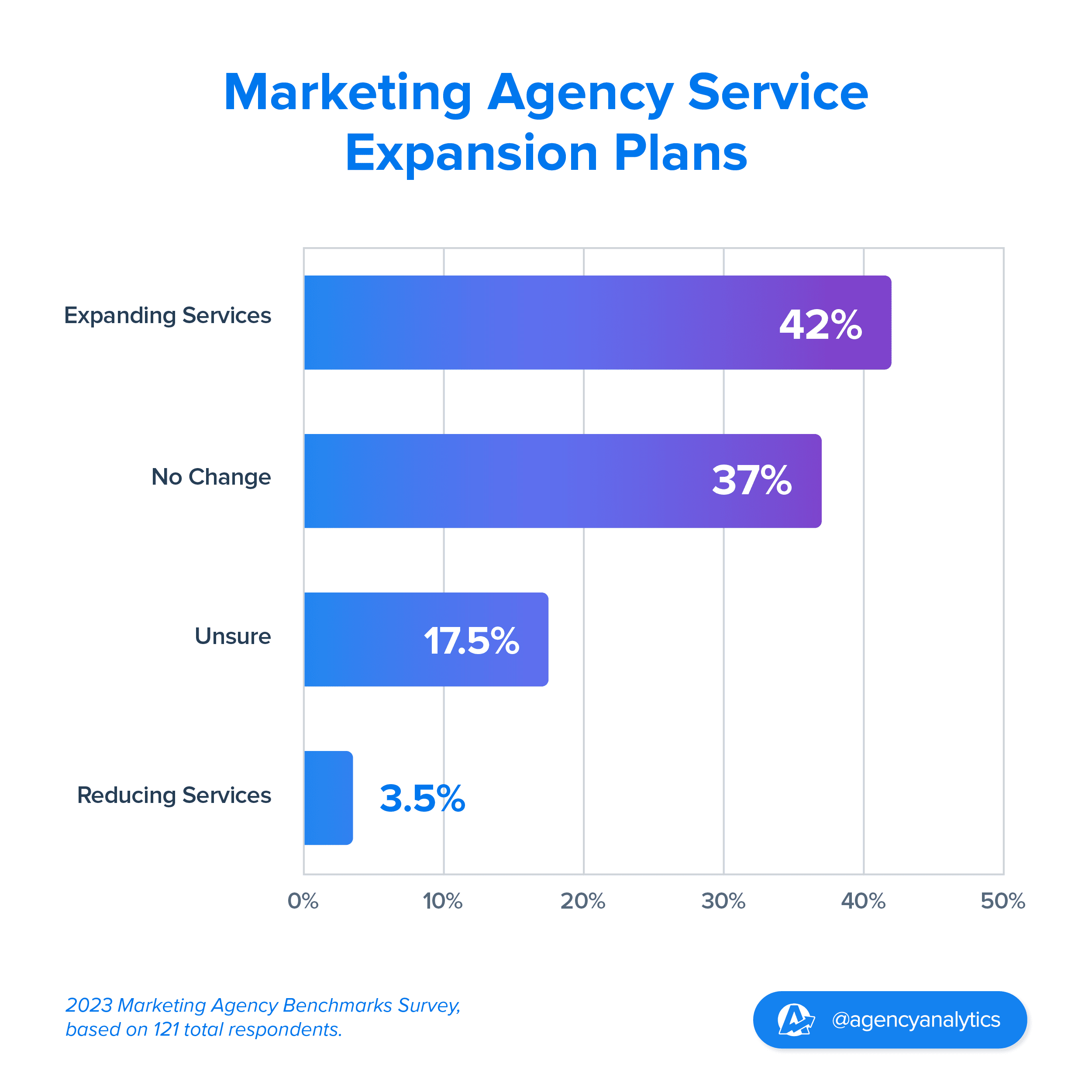

From the marketing agency owners surveyed:

42% of agencies plan on expanding their services in the coming year

37% of agencies will keep the same services in the next year

17.5% of agencies are unsure whether they will expand or reduce their services in the year to come

3.5% of agencies will reduce their services in the next year

This data not only provides a snapshot of agency intentions but also draws clear lines connecting past revenue changes, future growth perspectives, and service expansion strategies for the year ahead.

Drawing from this data, there's a discernible correlation: agencies aiming to expand their services are likely doing so with an eye on bolstering their revenue. By diversifying their offerings, they're positioning themselves to capture new market segments, meet evolving client needs, and ultimately, drive financial growth.

Agencies Eyeing New Horizons and Robust Revenue Growth

42% of agencies plan to expand their services in the upcoming year. This promising figure reflects a notable optimism and growth-oriented mindset among these agencies, as they endeavor to widen their offerings and explore potential new markets or clientele.

Forward-thinking agencies are aligning their strategies with service expansion aspirations directly correlating to ambitious revenue projections. Many of those gearing up to diversify their offerings in the next year anticipate a revenue surge of 25% or more. Such an expansion not only appeals to a wider client base but also positions agencies to seize emerging market opportunities, potentially driving higher profits.

The Revenue Potential of Perfected Service Portfolios

A solid 37% of agency owners surveyed have chosen to retain their current service lineup in the coming year, signaling a deliberate strategy of stability and mastery over their existing portfolio. Instead of branching out, these agencies are doubling down, honing, and optimizing what they already excel at.

Intriguingly, many of these agencies, even while maintaining their service offerings, project significant revenue growth. This underscores the power of established agencies with a loyal clientele and a proven track record. They've carved a profitable niche in the market and are set to further capitalize on their deep-rooted expertise.

The Power of Specialization and Informed Decision-Making

Only 3% of respondents plan to pare down their services in the coming year, possibly signaling a strategic pivot towards specialization or a response to evolving market dynamics.

Notably, even among those intending to slim down their offerings, many anticipate robust revenue growth of 25% or more. This underscores the strategy of honing in on core strengths, optimizing resources, and targeting high-value clientele for maximum revenue impact.

Meanwhile, 17.5% of agency owners remain strategically poised, still evaluating their service expansion plans. Their caution likely stems from current market dynamics, resource considerations, or the balance of opportunities against potential risks.

The survey insights affirm that revenue growth isn't solely about service expansion. Key drivers include:

Diversified Revenue Streams: Agencies are tapping into new sectors, pioneering marketing strategies, and leveraging emerging technologies.

Operational Efficiency: Profitability can surge by refining operations and enhancing productivity.

Niche Mastery: Agencies are zeroing in on specific niches, leveraging their expertise to attract premium clients.

Client Loyalty: Emphasizing customer satisfaction yields repeat business and valuable referrals.

Strategic Market Positioning: Solid branding and differentiation magnetize more clients, fueling revenue growth.

Ultimately, sustained growth hinges on agencies adeptly combining these strategies, responding to market shifts and client needs with agility and insight.

Most Promising Marketing Channels This Year

Agencies are constantly seeking innovative ways to reach their target audiences and drive results for their clients. In this section, we delve into the marketing channels that have caught the attention of agencies, showing the most promise for success this year.

Which channels do agencies believe will play a pivotal role in their strategies and deliver exceptional outcomes?

Let's explore the top contenders and discover the potential they hold for driving growth and engagement in the coming year.

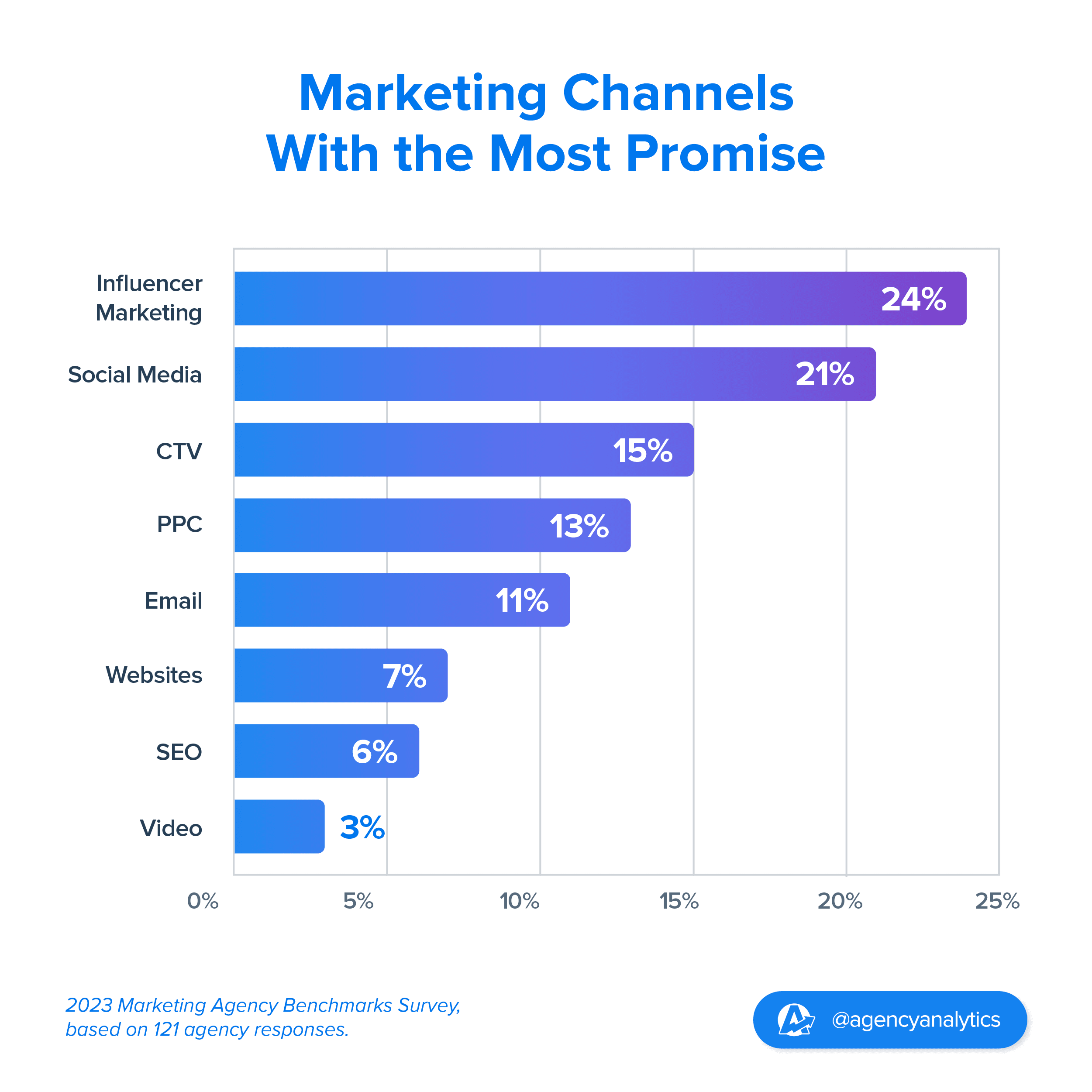

The survey results showcase the preferences of marketing agency leaders, providing valuable insights into the channels they believe hold the most potential for success in the upcoming year

24% of agencies say influencer marketing is the most promising channel

21% of agencies say social media holds the most promise

15% of agencies list CTV (Connected TV) as the most promising marketing channel

13% of agencies say PPC holds the most promise

11% of agencies say email is the most promising channel

7% of agencies see websites as the marketing channel with the most promise

6% of agencies say SEO holds the most promise

2% of agencies see video is the most promising channel

Top 3 Most Promising Marketing Channels

#1 Promising Channel: Influencer Marketing

The survey underscores influencer marketing's undeniable potential, with 24% of agencies acknowledging its significant value. This trend underscores the growing appeal of harnessing influencers to endorse products and cultivate genuine audience connections.

Today's consumers prioritize authenticity and personalized brand interactions. Influencers, often perceived as relatable and credible, excel in crafting content that deeply resonates with their audience.

By partnering with influencers who align with their brand values and target demographics, agency clients tap into a captive audience and build deeper connections with their potential customers. Benefits of influencer marketing include:

Shaping consumer preferences through their massive following

Amplifying brand messaging by leveraging influencers' reach

Maximizing ROI by tapping into niche markets and demographics via dedicated and specialized fan bases

Creating engaging and diverse content that’s authentic, capturing attention and fostering emotional connection with consumers

Increasing brand loyalty and advocacy, strengthening relationships with the target audience

The dominance of social media platforms has transformed the way consumers interact with brands and make purchasing decisions through influencers and social proof.

#2 Promising Channel: Social Media Marketing

The 2023 Agency Benchmarks Survey ranks social media as the second most promising marketing channel, capturing 21% of agency votes. Its continued relevance stems from its unparalleled capacity to cultivate genuine audience relationships. Social media platforms empower brands to showcase their authentic side, engage in real-time dialogues, and benefit from the organic spread of their messages. This natural sharing amplifies brand visibility and fosters widespread recognition.

Moreover, the data-centric nature of social media offers agencies a goldmine of insights into audience dynamics. Harnessing this data, agencies fine-tune content and targeting, ensuring optimal campaign outcomes for their clients. Despite evolving trends, social media's significance is not just enduring—it's growing.

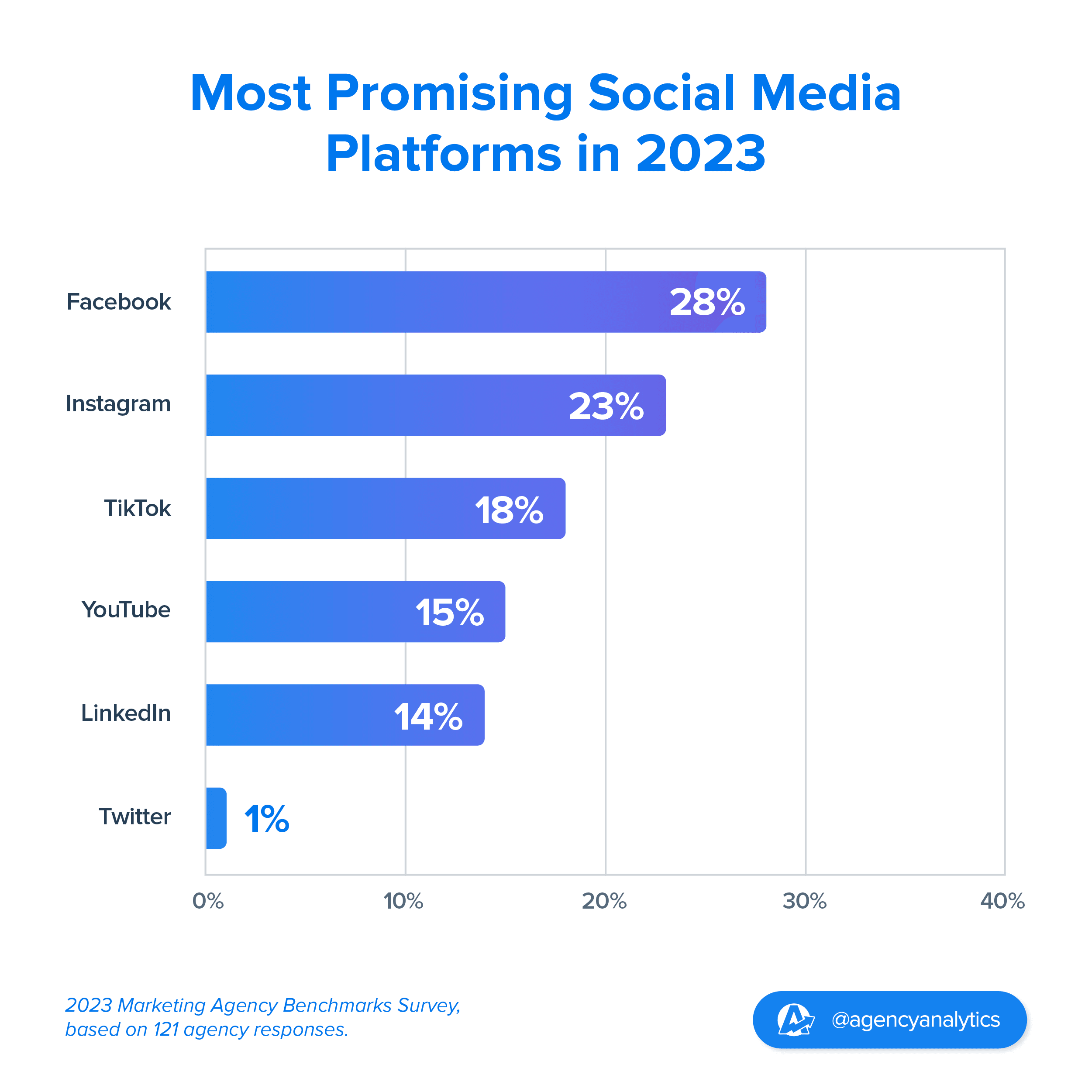

But which social channels dominate this year?

The Social Media Platforms With Greatest Potential

Having delved into the nuances of social media strategy, it's evident that agency owners' perspectives vary widely. This diversity of opinion extends to platform preference, as we'll explore next.

While Facebook (28%) and Instagram (23%) maintain their positions at the forefront, the data reveals a level playing field with no single platform overshadowing the others.

The sustained appeal of these social media platforms can be attributed to their vast user base, varied demographics, and advanced advertising tools, allowing agencies to cater to diverse audience segments.

TikTok, with 18% preference, underscores its burgeoning influence. Its emphasis on bite-sized video content and resonance with younger audiences positions it as a compelling choice for marketers.

YouTube, securing 15% of agency votes, remains a pivotal player, celebrated for its immersive long-form video content.

LinkedIn, capturing 14% of votes, stands out as the go-to for professional networking. Its prowess in B2B marketing and its appeal to a business-centric audience is undeniable.

Twitter garnered a modest 1%, suggesting it might cater to more niche strategies or specific campaign objectives.

In essence, the varied preferences signal that agencies are embracing a holistic social media approach, leveraging the unique strengths of each platform. It underscores the strategic shift towards a diversified approach to maximize audience engagement.

#3 Promising Channel: CTV

Connected TV (CTV) is the third most promising marketing channel, and its potential is being recognized by 15% of agencies surveyed. The rise of CTV is closely tied to the growing popularity of streaming services, which have become a preferred choice for consumers seeking entertainment and content on demand. As more people shift away from traditional television and embrace streaming platforms, CTV offers a lucrative avenue for targeted advertising.

CTV platforms provide advertisers with the capability to reach audiences in a highly targeted manner. Through the use of data-driven insights and advanced audience segmentation, agencies can deliver relevant ads to specific groups of viewers based on their interests, demographics, and behaviors. This level of precision targeting enhances the effectiveness of ad campaigns and ensures that brands are reaching the right audience with the right message.

Other Marketing Channels To Consider

Pay-per-click (PPC) advertising continues to be recognized as a valuable marketing channel for 13% of agencies surveyed. This finding highlights the effectiveness of targeted and measurable advertising campaigns, where businesses pay only for actual clicks, ensuring efficient use of advertising budgets.

Email marketing maintains its relevance, with 11% of agencies perceiving email as a channel with promise. This finding emphasizes the continued effectiveness of personalized and targeted email campaigns in reaching and engaging specific audiences.

Even with the increasing popularity of various digital marketing channels, websites remain relevant and essential for businesses, with 7% of agencies acknowledging websites as a strong channel to invest in. This finding suggests that agencies understand the importance of maintaining a strong online presence and optimizing websites to provide a seamless user experience.

Search engine optimization (SEO) continues to be a valuable marketing strategy, with 6% of agencies recognizing its impact. This finding highlights the significance of optimizing websites and content to improve organic search rankings and attract relevant organic traffic, ensuring long-term visibility and growth.

Forecasting Reduced Campaign Spending

Having charted the ambitious course of service expansion and most promising channels, we pivot to address the inevitable: strategic budget recalibrations.

Which sectors are agencies earmarking for leaner allocations? This segment decisively spotlights the areas poised for fiscal adjustments, setting the stage for understanding upcoming strategic shifts in marketing investments.

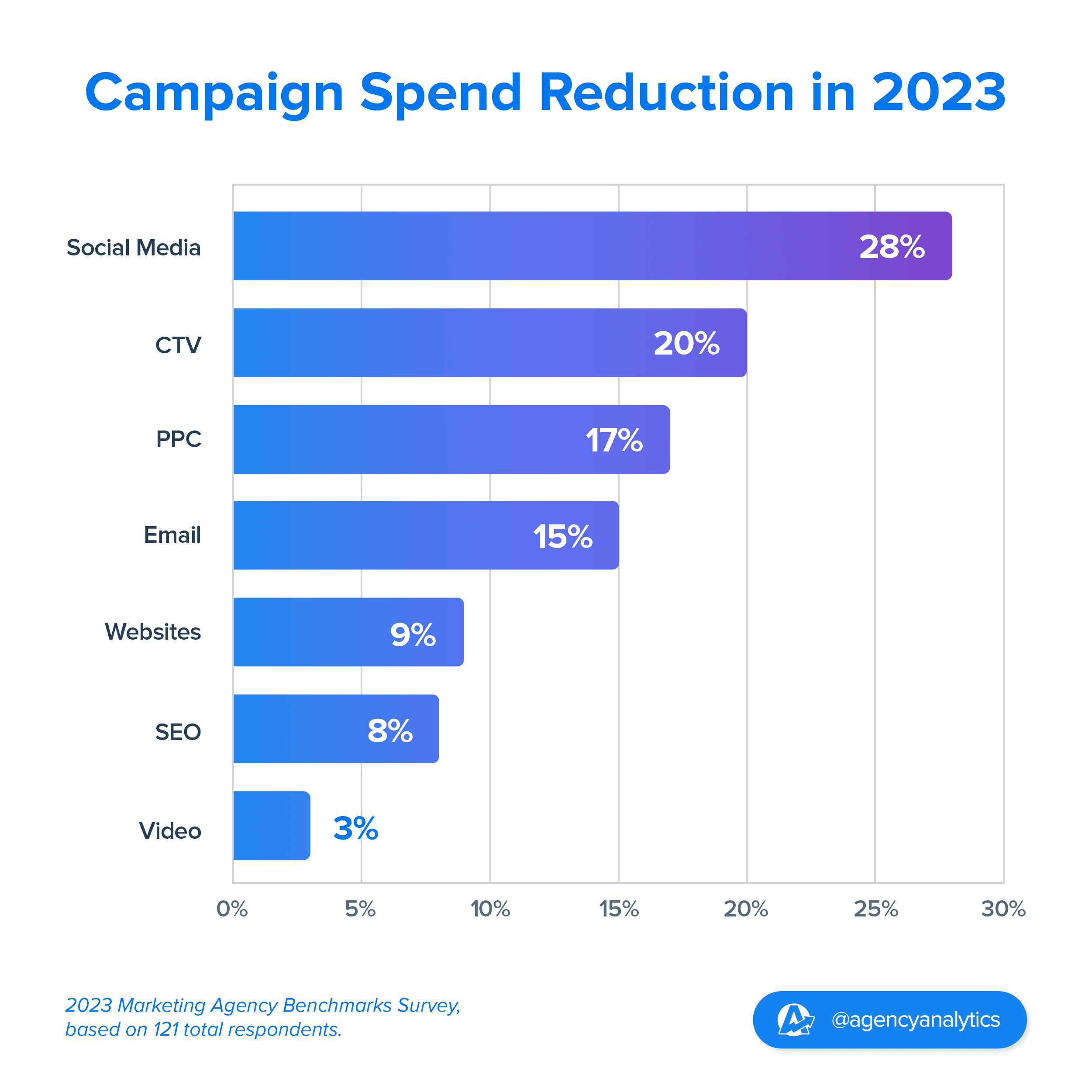

Survey insights shed light on the marketing channels agencies are re-evaluating in terms of budget allocation:

28% of agencies anticipate trimming their social media budgets

20% foresee a decrease in CTV advertising spend

17% are set to curtail PPC expenditures

15% predict cuts in email marketing budgets

9% will scale back on website-related expenses

8% plan to reduce SEO spending

A mere 3% will decrease their video marketing budget

Social media and CTV emerge as the primary channels facing the most significant budgetary constraints in 2023. Meanwhile, PPC, email, websites, SEO, and video advertising are also bracing for varying degrees of cutbacks. Notably, influencer marketing remains untouched, with no agencies indicating plans for budget reductions.

Let's delve deeper.

Top 3 Marketing Channels Facing Budget Cuts This Year

Having provided a broad overview of the channels facing budgetary adjustments, it's crucial to spotlight the most impacted areas. Let's zero in on the top three marketing channels that are bracing for the most significant cutbacks this year.

1. Social Media

As the survey results show, 28% of agencies are opting for budget cuts in social media advertising, indicating a notable shift in budget allocation. This decision likely stems from a reevaluation of the effectiveness and return on investment (ROI) of social media marketing efforts.

Social media platforms are currently characterized by a saturation of content and advertisements, making it increasingly challenging for agencies to stand out and organically reach their target audience.

Moreover, the heightened competition among advertisers on these platforms can drive up advertising costs, prompting agencies to explore alternative channels that offer better visibility and cost efficiency.

2. CTV

The survey results shed light on an interesting trend, with 20% of agencies planning to cut CTV campaign spending in the upcoming year. This decision could be attributed to several factors influencing agencies' advertising strategies.

Firstly, CTV advertising is known for its relatively higher costs compared to traditional TV or other digital advertising channels, particularly when agencies target premium inventory or specific demographics. In an environment where budget optimization and cost-effectiveness are key considerations, agencies may find it necessary to reevaluate their CTV spending.

Secondly, client budget constraints can play a significant role in agency decision-making. Clients may prioritize allocating their budgets across various marketing initiatives, and in some cases, this could lead to a reduction in CTV spending in favor of other marketing activities.

While CTV can be effective for reaching certain audiences, agencies might explore more diverse and cost-efficient advertising options that align better with their clients' goals and target audience preferences.

3. PPC

17% of agencies surveyed say they will reduce PPC campaign spending this year. One possible reason behind this decision could be the highly competitive nature of PPC advertising, especially in certain industries or niches.

As more businesses embrace digital marketing and PPC as a means to capture leads and drive conversions, the competition for ad placements can intensify. This increased competition can lead to higher bidding costs for keywords and ad placements, potentially impacting the overall return on investment for PPC campaigns.

Market saturation is another factor that agencies might be taking into account. When a client’s target audience has been repeatedly exposed to PPC ads from multiple competitors, there is a possibility of diminished interest or ad fatigue, resulting in reduced effectiveness of PPC campaigns.

To ensure optimal results for their clients, agencies might be proactively anticipating these challenges and exploring alternative advertising channels or strategies. For instance, they may focus on diversifying their marketing mix to include other digital channels that offer better cost efficiency or provide unique ways to engage with the target audience.

The decision to reduce PPC spending does not necessarily imply that PPC advertising is becoming irrelevant or ineffective in general. Instead, it showcases agencies' proactive approach to adapting their marketing strategies based on market dynamics and client-specific needs.

Agencies Navigating Email, Website, SEO, and Video Spending

Strategic budgeting is at the heart of every successful marketing campaign. As we further dissect the survey's data, we see agencies making deliberate choices in areas like email, website, SEO, and video spending. Let's unpack the reasons behind these pivotal decisions.

Email Marketing Budget Cuts

15% of the agencies surveyed will reduce email campaign spending in 2023. Changes to data privacy regulations, such as GDPR and CCPA have made email marketing compliance more complex. Agencies may anticipate challenges in ensuring compliance and addressing privacy concerns associated with email marketing.

Consequently, they may reduce their email marketing spending to mitigate risks and focus on channels that pose fewer compliance challenges.

Website Budget Cuts

9% of agencies plan to reduce client website budgets this year, shedding light on the strategic decisions made by these agencies to manage their financial resources effectively. The decision to reduce website budgets for clients may stem from a proactive effort to optimize costs while ensuring that clients still receive valuable and effective digital solutions.

As clients' marketing strategies evolve, some may prioritize other digital marketing channels or initiatives over website investments in the short term. This shift in focus might lead agencies to reallocate resources to areas that are more aligned with their clients' current goals and objectives.

SEO Budget Cuts

Meanwhile, 8% of agencies surveyed are anticipating reduced SEO campaign spending for their clients this year.

Reduced SEO campaign spending could stem from multiple factors. Agencies might encounter budget constraints, when clients are looking to optimize their overall marketing expenses. In such cases, agencies may need to strike a balance between SEO investments and other marketing initiatives based on the client's specific goals and priorities.

Moreover, clients' expectations for immediate results may also influence agencies' SEO spending decisions.

While SEO is a highly effective long-term strategy, it's not always conducive to delivering instant outcomes. Clients seeking rapid returns on their investment might prompt agencies to justify the tangible ROI of their SEO efforts, or even shift the focus to other marketing channels that can provide more immediate results, such as paid advertising or social media marketing.

What’s the Deal With Video Marketing?

The survey reveals intriguing and somewhat conflicting findings about video marketing among agencies:

Only 2% of agencies identify video marketing as a promising channel

Meanwhile, only 3% of agencies surveyed say it will face budget cuts this year.

Video marketing is neither deemed a highly promising channel nor considered obsolete. Instead, video channels remain a consistent and essential aspect of digital marketing strategies, showing no signs of fading away, especially with the increasing popularity of video consumption and video-first content.

It's worth noting, that the significant investment required for high-quality video production might have historically kept some marketers on the sidelines, making them more cautious about fully embracing video marketing.

Zero Budget Restraints for Influencer Marketing

The data shows that none of the surveyed agencies plan budget cuts on influencer marketing. This noteworthy finding emphasizes that influencer marketing, uniquely leveraging authenticity and connection to drive sales, continues to be a valuable strategy.

The survey results may also reflect that the agencies surveyed either do not offer influencer marketing services yet or that their clients have not expressed a need for influencer marketing campaigns. As a result, budget cuts in this area are not applicable.

Strategic Budgeting Paving the Way for Agency Success

While the data reveals certain areas facing budget adjustments, it's essential to view these decisions as strategic recalibrations rather than mere cuts. Agencies are continuously adapting, ensuring they deliver the most value for their clients. The minimal reductions in video and the sustained commitment to influencer marketing underscore the industry's forward-thinking approach.

Even in areas of budgetary restraint, agencies are positioning themselves and their clients for future success, ready to harness emerging opportunities and trends. As we transition into the report's conclusion, let's reflect on the resilience and adaptability that these findings truly represent.

Looking Forward

The results of the 2023 Annual Marketing Agency Benchmarks survey provide valuable insights into the resilience and optimism of the agency landscape. Despite ongoing economic uncertainty, agencies have demonstrated their adaptability and achieved remarkable success.

The majority of agencies surveyed experienced revenue growth in the past year, with a notable portion reporting substantial increases. This demonstrates their ability to seize emerging opportunities and drive business growth.

Moreover, a significant number of agencies maintained consistent revenue levels, showcasing stability and a strong customer base. These findings point towards a positive growth outlook for the industry, with agencies focusing on expanding their services and team sizes in the upcoming year. To succeed, agencies must remain adaptable, responsive, and proactive in leveraging new marketing channels and trends.

By capitalizing on these insights, agencies are well-positioned to thrive and emerge as leaders in the coming years.

Share the insights from this report on your social media channels to inspire and inform your peers by tagging us @AgencyAnalytics. And be sure to download the latest 2025 Marketing Agency Benchmarks Report for all the latest data-driven trends!

Bookmark All Four Parts of the 2023 Marketing Agency Benchmarks Report

Part One - Overcoming Top Barriers To Agency Growth |

Part Two - Marketing Agency Management Insights |

Part Three - Marketing Agency Growth Insights and Future Channel Strategies |

Part Four - Trends In Agency-Client Reporting |

Impress clients and save hours with custom, automated reporting.

Join 7,000+ agencies that create reports in under 30 minutes per client using AgencyAnalytics. Get started for free. No credit card required.

Already have an account?

Log in

Thanks to every agency that participated in this survey: you have each planted a tree through our partnership with Evertreen.

Written by

Melody Sinclair-Brooks brings nearly a decade of experience in marketing in the tech industry. Specializing in B2B messaging for startups and SaaS, she crafts campaigns that cut through the noise, leveraging customer insights and multichannel strategies for tangible growth.

Read more posts by Melody Sinclair-BrooksSee how 7,000+ marketing agencies help clients win

Free 14-day trial. No credit card required.